Scalper1 News

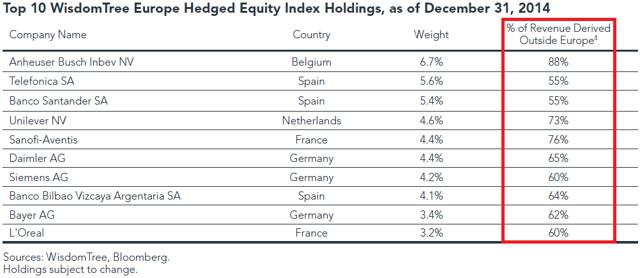

Summary HEDJ will benefit from falling oil prices and a growing spread between U.S. and European interest rates. Oil is set for a prolonged period of oversupply and depressed prices. European exporters will benefit from the declining Euro. Introduction One of the most popular exchange-traded funds of 2015 has bet big on Europe, and to date investors have been rewarded handsomely. WisdomTree’s Europe Hedged Equity Fund (NYSEARCA: HEDJ ) seeks to track the performance of the WisdomTree Europe Hedged Equity Index, which is largely comprised of dividend-paying companies in the Eurozone that generate more than half of their revenues outside of the region. According to WisdomTree, “the Index and Fund are designed to have higher returns than an equivalent non-currency hedged investment when the value of the U.S. dollar is increasing relative to the value of the euro, and lower returns when the U.S. dollar declines against the euro.” The bet that European equities will rise and the euro will fall has proven popular among investors seeking a combination of European exposure and currency protection, especially as central banks cut rates to remain competitive. Many market watchers anticipate Eurozone equities to continue advancing through 2015 as a result of the ECB’s stimulus alongside developing economic improvements and relatively cheap valuations compared to those of U.S. equities. Meanwhile, much of Wall Street expects the euro to fall further on the back of the ECB’s stimulus, with calls from some quarters that it could reach parity with the U.S. dollar. However, given its meteoric 15%+ YTD appreciation, investors may be wondering how much upside is left in the hedged European equity play. We believe that there are two primary drivers that will support the currency hedged European equity bet through 2015; namely, oil and interest rates. Before explaining how these catalysts will drive HEDJ’s appreciation through year end, let us first briefly recap the funds structure and goals. HEDJ Investment Process HEDJ seeks to track the performance of the WisdomTree Europe Hedged Equity Index. The universe of eligible companies begins with the WisdomTree DEFA Index, a very broad measure of the performance investable dividend payers. From WisdomTree: “The WisdomTree Europe Hedged Equity Index is designed to provide exposure to European equities while at the same time neutralizing exposure to fluctuations between the Euro and the U.S. dollar. In this sense, the Index “hedges” against fluctuations in the relative value of the Euro against the U.S. dollar. The Index is based on dividend paying companies in the WisdomTree DEFA Index that are domiciled in Europe and are traded in Euros, have at least $1 billion market capitalization, and derive at least 50% of their revenue in the latest fiscal year from countries outside of Europe.” ( Source ) (click to enlarge) Accordingly, the WisdomTree Europe Hedged Equity Fund offers investors a way to capitalize on the growth potential of these tremendous exporters derived from a weakening Euro while hedging their exposure to the currency itself. Key Drivers We expect that HEDJ will experience significant volatility over the course of the year as anxious investors react to the changing interest rate environment in the United States and abroad. However, we are confident that two drivers will support both the performance of European equities as well as a Euro depreciation over the months to come. These drivers are oil and interest rates . Oil We believe companies that derive a large share of their revenues from exports will experience a material benefit from the depression in oil prices. A falling cost of oil will not only help reduce costs for producers, but will likely also spur consumption on the European continent and abroad. This thesis is straightforward. However, there are a number of catalysts that we expect may drive the price of oil lower, which in turn should support European exporters. The U.S. Energy Information Administration (NYSEMKT: EIA ) released its weekly petroleum status report Wednesday morning. U.S. commercial crude inventories increased by 8.17 million barrels last week, maintaining a total U.S. commercial crude inventory of 466.7 million barrels, the tenth consecutive week of a higher total than at any time in at least 80 years ( Source ). While crude inventory levels have helped depress the price of oil, a major concern surrounds what will happen should storage inventory completely dry up. In such a scenario, it seems increasingly likely that domestic suppliers will continue oil production rather than shut down wells, at which point crude will flood the open market. This scenario appears increasingly possible and could help to drive oil prices even lower over the months ahead. In addition, a potential agreement with Iran could cause prices to drop sharply again, especially given predictions of Iran’s current oil stores. As Reuters reported this morning, “Iran is storing at least 30 million barrels of oil on its fleet of supertankers as Western sanctions continue to keep a lid on sales, tanker market sources say… One shipping industry source said 15 of NITC’s Very Large Crude Carriers (VLCC), each capable of carrying 2 million barrels of oil, were deployed for floating storage.” The combined impact of domestic refiners reaching storage capacity and an agreement with Iran which permits their sale of oil on the open market should be to drive crude prices lower. In turn, European exporters, which comprise the core of HEDJ’s holdings, should experience a twofold boon driven by reduces production costs and increased global consumer demand. Interest Rates As the Fed prepares to raise interest rates, market participants have become fixated on one thing: timing. Janet Yellen last week reiterated the Fed’s commitment to raising rates only once certain key criteria are met, among the most important being a return to healthy inflation of approximately 2% ( Source ). Yesterday’s CPI report showed a return to positive inflation of .2% following four months of declining CPI numbers. Accordingly, it is not unlikely that the Fed will begin raising rates following its June meeting. This sentiment has spread across the street, as Goldman Sachs downgraded its six-month euro forecast to parity with the dollar, from $1.10 previously. Goldman also reduced its twelve-month euro outlook to $0.95 and its 2017 year end forecast to $0.80 ( Source ). Critically, the ECB’s bond buying program is set to continue through Q3 of 2016, at which point U.S. interest rates are expected to approach 1.5% – 1.8% ( Source ). This spread will continue to depress the Euro into 2017. Also key to recognize are the impacts of stimulus programs begin pursued in India, China, South Korea, and Japan, whereby cheap Asian money is expected to contribute to the dollar’s strengthening. A rise in domestic interest rates will have a critical impact on HEDJ’s holdings, derived mainly through its impact on the Euro. Rising U.S. rates will drive a dollar appreciation, positioning European exporters to benefit from their comparatively lower real prices. We expect short-term European equity volatility but anticipate European equities, especially those of exporters, to outperform U.S. stocks over the next 12-18 months. Summary The WisdomTree Europe Hedged Equity Fund offers investors the opportunity to gain European equity exposure without Euro currency risk. We believe that HEDJ will experience short-term volatility but will remain an attractive European equity investment vehicle over through at least the end of 2015. Investors may wish to supplement investments in HEDJ with positions in the WisdomTree Germany Hedged Equity Fund (NASDAQ: DXGE ) as Germany has been the strongest contributor to growth on the European continent (also see the WisdomTree Europe Hedged SmallCap Equity Fund (NYSEARCA: EUSC )). Near-term events are expected to depress oil prices further, and developments in the global interest rate environment should both support the European exporters that comprise HEDJ’s holdings. In short, HEDJ is a long-term pure European equity play that may outperform U.S. equities over the remainder of 2015. Disclosure: The author is long HEDJ. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary HEDJ will benefit from falling oil prices and a growing spread between U.S. and European interest rates. Oil is set for a prolonged period of oversupply and depressed prices. European exporters will benefit from the declining Euro. Introduction One of the most popular exchange-traded funds of 2015 has bet big on Europe, and to date investors have been rewarded handsomely. WisdomTree’s Europe Hedged Equity Fund (NYSEARCA: HEDJ ) seeks to track the performance of the WisdomTree Europe Hedged Equity Index, which is largely comprised of dividend-paying companies in the Eurozone that generate more than half of their revenues outside of the region. According to WisdomTree, “the Index and Fund are designed to have higher returns than an equivalent non-currency hedged investment when the value of the U.S. dollar is increasing relative to the value of the euro, and lower returns when the U.S. dollar declines against the euro.” The bet that European equities will rise and the euro will fall has proven popular among investors seeking a combination of European exposure and currency protection, especially as central banks cut rates to remain competitive. Many market watchers anticipate Eurozone equities to continue advancing through 2015 as a result of the ECB’s stimulus alongside developing economic improvements and relatively cheap valuations compared to those of U.S. equities. Meanwhile, much of Wall Street expects the euro to fall further on the back of the ECB’s stimulus, with calls from some quarters that it could reach parity with the U.S. dollar. However, given its meteoric 15%+ YTD appreciation, investors may be wondering how much upside is left in the hedged European equity play. We believe that there are two primary drivers that will support the currency hedged European equity bet through 2015; namely, oil and interest rates. Before explaining how these catalysts will drive HEDJ’s appreciation through year end, let us first briefly recap the funds structure and goals. HEDJ Investment Process HEDJ seeks to track the performance of the WisdomTree Europe Hedged Equity Index. The universe of eligible companies begins with the WisdomTree DEFA Index, a very broad measure of the performance investable dividend payers. From WisdomTree: “The WisdomTree Europe Hedged Equity Index is designed to provide exposure to European equities while at the same time neutralizing exposure to fluctuations between the Euro and the U.S. dollar. In this sense, the Index “hedges” against fluctuations in the relative value of the Euro against the U.S. dollar. The Index is based on dividend paying companies in the WisdomTree DEFA Index that are domiciled in Europe and are traded in Euros, have at least $1 billion market capitalization, and derive at least 50% of their revenue in the latest fiscal year from countries outside of Europe.” ( Source ) (click to enlarge) Accordingly, the WisdomTree Europe Hedged Equity Fund offers investors a way to capitalize on the growth potential of these tremendous exporters derived from a weakening Euro while hedging their exposure to the currency itself. Key Drivers We expect that HEDJ will experience significant volatility over the course of the year as anxious investors react to the changing interest rate environment in the United States and abroad. However, we are confident that two drivers will support both the performance of European equities as well as a Euro depreciation over the months to come. These drivers are oil and interest rates . Oil We believe companies that derive a large share of their revenues from exports will experience a material benefit from the depression in oil prices. A falling cost of oil will not only help reduce costs for producers, but will likely also spur consumption on the European continent and abroad. This thesis is straightforward. However, there are a number of catalysts that we expect may drive the price of oil lower, which in turn should support European exporters. The U.S. Energy Information Administration (NYSEMKT: EIA ) released its weekly petroleum status report Wednesday morning. U.S. commercial crude inventories increased by 8.17 million barrels last week, maintaining a total U.S. commercial crude inventory of 466.7 million barrels, the tenth consecutive week of a higher total than at any time in at least 80 years ( Source ). While crude inventory levels have helped depress the price of oil, a major concern surrounds what will happen should storage inventory completely dry up. In such a scenario, it seems increasingly likely that domestic suppliers will continue oil production rather than shut down wells, at which point crude will flood the open market. This scenario appears increasingly possible and could help to drive oil prices even lower over the months ahead. In addition, a potential agreement with Iran could cause prices to drop sharply again, especially given predictions of Iran’s current oil stores. As Reuters reported this morning, “Iran is storing at least 30 million barrels of oil on its fleet of supertankers as Western sanctions continue to keep a lid on sales, tanker market sources say… One shipping industry source said 15 of NITC’s Very Large Crude Carriers (VLCC), each capable of carrying 2 million barrels of oil, were deployed for floating storage.” The combined impact of domestic refiners reaching storage capacity and an agreement with Iran which permits their sale of oil on the open market should be to drive crude prices lower. In turn, European exporters, which comprise the core of HEDJ’s holdings, should experience a twofold boon driven by reduces production costs and increased global consumer demand. Interest Rates As the Fed prepares to raise interest rates, market participants have become fixated on one thing: timing. Janet Yellen last week reiterated the Fed’s commitment to raising rates only once certain key criteria are met, among the most important being a return to healthy inflation of approximately 2% ( Source ). Yesterday’s CPI report showed a return to positive inflation of .2% following four months of declining CPI numbers. Accordingly, it is not unlikely that the Fed will begin raising rates following its June meeting. This sentiment has spread across the street, as Goldman Sachs downgraded its six-month euro forecast to parity with the dollar, from $1.10 previously. Goldman also reduced its twelve-month euro outlook to $0.95 and its 2017 year end forecast to $0.80 ( Source ). Critically, the ECB’s bond buying program is set to continue through Q3 of 2016, at which point U.S. interest rates are expected to approach 1.5% – 1.8% ( Source ). This spread will continue to depress the Euro into 2017. Also key to recognize are the impacts of stimulus programs begin pursued in India, China, South Korea, and Japan, whereby cheap Asian money is expected to contribute to the dollar’s strengthening. A rise in domestic interest rates will have a critical impact on HEDJ’s holdings, derived mainly through its impact on the Euro. Rising U.S. rates will drive a dollar appreciation, positioning European exporters to benefit from their comparatively lower real prices. We expect short-term European equity volatility but anticipate European equities, especially those of exporters, to outperform U.S. stocks over the next 12-18 months. Summary The WisdomTree Europe Hedged Equity Fund offers investors the opportunity to gain European equity exposure without Euro currency risk. We believe that HEDJ will experience short-term volatility but will remain an attractive European equity investment vehicle over through at least the end of 2015. Investors may wish to supplement investments in HEDJ with positions in the WisdomTree Germany Hedged Equity Fund (NASDAQ: DXGE ) as Germany has been the strongest contributor to growth on the European continent (also see the WisdomTree Europe Hedged SmallCap Equity Fund (NYSEARCA: EUSC )). Near-term events are expected to depress oil prices further, and developments in the global interest rate environment should both support the European exporters that comprise HEDJ’s holdings. In short, HEDJ is a long-term pure European equity play that may outperform U.S. equities over the remainder of 2015. Disclosure: The author is long HEDJ. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News