Scalper1 News

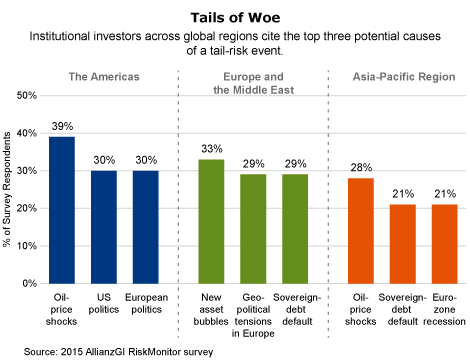

Tail risk, the risk of an asset or portfolio moving more than three standard deviations away from its current price, appears to be increasing around the world. And some investors feel ill-equipped to manage this risk. This according to our latest poll of institutional investors. Last week, we released the results of the Allianz Global Investors RiskMonitor survey, a comprehensive look at views on portfolio construction, asset allocation and risk. This year we queried 735 institutional investors around the globe representing a variety of different institutions: pension funds, foundations, endowments, sovereign wealth funds, family offices, banks and insurance companies. The findings of this year’s survey reinforced our view that global risks are increasing amid a complicated economic, geopolitical and monetary policy environment. In particular, this challenging climate was underscored by the survey results, which showed that two-thirds of the respondents believe that tail-risk events are likely to be more frequent due to the interconnectedness of global financial markets. In addition, two-thirds of the survey participants also assert that tail risk has become an increasing worry since the 2008-2009 global financial crisis. Specifically, 62% believe tail risk is a “high” or “very high” risk. And 41% of the institutional investors surveyed believe a tail-risk event is “likely” or “very likely” in the next 12 months. Yet far fewer are “confident” or “somewhat confident” that their portfolios have appropriate downside protection for the next tail-risk event. Known Unknowns? Where are they seeing the biggest risks? The institutional investors we surveyed believe the most likely cause of future tail-risk events include oil-price shocks, sovereign-debt default, European politics, new asset bubbles and a euro-zone recession. However, this view varies by region. In the Americas, investors polled believe oil-price shocks are most likely to be the cause of the next tail-risk event, followed by US politics and European politics. In Europe and the Middle East, new asset bubbles are believed to be the most likely cause of the next tail-risk event, followed by geopolitical tensions in Europe and sovereign-debt default. Meanwhile, in the Asia-Pacific region, oil-price shocks are perceived to be the most likely cause of the next tail-risk event, followed by sovereign-debt default and a euro-zone recession. Interestingly, the timing of the release of the study coincides with an escalation of the ongoing debt crisis in Greece. That volatile situation aligns with the view that a sovereign-debt default and European politics are probable causes of future tail-risk events. Heading for the Grexit? So could Greece’s problems trigger a tail-risk event? Today, in light of the recent deterioration in negotiations between Greek government officials and Greece’s creditors, we see a material rise in the risk of a mistake by either side. We now have less confidence in a constructive outcome than we’ve had previously. As a result, we see increasing potential for a “Grexit” – Greece intentionally leaving the European Monetary Union – or a “Graccident” – Greece accidentally exiting. The accidental exit could occur if there’s a run on the banks, which would trigger the termination of emergency liquidity assistance from the European Central Bank. We believe that the ECB’s quantitative easing program and Outright Monetary Transactions will temper a lot of the bond and currency volatility, and some of the stock-market volatility. However, a “black swan” event remains a possibility. This is relevant because, despite heightening risks, only 36% of institutional investors we surveyed believe they have access to the appropriate tools or solutions for dealing with tail risk. This lack of preparedness could be a recipe for bigger problems down the road for investors without sufficient risk management baked into to their portfolios. Obstacles hindering the adoption of appropriate tools include concerns about cost and a lack of understanding of tail risk. Scalper1 News

Tail risk, the risk of an asset or portfolio moving more than three standard deviations away from its current price, appears to be increasing around the world. And some investors feel ill-equipped to manage this risk. This according to our latest poll of institutional investors. Last week, we released the results of the Allianz Global Investors RiskMonitor survey, a comprehensive look at views on portfolio construction, asset allocation and risk. This year we queried 735 institutional investors around the globe representing a variety of different institutions: pension funds, foundations, endowments, sovereign wealth funds, family offices, banks and insurance companies. The findings of this year’s survey reinforced our view that global risks are increasing amid a complicated economic, geopolitical and monetary policy environment. In particular, this challenging climate was underscored by the survey results, which showed that two-thirds of the respondents believe that tail-risk events are likely to be more frequent due to the interconnectedness of global financial markets. In addition, two-thirds of the survey participants also assert that tail risk has become an increasing worry since the 2008-2009 global financial crisis. Specifically, 62% believe tail risk is a “high” or “very high” risk. And 41% of the institutional investors surveyed believe a tail-risk event is “likely” or “very likely” in the next 12 months. Yet far fewer are “confident” or “somewhat confident” that their portfolios have appropriate downside protection for the next tail-risk event. Known Unknowns? Where are they seeing the biggest risks? The institutional investors we surveyed believe the most likely cause of future tail-risk events include oil-price shocks, sovereign-debt default, European politics, new asset bubbles and a euro-zone recession. However, this view varies by region. In the Americas, investors polled believe oil-price shocks are most likely to be the cause of the next tail-risk event, followed by US politics and European politics. In Europe and the Middle East, new asset bubbles are believed to be the most likely cause of the next tail-risk event, followed by geopolitical tensions in Europe and sovereign-debt default. Meanwhile, in the Asia-Pacific region, oil-price shocks are perceived to be the most likely cause of the next tail-risk event, followed by sovereign-debt default and a euro-zone recession. Interestingly, the timing of the release of the study coincides with an escalation of the ongoing debt crisis in Greece. That volatile situation aligns with the view that a sovereign-debt default and European politics are probable causes of future tail-risk events. Heading for the Grexit? So could Greece’s problems trigger a tail-risk event? Today, in light of the recent deterioration in negotiations between Greek government officials and Greece’s creditors, we see a material rise in the risk of a mistake by either side. We now have less confidence in a constructive outcome than we’ve had previously. As a result, we see increasing potential for a “Grexit” – Greece intentionally leaving the European Monetary Union – or a “Graccident” – Greece accidentally exiting. The accidental exit could occur if there’s a run on the banks, which would trigger the termination of emergency liquidity assistance from the European Central Bank. We believe that the ECB’s quantitative easing program and Outright Monetary Transactions will temper a lot of the bond and currency volatility, and some of the stock-market volatility. However, a “black swan” event remains a possibility. This is relevant because, despite heightening risks, only 36% of institutional investors we surveyed believe they have access to the appropriate tools or solutions for dealing with tail risk. This lack of preparedness could be a recipe for bigger problems down the road for investors without sufficient risk management baked into to their portfolios. Obstacles hindering the adoption of appropriate tools include concerns about cost and a lack of understanding of tail risk. Scalper1 News

Scalper1 News