Scalper1 News

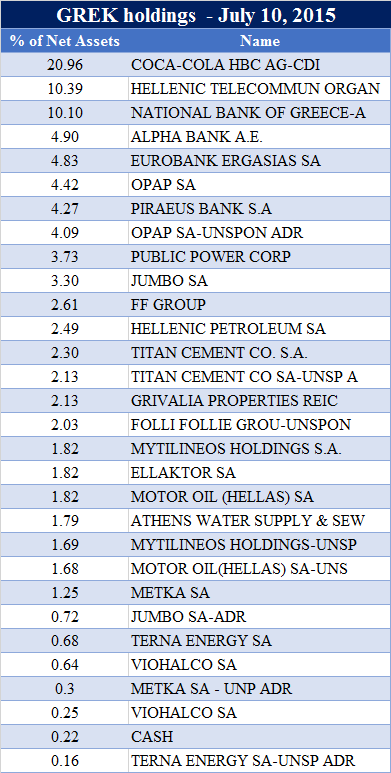

Summary A deal between Greece and its creditors is near, but the Greek parliament must accept austerity measures by Wednesday. Greek banks need liquidity but the ECB won’t provide it to them if the parliament doesn’t pass the measures. Bank shares represent 25% of GREK’s portfolio and they may push its share price significantly upwards as well as downwards. GREK has a lot of upside potential after the new deal is closed, but investors should monitor steps of Greek government closely, as the Greek politicians are highly unreliable. As I wrote back in March , the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ) has a significant upside potential, after the current situation is resolved. A lot of things have changed, but the situation hasn’t been resolved yet. GREK lost half of its value over the last 12 months, but the decline has slowed down significantly over the last couple of months. The $9 line wasn’t breached and the recent developments indicate that it maybe won’t be retested anytime soon. But the Greek debt saga hasn’t ended yet and the current optimism may turn into a huge sell off as soon as on Wednesday. Do we have a deal? Although the deal between Greece and its creditors is close, the game is still not over. After 17 hours of negotiations, there is an agreement that Greece will not have to leave the eurozone and that it will get another €86 billion, but the Greek parliament must approve austerity measures by Wednesday. The Greeks have to reform their VAT system, reduce pensions and make some immediate budget cuts. Greece will also create a trust fund that will manage state assets worth approximately €50 billion. The fund should be based in Greece but it will be managed by an external agency. The assets held by the fund should be privatized and the proceeds should be used primarily for debt repayments. It is expected that shares of Greek banks will represent a big part of the assets, as the Greek government will buy new shares of the banks in order to refinance them. The shares will be transferred to the fund subsequently. All of the measures must be accepted by the Greek parliament by Wednesday. And it is not sure whether all of the proposals will really pass, as there is a lot of Greek politicians who are against the austerity measures. Tsipras will need votes of the opposition, as he can’t rely on support of his own party. The Wednesday deadline is important also for the cash-strapped Greek banks. They desperately need liquidity from the ECB but it is expected that the ECB won’t provide them any liquidity if the austerity measures are not accepted by the parliament on Wednesday. If the measures pass on Wednesday, the GREK share price should start to realize its upside potential. Although there is a significant danger that there will be some complications. In this case the EU will probably postpone the deadline by a couple of days (the EU is really great in postponing deadlines and Greece is really great in missing deadlines) in order to enable another voting, but the reaction of investors may be very nervous. A breakage of the $9 level isn’t excluded. GREK composition and growth prospects The table below shows complete holdings of GREK, as of July 10. The biggest holding is Coca-Cola HBC ( OTC:CCHBF ) that represents almost 21% of GREK’s portfolio. A strong position has also Hellenic Telecommunications Organization ( OTC:HLTOY ). Both of the companies should be relatively stable. The problem is that GREK also holds a lot of bank shares. Source: own processing, using data of globalxfunds.com The National Bank of Greece (NYSE: NBG ), Alpha Bank ( OTC:ALBKY ), Eurobank Ergasias ( OTC:EGFEY ) and Piraeus Bank ( OTC:BPIRY ) represent almost 25% of GREK’s portfolio. These shares may lead the rally if the austerity measures are accepted and the ECB provides liquidity to Greek banks. On the other hand if there are some complications, shares of banks will be most probably the biggest losers. Conclusion I still believe that GREK has a significant upside potential, in the longer term. After the austerity measures are accepted, we can expect a relief rally. But the investors should be careful, as the Greek politicians have shown that they are highly unreliable. They had agreed to make some economic reforms in the past, but they violated their promises only a couple of months later. Even if the Greek parliament accepts the current proposals, there is no warranty that the Greek government will play by the rules. In this case, GREK shareholders should be prepared to liquidate their positions as soon as possible, to avoid losses similar to those recorded by GREK over the last 12 months. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary A deal between Greece and its creditors is near, but the Greek parliament must accept austerity measures by Wednesday. Greek banks need liquidity but the ECB won’t provide it to them if the parliament doesn’t pass the measures. Bank shares represent 25% of GREK’s portfolio and they may push its share price significantly upwards as well as downwards. GREK has a lot of upside potential after the new deal is closed, but investors should monitor steps of Greek government closely, as the Greek politicians are highly unreliable. As I wrote back in March , the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ) has a significant upside potential, after the current situation is resolved. A lot of things have changed, but the situation hasn’t been resolved yet. GREK lost half of its value over the last 12 months, but the decline has slowed down significantly over the last couple of months. The $9 line wasn’t breached and the recent developments indicate that it maybe won’t be retested anytime soon. But the Greek debt saga hasn’t ended yet and the current optimism may turn into a huge sell off as soon as on Wednesday. Do we have a deal? Although the deal between Greece and its creditors is close, the game is still not over. After 17 hours of negotiations, there is an agreement that Greece will not have to leave the eurozone and that it will get another €86 billion, but the Greek parliament must approve austerity measures by Wednesday. The Greeks have to reform their VAT system, reduce pensions and make some immediate budget cuts. Greece will also create a trust fund that will manage state assets worth approximately €50 billion. The fund should be based in Greece but it will be managed by an external agency. The assets held by the fund should be privatized and the proceeds should be used primarily for debt repayments. It is expected that shares of Greek banks will represent a big part of the assets, as the Greek government will buy new shares of the banks in order to refinance them. The shares will be transferred to the fund subsequently. All of the measures must be accepted by the Greek parliament by Wednesday. And it is not sure whether all of the proposals will really pass, as there is a lot of Greek politicians who are against the austerity measures. Tsipras will need votes of the opposition, as he can’t rely on support of his own party. The Wednesday deadline is important also for the cash-strapped Greek banks. They desperately need liquidity from the ECB but it is expected that the ECB won’t provide them any liquidity if the austerity measures are not accepted by the parliament on Wednesday. If the measures pass on Wednesday, the GREK share price should start to realize its upside potential. Although there is a significant danger that there will be some complications. In this case the EU will probably postpone the deadline by a couple of days (the EU is really great in postponing deadlines and Greece is really great in missing deadlines) in order to enable another voting, but the reaction of investors may be very nervous. A breakage of the $9 level isn’t excluded. GREK composition and growth prospects The table below shows complete holdings of GREK, as of July 10. The biggest holding is Coca-Cola HBC ( OTC:CCHBF ) that represents almost 21% of GREK’s portfolio. A strong position has also Hellenic Telecommunications Organization ( OTC:HLTOY ). Both of the companies should be relatively stable. The problem is that GREK also holds a lot of bank shares. Source: own processing, using data of globalxfunds.com The National Bank of Greece (NYSE: NBG ), Alpha Bank ( OTC:ALBKY ), Eurobank Ergasias ( OTC:EGFEY ) and Piraeus Bank ( OTC:BPIRY ) represent almost 25% of GREK’s portfolio. These shares may lead the rally if the austerity measures are accepted and the ECB provides liquidity to Greek banks. On the other hand if there are some complications, shares of banks will be most probably the biggest losers. Conclusion I still believe that GREK has a significant upside potential, in the longer term. After the austerity measures are accepted, we can expect a relief rally. But the investors should be careful, as the Greek politicians have shown that they are highly unreliable. They had agreed to make some economic reforms in the past, but they violated their promises only a couple of months later. Even if the Greek parliament accepts the current proposals, there is no warranty that the Greek government will play by the rules. In this case, GREK shareholders should be prepared to liquidate their positions as soon as possible, to avoid losses similar to those recorded by GREK over the last 12 months. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News