The provider of industrial packaging products and services, Greif, Inc. GEF reported adjusted earnings of 45 cents per share in first-quarter fiscal 2017 (ended Jan 31, 2017), which increased 12.5% year over year. However, earnings fell short of the Zacks Consensus Estimate of 50 cents.

Including one-time items, the company posted earnings of 10 cents per share, compared to a loss of 19 cents per share recorded in the year-ago quarter.

Operational Update

Revenues increased 6% year over year to $ 820.9 million from $ 771.4 million in the prior-year quarter. Also, revenues beat the Zacks Consensus Estimate of $ 811 million.

Cost of sales increased 6% year over year to $ 657.6 million. Gross profit grew 8% year over year to $ 163.3 million. Gross margin expanded 20 basis points to 19.8% in the quarter. Selling, general and administrative (SG&A) expenses went up 3.6% year over year to $ 96.6 million. Adjusted operating profit climbed 14.8% year over year to $ 66.7 million. Adjusted operating margin advanced 50 basis points to 8% in the quarter.

Segmental Performance

Rigid Industrial Packaging & Services : This segment reported sales of $ 561.5 million, down 5% from $ 601 million in the year-ago quarter. Adjusted operating profit jumped 22.6% year over year to $ 43.4 million from $ 35.4 million.

Paper Packaging : Sales were up 15.5% year over year to $ 182.9 million, on the back of increases in volumes and increased sales of specialty products. The segment reported an adjusted operating profit of $ 19.9 million, down 12.3% year over year, due primarily to an increase in pension costs and allocated corporate costs.

Flexible Products & Services : Sales from this segment declined 4.4% year over year to $ 69.7 million. Excluding the impact of divestitures, sales increased 3.5% mainly due to product volume improvements. The segment reported adjusted operating profit of $ 1.6 million compared to an operating loss of $ 1.6 million in the year-earlier quarter.

Land Management: The segment’s sales plunged 30.8% year over year to $ 1.6 million. Operating income remained flat year over year at $ 2.1 million.

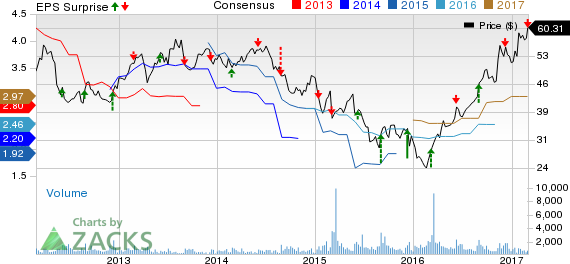

Greif Bros. Corporation Price, Consensus and EPS Surprise

Greif Bros. Corporation Price, Consensus and EPS Surprise | Greif Bros. Corporation Quote

Financial Position

Greif ended the quarter with cash and cash equivalents of $ 106.8 million, compared with $ 103.7 million at the end of the prior-year quarter. Cash used in operations was $ 44 million for fiscal first quarter compared with cash usage of $ 26 million in the year-ago quarter. Long-term debt was $ 1074.8 million as of Jan 31, 2017, compared with $ 974.6 million as of Oct 31, 2016.

On Feb 28, 2017, Greif declared a quarterly dividend of 42 cents per share of Class A Common Stock and 63 cents per share of Class B Common Stock. The dividends are payable on Apr 1, 2017, to stockholders of record at the close of business as of Mar 17.

Guidance

Greif reaffirmed its fiscal 2017 earnings per share guidance range of $ 2.78 and $ 3.08. Compared to the adjusted earnings per share of $ 2.44 in fiscal 2016, the guidance range depicts year-over-year growth in the range of 14-26%.

Share Price Performance

In the last one year, Greif has outperformed the Zacks classified Containers-Metal/Glass sub-industry with respect to price performance. The stock gained around 118.8%, while the industry rose 17.6% over the same time frame.

Zacks Rank & Key Picks

Greif currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the sector include ACCO Brands Corporation ACCO , Brady Corporation BRC and Deere & Company DE . All of the three stocks boast a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ACCO Brands has an earnings ESP of 24.74% for the trailing four quarters. Brady Corporation has an average earnings surprise of 20.84% for the last four quarters, while Deere & Company has an average earnings surprise of 60.50% for the past four quarters.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 “Strong Buy” stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 “Strong Sells” and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Greif Bros. Corporation (GEF): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

Acco Brands Corporation (ACCO): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International