Scalper1 News

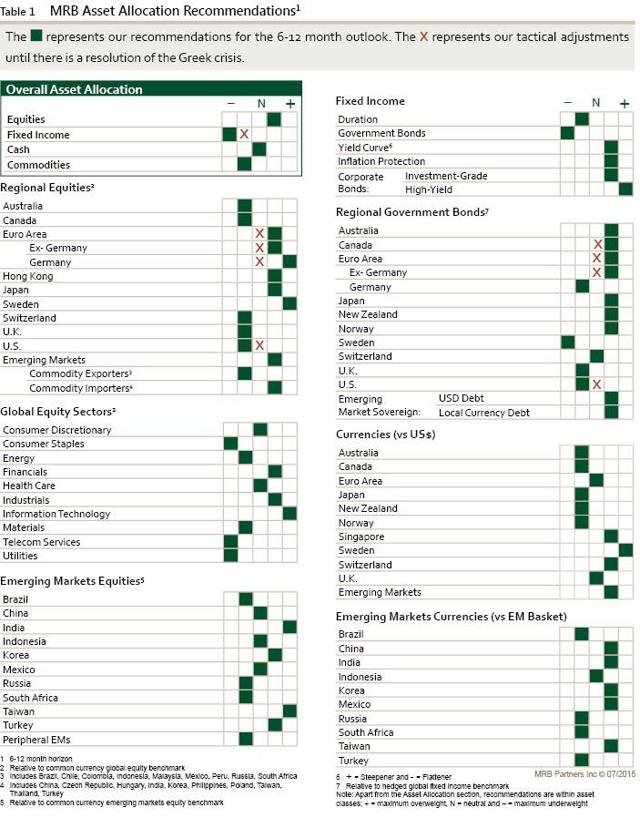

By Douglas R. Terry, CFA Jeff Snider and I often speak of the balance sheet leverage effect in markets. In the modern system, computer models assess the risk of portfolios throughout the industry. One key input to any value at risk model is volatility. If the standard deviation of prices rises, the computer will tell the managers that there is a greater probability of losses to the portfolio. Thus, managers have a mandate to reduce the risk in the portfolio to get their VAR back in down to acceptable levels. Thus, rising volatility is like a deleveraging type event as assets are sold. Many times the best performing assets in the portfolio are the ones that get chopped. This is partially because the out-performance likely means they are currently overweight in the portfolio, thus a rebalancing. Second, valuations of recent high flyers can be frothy compared to lagging peers. And third, assets with underlying strength can be easier to sell during market turmoil. Chinese equity weakness this past week was blamed on the Chinese economy. But I’m not convinced China shares were not merely the victim of recent success during a time of risk reduction. The table below shows some recommended changes in your asset allocation in order to reduce risk in your portfolio until the current Greek crisis is resolved and volatility comes back down. (click to enlarge) Disclosure : None Scalper1 News

By Douglas R. Terry, CFA Jeff Snider and I often speak of the balance sheet leverage effect in markets. In the modern system, computer models assess the risk of portfolios throughout the industry. One key input to any value at risk model is volatility. If the standard deviation of prices rises, the computer will tell the managers that there is a greater probability of losses to the portfolio. Thus, managers have a mandate to reduce the risk in the portfolio to get their VAR back in down to acceptable levels. Thus, rising volatility is like a deleveraging type event as assets are sold. Many times the best performing assets in the portfolio are the ones that get chopped. This is partially because the out-performance likely means they are currently overweight in the portfolio, thus a rebalancing. Second, valuations of recent high flyers can be frothy compared to lagging peers. And third, assets with underlying strength can be easier to sell during market turmoil. Chinese equity weakness this past week was blamed on the Chinese economy. But I’m not convinced China shares were not merely the victim of recent success during a time of risk reduction. The table below shows some recommended changes in your asset allocation in order to reduce risk in your portfolio until the current Greek crisis is resolved and volatility comes back down. (click to enlarge) Disclosure : None Scalper1 News

Scalper1 News