Scalper1 News

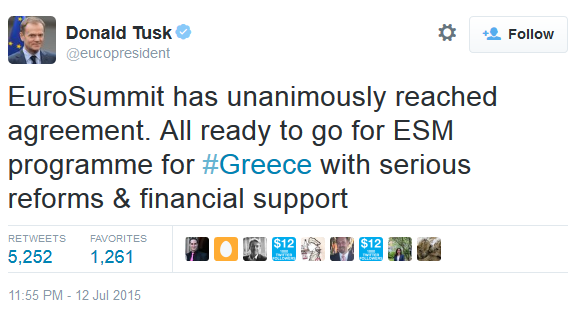

Summary Greece had finally yielded to Creditor’s demand for austerity against the wishes of its people and this removes the Grexit risk. Fed is now more likely to rise rates as global growth is now more secured to get against financial stability as advocated by the BIS. Gold prices will continue to slump as a result. Greek Bailout Agreement This article is motivated by the breaking news that Greece had reached an agreement with its creditors after a 17 hour marathon negotiation session. It was a make or break moment for Greece and Greece folded to the EU austerity demands despite a clear ‘No’ referendum result on July 5. As the screen shot from European Council President Donald Tusk’s Twitter account shows, there was unanimous approval for the third Greek bailout. Source : Twitter In the end, pensions will be cut and taxes will rise for Greece to stay within the Eurozone and pay its debt on time. Austerity will continue to bite against of the Greek population wishes but at least we can see the light at the end of the tunnel. It is possible that Greek banks will open by the end of the month as the European Central Bank (ECB) is likely to increase its funding support and deposit flight would be reduced greatly. Implication For Gold Prices However the key question for this article would be what does it mean for the price of gold? My previous position for the price of gold is that the premium for USD in the rush for safety will outweigh the premium for gold over Grexit financial stability concerns. This has largely played out which I would highlight in the gold price chart towards the end of the article. Today we have a different situation where the threat of Grexit has largely been taken off the table. This would be even more bearish for the price of gold. The obvious point is that there will be less concern over financial stability. Hence there is now less need for the financial markets to hold gold. The second and less obvious pull factor away from gold would be that it would clear the path for the Fed to rise rates earlier. This could now be done as early as the FOMC meeting on 17 September 2015. We can have more clues from the July 29 FOMC statement and the minutes which will be published on August 19. It is clear that the US economy had been consistent progress especially in the second quarter of 2015. The Fed is approaching its mandate of maximum employment with unemployment at 5.3% and the target unemployment range is from 5.0% to 5.2%. This range has been revised lower consistently and wages have gone up as a result. Quit rates have gone up as well as employees quit jobs to find jobs that fits them better. This is a result of higher confidence in the jobs market which translated to better consumer confidence. The Fed is confident of hitting its 2% inflation target in the medium term over the next 2 years and this period would be the time for them to raise rates and get ahead of the curve. BIS Support For Rate Hike & Growth Implication On the international front, there has been difference in opinion between the Bank of International Settlements (BIS) and the International Monetary Fund (IMF). The BIS advocated that the Fed rise rates as soon as possible so as not to punish savers unnecessarily and to create bubbles in other parts of the financial markets. In addition, the higher rates would also give the Fed the tools it need to deal with the next crisis. This is the quote for the relevant Handelsblatt interview which the BIS expressed its views Do you think that central banks should raise the interest rate earlier and faster in order to preserve financial stability? Would that be your advice for the Fed? Mr. Caruana: We think there are risks and costs if central banks raise interest rates too late. They become apparent only once you fully factor financial stability considerations into monetary policy. But at present the debate is not paying much attention to this. Rather, it focuses on the costs of raising interest rates too early. Mr Jamie Caruana is the General Manager of the BIS. This article was published recently on July 10 and it is in response to the IMF opinion that the Fed should push its rate hike to year 2016. IMF Managing Director Christine Lagarde advocated that the Fed push its rate hike to year 2016 so as not to undermine the fragile recovery. Conclusion The Greek bailout agreement takes the risk away that a rate hike would hurt the European recovery as a whole. This would also mean that higher growth would also necessitate higher interest rates to tame inflation going forward. If institutional savers are constrained by artificial low interest rates, they would be tempted to push up other asset values such as real estate or the equity market. This is the financial stability risk which the BIS was referring to. It is not saying that the Greek bailout would lessen financial stability risk and hence there is lesser need for a rate hike. (click to enlarge) As we can see from the SPDR Gold Trust ETF (NYSEARCA: GLD ) chart above, gold prices have been bearish for the past month as the Grexit crisis intensified as predicted by my previous articles. This is likely to continue in the near future as the chances of a Fed rate hike in September 2015 goes up. Hence we should continue to avoid gold in the short run. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Greece had finally yielded to Creditor’s demand for austerity against the wishes of its people and this removes the Grexit risk. Fed is now more likely to rise rates as global growth is now more secured to get against financial stability as advocated by the BIS. Gold prices will continue to slump as a result. Greek Bailout Agreement This article is motivated by the breaking news that Greece had reached an agreement with its creditors after a 17 hour marathon negotiation session. It was a make or break moment for Greece and Greece folded to the EU austerity demands despite a clear ‘No’ referendum result on July 5. As the screen shot from European Council President Donald Tusk’s Twitter account shows, there was unanimous approval for the third Greek bailout. Source : Twitter In the end, pensions will be cut and taxes will rise for Greece to stay within the Eurozone and pay its debt on time. Austerity will continue to bite against of the Greek population wishes but at least we can see the light at the end of the tunnel. It is possible that Greek banks will open by the end of the month as the European Central Bank (ECB) is likely to increase its funding support and deposit flight would be reduced greatly. Implication For Gold Prices However the key question for this article would be what does it mean for the price of gold? My previous position for the price of gold is that the premium for USD in the rush for safety will outweigh the premium for gold over Grexit financial stability concerns. This has largely played out which I would highlight in the gold price chart towards the end of the article. Today we have a different situation where the threat of Grexit has largely been taken off the table. This would be even more bearish for the price of gold. The obvious point is that there will be less concern over financial stability. Hence there is now less need for the financial markets to hold gold. The second and less obvious pull factor away from gold would be that it would clear the path for the Fed to rise rates earlier. This could now be done as early as the FOMC meeting on 17 September 2015. We can have more clues from the July 29 FOMC statement and the minutes which will be published on August 19. It is clear that the US economy had been consistent progress especially in the second quarter of 2015. The Fed is approaching its mandate of maximum employment with unemployment at 5.3% and the target unemployment range is from 5.0% to 5.2%. This range has been revised lower consistently and wages have gone up as a result. Quit rates have gone up as well as employees quit jobs to find jobs that fits them better. This is a result of higher confidence in the jobs market which translated to better consumer confidence. The Fed is confident of hitting its 2% inflation target in the medium term over the next 2 years and this period would be the time for them to raise rates and get ahead of the curve. BIS Support For Rate Hike & Growth Implication On the international front, there has been difference in opinion between the Bank of International Settlements (BIS) and the International Monetary Fund (IMF). The BIS advocated that the Fed rise rates as soon as possible so as not to punish savers unnecessarily and to create bubbles in other parts of the financial markets. In addition, the higher rates would also give the Fed the tools it need to deal with the next crisis. This is the quote for the relevant Handelsblatt interview which the BIS expressed its views Do you think that central banks should raise the interest rate earlier and faster in order to preserve financial stability? Would that be your advice for the Fed? Mr. Caruana: We think there are risks and costs if central banks raise interest rates too late. They become apparent only once you fully factor financial stability considerations into monetary policy. But at present the debate is not paying much attention to this. Rather, it focuses on the costs of raising interest rates too early. Mr Jamie Caruana is the General Manager of the BIS. This article was published recently on July 10 and it is in response to the IMF opinion that the Fed should push its rate hike to year 2016. IMF Managing Director Christine Lagarde advocated that the Fed push its rate hike to year 2016 so as not to undermine the fragile recovery. Conclusion The Greek bailout agreement takes the risk away that a rate hike would hurt the European recovery as a whole. This would also mean that higher growth would also necessitate higher interest rates to tame inflation going forward. If institutional savers are constrained by artificial low interest rates, they would be tempted to push up other asset values such as real estate or the equity market. This is the financial stability risk which the BIS was referring to. It is not saying that the Greek bailout would lessen financial stability risk and hence there is lesser need for a rate hike. (click to enlarge) As we can see from the SPDR Gold Trust ETF (NYSEARCA: GLD ) chart above, gold prices have been bearish for the past month as the Grexit crisis intensified as predicted by my previous articles. This is likely to continue in the near future as the chances of a Fed rate hike in September 2015 goes up. Hence we should continue to avoid gold in the short run. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News