Scalper1 News

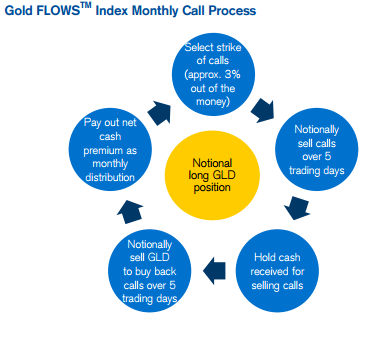

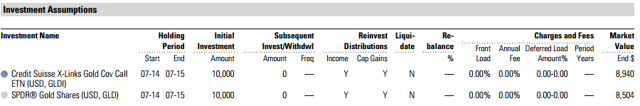

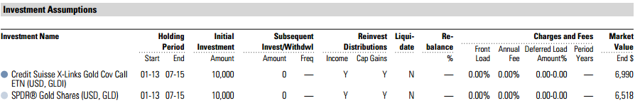

Summary GLDI is the gold variant of Credit Suisse’s covered call strategy ETNs. GLDI is an ETN issued by Credit Suisse, benchmarked to the Credit Suisse NASDAQ Gold FLOWS 103 Index, a proprietary index designed to track a covered call strategy. The Credit Suisse NASDAQ Gold FLOWS TM 103 Index notionally sells approximately 3% out of the money notional calls each month while maintaining a notional long position in GLD shares. The exchange traded note can potentially lower the downside risk over owning GLD shares or gold bullion outright with the approximately 11% distribution representing the covered call premiums. A few days ago I wrote about the silver sister product of this ETN offered by Credit Suisse. While the products are very similar in nature, there are a few differences as it relates to both the income generating strategy, and the resulting performance of the product. You can read the article about the Credit Suisse Silver Shares Covered Call ETN (NASDAQ: SLVO ) here. Before diving into the specifics of Credit Suisse X-Links Gold Shares Covered Call ETN (NASDAQ: GLDI ), let’s quickly review who this product is for and for whom it is not. I am going to quote myself from the previous article as it will sum it up quite well. Unlike in the world of stock and bond investors, the precious metals world has a wide variety of investors, ranging from individuals and institutions who just want to have precious metals exposures, to bullion purists who believe the only “real” way to invest in precious metals is to buy bullion that you hold in your hands, in your safe. This investment… is not for them. Source: SLVO: A Safer Way to Invest In Silver? GLDI is for someone who is not opposed to owning exposure to gold, either through exchange traded funds that invest in gold bullion such as the SPDR Gold Trust ETF (NYSEARCA: GLD ), the Sprott Physical Gold Trust (NYSEARCA: PHYS ) or the iShares Gold Trust ETF (NYSEARCA: IAU ), gold derivatives and indexes such as the PowerShares DB Gold ETF (NYSEARCA: DGL ), or gold mining stocks via ETFs or individual names and wants incremental income and lower volatility. What is the Credit Suisse X-Links Gold Shares Covered Call ETN ? GLDI is an exchange traded note benchmarked to the Credit Suisse NASDAQ Gold FLOWS 103 Index. The index is designed to replicate a strategy where you would write short term options against shares of GLD, the gold ETF. Specifically, Credit Suisse describes the index and strategy as follows: In a covered call (or “overwrite”) strategy, an investor holds a long position in an asset and sells call options on that same asset. Call options provide the seller with an up front premium payment, but require the seller to deliver to the buyer any upside an asset experiences beyond a set level (the “strike price”). The Gold FLOWSTM 103 Index sells approximately 3% out-of-the-money notional calls each month while maintaining a notional long position in shares. The notional net premiums received (if any) for selling the calls are paid out at the end of each monthly period. The strategy is designed to generate monthly cash flow in exchange for giving up any gains beyond the strike price. The strategy provides no protection from losses resulting from a decline in the value of the shares beyond the notional call premium. Source: Credit Suisse Below is a graphical representation of the Index Strategy: Source: Credit Suisse Performance For anyone who invested in Gold over the last 5 years, it would be tough to find a person who is happy with their investment, especially amongst those who purchased gold anywhere between $1,500 and $1,900 an ounce. With Gold currently at around $1,100 an ounce and trading within a fairly well established multi year, long term downtrend, it is not unreasonable to start thinking about what you could have done differently. While many gold bugs would justify any drop in price by diverting attention to the amount of ounces saved. Most investors though, particularly those investing in gold within their investment accounts are going to be forced to look at the value on the statement. A covered call strategy employed by this ETN would potentially lower a bit of the downside volatility and generate income by monetizing the risk you are taking for holding an inherently risky investment. Theoretically, a covered call strategy will be able to generate more income and outperform a simple buy and hold strategy in falling and flat markets. In order to generate the incremental income, you are giving up your upside over the strike price of the call options. In more volatile markets, writing call options generally makes sense as you are able to monetize the risk you are already taking by holding the underlying investment. Where you end up losing is during rising markets and your investments are called. Source: : A Safer Way to Invest In Silver? GLDI has performed exactly as expected over 1 year, 2 years, and since inception time periods. Below you can see the results of what a $10,000 investment in each of GLDI and GLD would net you. While a $10,000 investment in GLD would be worth approximately $8,504, representing a loss of nearly 15%, an investment in GLDI would be worth approximately $8,904, or a loss of approximately 11%. This hypothetical included a reinvestment of distributions. (click to enlarge) Since inception this trend stands true. A $10,000 investment from January 2013 in GLD would yield $6,518, whereas an investment in GLDI would be worth approximately $6,990. (click to enlarge) Is GLDI right for you? Perhaps. Even though GLDI has handily outperformed an outright investment in GLD, there are a number of downsides. The first risk is the strategy risk. In rising markets, writing covered calls will cap your upside on the investment. If for any reason gold spot price will rally over a sustained period of time, your upside will be limited typically to the 3% over spot price at the time the covered call was written, plus the premium received for writing the call. So for example if you purchased GLD today, for $106.26, a 3% over market price would imply $109.44, so let’s look at a $110.00 strike price, approximately 40 days out, in which case we would look at the September 18th, 2015 expiring option. The $110 strike is trading for approximately $.64, which you would receive. As we get closer to September 18th, that time premium would eradicate, and the only thing left over would be any intrinsic value. Since you are writing $110 options, and GLD is currently $106.26, there is only time value, and no intrinsic value in those options. If at expiration GLD is under $110, those options would expire worthless and you keep your $.64, in which case it is all profit. If GLD is over $110, let’s say $112, that option would be worth somewhere close to $2.00, the “intrinsic value.” At expiration, you would have the choice, either buy the option back for the $2.00, or let the shares of GLD get called away, where you would get the $110, plus the $.64 you received for writing the calls. Yes, you are making money, but you capped your upside. Because the benchmark has clear rules over what happens, the ETN index will buy back those calls approximately 5 days before expiration. The second risk here is the product structure. In this case, you must absolutely be aware that this is not an ETF, an exchange traded fund with underlying investments. This is an ETN, an exchange traded note. Unlike an ETF, ETNs are not shares of the actual underlying funds, ETNs are credit obligations, like bonds of the underlying issuer, whose value tracks a specified index. In the event of a default, owners of the ETN would be lining up for the settlement in the liquidation of the issuer. In order to invest in this ETN, you should be absolutely comfortable with Credit Suisse’s credit risk. While Credit Suisse is a seemingly sound institution, your investment in this ETN is not backed or invested in any underlying shares of gold. This is an additional risk that you should take into account. If you are not comfortable with taking on that credit risk, the alternative is to purchase your own shares of GLD and write the covered call options by yourself, to replicate this strategy. Note that you may incur additional trading fees, by both buying and selling the individual securities as well as writing and buying back any options. For smaller accounts, GLDI’s annual expense of .65% will likely be cheaper over the long term, however by owning your own shares of GLD, you will have more flexibility as to what options you will want to write. Other products that you may want to consider are the GAMCO Global Gold, Natural Resources & Income Trust (NYSEMKT: GGN ) and the BlackRock Resources & Commodities Strategy Trust (NYSE: BCX ). Both are Closed End Funds, which do carry annual fees, however there is an underlying portfolio of investments in case of liquidation. For more discussion about risk faced with ETN investing, feel free to read my previous ETN articles such as RBS ETNS: When A Good Idea Alone is Not Enough , as well as SLVO, linked above. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: None of the information discussed should be considered investment advice or a solicitation to buy or sell any securities. Please consult your investment advisor for specific recommendations. Scalper1 News

Summary GLDI is the gold variant of Credit Suisse’s covered call strategy ETNs. GLDI is an ETN issued by Credit Suisse, benchmarked to the Credit Suisse NASDAQ Gold FLOWS 103 Index, a proprietary index designed to track a covered call strategy. The Credit Suisse NASDAQ Gold FLOWS TM 103 Index notionally sells approximately 3% out of the money notional calls each month while maintaining a notional long position in GLD shares. The exchange traded note can potentially lower the downside risk over owning GLD shares or gold bullion outright with the approximately 11% distribution representing the covered call premiums. A few days ago I wrote about the silver sister product of this ETN offered by Credit Suisse. While the products are very similar in nature, there are a few differences as it relates to both the income generating strategy, and the resulting performance of the product. You can read the article about the Credit Suisse Silver Shares Covered Call ETN (NASDAQ: SLVO ) here. Before diving into the specifics of Credit Suisse X-Links Gold Shares Covered Call ETN (NASDAQ: GLDI ), let’s quickly review who this product is for and for whom it is not. I am going to quote myself from the previous article as it will sum it up quite well. Unlike in the world of stock and bond investors, the precious metals world has a wide variety of investors, ranging from individuals and institutions who just want to have precious metals exposures, to bullion purists who believe the only “real” way to invest in precious metals is to buy bullion that you hold in your hands, in your safe. This investment… is not for them. Source: SLVO: A Safer Way to Invest In Silver? GLDI is for someone who is not opposed to owning exposure to gold, either through exchange traded funds that invest in gold bullion such as the SPDR Gold Trust ETF (NYSEARCA: GLD ), the Sprott Physical Gold Trust (NYSEARCA: PHYS ) or the iShares Gold Trust ETF (NYSEARCA: IAU ), gold derivatives and indexes such as the PowerShares DB Gold ETF (NYSEARCA: DGL ), or gold mining stocks via ETFs or individual names and wants incremental income and lower volatility. What is the Credit Suisse X-Links Gold Shares Covered Call ETN ? GLDI is an exchange traded note benchmarked to the Credit Suisse NASDAQ Gold FLOWS 103 Index. The index is designed to replicate a strategy where you would write short term options against shares of GLD, the gold ETF. Specifically, Credit Suisse describes the index and strategy as follows: In a covered call (or “overwrite”) strategy, an investor holds a long position in an asset and sells call options on that same asset. Call options provide the seller with an up front premium payment, but require the seller to deliver to the buyer any upside an asset experiences beyond a set level (the “strike price”). The Gold FLOWSTM 103 Index sells approximately 3% out-of-the-money notional calls each month while maintaining a notional long position in shares. The notional net premiums received (if any) for selling the calls are paid out at the end of each monthly period. The strategy is designed to generate monthly cash flow in exchange for giving up any gains beyond the strike price. The strategy provides no protection from losses resulting from a decline in the value of the shares beyond the notional call premium. Source: Credit Suisse Below is a graphical representation of the Index Strategy: Source: Credit Suisse Performance For anyone who invested in Gold over the last 5 years, it would be tough to find a person who is happy with their investment, especially amongst those who purchased gold anywhere between $1,500 and $1,900 an ounce. With Gold currently at around $1,100 an ounce and trading within a fairly well established multi year, long term downtrend, it is not unreasonable to start thinking about what you could have done differently. While many gold bugs would justify any drop in price by diverting attention to the amount of ounces saved. Most investors though, particularly those investing in gold within their investment accounts are going to be forced to look at the value on the statement. A covered call strategy employed by this ETN would potentially lower a bit of the downside volatility and generate income by monetizing the risk you are taking for holding an inherently risky investment. Theoretically, a covered call strategy will be able to generate more income and outperform a simple buy and hold strategy in falling and flat markets. In order to generate the incremental income, you are giving up your upside over the strike price of the call options. In more volatile markets, writing call options generally makes sense as you are able to monetize the risk you are already taking by holding the underlying investment. Where you end up losing is during rising markets and your investments are called. Source: : A Safer Way to Invest In Silver? GLDI has performed exactly as expected over 1 year, 2 years, and since inception time periods. Below you can see the results of what a $10,000 investment in each of GLDI and GLD would net you. While a $10,000 investment in GLD would be worth approximately $8,504, representing a loss of nearly 15%, an investment in GLDI would be worth approximately $8,904, or a loss of approximately 11%. This hypothetical included a reinvestment of distributions. (click to enlarge) Since inception this trend stands true. A $10,000 investment from January 2013 in GLD would yield $6,518, whereas an investment in GLDI would be worth approximately $6,990. (click to enlarge) Is GLDI right for you? Perhaps. Even though GLDI has handily outperformed an outright investment in GLD, there are a number of downsides. The first risk is the strategy risk. In rising markets, writing covered calls will cap your upside on the investment. If for any reason gold spot price will rally over a sustained period of time, your upside will be limited typically to the 3% over spot price at the time the covered call was written, plus the premium received for writing the call. So for example if you purchased GLD today, for $106.26, a 3% over market price would imply $109.44, so let’s look at a $110.00 strike price, approximately 40 days out, in which case we would look at the September 18th, 2015 expiring option. The $110 strike is trading for approximately $.64, which you would receive. As we get closer to September 18th, that time premium would eradicate, and the only thing left over would be any intrinsic value. Since you are writing $110 options, and GLD is currently $106.26, there is only time value, and no intrinsic value in those options. If at expiration GLD is under $110, those options would expire worthless and you keep your $.64, in which case it is all profit. If GLD is over $110, let’s say $112, that option would be worth somewhere close to $2.00, the “intrinsic value.” At expiration, you would have the choice, either buy the option back for the $2.00, or let the shares of GLD get called away, where you would get the $110, plus the $.64 you received for writing the calls. Yes, you are making money, but you capped your upside. Because the benchmark has clear rules over what happens, the ETN index will buy back those calls approximately 5 days before expiration. The second risk here is the product structure. In this case, you must absolutely be aware that this is not an ETF, an exchange traded fund with underlying investments. This is an ETN, an exchange traded note. Unlike an ETF, ETNs are not shares of the actual underlying funds, ETNs are credit obligations, like bonds of the underlying issuer, whose value tracks a specified index. In the event of a default, owners of the ETN would be lining up for the settlement in the liquidation of the issuer. In order to invest in this ETN, you should be absolutely comfortable with Credit Suisse’s credit risk. While Credit Suisse is a seemingly sound institution, your investment in this ETN is not backed or invested in any underlying shares of gold. This is an additional risk that you should take into account. If you are not comfortable with taking on that credit risk, the alternative is to purchase your own shares of GLD and write the covered call options by yourself, to replicate this strategy. Note that you may incur additional trading fees, by both buying and selling the individual securities as well as writing and buying back any options. For smaller accounts, GLDI’s annual expense of .65% will likely be cheaper over the long term, however by owning your own shares of GLD, you will have more flexibility as to what options you will want to write. Other products that you may want to consider are the GAMCO Global Gold, Natural Resources & Income Trust (NYSEMKT: GGN ) and the BlackRock Resources & Commodities Strategy Trust (NYSE: BCX ). Both are Closed End Funds, which do carry annual fees, however there is an underlying portfolio of investments in case of liquidation. For more discussion about risk faced with ETN investing, feel free to read my previous ETN articles such as RBS ETNS: When A Good Idea Alone is Not Enough , as well as SLVO, linked above. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: None of the information discussed should be considered investment advice or a solicitation to buy or sell any securities. Please consult your investment advisor for specific recommendations. Scalper1 News

Scalper1 News