Scalper1 News

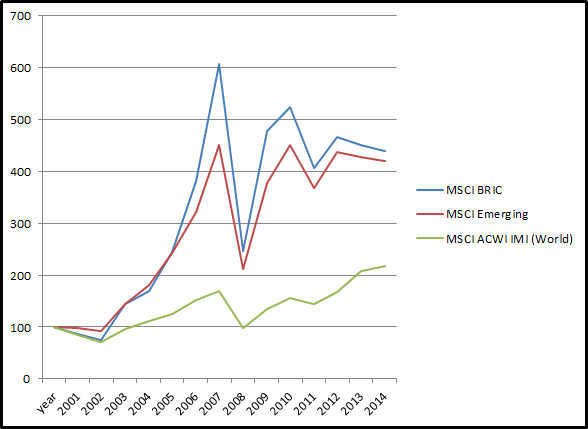

Most investors would benefit from exposure in frontier markets, despite their risks. In the next decade or two, frontier markets could (some probably will) make the same leap as EM and BRIC markets did. Investors should not miss that. Investing through the more popular ETFs might not be as viable in the case of frontier markets as it usually is. Active managers are also a great option in this space. Frontier market countries are loosely defined as countries between the emerging economies and the least developed economies. They are still economic dwarfs compared to emerging or developed nations by metrics such as GDP, or equity market capitalization. For example, countries such as Romania and Bulgaria in Europe, Vietnam or Pakistan in Asia and Nigeria or Morocco in Africa, or Kuwait in the Middle East are defined to be frontier markets. Growth in these countries should be faster in the future compared to developed or emerging economies based on favorable demographics and simply catching up to the rest of the world (the economic convergence effect). According to forecasts of the World Bank, Sub-Saharan Africa and South Asia regions should achieve real GDP growth between 4% and 8% depending on the country. Also in Emerging Europe, countries like Kazakhstan, Turkey and Romania are expected to achieve solid growth. There is significant potential in the frontier markets, and for once the small guys could actually get a head start. Frontier markets are still often too small for bigger institutional investors to get a meaningful exposure. (The MSCI Frontier Markets market cap is about $93 billion. For comparison Johnson & Johnson’s (NYSE: JNJ ) Mcap = $272 billion and China Mobile’s (NYSE: CHL ) market cap = $269 billion) Once the institutional funds start flowing, there could be a lot of upside. The leap that emerging markets and especially BRICs made before the financial crisis gives some perspective. The BRIC term was popularized in 2003 Goldman Sachs report. (In 2003 MSCI BRIC index returned 91%) I think it is certain that at least some of the current countries defined as frontier markets will make similar leap at some point in time. Valuations are also quite low in the frontier space. iShares MSCI Frontier 100 (NYSEARCA: FM ) P/E ratio is about 10, Price/Cash flow is 4.4 and dividend yield is also over 4%. (Source: Morningstar ) Picture data: MSCI Indices Countries and Indices One of the problems in investing in the frontier market space is the fact that the term is very loosely defined and is not really tied to any particular geographic area, so getting broad exposure is not easy. Many ETFs and funds also combine smaller emerging markets and frontier markets, so you do not necessarily know if you are investing in emerging or frontier markets, although this line is sometimes very blurred. The biggest weights in frontier market indices are often in a few single countries such as Kuwait (22%) in MSCI Frontier Markets 100 index, Argentina (19%) and Qatar (28%) in FTSE Frontier 50 Index and Argentina (30%) and Pakistan (19%) in S&P Select Frontier Index. Also because frontier markets are really small, few countries with bigger equity markets and just a few firms in those countries easily dominate the indices. From example MSCI Frontier 100 index has over 20% exposure to Kuwait. And over 12% of that exposure consists of just two financial firms. (National Bank of Kuwait and Kuwait Finance House) So an investor would actually have large tail risk regarding the banking sector in Kuwait. I doubt that many investing in the index are aware of this and that risk sounds like something I would rather not take. Also according to Morningstar report correlations between different frontier markets are very low. So there is fair amount of idiosyncratic risk in the indices, because there could easily be a shock (for example some political risk) that would affect only one country. It is in essence the same as having over 20% of a stock portfolio in a single stock. Just for comparison the biggest firm in the S&P 500, which is Apple (NASDAQ: AAPL ), is 4% of the index. And S&P 500 represents just US equity markets, not a whole asset class as FM indices are supposed to do. The same problem is in pretty much all of the mcap weighted frontier indices. Also one aspect of this is that the weight of the countries with smaller equity markets is nonexistent. But if one looks at the GDP of Kuwait vs. Romania, for example, Romania is actually the bigger economy (Data: Romania , Kuwait ). But Romania gets under 5% weighting as Kuwait gets 22% in MSCI index. I am not arguing that GDP weighting would necessarily be better, but the disparity seems very large. So although with ETFs following the main indices it is usually hard to go wrong, I doubt that it is the best way in the case of frontier markets. With only one ETF, investor would not get a good exposure. It might be better to buy a basket of different ETFs (FM, EMFM , FRN ) and maybe country specific ETFs when available. There are direct products at least to Vietnam , Pakistan and apparently even Kazakhstan and to many other countries too if one takes the time to search. Creating a basket is costly and time consuming, but this way one would get more broad exposure, which would not be so concentrated in a few big financial firms and certain countries. Those countries might not even be the growth stories of the decades to come. And actually those much denounced active managers could really earn their paycheck when investing in often illiquid and information scarce frontier markets. Active vs. Passive In the case of frontier markets, active managers could actually be a very decent choice. First of all the costs of the ETF-products are not really small either. The iShares FM charges 0.79% which is a high number compared to developed or even emerging (iShares Emerging Markets ETF IMI: 0.25%) fees. The average annual fees of a mutual fund investing in the space is about 2%, smaller for larger investors and bigger for individuals. Here I have calculated returns, volatility and Sharpe ratios for two frontier market funds, which had a track record of 3 years. Funds are Harding Loevner Frontier Emerging Markets (MUTF: HLFMX ) and Morgan Stanley Frontier EM markets A (MUTF: MFMPX ). The index option is represented by the popular iShares MSCI 100 Frontier. Annual return Volatility Sharpe HLFMX 7.78 % 10.10 % 0.77 MFMPX 13.87 % 11.03 % 1.26 FM 9.04 % 12.42 % 0.73 As can be seen both funds have performed better risk adjusted than the index. Also in addition to lower volatility it seems likely that the risks are better managed in the active funds because of the large single country (and firm) exposure of MSCI frontier 100 index. At least the active options definitely seem to be an interesting option. Summary and Risks In my opinion having some kind of an allocation in Frontier markets is a great idea and it could be worthwhile even to overweight them relative to developed and emerging markets. Arbitrarily I would say that 10% allocation would be decent from a risk/reward perspective. There is a lot of potential in terms of upside when markets and economies mature and capital starts flowing in the next 10+ years. Also correlations between developed economies is low, which provides great diversification for an investor in developed countries. MSCI Frontier 10 year correlation to US equity markets is just 0.58. (Source: Morningstar report ) Active management seems to be a solid choice too and there are funds with great track record and lower risk than the ETFs. Also the cost of trading and information is higher, which should give more edge to great active managers. Just one ETF is not enough exposure in my opinion, because of the problems of underlying FM indices. Investors should look closely what the underlying index includes and maybe use a basket approach of many products if possible. However, there are some downsides too. Because Frontier markets are illiquid the drawdowns can be large. In 2008 frontier markets was the asset class that came down the most ( -66% ). (Source: Morningstar report ) Also the Fed tapering in 2013 caused a bit of a panic in emerging markets and as the rate hike looms, we could well see another one. The tapering affected most to the countries that have been dependent on US Capital flows (such as Turkey). Actually many frontier markets are not dependent from these flows because of their small size, but it could still cause a lot of turbulence in all of the emerging and frontier market space. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Most investors would benefit from exposure in frontier markets, despite their risks. In the next decade or two, frontier markets could (some probably will) make the same leap as EM and BRIC markets did. Investors should not miss that. Investing through the more popular ETFs might not be as viable in the case of frontier markets as it usually is. Active managers are also a great option in this space. Frontier market countries are loosely defined as countries between the emerging economies and the least developed economies. They are still economic dwarfs compared to emerging or developed nations by metrics such as GDP, or equity market capitalization. For example, countries such as Romania and Bulgaria in Europe, Vietnam or Pakistan in Asia and Nigeria or Morocco in Africa, or Kuwait in the Middle East are defined to be frontier markets. Growth in these countries should be faster in the future compared to developed or emerging economies based on favorable demographics and simply catching up to the rest of the world (the economic convergence effect). According to forecasts of the World Bank, Sub-Saharan Africa and South Asia regions should achieve real GDP growth between 4% and 8% depending on the country. Also in Emerging Europe, countries like Kazakhstan, Turkey and Romania are expected to achieve solid growth. There is significant potential in the frontier markets, and for once the small guys could actually get a head start. Frontier markets are still often too small for bigger institutional investors to get a meaningful exposure. (The MSCI Frontier Markets market cap is about $93 billion. For comparison Johnson & Johnson’s (NYSE: JNJ ) Mcap = $272 billion and China Mobile’s (NYSE: CHL ) market cap = $269 billion) Once the institutional funds start flowing, there could be a lot of upside. The leap that emerging markets and especially BRICs made before the financial crisis gives some perspective. The BRIC term was popularized in 2003 Goldman Sachs report. (In 2003 MSCI BRIC index returned 91%) I think it is certain that at least some of the current countries defined as frontier markets will make similar leap at some point in time. Valuations are also quite low in the frontier space. iShares MSCI Frontier 100 (NYSEARCA: FM ) P/E ratio is about 10, Price/Cash flow is 4.4 and dividend yield is also over 4%. (Source: Morningstar ) Picture data: MSCI Indices Countries and Indices One of the problems in investing in the frontier market space is the fact that the term is very loosely defined and is not really tied to any particular geographic area, so getting broad exposure is not easy. Many ETFs and funds also combine smaller emerging markets and frontier markets, so you do not necessarily know if you are investing in emerging or frontier markets, although this line is sometimes very blurred. The biggest weights in frontier market indices are often in a few single countries such as Kuwait (22%) in MSCI Frontier Markets 100 index, Argentina (19%) and Qatar (28%) in FTSE Frontier 50 Index and Argentina (30%) and Pakistan (19%) in S&P Select Frontier Index. Also because frontier markets are really small, few countries with bigger equity markets and just a few firms in those countries easily dominate the indices. From example MSCI Frontier 100 index has over 20% exposure to Kuwait. And over 12% of that exposure consists of just two financial firms. (National Bank of Kuwait and Kuwait Finance House) So an investor would actually have large tail risk regarding the banking sector in Kuwait. I doubt that many investing in the index are aware of this and that risk sounds like something I would rather not take. Also according to Morningstar report correlations between different frontier markets are very low. So there is fair amount of idiosyncratic risk in the indices, because there could easily be a shock (for example some political risk) that would affect only one country. It is in essence the same as having over 20% of a stock portfolio in a single stock. Just for comparison the biggest firm in the S&P 500, which is Apple (NASDAQ: AAPL ), is 4% of the index. And S&P 500 represents just US equity markets, not a whole asset class as FM indices are supposed to do. The same problem is in pretty much all of the mcap weighted frontier indices. Also one aspect of this is that the weight of the countries with smaller equity markets is nonexistent. But if one looks at the GDP of Kuwait vs. Romania, for example, Romania is actually the bigger economy (Data: Romania , Kuwait ). But Romania gets under 5% weighting as Kuwait gets 22% in MSCI index. I am not arguing that GDP weighting would necessarily be better, but the disparity seems very large. So although with ETFs following the main indices it is usually hard to go wrong, I doubt that it is the best way in the case of frontier markets. With only one ETF, investor would not get a good exposure. It might be better to buy a basket of different ETFs (FM, EMFM , FRN ) and maybe country specific ETFs when available. There are direct products at least to Vietnam , Pakistan and apparently even Kazakhstan and to many other countries too if one takes the time to search. Creating a basket is costly and time consuming, but this way one would get more broad exposure, which would not be so concentrated in a few big financial firms and certain countries. Those countries might not even be the growth stories of the decades to come. And actually those much denounced active managers could really earn their paycheck when investing in often illiquid and information scarce frontier markets. Active vs. Passive In the case of frontier markets, active managers could actually be a very decent choice. First of all the costs of the ETF-products are not really small either. The iShares FM charges 0.79% which is a high number compared to developed or even emerging (iShares Emerging Markets ETF IMI: 0.25%) fees. The average annual fees of a mutual fund investing in the space is about 2%, smaller for larger investors and bigger for individuals. Here I have calculated returns, volatility and Sharpe ratios for two frontier market funds, which had a track record of 3 years. Funds are Harding Loevner Frontier Emerging Markets (MUTF: HLFMX ) and Morgan Stanley Frontier EM markets A (MUTF: MFMPX ). The index option is represented by the popular iShares MSCI 100 Frontier. Annual return Volatility Sharpe HLFMX 7.78 % 10.10 % 0.77 MFMPX 13.87 % 11.03 % 1.26 FM 9.04 % 12.42 % 0.73 As can be seen both funds have performed better risk adjusted than the index. Also in addition to lower volatility it seems likely that the risks are better managed in the active funds because of the large single country (and firm) exposure of MSCI frontier 100 index. At least the active options definitely seem to be an interesting option. Summary and Risks In my opinion having some kind of an allocation in Frontier markets is a great idea and it could be worthwhile even to overweight them relative to developed and emerging markets. Arbitrarily I would say that 10% allocation would be decent from a risk/reward perspective. There is a lot of potential in terms of upside when markets and economies mature and capital starts flowing in the next 10+ years. Also correlations between developed economies is low, which provides great diversification for an investor in developed countries. MSCI Frontier 10 year correlation to US equity markets is just 0.58. (Source: Morningstar report ) Active management seems to be a solid choice too and there are funds with great track record and lower risk than the ETFs. Also the cost of trading and information is higher, which should give more edge to great active managers. Just one ETF is not enough exposure in my opinion, because of the problems of underlying FM indices. Investors should look closely what the underlying index includes and maybe use a basket approach of many products if possible. However, there are some downsides too. Because Frontier markets are illiquid the drawdowns can be large. In 2008 frontier markets was the asset class that came down the most ( -66% ). (Source: Morningstar report ) Also the Fed tapering in 2013 caused a bit of a panic in emerging markets and as the rate hike looms, we could well see another one. The tapering affected most to the countries that have been dependent on US Capital flows (such as Turkey). Actually many frontier markets are not dependent from these flows because of their small size, but it could still cause a lot of turbulence in all of the emerging and frontier market space. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News