New York City-based Foot Locker, Inc. FL looks promising, backed by its strong brand recognition, solid third-quarter fiscal 2016 results and innovative strategies, all underscoring its inherent strength.

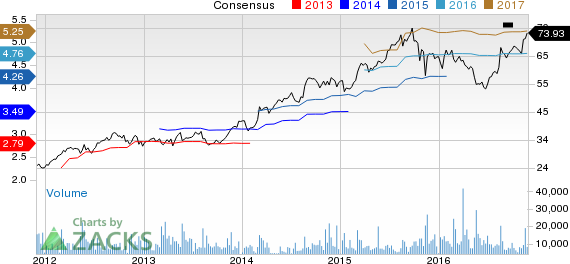

Driven by these factors, this Zacks Rank #3 (Hold) company hit a 52-week high of $ 74.74 on Nov 25, though it eventually closed lower at $ 73.93. Also, the stock has surged nearly 35.1% in the past six months.

FOOT LOCKER INC Price and Consensus

FOOT LOCKER INC Price and Consensus | FOOT LOCKER INC Quote

Foot Locker is one of the widely recognized names in the athletic footwear and apparel industry. The company boasts a strong portfolio of leading brands under a variety of store banners that helps it to target specific markets and effectively meet consumer demand.

Sturdy comparable-store sales performance and cost containment efforts helped Foot Locker to continue registering year-over-year growth in both the top and bottom lines in third-quarter fiscal 2016. Moreover, the stellar performance was backed by effective implementation of its operational and financial initiatives. (Read more: Foot Locker Posts Positive Q3 Earnings Surprise )

International expansion, especially in Europe, is another growth catalyst. Also, Foot Locker is focused on augmenting its eCommerce platform, growing direct-to-consumer operations, margin expansion and tapping underpenetrated markets. Further, the company is actively managing its cash flows − via investment in new store openings, remodeling projects, digital capabilities as well as shareholder-friendly moves.

Additionally, we note that continuous exploitation of opportunities such as kids’ and women’s business, shop-in-shop expansion, store refurbishment and enhancement of assortments are likely to benefit the company, going forward. However, a competitive retail landscape, fashion obsolescence and foreign currency headwinds remain concerns.

Apart from Foot Locker, Fresh Del Monte Produce Inc. FDP also hit a 52-week high of $ 66.86.

Stocks that Warrant a Look

Some better-ranked stocks in the same industry include The Children’s Place, Inc. PLCE and Boot Barn Holdings, Inc. BOOT .

The Children’s Place, with a long-term earnings growth rate of 10.3%, has jumped nearly 91.4% year to date. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Boot Barn, with a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 14.5%. The stock has soared 120.3% in the past six months.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks’ private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $ 10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks’ private trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FRESH DEL MONTE (FDP): Free Stock Analysis Report

FOOT LOCKER INC (FL): Free Stock Analysis Report

CHILDRENS PLACE (PLCE): Free Stock Analysis Report

BOOT BARN HLDGS (BOOT): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International