Scalper1 News

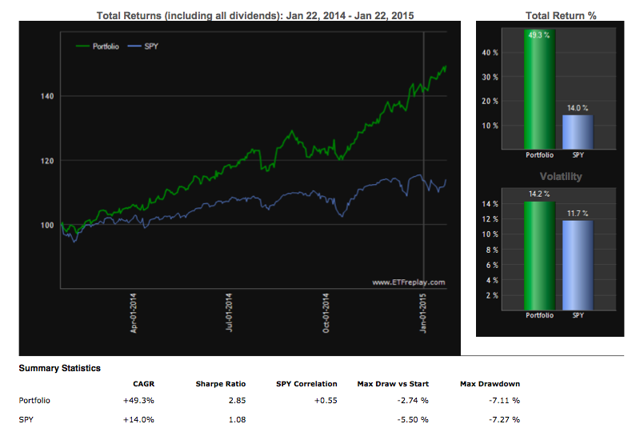

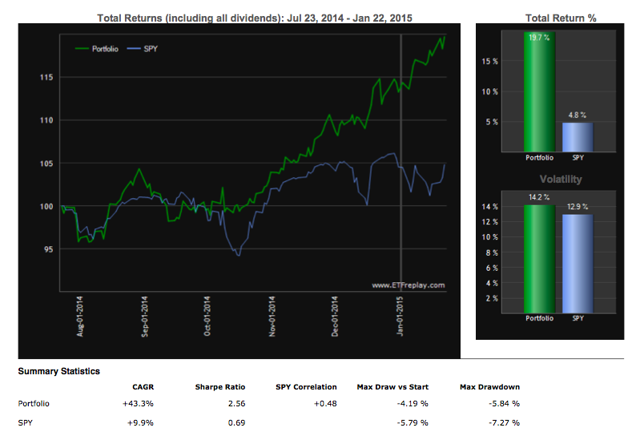

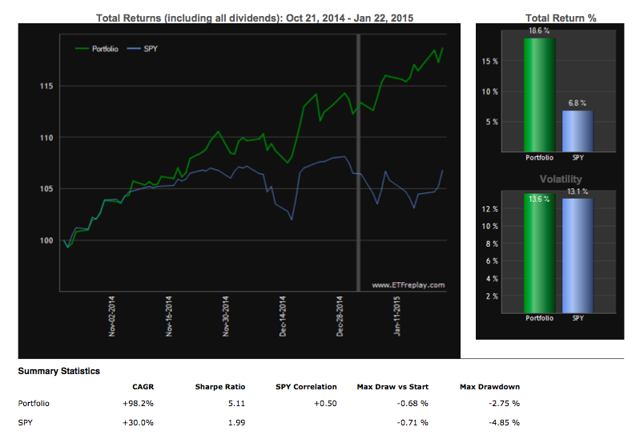

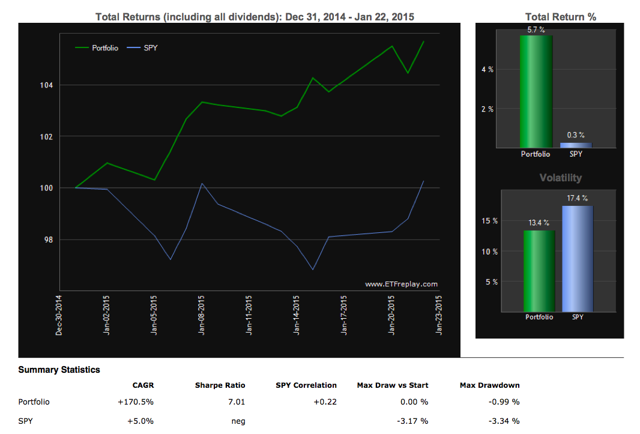

The strategy has been further improved. We use multiple markets for both return generation and hedging. This improves returns in relation to risk. The strategy can survive shocks in both the equity and the fixed income markets. Here are the refined strategy’s rules: 1. Buy SPXL (NYSEARCA: SPXL ) with 40% of the dollar value of the portfolio. 2. Buy ZIV (NASDAQ: ZIV ) with 20% of the dollar value of the portfolio. 3. Buy TMF (NYSEARCA: TMF ) with 35% of the dollar value of the portfolio. 4. Buy TVIX (NASDAQ: TVIX ) with 5% of the dollar value of the portfolio. 5. Rebalance annually to maintain the 40%/20%/35%/5% dollar value split between the positions. Here are the strategy’s results in a log scale: (click to enlarge) The strategy’s performance is outstanding. During the test period, it beats the market by over 20 percentage points per year, while enjoying a lower max drawdown. We can understand how the refined strategy accomplishes this by breaking down the strategy into its return-generating components and its hedging components . Synthetically selling Mid-Term Volatility and holding a leveraged S&P 500 position create the return-generating components of the strategy . Then, holding a leveraged Long Bond position and holding a leveraged Short-Term Volatility position create the hedging components of the strategy . The refined strategy uses multiple markets for both return generation and hedging, smoothing returns, and increasing the strategy’s robustness to shocks in both the equity and the fixed income markets. The net result is outstanding. This strategy index would be perfect for an ETF provider which wishes to launch a product which can beat the SPY even in a bull market, while also enjoying moderate correlations to both equities and fixed income. During the recent stock market confusion, the strategy has really hit its stride. The last 12 months: (click to enlarge) The last 6 months: (click to enlarge) The last 3 months: (click to enlarge) 2015 YTD: (click to enlarge) The sharpe and CAGR/Max Drawdown ratios just destroy the performance of the S&P 500. When faced with this type of technology, I cannot understand why anyone would want to invest in conventional stock picking funds or traditional asset allocation regimes such as risk parity. The strategy powers through market chop. The index is hedged multiple ways, unlike most strategies which solely rely upon bonds as the hedging component. That’s why the strategy has a low correlation to both stocks and bonds. It has volatility exposure in order to help achieve absolute returns during market dislocations. We believe that our more advanced strategies should replace most equity/bond/commodity mixes, since they are empirically safer. And after a multi-decade bond bull market, hedging using multiple markets is the responsible thing to explore. Scalper1 News

The strategy has been further improved. We use multiple markets for both return generation and hedging. This improves returns in relation to risk. The strategy can survive shocks in both the equity and the fixed income markets. Here are the refined strategy’s rules: 1. Buy SPXL (NYSEARCA: SPXL ) with 40% of the dollar value of the portfolio. 2. Buy ZIV (NASDAQ: ZIV ) with 20% of the dollar value of the portfolio. 3. Buy TMF (NYSEARCA: TMF ) with 35% of the dollar value of the portfolio. 4. Buy TVIX (NASDAQ: TVIX ) with 5% of the dollar value of the portfolio. 5. Rebalance annually to maintain the 40%/20%/35%/5% dollar value split between the positions. Here are the strategy’s results in a log scale: (click to enlarge) The strategy’s performance is outstanding. During the test period, it beats the market by over 20 percentage points per year, while enjoying a lower max drawdown. We can understand how the refined strategy accomplishes this by breaking down the strategy into its return-generating components and its hedging components . Synthetically selling Mid-Term Volatility and holding a leveraged S&P 500 position create the return-generating components of the strategy . Then, holding a leveraged Long Bond position and holding a leveraged Short-Term Volatility position create the hedging components of the strategy . The refined strategy uses multiple markets for both return generation and hedging, smoothing returns, and increasing the strategy’s robustness to shocks in both the equity and the fixed income markets. The net result is outstanding. This strategy index would be perfect for an ETF provider which wishes to launch a product which can beat the SPY even in a bull market, while also enjoying moderate correlations to both equities and fixed income. During the recent stock market confusion, the strategy has really hit its stride. The last 12 months: (click to enlarge) The last 6 months: (click to enlarge) The last 3 months: (click to enlarge) 2015 YTD: (click to enlarge) The sharpe and CAGR/Max Drawdown ratios just destroy the performance of the S&P 500. When faced with this type of technology, I cannot understand why anyone would want to invest in conventional stock picking funds or traditional asset allocation regimes such as risk parity. The strategy powers through market chop. The index is hedged multiple ways, unlike most strategies which solely rely upon bonds as the hedging component. That’s why the strategy has a low correlation to both stocks and bonds. It has volatility exposure in order to help achieve absolute returns during market dislocations. We believe that our more advanced strategies should replace most equity/bond/commodity mixes, since they are empirically safer. And after a multi-decade bond bull market, hedging using multiple markets is the responsible thing to explore. Scalper1 News

Scalper1 News