Scalper1 News

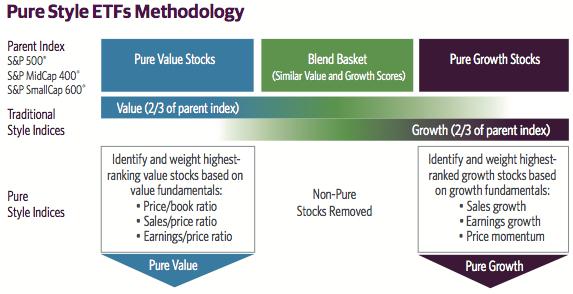

The first key to finding your best small cap value ETF is to understand what “value” means. Unfortunately, there is no industry standard. What is considered value to some companies is growth to others. In 2005, Standard and Poor’s introduced a set of “pure style” indexes. These indexes employ a strict definition of style between growth and value. They also do not have any stock overlap, which is a common problem with traditional style indexes. These indexes are weighted on how much they represent the style. The more a stock represents a small value stock, the more it is weighted in this index, which reduces some of the size bias of the traditional market cap weighting scheme. This graphic from Guggenheim does a great job of showing how a pure style index works: The S&P SmallCap 600 Pure Value Index would be the index to investigate when looking for the best small cap value ETF. Tip #1 – Be ready for increased volatility This index starts with small cap stocks and essentially gets smaller. A traditional small cap index weights the stocks based on their market capitalization, which is the total number of outstanding shares multiplied by the current share price. Bigger companies tend to dominate these indexes. The S&P SmallCap 600 Pure Value Index weights the stocks based on how much of a value they are, which is good if you are looking for value stocks. However, many of the stocks that are at the micro cap level are the biggest value stocks. That moves this index into a much smaller cap environment. This can be seen in the increased volatility of the index. While the S&P SmallCap 600 Pure Value Index has outperformed the S&P 500 Index substantially since its introduction, it dropped 72% in the 2008 Subprime Meltdown versus 51% for the S&P 500 Index. A great index for pure small cap value players, but you need to be able to stand the fluctuation. Tip #2 – Combine pure small cap value ETF with traditional small cap growth ETF If you look closely at the chart from Guggenheim above, you will see that there is an overlap area between pure small cap value and pure small cap growth. If you pair a pure small cap value ETF with a pure small cap growth ETF, you will be missing many of the small cap stocks in the middle. Our historical testing has shown that using a small cap pure value ETF combined with a broad small cap growth ETF is a perfect combination. Our favorite broad growth ETF is the Vanguard Small Cap Growth ETF (NYSEARCA: VBK ). Tip #3 – Use The Guggenheim S&P Smallcap 600 Pure Value ETF (NYSEARCA: RZV ) This is an easy one. Only one ETF follows the S&P SmallCap 600 Pure Value Index, and it is this one created by Guggenheim. Understand that we would still not use it in our small cap satellite portfolio if it did not make it through our vigorous screening process. Originally published on 1/30/14. Updated on 3/2/15. The author is long VBK Are you Bullish or Bearish on ? Bullish Bearish Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

The first key to finding your best small cap value ETF is to understand what “value” means. Unfortunately, there is no industry standard. What is considered value to some companies is growth to others. In 2005, Standard and Poor’s introduced a set of “pure style” indexes. These indexes employ a strict definition of style between growth and value. They also do not have any stock overlap, which is a common problem with traditional style indexes. These indexes are weighted on how much they represent the style. The more a stock represents a small value stock, the more it is weighted in this index, which reduces some of the size bias of the traditional market cap weighting scheme. This graphic from Guggenheim does a great job of showing how a pure style index works: The S&P SmallCap 600 Pure Value Index would be the index to investigate when looking for the best small cap value ETF. Tip #1 – Be ready for increased volatility This index starts with small cap stocks and essentially gets smaller. A traditional small cap index weights the stocks based on their market capitalization, which is the total number of outstanding shares multiplied by the current share price. Bigger companies tend to dominate these indexes. The S&P SmallCap 600 Pure Value Index weights the stocks based on how much of a value they are, which is good if you are looking for value stocks. However, many of the stocks that are at the micro cap level are the biggest value stocks. That moves this index into a much smaller cap environment. This can be seen in the increased volatility of the index. While the S&P SmallCap 600 Pure Value Index has outperformed the S&P 500 Index substantially since its introduction, it dropped 72% in the 2008 Subprime Meltdown versus 51% for the S&P 500 Index. A great index for pure small cap value players, but you need to be able to stand the fluctuation. Tip #2 – Combine pure small cap value ETF with traditional small cap growth ETF If you look closely at the chart from Guggenheim above, you will see that there is an overlap area between pure small cap value and pure small cap growth. If you pair a pure small cap value ETF with a pure small cap growth ETF, you will be missing many of the small cap stocks in the middle. Our historical testing has shown that using a small cap pure value ETF combined with a broad small cap growth ETF is a perfect combination. Our favorite broad growth ETF is the Vanguard Small Cap Growth ETF (NYSEARCA: VBK ). Tip #3 – Use The Guggenheim S&P Smallcap 600 Pure Value ETF (NYSEARCA: RZV ) This is an easy one. Only one ETF follows the S&P SmallCap 600 Pure Value Index, and it is this one created by Guggenheim. Understand that we would still not use it in our small cap satellite portfolio if it did not make it through our vigorous screening process. Originally published on 1/30/14. Updated on 3/2/15. The author is long VBK Are you Bullish or Bearish on ? Bullish Bearish Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News