Scalper1 News

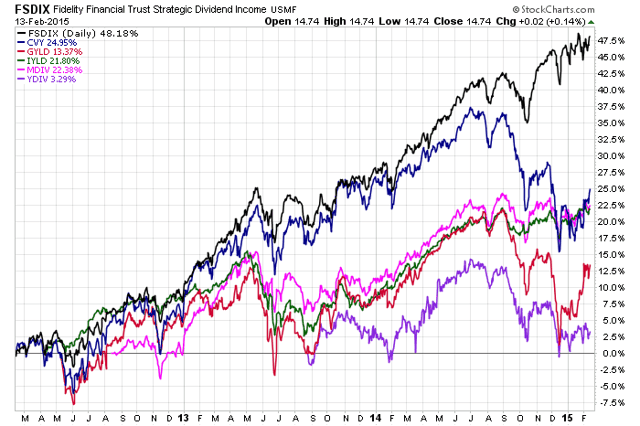

Summary FSDIX is a multi-asset fund that has held up very well versus newer multi-asset ETFs. FSDIX aims for capital appreciation in addition to income, so yield is relatively low at 2.34 percent. FSDIX is less volatile than the competition. The Fidelity Strategic Dividend & Income Fund (MUTF: FSDIX ) was established in December 2003. The fund offers investors a multi-asset approach to income, with five major asset classes included in the portfolio. A 2.34 percent yield puts the fund’s yield not far above that of the broader market, but it comes with wider diversification and lower volatility. Manager Outlook With over two decades of experience in the financial investment industry, Joanna Bewick has served as the portfolio’s lead manager since 2008. She is assisted by co-manager Ford O’Neil who has been with Fidelity since 1990. Both of them also manage the Fidelity Strategic Income Fund (MUTF: FSICX ). The fund’s default allocations are 50 percent common stock, 15 percent convertible securities, 15 percent in REITs or other real estate-related investments, and 20 percent preferred stocks. The lead managers believe the U.S. economy will continue to improve across the majority of economic sectors. They also see the economy as being in a mid-cycle expansion, which creates an expectation of moderate corporate earnings growth. The managers believe asset classes have a fair to slightly rich valuation. Although the quantitative easing program has ended, their expectation is that any interest rate adjustments by the Federal Reserve will be gradual and data dependent. Recent low inflation numbers provide the Fed with more leeway for keeping rates low in the near term. This creates a situation where domestic bond yields are more attractive than the returns of other sovereign bonds. While they predict that dividends and income are likely to play more of a role in total returns than capital appreciation, the increased volatility may create more investment opportunities. The result is a continued bias towards dividend paying stocks, which still comprise the largest portion of the fund, due to their current income and secondary potential for capital appreciation. The fund will also maintain a normal weighting of REITs on a risk-adjusted basis as long as the macroeconomic environment remains steady. While the fundamentals of this asset class remain strong and could produce significant returns, the weighting minimizes the impact of rising interest rates that could hamper returns. Managers believe that it may be difficult to find opportunities to deploy cash in the shrinking convertible securities market, which may cause an underweighting of this asset class. They also expect to remain underweight preferred stock until valuations become more advantageous. Managers will rebalance the fund based on market conditions. Asset Allocation and Security Selection The fund seeks to provide investors with reasonable current income with the potential for capital appreciation. With an investment strategy focused on equity securities that provide current income and have the potential for capital appreciation, the no-load fund tends to concentrate on value stocks. The portfolio invests in domestic and foreign issues. When building the portfolio, lead and sub-portfolio managers evaluate securities based on the macroeconomic environment, investor sentiment and fundamentals, as well as their current and historic valuations. The team manages risks and shift allocations based on a bull-or-bear case for each asset class. Over the past quarter ending December 2014, the fund continued to favor dividend paying equities. Veteran investor Scott Offen, who has been with Fidelity since 1985, manages the common stock sleeve. His focus is on mega-cap dividend paying stocks of companies with wide economic moats, with a portfolio yield 50 percent greater than the S&P 500 and lower volatility. In addition to boasting a 3 percent yield, a strong selection of individual securities in consumer discretionary, energy and industrials helped this sub-portfolio outpace the benchmark and boost the fund’s overall returns. Adam Kramer manages the fund’s preferred stock and convertibles sleeves. Through his acumen, the fund has held up better during recent stock market declines. While the yields on preferred shares were attractive, their long durations were considered a negative factor. The resulting underweighting proved advantageous as this sector underperformed the overall market. The main drag on results was the concentration in banks, healthcare and cable TV. Another modest advantage was Kramer’s underweighting of convertible securities as this asset class also underperformed. This decision was based upon the manager’s belief that good investment opportunities were more difficult to obtain as the overall number of available issues decline. Information technology and industrial securities generated the most drag on this sub-portfolio. Minimizing exposure to these two underperforming asset classes provided a modest advantage for the overall fund. Managed by Samuel Ward, the real estate-related sleeve held a neutral weighting of REITs. This position was a contributor to the fund’s overall performance as the sector had a tremendous run. The greatest contributors were the fund’s investments in apartment and office REITs, which outperformed relative to the benchmark index. While the managers believe that fundamentals remain strong, they remain vigilant on interest rates and the possible negative impact that rising interest rates could have on the sector. Portfolio Composition and Holdings As of December 2014, this four-star Morningstar rated fund has $4.82 billion in assets under management. Compared to its goal of a neutral mix, the fund is slightly overweight common stocks and preferred stocks, while being underweight convertibles. Individual holdings are concentrated in financials, information technology, healthcare and consumer staples. The fund is underweight telecommunications and materials. While 95.84 percent of holdings are domestic securities, the portfolio has a small exposure to Europe and Asia, as well as a slight exposure to emerging markets. The market capitalization of the portfolio is 52.48 percent giant, 23.75 percent large and 16.15 percent mid cap, as well as 6.52 percent small and 1.09 percent micro cap. The fund has a P/E ratio of 18.73 and a price-to-book ratio of 2.59. The fund’s top five holdings are securities issued by Exxon Mobil (NYSE: XOM ), Chevron (NYSE: CVX ), Proctor & Gamble (NYSE: PG ), Johnson & Johnson (NYSE: JNJ ) and IBM (NYSE: IBM ). These holdings comprise 11.85 percent of the total portfolio. Roughly 9 percent of assets are in fixed income, the specialty of lead and co-managers Bewick and O’Neil. The fixed income portion of the portfolio is concentrated in debt instruments rated BBB, BB and B, with a focus on maturities between three and seven years. The fund’s average duration is 3.91 years with a 30-day yield of 2.34 percent. Historical Performance and Risk Earning a high average return rating from Morningstar, FSDIX has delivered annualized returns of 14.48 percent, 13.85 percent and 13.87 percent over the past 1, 3 and 5 years, respectively. This compares to the category averages of 8.63 percent, 11.58 percent and 11.32 percent over the same periods. FSDIX has a low risk rating from Morningstar. The fund’s three-year beta and standard deviation of 0.98 and 6.64 compare favorably to the category ratings of 1.29 and 8.45. The SPDR Dividend ETF (NYSEARCA: SDY ) has a standard deviation of 9.26, making FSDIX less volatile than plain vanilla dividend funds. Fees, Expenses and Distributions The fund does not have any 12b-1, front-end or redemption fees. The low 0.74 percent expense ratio is below the category average of 0.92 percent. FSDIX supports automatic account builder and direct deposit functions. It has a minimum initial investment of $2,500 for both taxable and non-taxable accounts. Conclusion FSDIX is a multi-asset fund that offers a yield similar to a dividend ETF, but with lower volatility. Income growth hasn’t been great given the fact that certain asset classes, such as preferred shares, do not pay rising dividends. Shares fell 41 percent in 2008, so while they are less volatile, they aren’t without risk. However, some of those losses were excessive due to fears about bank solvency during the crisis, which hit preferred shares hard. In a more typical and milder bear market, the fund should hold up better than the broader market. FSDIX fund fills a niche for investors who want slightly higher income along with their capital appreciation, plus lower volatility. Investors who want to go the ETF route can check out some of the best multi-asset ETFs . FSDIX compares favorably to these funds thanks to a heavyweight towards equities and the fact that the equity heavy Guggenheim Multi-Asset Income ETF (NYSEARCA: CVY ) was stung by exposure to energy-related holdings. (click to enlarge) Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary FSDIX is a multi-asset fund that has held up very well versus newer multi-asset ETFs. FSDIX aims for capital appreciation in addition to income, so yield is relatively low at 2.34 percent. FSDIX is less volatile than the competition. The Fidelity Strategic Dividend & Income Fund (MUTF: FSDIX ) was established in December 2003. The fund offers investors a multi-asset approach to income, with five major asset classes included in the portfolio. A 2.34 percent yield puts the fund’s yield not far above that of the broader market, but it comes with wider diversification and lower volatility. Manager Outlook With over two decades of experience in the financial investment industry, Joanna Bewick has served as the portfolio’s lead manager since 2008. She is assisted by co-manager Ford O’Neil who has been with Fidelity since 1990. Both of them also manage the Fidelity Strategic Income Fund (MUTF: FSICX ). The fund’s default allocations are 50 percent common stock, 15 percent convertible securities, 15 percent in REITs or other real estate-related investments, and 20 percent preferred stocks. The lead managers believe the U.S. economy will continue to improve across the majority of economic sectors. They also see the economy as being in a mid-cycle expansion, which creates an expectation of moderate corporate earnings growth. The managers believe asset classes have a fair to slightly rich valuation. Although the quantitative easing program has ended, their expectation is that any interest rate adjustments by the Federal Reserve will be gradual and data dependent. Recent low inflation numbers provide the Fed with more leeway for keeping rates low in the near term. This creates a situation where domestic bond yields are more attractive than the returns of other sovereign bonds. While they predict that dividends and income are likely to play more of a role in total returns than capital appreciation, the increased volatility may create more investment opportunities. The result is a continued bias towards dividend paying stocks, which still comprise the largest portion of the fund, due to their current income and secondary potential for capital appreciation. The fund will also maintain a normal weighting of REITs on a risk-adjusted basis as long as the macroeconomic environment remains steady. While the fundamentals of this asset class remain strong and could produce significant returns, the weighting minimizes the impact of rising interest rates that could hamper returns. Managers believe that it may be difficult to find opportunities to deploy cash in the shrinking convertible securities market, which may cause an underweighting of this asset class. They also expect to remain underweight preferred stock until valuations become more advantageous. Managers will rebalance the fund based on market conditions. Asset Allocation and Security Selection The fund seeks to provide investors with reasonable current income with the potential for capital appreciation. With an investment strategy focused on equity securities that provide current income and have the potential for capital appreciation, the no-load fund tends to concentrate on value stocks. The portfolio invests in domestic and foreign issues. When building the portfolio, lead and sub-portfolio managers evaluate securities based on the macroeconomic environment, investor sentiment and fundamentals, as well as their current and historic valuations. The team manages risks and shift allocations based on a bull-or-bear case for each asset class. Over the past quarter ending December 2014, the fund continued to favor dividend paying equities. Veteran investor Scott Offen, who has been with Fidelity since 1985, manages the common stock sleeve. His focus is on mega-cap dividend paying stocks of companies with wide economic moats, with a portfolio yield 50 percent greater than the S&P 500 and lower volatility. In addition to boasting a 3 percent yield, a strong selection of individual securities in consumer discretionary, energy and industrials helped this sub-portfolio outpace the benchmark and boost the fund’s overall returns. Adam Kramer manages the fund’s preferred stock and convertibles sleeves. Through his acumen, the fund has held up better during recent stock market declines. While the yields on preferred shares were attractive, their long durations were considered a negative factor. The resulting underweighting proved advantageous as this sector underperformed the overall market. The main drag on results was the concentration in banks, healthcare and cable TV. Another modest advantage was Kramer’s underweighting of convertible securities as this asset class also underperformed. This decision was based upon the manager’s belief that good investment opportunities were more difficult to obtain as the overall number of available issues decline. Information technology and industrial securities generated the most drag on this sub-portfolio. Minimizing exposure to these two underperforming asset classes provided a modest advantage for the overall fund. Managed by Samuel Ward, the real estate-related sleeve held a neutral weighting of REITs. This position was a contributor to the fund’s overall performance as the sector had a tremendous run. The greatest contributors were the fund’s investments in apartment and office REITs, which outperformed relative to the benchmark index. While the managers believe that fundamentals remain strong, they remain vigilant on interest rates and the possible negative impact that rising interest rates could have on the sector. Portfolio Composition and Holdings As of December 2014, this four-star Morningstar rated fund has $4.82 billion in assets under management. Compared to its goal of a neutral mix, the fund is slightly overweight common stocks and preferred stocks, while being underweight convertibles. Individual holdings are concentrated in financials, information technology, healthcare and consumer staples. The fund is underweight telecommunications and materials. While 95.84 percent of holdings are domestic securities, the portfolio has a small exposure to Europe and Asia, as well as a slight exposure to emerging markets. The market capitalization of the portfolio is 52.48 percent giant, 23.75 percent large and 16.15 percent mid cap, as well as 6.52 percent small and 1.09 percent micro cap. The fund has a P/E ratio of 18.73 and a price-to-book ratio of 2.59. The fund’s top five holdings are securities issued by Exxon Mobil (NYSE: XOM ), Chevron (NYSE: CVX ), Proctor & Gamble (NYSE: PG ), Johnson & Johnson (NYSE: JNJ ) and IBM (NYSE: IBM ). These holdings comprise 11.85 percent of the total portfolio. Roughly 9 percent of assets are in fixed income, the specialty of lead and co-managers Bewick and O’Neil. The fixed income portion of the portfolio is concentrated in debt instruments rated BBB, BB and B, with a focus on maturities between three and seven years. The fund’s average duration is 3.91 years with a 30-day yield of 2.34 percent. Historical Performance and Risk Earning a high average return rating from Morningstar, FSDIX has delivered annualized returns of 14.48 percent, 13.85 percent and 13.87 percent over the past 1, 3 and 5 years, respectively. This compares to the category averages of 8.63 percent, 11.58 percent and 11.32 percent over the same periods. FSDIX has a low risk rating from Morningstar. The fund’s three-year beta and standard deviation of 0.98 and 6.64 compare favorably to the category ratings of 1.29 and 8.45. The SPDR Dividend ETF (NYSEARCA: SDY ) has a standard deviation of 9.26, making FSDIX less volatile than plain vanilla dividend funds. Fees, Expenses and Distributions The fund does not have any 12b-1, front-end or redemption fees. The low 0.74 percent expense ratio is below the category average of 0.92 percent. FSDIX supports automatic account builder and direct deposit functions. It has a minimum initial investment of $2,500 for both taxable and non-taxable accounts. Conclusion FSDIX is a multi-asset fund that offers a yield similar to a dividend ETF, but with lower volatility. Income growth hasn’t been great given the fact that certain asset classes, such as preferred shares, do not pay rising dividends. Shares fell 41 percent in 2008, so while they are less volatile, they aren’t without risk. However, some of those losses were excessive due to fears about bank solvency during the crisis, which hit preferred shares hard. In a more typical and milder bear market, the fund should hold up better than the broader market. FSDIX fund fills a niche for investors who want slightly higher income along with their capital appreciation, plus lower volatility. Investors who want to go the ETF route can check out some of the best multi-asset ETFs . FSDIX compares favorably to these funds thanks to a heavyweight towards equities and the fact that the equity heavy Guggenheim Multi-Asset Income ETF (NYSEARCA: CVY ) was stung by exposure to energy-related holdings. (click to enlarge) Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News