Scalper1 News

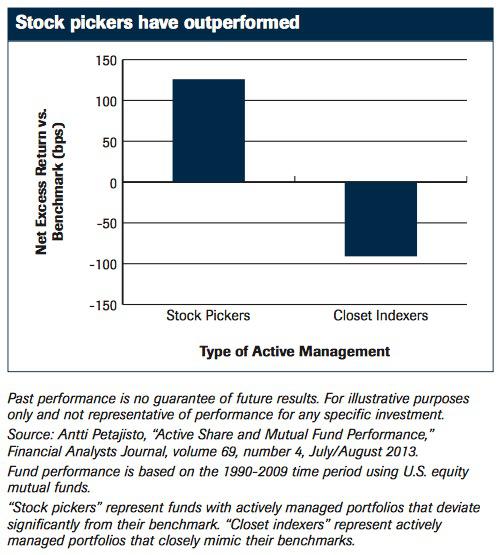

By DailyAlts Staff “It can pay to be active,” according to Federated Investment Consulting, whose recent whitepaper makes the case against passive indexing and for “truly active management.” Conceding that passive strategies can perform “as well as the average,” Federated argues that portfolios constructed with little regard to benchmarks can outperform, particularly during periods like the one we appear to be entering. Truly Active Management Actively managed funds seek to outperform their benchmarks, such as the S&P 500 for equity funds. Passively managed funds, by contrast, seek only to match the performance of the benchmark to which they’re indexed. Thus, in bear markets, passively managed funds tend to post wide losses, while actively managed funds have the flexibility to shift exposures to minimize losses or even eke out gains. According to Federated’s whitepaper , studies suggest “truly active management” can “generate the opportunity for outperformance” even after fees. These same studies show that “truly active management” tends to do better than passive management during periods of declining correlations across markets. For years, global central banks were “on the same page” coordinating monetary policy; but now the Federal Reserve is widely expected to begin raising interest rates in the U.S. sometime in 2015, while the Bank of Japan and European Central Bank are doing the opposite. This divergence of global policy is widely expected to result in the “declining correlations across markets” under which “truly active management” tends to outperform. But what is “truly active management?” Federated defines it simply as strategies “that construct portfolios with little regard to their benchmark,” in which security selection and weighting “deviates significantly” from the benchmark. These are “stock picking” strategies, and Federated believes “the virtues of stock picking may rise” since the U.S. stock market is near record highs and “the prospect for higher rates is threatening the outlook for bonds.” Federated also references a study conducted by Antti Petajisto and Martijn Cremers of the Yale School of Management that shows that funds with higher levels of active management outperform those that are considered “benchmark huggers,” as seen in the following chart: Historical Evidence Federated uses historical evidence in support of its thesis. The period of 2010-2011 saw increasing correlation, high volatility, and “low dispersion between the highest individual stock return and the lowest individual stock return.” These conditions naturally favor passive managers. But in 2012 and 2013, correlations fell and dispersion rose, creating the conditions under which active managers can more easily outperform. Passive strategies generated returns of roughly 16% and 32% in 2012 and 2013, but the returns of actively managed strategies were even higher. The top 25% of active managers have significantly outperformed passive strategies dating back to 1999. A $10,000 investment in a top quartile active manager made on December 31, 1998 would have grown to $35,411 by year-end 2013, while the same investment in the S&P 500 would have grown to just $19,854, according to Federated. This significant outperformance among the top 25% is a strong argument for investors to conduct thorough due diligence on prospective active managers. Conclusion “Active management has its issues,” Federated concedes near the end of the whitepaper, and chief among them are fees. But at the same time, Federated says “fees are relative,” and that low-fee options make sense for “highly efficient asset classes,” but not asset classes such as “international growth and value stocks, and small-cap core and value stocks,” which are “highly inefficient.” Management fees are justified since passive indexing to “highly inefficient” asset classes will result in relative underperformance, in Federated’s view. Most investors want to beat the average, and the only way to do that is through active management. Low-fee passive indexing inevitably results in average returns, minus a low fee. But active management, even with higher fees, can result in returns that greatly exceed the average, thereby resulting in market-beating returns – even after fees. Scalper1 News

By DailyAlts Staff “It can pay to be active,” according to Federated Investment Consulting, whose recent whitepaper makes the case against passive indexing and for “truly active management.” Conceding that passive strategies can perform “as well as the average,” Federated argues that portfolios constructed with little regard to benchmarks can outperform, particularly during periods like the one we appear to be entering. Truly Active Management Actively managed funds seek to outperform their benchmarks, such as the S&P 500 for equity funds. Passively managed funds, by contrast, seek only to match the performance of the benchmark to which they’re indexed. Thus, in bear markets, passively managed funds tend to post wide losses, while actively managed funds have the flexibility to shift exposures to minimize losses or even eke out gains. According to Federated’s whitepaper , studies suggest “truly active management” can “generate the opportunity for outperformance” even after fees. These same studies show that “truly active management” tends to do better than passive management during periods of declining correlations across markets. For years, global central banks were “on the same page” coordinating monetary policy; but now the Federal Reserve is widely expected to begin raising interest rates in the U.S. sometime in 2015, while the Bank of Japan and European Central Bank are doing the opposite. This divergence of global policy is widely expected to result in the “declining correlations across markets” under which “truly active management” tends to outperform. But what is “truly active management?” Federated defines it simply as strategies “that construct portfolios with little regard to their benchmark,” in which security selection and weighting “deviates significantly” from the benchmark. These are “stock picking” strategies, and Federated believes “the virtues of stock picking may rise” since the U.S. stock market is near record highs and “the prospect for higher rates is threatening the outlook for bonds.” Federated also references a study conducted by Antti Petajisto and Martijn Cremers of the Yale School of Management that shows that funds with higher levels of active management outperform those that are considered “benchmark huggers,” as seen in the following chart: Historical Evidence Federated uses historical evidence in support of its thesis. The period of 2010-2011 saw increasing correlation, high volatility, and “low dispersion between the highest individual stock return and the lowest individual stock return.” These conditions naturally favor passive managers. But in 2012 and 2013, correlations fell and dispersion rose, creating the conditions under which active managers can more easily outperform. Passive strategies generated returns of roughly 16% and 32% in 2012 and 2013, but the returns of actively managed strategies were even higher. The top 25% of active managers have significantly outperformed passive strategies dating back to 1999. A $10,000 investment in a top quartile active manager made on December 31, 1998 would have grown to $35,411 by year-end 2013, while the same investment in the S&P 500 would have grown to just $19,854, according to Federated. This significant outperformance among the top 25% is a strong argument for investors to conduct thorough due diligence on prospective active managers. Conclusion “Active management has its issues,” Federated concedes near the end of the whitepaper, and chief among them are fees. But at the same time, Federated says “fees are relative,” and that low-fee options make sense for “highly efficient asset classes,” but not asset classes such as “international growth and value stocks, and small-cap core and value stocks,” which are “highly inefficient.” Management fees are justified since passive indexing to “highly inefficient” asset classes will result in relative underperformance, in Federated’s view. Most investors want to beat the average, and the only way to do that is through active management. Low-fee passive indexing inevitably results in average returns, minus a low fee. But active management, even with higher fees, can result in returns that greatly exceed the average, thereby resulting in market-beating returns – even after fees. Scalper1 News

Scalper1 News