Scalper1 News

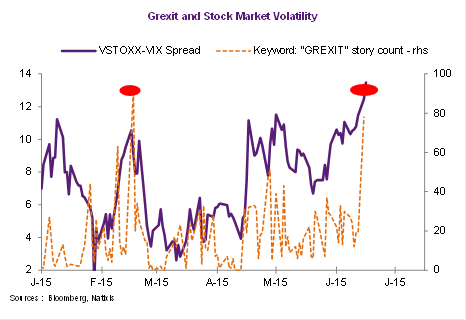

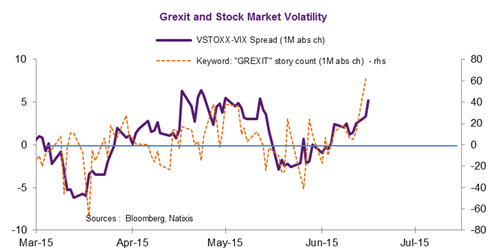

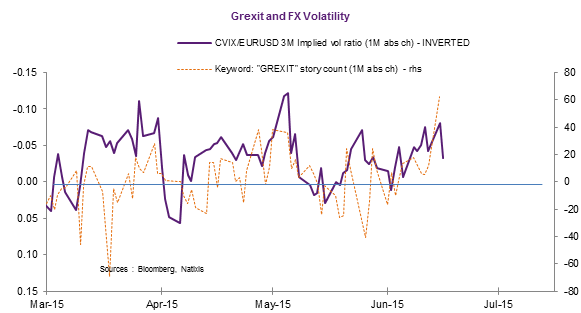

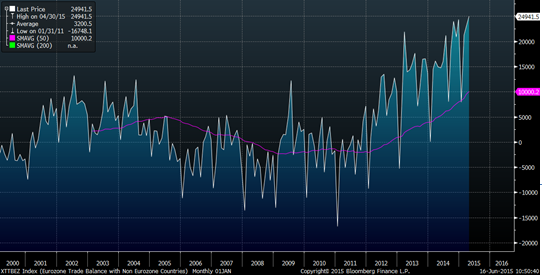

Long-term horizon, energy, currencies “}); $$(‘#article_top_info .info_content div’)[0].insert(bottom: $(‘mover’)); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function() setEvents();); The spread of implied volatilities on both the S&P500 (VIX) and the Euro Stoxx 50 (VSTOXX) has widened to a new high. It is clearly attributable to the renewed tensions on a possible Grexit. Yet, the forthcoming Fed tightening might lead to an increase in the VIX, hence my suggestion to play a tightening of the volatility spread. The post-winter acceleration of growth in the U.S. has been a blessing but also a curse since it increases the probability of a liftoff in the second half of 2015. So far, the risk associated to what we could call a traditional cyclical/monetary policy related risk has been overwhelmed by that related to Greece. The chart below shows the spread between implied volatilities on European vs. U.S. stocks. Since the beginning of the year, it has been very responsive to the news flow pertaining to the “Grexit”. The link is also visible on a month-over-month basis, where it shows that the volatility spread might widen a little bit more. The same pattern is also visible in the FX space where the implied volatility on the EUR/USD has risen much more against the CVIX. Interestingly enough, the EUR/USD is well above parity even though the distance to default of Greece has never been that short. The strength of the trade balance of the Euro area is probably part of the explanation. The view here is simple. Any worsening of the Greek crisis should not be rejected but given 1. The width of the spread between Vstoxx and VIX; 2. It’s tendency to mean revert 3. The possibility that Yellen remains evasive enough to increase the uncertainty related to the aggressiveness of the Fed between now and year-end. I would not be surprised by a tightening, over the next few weeks, of the volatility spread across the Atlantic. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague Scalper1 News

Long-term horizon, energy, currencies “}); $$(‘#article_top_info .info_content div’)[0].insert(bottom: $(‘mover’)); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function() setEvents();); The spread of implied volatilities on both the S&P500 (VIX) and the Euro Stoxx 50 (VSTOXX) has widened to a new high. It is clearly attributable to the renewed tensions on a possible Grexit. Yet, the forthcoming Fed tightening might lead to an increase in the VIX, hence my suggestion to play a tightening of the volatility spread. The post-winter acceleration of growth in the U.S. has been a blessing but also a curse since it increases the probability of a liftoff in the second half of 2015. So far, the risk associated to what we could call a traditional cyclical/monetary policy related risk has been overwhelmed by that related to Greece. The chart below shows the spread between implied volatilities on European vs. U.S. stocks. Since the beginning of the year, it has been very responsive to the news flow pertaining to the “Grexit”. The link is also visible on a month-over-month basis, where it shows that the volatility spread might widen a little bit more. The same pattern is also visible in the FX space where the implied volatility on the EUR/USD has risen much more against the CVIX. Interestingly enough, the EUR/USD is well above parity even though the distance to default of Greece has never been that short. The strength of the trade balance of the Euro area is probably part of the explanation. The view here is simple. Any worsening of the Greek crisis should not be rejected but given 1. The width of the spread between Vstoxx and VIX; 2. It’s tendency to mean revert 3. The possibility that Yellen remains evasive enough to increase the uncertainty related to the aggressiveness of the Fed between now and year-end. I would not be surprised by a tightening, over the next few weeks, of the volatility spread across the Atlantic. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague Scalper1 News

Scalper1 News