Scalper1 News

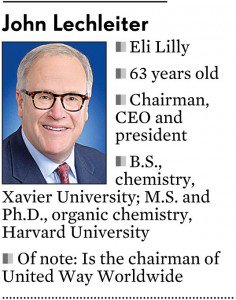

During the drug-stock boom, the newer biotech companies tended to get the most play as growth stocks. But last year, one of the top-performing large-cap drugmakers was none other than 140-year-old Eli Lilly. Like other big pharmas, Lilly ( LLY ) has spent the last few years climbing out of an earnings trough brought on by the loss of patent protection on some of its biggest drugs. While growth is still slow, investors have gotten ever more interested in the company’s pipeline: Lilly’s late-stage drug candidate solanezumab could bring a breakthrough in a currently untreatable disease — Alzheimer’s. Psoriasis treatment ixekizumab is expected to launch anytime now and eventually achieve blockbuster sales. Another immunology drug, baricitinib, which Lilly co-developed with Incyte ( INCY ), was also recently filed with the FDA. Meanwhile, the already marketed diabetes drug Jardiance shocked Wall Street last year by reducing deaths from heart failure by 32% in a large-scale study called Empa-Reg. Recently, Lilly CEO John Lechleiter sat down with IBD to explain Lilly’s strategy for 2016 and beyond. IBD : I’m interested in your immunology strategy. Given that there are a lot of medicines out there in that area, how do you see yourself fitting into the space? Lechleiter : Well, I think the only way we can enter that space — and lay claim to any of these disease areas — is to offer something better. And I believe the data we have on ixekizumab, which is our anti-IL17 antibody for psoriasis, is excellent. You look at clearance rates: 31% to 41% of people across three studies had 100% clearance of their plaque. So while there are competitors there, we feel very good about the profile of that product. I think with baricitinib, in four studies we established, in one of them superiority to methotrexate, which is the current first-line standard of care; and in another study, superiority in terms of signs and symptoms of RA (rheumatoid arthritis) to ( AbbVie ‘s ( ABBV )) Humira, which is the biggest drug in the world. I think we’re bringing something new to these categories. In the case of RA, we know people cycle between different courses of therapy, and I think there’s no question, even with the drugs we have in that space today, there’s still an unmet need. IBD : In the diabetes area, you have this impressive data from Jardiance, and people are wondering is this going to be a class effect? If it is, do you have a point of differentiation? Lechleiter : Well, I think first of all, the people (who are) asking if it’s a class effect (meaning the entire class of drugs would all perform the same) are the people who don’t have Jardiance. The fact is, we have the data. Anything else about any of the other ones is speculation. So I think the advantage we have is first-mover advantage. Obviously, as soon as we get the label changed, we will exercise that. We filed that with the FDA … (and) expect to get updated labeling reflecting the outcome of Empa-Reg later this year. IBD : T he overall diabetes market has been under pressure lately. Sanofi ( SNY ) and Novo Nordisk ( NVO ) have been warning of slower growth. Is this true of the market in general or just certain segments? Lechleiter : I think that several categories are still growing in the diabetes space. It’s very competitive. Each of these drug categories has three or four different players. We happen to be the only company that has a complete spectrum across the treatment paradigm, along with Boehringer Ingelheim. The growth of insulins is slowing a bit, because we believe that more and more people using insulin are using an sglt2 inhibitor like Jardiance that are lowering insulin requirements. So I think there’s some interplay between the drugs. But we also know that SGLT2 category growth is coming at the expense, in many cases, of generic sulfonylureas. So that brand category is expanding. I think from a market standpoint, there’s a lot of competition. That’s great for consumers (and) great for physicians. But it remains for us to differentiate our products and to compete in that mix. IBD : Building the complete portfolio of diabetes medicines — what is the advantage of that? Is it a marketing advantage? Lechleiter : Well, at a fundamental level, we can work with physicians to address, “What’s the right drug for a given patient?” vs. “How do you fit the patient into our drug?” if that makes sense. Let’s understand, diabetes is a progressive disease. So understanding where the patient is in that journey, and how our medicines can best help the patient. We can be agnostic about what choice a physician makes, because we have an offering at every step of the way. Ultimately, we can also, hopefully, better understand what the right combinations are. We have a fixed-dose combination of a DPP4 along with Jardiance — we’re the only company that offers that today. We have not just orals, we have insulins. We have not just insulins, but our GLP-1 drug Trulicity. So I think there’s some advantages in terms of being able to optimize treatment. And ultimately there may be some marketplace advantages to having a full basket of products — if you think about negotiating with payers and insurers, for example. IBD : In Alzheimer’s, you have different programs going. Do you anticipate there will be multiple drugs in this category? Lechleiter : First of all, if solanezumab is positive — we’ll know by the end of the year — that’s going to generate a tremendous amount of interest in companies developing BACE inhibitors, antibodies and other drugs. We believe that ultimately this will probably be treated with a combination, not unlike the way diabetes is treated today, not unlike the way cancer is treated. It may be an antibody with an oral BACE inhibitor, for example. But we’re also developing agents that act against tau (protein), which is a downstream aspect of the disease progression. It remains to be seen, but our best guess is that it will be a combination. If (solanezumab) is successful, others will follow, and we aim to be in that group. IBD : In oncology, again I’m thinking about your positioning — there’s been lot of drug industry activity in cancer. Can you talk about your strategy? Lechleiter : The pillar of our oncology business, going back eight or nine years ago, was Alimta, and it still is today. We bought ImClone in October of 2008. We’ve had two drugs approved from that ImClone pipeine: Cyramza, which now has four indications — two gastric cancers, colorectal cancer and lung cancer — and then late last year we got approval for Portrazza, and that’s indicated for squamous-cell non-small-cell lung cancer. And that’s a type of lung cancer that, in the first line, has not seen an improvement in survival for 20 years. So we’re excited about that. We have a third ImClone product that we’ve commenced filing with the FDA, called olaratumab. That is for soft-tissue sarcoma. Behind that we have three drugs in the clinic today that have immune-system components associated with them, as we begin to build an immuno-oncology portfolio. We also have a drug that I think everyone is excited about called abemaciclib. That’s a CDK4/6 inhibitor. We’ll have the phase-two data for breast cancer this year. We also have a phase-three (trial) underway. We also have a phase-three underway for our CDK4/6 inhibitor in lung cancer. So we’re focused on immuno-oncology, microenvironment — which would be Cyramza, in other words anti-angiogenesis drugs — and cell cycle inhibitors. So it’s a three-pronged approach, and I think we’ve got a good portfolio of products in the pipeline to address all three. Scalper1 News

During the drug-stock boom, the newer biotech companies tended to get the most play as growth stocks. But last year, one of the top-performing large-cap drugmakers was none other than 140-year-old Eli Lilly. Like other big pharmas, Lilly ( LLY ) has spent the last few years climbing out of an earnings trough brought on by the loss of patent protection on some of its biggest drugs. While growth is still slow, investors have gotten ever more interested in the company’s pipeline: Lilly’s late-stage drug candidate solanezumab could bring a breakthrough in a currently untreatable disease — Alzheimer’s. Psoriasis treatment ixekizumab is expected to launch anytime now and eventually achieve blockbuster sales. Another immunology drug, baricitinib, which Lilly co-developed with Incyte ( INCY ), was also recently filed with the FDA. Meanwhile, the already marketed diabetes drug Jardiance shocked Wall Street last year by reducing deaths from heart failure by 32% in a large-scale study called Empa-Reg. Recently, Lilly CEO John Lechleiter sat down with IBD to explain Lilly’s strategy for 2016 and beyond. IBD : I’m interested in your immunology strategy. Given that there are a lot of medicines out there in that area, how do you see yourself fitting into the space? Lechleiter : Well, I think the only way we can enter that space — and lay claim to any of these disease areas — is to offer something better. And I believe the data we have on ixekizumab, which is our anti-IL17 antibody for psoriasis, is excellent. You look at clearance rates: 31% to 41% of people across three studies had 100% clearance of their plaque. So while there are competitors there, we feel very good about the profile of that product. I think with baricitinib, in four studies we established, in one of them superiority to methotrexate, which is the current first-line standard of care; and in another study, superiority in terms of signs and symptoms of RA (rheumatoid arthritis) to ( AbbVie ‘s ( ABBV )) Humira, which is the biggest drug in the world. I think we’re bringing something new to these categories. In the case of RA, we know people cycle between different courses of therapy, and I think there’s no question, even with the drugs we have in that space today, there’s still an unmet need. IBD : In the diabetes area, you have this impressive data from Jardiance, and people are wondering is this going to be a class effect? If it is, do you have a point of differentiation? Lechleiter : Well, I think first of all, the people (who are) asking if it’s a class effect (meaning the entire class of drugs would all perform the same) are the people who don’t have Jardiance. The fact is, we have the data. Anything else about any of the other ones is speculation. So I think the advantage we have is first-mover advantage. Obviously, as soon as we get the label changed, we will exercise that. We filed that with the FDA … (and) expect to get updated labeling reflecting the outcome of Empa-Reg later this year. IBD : T he overall diabetes market has been under pressure lately. Sanofi ( SNY ) and Novo Nordisk ( NVO ) have been warning of slower growth. Is this true of the market in general or just certain segments? Lechleiter : I think that several categories are still growing in the diabetes space. It’s very competitive. Each of these drug categories has three or four different players. We happen to be the only company that has a complete spectrum across the treatment paradigm, along with Boehringer Ingelheim. The growth of insulins is slowing a bit, because we believe that more and more people using insulin are using an sglt2 inhibitor like Jardiance that are lowering insulin requirements. So I think there’s some interplay between the drugs. But we also know that SGLT2 category growth is coming at the expense, in many cases, of generic sulfonylureas. So that brand category is expanding. I think from a market standpoint, there’s a lot of competition. That’s great for consumers (and) great for physicians. But it remains for us to differentiate our products and to compete in that mix. IBD : Building the complete portfolio of diabetes medicines — what is the advantage of that? Is it a marketing advantage? Lechleiter : Well, at a fundamental level, we can work with physicians to address, “What’s the right drug for a given patient?” vs. “How do you fit the patient into our drug?” if that makes sense. Let’s understand, diabetes is a progressive disease. So understanding where the patient is in that journey, and how our medicines can best help the patient. We can be agnostic about what choice a physician makes, because we have an offering at every step of the way. Ultimately, we can also, hopefully, better understand what the right combinations are. We have a fixed-dose combination of a DPP4 along with Jardiance — we’re the only company that offers that today. We have not just orals, we have insulins. We have not just insulins, but our GLP-1 drug Trulicity. So I think there’s some advantages in terms of being able to optimize treatment. And ultimately there may be some marketplace advantages to having a full basket of products — if you think about negotiating with payers and insurers, for example. IBD : In Alzheimer’s, you have different programs going. Do you anticipate there will be multiple drugs in this category? Lechleiter : First of all, if solanezumab is positive — we’ll know by the end of the year — that’s going to generate a tremendous amount of interest in companies developing BACE inhibitors, antibodies and other drugs. We believe that ultimately this will probably be treated with a combination, not unlike the way diabetes is treated today, not unlike the way cancer is treated. It may be an antibody with an oral BACE inhibitor, for example. But we’re also developing agents that act against tau (protein), which is a downstream aspect of the disease progression. It remains to be seen, but our best guess is that it will be a combination. If (solanezumab) is successful, others will follow, and we aim to be in that group. IBD : In oncology, again I’m thinking about your positioning — there’s been lot of drug industry activity in cancer. Can you talk about your strategy? Lechleiter : The pillar of our oncology business, going back eight or nine years ago, was Alimta, and it still is today. We bought ImClone in October of 2008. We’ve had two drugs approved from that ImClone pipeine: Cyramza, which now has four indications — two gastric cancers, colorectal cancer and lung cancer — and then late last year we got approval for Portrazza, and that’s indicated for squamous-cell non-small-cell lung cancer. And that’s a type of lung cancer that, in the first line, has not seen an improvement in survival for 20 years. So we’re excited about that. We have a third ImClone product that we’ve commenced filing with the FDA, called olaratumab. That is for soft-tissue sarcoma. Behind that we have three drugs in the clinic today that have immune-system components associated with them, as we begin to build an immuno-oncology portfolio. We also have a drug that I think everyone is excited about called abemaciclib. That’s a CDK4/6 inhibitor. We’ll have the phase-two data for breast cancer this year. We also have a phase-three (trial) underway. We also have a phase-three underway for our CDK4/6 inhibitor in lung cancer. So we’re focused on immuno-oncology, microenvironment — which would be Cyramza, in other words anti-angiogenesis drugs — and cell cycle inhibitors. So it’s a three-pronged approach, and I think we’ve got a good portfolio of products in the pipeline to address all three. Scalper1 News

Scalper1 News