Scalper1 News

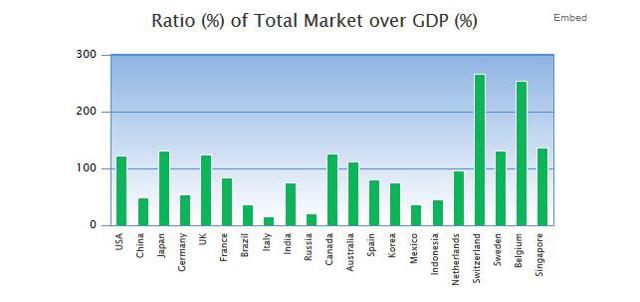

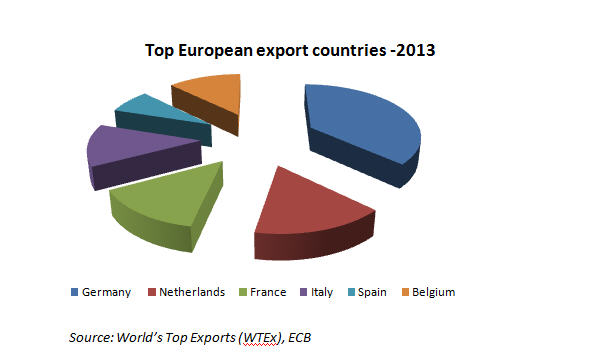

Summary The European QE, while beneficial, will have different impact and consequences than the US and the UK style QE. The retail European market is not as well developed as in the US, UK so the main risk asset likely to benefit from a large QE will be real estate. Countries with largest equity markets to GDP like the Netherlands, Belgium, France and Spain will benefit disproportionately from a risk on equity trade. Difference between European QE and US and UK style QE The European QE announced by ECB last week consists of a monthly Euros 60 bn private and public bond buying that will last until at least September 2016. The euro denominated debt purchases will be all along the yield curve between 2 and 30 years maturities and will represent no more than 25% of each issue. The debt purchases will be mutualised, sharing the loss up to 20% and the rest of 80% will stay with the national central banks. Interestingly, the government debt to be acquired by ECB is investment grade only so Greece and Cyprus debt will likely not be considered for this QE round. While both the Fed and the BoE bought back government debt, so in nature the style of the ECB QE is similar, the lack of debt mutualisation across the Euro zone will skew the benefits towards the countries with best fundamentals in 2016 when the QE starts to slow down. In addition, the funding transmission mechanism in the Euro zone does not work quite the same as in the US or in the UK. Lower rates across the euro zone should lower rates for corporates and individuals but we may not see the impact of these rates in the short term and uniformly across the Euro countries. Euro corporates use far less bond debt than the UK Plc or the US corporates. Even though the European bond market has seen significant growth after the 2009 financial crisis, the majority of the corporate debt, especially for the long term maturities and for the small and medium sized companies, is still bank debt which will be slow to adjust to market yields. The positive and perhaps intended long term consequence here is that it may encourage SMEs to increase financing with corporate bonds issuances in the eurobond market, just like it did after 2009 when bank liquidity dried up. So in the medium and longer term – this is some of the SMEs in Spain and Italy and other non-core Euro markets where the bank lending rates are at 4-6% (Reuters). Most of the immediate positive impact however will be on the larger Eurozone corporates from Germany, France, Spain and the Netherlands (that operate mainly within the Eurozone and as such don’t have a negative currency impact on their revenues) and who can improve their average debt rate substantially. Eurozone mortgages are by and large fixed mortgages from 1 to 5 years and longer and refinancing for these mortgages is not straightforward. While the proportion of variable rate mortgages has increased since 2009, the fixed rate mortgages are still predominant in France, Italy, the Netherlands and Germany, so it will take some time for the wealth effect from lower mortgages and refinancing to have an impact on the consumers in these markets. On the other hand, countries like Spain and Ireland, where most mortgages are based on variable rates may benefit most on short term. Investment Implications As yields are going down, institutional and individual investors are likely to chase higher yield assets like equities, high yield bonds and alternative assets like real estate and private equity: Equity markets in the Eurozone are not as developed as in the UK or the US relative to the size of their GDP. As the chart below shows, the ratio of the equity market to GDP in some European countries like Germany at 54% or Italy at 15% is incredibly low when compared to the UK or the US. Countries with the most developed equity markets, like the Netherlands (NYSEARCA: EWN ), Belgium (NYSEARCA: EWK ), France (NYSEARCA: EWQ ) and Spain (NYSEARCA: EWP ) will likely benefit most from a risk on equity trade. (click to enlarge) Source: Gurufocus, ECB, Reuters Low rates will benefit new investment in real estate and we are likely to see real estate prices going even further up especially in countries where equity markets are not very popular and in countries with mostly variable mortgage rates. Despite a strong performance in the past year, German REITs like Deutsche Wohnen ( OTC:DWHHF ) and Deutsche Annington ( OTC:DAIMF ) are still the best positioned to take advantage of a rising real estate market. Some Spanish real estate developers like Immobiliaria Colonial [COL.SM] may also be an interesting though volatile play. (click to enlarge) Source: Bloomberg Lower Euro will likely bring significant positive changes, even though some economists don’t think so as too many of the goods produced by the euro companies are outside of the Eurozone territory. The services sector, especially the travel and leisure sector including companies like TUI AG, is a clear winner from a lower currency. The SMEs and the corporates with competitive manufacturing bases in the Eurozone exporting outside of the area will also benefit. A lower exchange rate for the Euro will further support the exporters, especially the largest two exporters in the Eurozone who are also highly competitive manufacturers: mostly Germany (which according to WTEx, produced about 29% of the European exports in 2013 and has a large SME sector) and to a lesser extent the Netherlands (with about 9-10% of the European exports in 2013 but a smaller SME sector). In Italy only, the estimated boost to GDP from a lower currency is about 0.6% per year ( CSC, Il Sole 24) While the QE benefits will be widely spread and may give a fresh respite to countries like Italy and France, somewhat ironically the largest positive impact will benefit the countries that have fought it mostly. The Dutch and to a lesser extent the Belgian equity markets and real estate sectors in countries like Germany and Spain will likely be the big winners. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in EWN over the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in EWN over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The European QE, while beneficial, will have different impact and consequences than the US and the UK style QE. The retail European market is not as well developed as in the US, UK so the main risk asset likely to benefit from a large QE will be real estate. Countries with largest equity markets to GDP like the Netherlands, Belgium, France and Spain will benefit disproportionately from a risk on equity trade. Difference between European QE and US and UK style QE The European QE announced by ECB last week consists of a monthly Euros 60 bn private and public bond buying that will last until at least September 2016. The euro denominated debt purchases will be all along the yield curve between 2 and 30 years maturities and will represent no more than 25% of each issue. The debt purchases will be mutualised, sharing the loss up to 20% and the rest of 80% will stay with the national central banks. Interestingly, the government debt to be acquired by ECB is investment grade only so Greece and Cyprus debt will likely not be considered for this QE round. While both the Fed and the BoE bought back government debt, so in nature the style of the ECB QE is similar, the lack of debt mutualisation across the Euro zone will skew the benefits towards the countries with best fundamentals in 2016 when the QE starts to slow down. In addition, the funding transmission mechanism in the Euro zone does not work quite the same as in the US or in the UK. Lower rates across the euro zone should lower rates for corporates and individuals but we may not see the impact of these rates in the short term and uniformly across the Euro countries. Euro corporates use far less bond debt than the UK Plc or the US corporates. Even though the European bond market has seen significant growth after the 2009 financial crisis, the majority of the corporate debt, especially for the long term maturities and for the small and medium sized companies, is still bank debt which will be slow to adjust to market yields. The positive and perhaps intended long term consequence here is that it may encourage SMEs to increase financing with corporate bonds issuances in the eurobond market, just like it did after 2009 when bank liquidity dried up. So in the medium and longer term – this is some of the SMEs in Spain and Italy and other non-core Euro markets where the bank lending rates are at 4-6% (Reuters). Most of the immediate positive impact however will be on the larger Eurozone corporates from Germany, France, Spain and the Netherlands (that operate mainly within the Eurozone and as such don’t have a negative currency impact on their revenues) and who can improve their average debt rate substantially. Eurozone mortgages are by and large fixed mortgages from 1 to 5 years and longer and refinancing for these mortgages is not straightforward. While the proportion of variable rate mortgages has increased since 2009, the fixed rate mortgages are still predominant in France, Italy, the Netherlands and Germany, so it will take some time for the wealth effect from lower mortgages and refinancing to have an impact on the consumers in these markets. On the other hand, countries like Spain and Ireland, where most mortgages are based on variable rates may benefit most on short term. Investment Implications As yields are going down, institutional and individual investors are likely to chase higher yield assets like equities, high yield bonds and alternative assets like real estate and private equity: Equity markets in the Eurozone are not as developed as in the UK or the US relative to the size of their GDP. As the chart below shows, the ratio of the equity market to GDP in some European countries like Germany at 54% or Italy at 15% is incredibly low when compared to the UK or the US. Countries with the most developed equity markets, like the Netherlands (NYSEARCA: EWN ), Belgium (NYSEARCA: EWK ), France (NYSEARCA: EWQ ) and Spain (NYSEARCA: EWP ) will likely benefit most from a risk on equity trade. (click to enlarge) Source: Gurufocus, ECB, Reuters Low rates will benefit new investment in real estate and we are likely to see real estate prices going even further up especially in countries where equity markets are not very popular and in countries with mostly variable mortgage rates. Despite a strong performance in the past year, German REITs like Deutsche Wohnen ( OTC:DWHHF ) and Deutsche Annington ( OTC:DAIMF ) are still the best positioned to take advantage of a rising real estate market. Some Spanish real estate developers like Immobiliaria Colonial [COL.SM] may also be an interesting though volatile play. (click to enlarge) Source: Bloomberg Lower Euro will likely bring significant positive changes, even though some economists don’t think so as too many of the goods produced by the euro companies are outside of the Eurozone territory. The services sector, especially the travel and leisure sector including companies like TUI AG, is a clear winner from a lower currency. The SMEs and the corporates with competitive manufacturing bases in the Eurozone exporting outside of the area will also benefit. A lower exchange rate for the Euro will further support the exporters, especially the largest two exporters in the Eurozone who are also highly competitive manufacturers: mostly Germany (which according to WTEx, produced about 29% of the European exports in 2013 and has a large SME sector) and to a lesser extent the Netherlands (with about 9-10% of the European exports in 2013 but a smaller SME sector). In Italy only, the estimated boost to GDP from a lower currency is about 0.6% per year ( CSC, Il Sole 24) While the QE benefits will be widely spread and may give a fresh respite to countries like Italy and France, somewhat ironically the largest positive impact will benefit the countries that have fought it mostly. The Dutch and to a lesser extent the Belgian equity markets and real estate sectors in countries like Germany and Spain will likely be the big winners. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in EWN over the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in EWN over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News