Scalper1 News

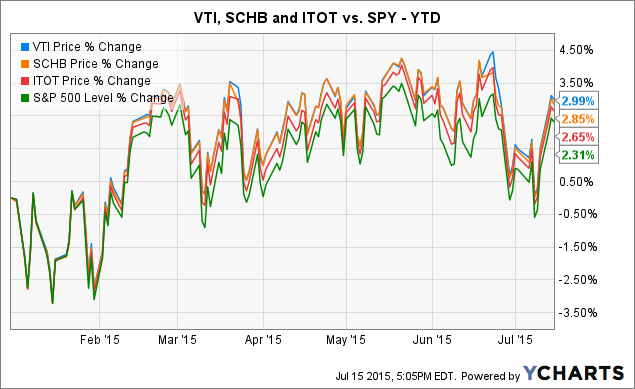

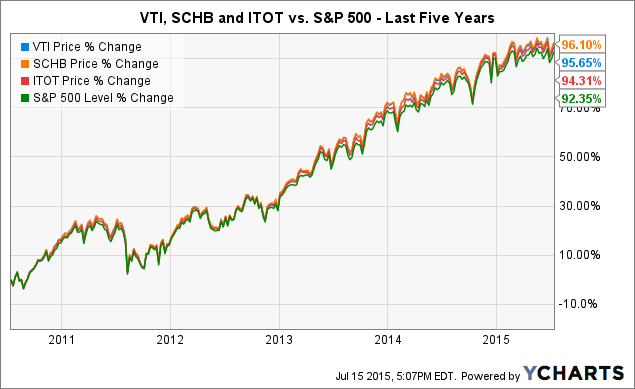

Summary Every ETF investor needs to consider what holdings will form the very core of their portfolio. For the portion relating to domestic stocks, in a previous article I featured Vanguard’s Total Stock Market ETF. In this article, I will examine two other worthy competitors, and analyze how they stack up against VTI. Every investor desirous of developing an ETF-based portfolio does well to start by selecting a few core holdings. In my view, such holdings should offer great diversification along with a rock-bottom cost structure. In a previous article for Seeking Alpha, I featured the Vanguard Total Stock Market ETF (NYSEARCA: VTI ). I concluded that one should seriously consider VTI as a core holding for the portion of your portfolio devoted to domestic stocks. However, there are several worthy competitors in the marketplace. And, they may be even more worthy if your brokerage offers commission-free trading in these ETFs; particularly if one of your goals is to invest regularly and in small increments. In this article, we will examine two such competitors; the Schwab U.S. Broad Market ETF (NYSEARCA: SCHB ) and the iShares Core S&P Total U.S. Stock Market ETF (NYSEARCA: ITOT ). We will compare their structure, expense ratio and other features against VTI, and see how they stack up. Schwab U.S. Broad Market ETF While the history of Charles Schwab (NYSE: SCHW ) traces back over 40 years, the firm is a fairly recent entrant to the ETF market, really getting into the area in a big way in 2009. However, once it committed, it quickly became a formidable competitor. The firm now sports no less than 13 ETFs featuring an expense ratio of .10% or less, as shown here: Heading the list is SCHB, with a market-leading .04% expense ratio. SCHB is based on the Dow Jones Broad Stock Market Index , which tracks the 2,500 largest publicly traded U.S. companies for which pricing information is readily available. This index is a subset of the Dow Jones U.S. Total Stock Market Index, but excludes companies defined as micro-caps. This index has a median market cap of $1.9 billion. Currently, there are exactly 2,506 stocks in this index. If you look at the informational table I include later in this article, you will note that SCHB only contains 2,020 stocks. The answer to why this is the case actually offers a helpful insight into how ETFs, particularly those with incredibly low expense ratios, are able to function. Here is the explanation given in the SCHB prospectus : Because it may not be possible or practicable to purchase all of the stocks in the index, the Adviser seeks to track the total return of the index by using statistical sampling techniques. These techniques involve investing in a limited number of index securities which, when taken together, are expected to perform similarly to the index as a whole. Look at that phrase “possible or practicable .” In other words, they are explaining that the trading costs involved in attempting to purchase every security in the index would lead to a greater tracking error (or divergence from the index) than their actual practice of sampling the index. In many ways, SCHB mirrors VTI quite closely. As of the date I researched this article, it has a 1.85% distribution yield, against 1.88% for VTI. The weighting of the Top 10 holdings in each fund is also virtually identical. The fund is significantly smaller than VTI, with “only” $5.0 billion in Assets Under Management (AUM) as compared to $55.6 billion for VTI. You will see a small reflection of this in average spread (see definition below) of .03% vs. VTI’s industry-low .01%. This simply reflects the massive daily volume that trades in VTI due to its size. iShares Core S&P Total U.S. Stock Market ETF Our second competitor is from the iShares family of ETFs offered by BlackRock, Inc (NYSE: BLK ). BlackRock is another formidable competitor in the sphere of low-cost ETFs, with 19 ETFs featuring an expense ratio of .10% or less . Several of these are Bond ETFs with specific maturity dates so, for the sake of brevity, I show here the 5 ETFs with an expense ratio of .09% or less: (click to enlarge) ITOT is based on the S&P Composite 1500 Index . This index combines the legendary S&P 500, the S&P MidCap 400, and the S&P SmallCap 600 indexes, and covers some 90% of the total U.S. market capitalization. It covers companies with market capitalization of approximately $350 million or greater, with a median market cap of $3.3 billion. You may recall that SCHB’s median market cap is $1.9 billion, signifying that it contains a larger percentage of small-caps than does ITOT. NOTE: If you are interested in a nice visual representation of the scope of the various indexes, I found a wonderful graphic on the bogleheads website. ITOT has a 1.80% distribution yield, against 1.88% for VTI. The weighting of the Top 10 holdings is slightly more concentrated than VTI, at 15.12% vs. 14.00%. The fund is the smallest of our 3 competitors, with $2.4 billion in Assets Under Management (AUM). As a result, the average spread (see definition below) is .05% compared to .03% for SCHB and .01% for VTI. Key Comparative Information I have prepared the tables below as a quick visual comparative reference to help you evaluate the three ETFs side-by-side. First, some key high-level information: VTI, SCHB, and ITOT: Key Information VTI SCHB ITOT Assets Under Management (AUM) $55.6 Billion $5.0 Billion $2.4 Billion Index Tracked CRSP Total U.S. Market Index Dow Jones Broad Stock Market Index S&P Composite 1500 Index Number of Holdings 3,824 2,020 1,503 Weighting of Top-10 Holdings 14.00% 13.80% 15.12% Distribution Yield 1.88% 1.85% 1.80% Expense Ratio .05% .04% .07% Average Spread .01% .03% .05% Notes on terms that may be unclear: Distribution Yield refers to the ratio of distributions paid by the fund for the past 12 months divided by the Net Asset Value. Average Spread refers to the average price difference between the price buyers were willing to pay and sellers were willing to sell, averaged over the latest 45 days. Next, the sector breakdown: VTI, SCHB, and ITOT: Sector Breakdown VTI SCHB ITOT Financials 18.90% 17.90% 17.47% Technology 16.10% 18.70% 19.01% Health Care 14.00% 14.80% 14.92% Consumer Discretionary 13.80% 13.70% 13.01% Industrials 12.40% 10.50% 10.68% Consumer Staples 9.70% 8.40% 8.92% Energy 7.30% 6.80% 7.26% Utilities 3.00% 3.00% 3.04% Materials 2.80% 3.40% 3.44% Telecommunications 2.00% 2.00% 2.02% Other 0.00% 0.80% 0.23% TOTAL 100.0% 100.0% 100.0% Summary All three ETFs are worthy competitors. If you look at this YTD chart, you will see that VTI has a slight lead, and all three have outperformed the S&P 500. VTI data by YCharts If you look at this 5-year chart as a longer-term comparison, you will see that SCHB actually has a very slight lead over that time span, again with all three outperforming the S&P 500. VTI data by YCharts Setting aside the question of whether you can trade a particular ETF commission-free, here is my rating: VTI : In my mind, it was a very close battle between VTI and SCHB. Certainly, SCHB’s stunning .04% expense ratio is not to be ignored. Further, SCHB has slightly edged out VTI over the past 5 years. However, VTI’s slightly higher distribution ratio, huge size, extremely competitive .05% expense ratio, broader market coverage and recent outperformance nudge it to the #1 spot in my evaluation. SCHB : As I mention, this was a very close call. I think Schwab has done an incredible job putting together a world-class ETF for this category. I find it of no small note that SCHB has slightly edged out VTI over the past 5 years and its low expense ratio will doubtless make it extremely competitive as time moves forward. ITOT : Well, in a comparison of 3, one has to come out third. In this extremely tough head-to-head showdown, ITOT’s smaller size, .07% expense ratio and slight comparative underperformance weigh against it. On the other hand, its slight tilt toward large-caps might lower your risk in the event of a market downturn. I must say, however, that the question of which ETF you can trade commission-free may be the ultimate decider for you. Particularly will this come into play if regular, incremental, investments form a large part of your plan. Happy investing! Disclosure: I am/we are long VTI, ITOT. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal. Scalper1 News

Summary Every ETF investor needs to consider what holdings will form the very core of their portfolio. For the portion relating to domestic stocks, in a previous article I featured Vanguard’s Total Stock Market ETF. In this article, I will examine two other worthy competitors, and analyze how they stack up against VTI. Every investor desirous of developing an ETF-based portfolio does well to start by selecting a few core holdings. In my view, such holdings should offer great diversification along with a rock-bottom cost structure. In a previous article for Seeking Alpha, I featured the Vanguard Total Stock Market ETF (NYSEARCA: VTI ). I concluded that one should seriously consider VTI as a core holding for the portion of your portfolio devoted to domestic stocks. However, there are several worthy competitors in the marketplace. And, they may be even more worthy if your brokerage offers commission-free trading in these ETFs; particularly if one of your goals is to invest regularly and in small increments. In this article, we will examine two such competitors; the Schwab U.S. Broad Market ETF (NYSEARCA: SCHB ) and the iShares Core S&P Total U.S. Stock Market ETF (NYSEARCA: ITOT ). We will compare their structure, expense ratio and other features against VTI, and see how they stack up. Schwab U.S. Broad Market ETF While the history of Charles Schwab (NYSE: SCHW ) traces back over 40 years, the firm is a fairly recent entrant to the ETF market, really getting into the area in a big way in 2009. However, once it committed, it quickly became a formidable competitor. The firm now sports no less than 13 ETFs featuring an expense ratio of .10% or less, as shown here: Heading the list is SCHB, with a market-leading .04% expense ratio. SCHB is based on the Dow Jones Broad Stock Market Index , which tracks the 2,500 largest publicly traded U.S. companies for which pricing information is readily available. This index is a subset of the Dow Jones U.S. Total Stock Market Index, but excludes companies defined as micro-caps. This index has a median market cap of $1.9 billion. Currently, there are exactly 2,506 stocks in this index. If you look at the informational table I include later in this article, you will note that SCHB only contains 2,020 stocks. The answer to why this is the case actually offers a helpful insight into how ETFs, particularly those with incredibly low expense ratios, are able to function. Here is the explanation given in the SCHB prospectus : Because it may not be possible or practicable to purchase all of the stocks in the index, the Adviser seeks to track the total return of the index by using statistical sampling techniques. These techniques involve investing in a limited number of index securities which, when taken together, are expected to perform similarly to the index as a whole. Look at that phrase “possible or practicable .” In other words, they are explaining that the trading costs involved in attempting to purchase every security in the index would lead to a greater tracking error (or divergence from the index) than their actual practice of sampling the index. In many ways, SCHB mirrors VTI quite closely. As of the date I researched this article, it has a 1.85% distribution yield, against 1.88% for VTI. The weighting of the Top 10 holdings in each fund is also virtually identical. The fund is significantly smaller than VTI, with “only” $5.0 billion in Assets Under Management (AUM) as compared to $55.6 billion for VTI. You will see a small reflection of this in average spread (see definition below) of .03% vs. VTI’s industry-low .01%. This simply reflects the massive daily volume that trades in VTI due to its size. iShares Core S&P Total U.S. Stock Market ETF Our second competitor is from the iShares family of ETFs offered by BlackRock, Inc (NYSE: BLK ). BlackRock is another formidable competitor in the sphere of low-cost ETFs, with 19 ETFs featuring an expense ratio of .10% or less . Several of these are Bond ETFs with specific maturity dates so, for the sake of brevity, I show here the 5 ETFs with an expense ratio of .09% or less: (click to enlarge) ITOT is based on the S&P Composite 1500 Index . This index combines the legendary S&P 500, the S&P MidCap 400, and the S&P SmallCap 600 indexes, and covers some 90% of the total U.S. market capitalization. It covers companies with market capitalization of approximately $350 million or greater, with a median market cap of $3.3 billion. You may recall that SCHB’s median market cap is $1.9 billion, signifying that it contains a larger percentage of small-caps than does ITOT. NOTE: If you are interested in a nice visual representation of the scope of the various indexes, I found a wonderful graphic on the bogleheads website. ITOT has a 1.80% distribution yield, against 1.88% for VTI. The weighting of the Top 10 holdings is slightly more concentrated than VTI, at 15.12% vs. 14.00%. The fund is the smallest of our 3 competitors, with $2.4 billion in Assets Under Management (AUM). As a result, the average spread (see definition below) is .05% compared to .03% for SCHB and .01% for VTI. Key Comparative Information I have prepared the tables below as a quick visual comparative reference to help you evaluate the three ETFs side-by-side. First, some key high-level information: VTI, SCHB, and ITOT: Key Information VTI SCHB ITOT Assets Under Management (AUM) $55.6 Billion $5.0 Billion $2.4 Billion Index Tracked CRSP Total U.S. Market Index Dow Jones Broad Stock Market Index S&P Composite 1500 Index Number of Holdings 3,824 2,020 1,503 Weighting of Top-10 Holdings 14.00% 13.80% 15.12% Distribution Yield 1.88% 1.85% 1.80% Expense Ratio .05% .04% .07% Average Spread .01% .03% .05% Notes on terms that may be unclear: Distribution Yield refers to the ratio of distributions paid by the fund for the past 12 months divided by the Net Asset Value. Average Spread refers to the average price difference between the price buyers were willing to pay and sellers were willing to sell, averaged over the latest 45 days. Next, the sector breakdown: VTI, SCHB, and ITOT: Sector Breakdown VTI SCHB ITOT Financials 18.90% 17.90% 17.47% Technology 16.10% 18.70% 19.01% Health Care 14.00% 14.80% 14.92% Consumer Discretionary 13.80% 13.70% 13.01% Industrials 12.40% 10.50% 10.68% Consumer Staples 9.70% 8.40% 8.92% Energy 7.30% 6.80% 7.26% Utilities 3.00% 3.00% 3.04% Materials 2.80% 3.40% 3.44% Telecommunications 2.00% 2.00% 2.02% Other 0.00% 0.80% 0.23% TOTAL 100.0% 100.0% 100.0% Summary All three ETFs are worthy competitors. If you look at this YTD chart, you will see that VTI has a slight lead, and all three have outperformed the S&P 500. VTI data by YCharts If you look at this 5-year chart as a longer-term comparison, you will see that SCHB actually has a very slight lead over that time span, again with all three outperforming the S&P 500. VTI data by YCharts Setting aside the question of whether you can trade a particular ETF commission-free, here is my rating: VTI : In my mind, it was a very close battle between VTI and SCHB. Certainly, SCHB’s stunning .04% expense ratio is not to be ignored. Further, SCHB has slightly edged out VTI over the past 5 years. However, VTI’s slightly higher distribution ratio, huge size, extremely competitive .05% expense ratio, broader market coverage and recent outperformance nudge it to the #1 spot in my evaluation. SCHB : As I mention, this was a very close call. I think Schwab has done an incredible job putting together a world-class ETF for this category. I find it of no small note that SCHB has slightly edged out VTI over the past 5 years and its low expense ratio will doubtless make it extremely competitive as time moves forward. ITOT : Well, in a comparison of 3, one has to come out third. In this extremely tough head-to-head showdown, ITOT’s smaller size, .07% expense ratio and slight comparative underperformance weigh against it. On the other hand, its slight tilt toward large-caps might lower your risk in the event of a market downturn. I must say, however, that the question of which ETF you can trade commission-free may be the ultimate decider for you. Particularly will this come into play if regular, incremental, investments form a large part of your plan. Happy investing! Disclosure: I am/we are long VTI, ITOT. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal. Scalper1 News

Scalper1 News