Scalper1 News

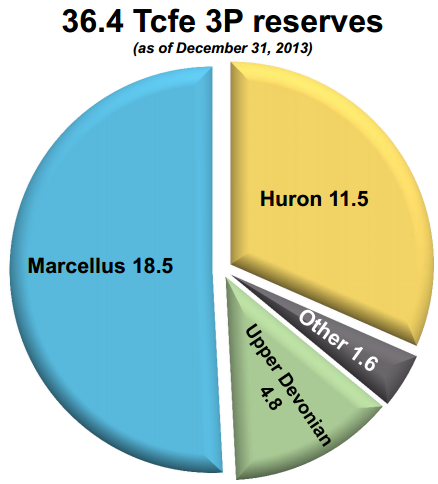

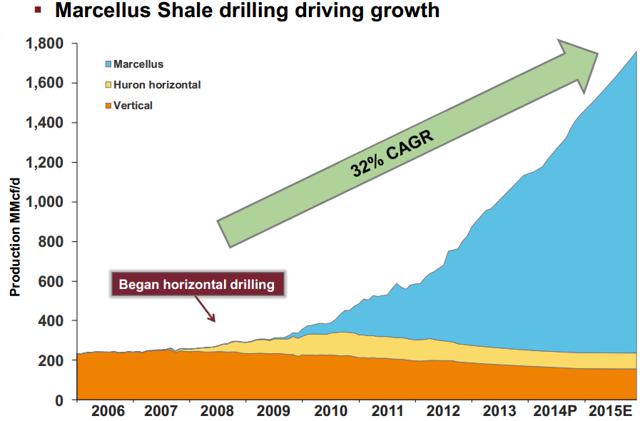

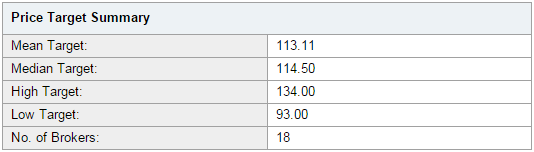

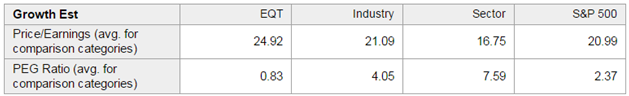

Summary EQT is one of the largest natural gas players in the market that is involved in production and midstream activities. The company also enjoys healthy growth prospects. EQT has announced its plans to drill 181 new wells in the Marcellus Shale in 2015 which is one of the most efficient natural gas plays in the US. EQT is in a good position to report healthy financial performances. The consensus target price and the relative valuation reveals attractive upside at its current price. EQT Corporation (NYSE: EQT ) is one of the largest and most dynamic US natural gas producers involved in production and midstream activities. The company aims to fulfill the growing demand for natural gas in the US. EQT is an efficient company that owns valuable gas reserves in the US. EQT has reported healthy financial performances in the past and despite short-term challenges it is in a strong position to create value for its investors in the coming years. EQT Owns Valuable Natural Gas Assets The Marcellus Shale is one of the most productive and efficient gas plays in North America and EQT has greatly benefited from the growth in reserves in the Marcellus Shale. The Marcellus Shale produces about 40% of the US shale gas production. EQT owns about 580,000 net acres in this shale. The total reserves held by EQT account for about 36.4 trillion cubic feet equivalent (cfe) and about half of these reserves (18.5 Tcfe) are present in the Marcellus play. Source: EQT website EQT has reaped healthy growth in the reserves in the Marcellus play with proven reserves growing by a CAGR of 32% in the past few years. EQT estimates the total resource potential of the Marcellus Shale to be 23.9 Tcfe. EQT has announced its capital investment program for 2015 in which it plans to drill 181 wells in the Marcellus Shale. EQT has the proven ability to develop reserves and this new capital investment for drilling new wells will also prove to be beneficial. (click to enlarge) Source: EQT website EQT plans to make a total capital expenditure of $2.5 billion, out of which $2.3 billion is to be spent on EQT’s production activities. Apart from drilling wells in the Marcellus Shale, EQT has also announced that it will drill 58 Upper Devonian wells, 15 Permian wells, and 5 Utica wells. An Efficient Industry Leader EQT possesses more than a century of experience and this makes it an efficient company with leading cost structure in the industry. EQT’s finding and development cost of $0.88 per Mcfe is well below the industry average of $2.74 per Mcfe. EQT also enjoys very low operating costs compared to the industry. EQT’s operating expense is $0.52 per Mcfe which is well below the industry’s average operating cost of $1.68 per Mcfe. The company’s valuable assets and efficient operations make it a strong business with healthy growth prospects. A Look at Historical Performance EQT has reported healthy financial performances in the past decade. The revenue grew by a healthy CAGR of 7% in the past ten years. EQT managed to increase its gross and operating margins which allowed top line growth to translate to the bottom line. The gross margin improved from 45.4% in 2004 to 80.9% in 2014. The operating margin improved from 24% in 2004 to 44% in 2014. Net income increased by a CAGR of 6% in ten years. This improvement in the financial performance is indicative of the strength of EQT’s business. EQT holds valuable assets that have the ability to create value for its investors in the future. (click to enlarge) Source: Morningstar.com The Consensus Target Price Estimate EQT’s healthy prospects are the basis of the attractive valuation made by analysts covering EQT. The consensus target price reveals upside potential at its current share price of $77.50. The mean target price of $113.11 presents an upside of 46% and the median target price of $114.50 presents an upside of 48% based on the current price. The most optimistic intrinsic value estimate of $134, if realized, presents an upside of 73%. It is worth noting that the most conservative intrinsic value estimate of $93 also presents a very attractive upside of 20%. EQT is a great enterprise with assets that make it an attractive long-term investment. Investors that wish to GAIN exposure in the oil and gas industry should consider investing in EQT. The following is a summary of target price estimates polled by Thomson Reuters from 18 brokers covering EQT. Source: Yahoo Finance Relative Valuation EQT’s price to earnings ratio of 24.92 shows that it is overvalued compared to the industry, sector, and S&P 500. However, after incorporating forecasted growth in the price to earnings multiple, THE RESULTANT PEG ratio shows that EQT is undervalued compared to all the benchmarks used. EQT’s share is an appropriate investment at its current share price. Source: Yahoo Finance Conclusion EQT Corporation is a strong business that has reported healthy financial performances in the past. It is one of the most efficient industry players with a low cost structure. It owns huge reserves of natural gas and has the proven ability to economically develop reserves. EQT has announced its 2015 CAPEX plan worth $2.5 billion with proposals to drill 181 more wells in the Marcellus Shale which is one of the most prolific plays in the US. EQT enjoys healthy growth prospects and this makes it a valuable long-term investment. The consensus target price and the relative valuation show that EQT is an attractive investment based on its current price. Scalper1 News

Summary EQT is one of the largest natural gas players in the market that is involved in production and midstream activities. The company also enjoys healthy growth prospects. EQT has announced its plans to drill 181 new wells in the Marcellus Shale in 2015 which is one of the most efficient natural gas plays in the US. EQT is in a good position to report healthy financial performances. The consensus target price and the relative valuation reveals attractive upside at its current price. EQT Corporation (NYSE: EQT ) is one of the largest and most dynamic US natural gas producers involved in production and midstream activities. The company aims to fulfill the growing demand for natural gas in the US. EQT is an efficient company that owns valuable gas reserves in the US. EQT has reported healthy financial performances in the past and despite short-term challenges it is in a strong position to create value for its investors in the coming years. EQT Owns Valuable Natural Gas Assets The Marcellus Shale is one of the most productive and efficient gas plays in North America and EQT has greatly benefited from the growth in reserves in the Marcellus Shale. The Marcellus Shale produces about 40% of the US shale gas production. EQT owns about 580,000 net acres in this shale. The total reserves held by EQT account for about 36.4 trillion cubic feet equivalent (cfe) and about half of these reserves (18.5 Tcfe) are present in the Marcellus play. Source: EQT website EQT has reaped healthy growth in the reserves in the Marcellus play with proven reserves growing by a CAGR of 32% in the past few years. EQT estimates the total resource potential of the Marcellus Shale to be 23.9 Tcfe. EQT has announced its capital investment program for 2015 in which it plans to drill 181 wells in the Marcellus Shale. EQT has the proven ability to develop reserves and this new capital investment for drilling new wells will also prove to be beneficial. (click to enlarge) Source: EQT website EQT plans to make a total capital expenditure of $2.5 billion, out of which $2.3 billion is to be spent on EQT’s production activities. Apart from drilling wells in the Marcellus Shale, EQT has also announced that it will drill 58 Upper Devonian wells, 15 Permian wells, and 5 Utica wells. An Efficient Industry Leader EQT possesses more than a century of experience and this makes it an efficient company with leading cost structure in the industry. EQT’s finding and development cost of $0.88 per Mcfe is well below the industry average of $2.74 per Mcfe. EQT also enjoys very low operating costs compared to the industry. EQT’s operating expense is $0.52 per Mcfe which is well below the industry’s average operating cost of $1.68 per Mcfe. The company’s valuable assets and efficient operations make it a strong business with healthy growth prospects. A Look at Historical Performance EQT has reported healthy financial performances in the past decade. The revenue grew by a healthy CAGR of 7% in the past ten years. EQT managed to increase its gross and operating margins which allowed top line growth to translate to the bottom line. The gross margin improved from 45.4% in 2004 to 80.9% in 2014. The operating margin improved from 24% in 2004 to 44% in 2014. Net income increased by a CAGR of 6% in ten years. This improvement in the financial performance is indicative of the strength of EQT’s business. EQT holds valuable assets that have the ability to create value for its investors in the future. (click to enlarge) Source: Morningstar.com The Consensus Target Price Estimate EQT’s healthy prospects are the basis of the attractive valuation made by analysts covering EQT. The consensus target price reveals upside potential at its current share price of $77.50. The mean target price of $113.11 presents an upside of 46% and the median target price of $114.50 presents an upside of 48% based on the current price. The most optimistic intrinsic value estimate of $134, if realized, presents an upside of 73%. It is worth noting that the most conservative intrinsic value estimate of $93 also presents a very attractive upside of 20%. EQT is a great enterprise with assets that make it an attractive long-term investment. Investors that wish to GAIN exposure in the oil and gas industry should consider investing in EQT. The following is a summary of target price estimates polled by Thomson Reuters from 18 brokers covering EQT. Source: Yahoo Finance Relative Valuation EQT’s price to earnings ratio of 24.92 shows that it is overvalued compared to the industry, sector, and S&P 500. However, after incorporating forecasted growth in the price to earnings multiple, THE RESULTANT PEG ratio shows that EQT is undervalued compared to all the benchmarks used. EQT’s share is an appropriate investment at its current share price. Source: Yahoo Finance Conclusion EQT Corporation is a strong business that has reported healthy financial performances in the past. It is one of the most efficient industry players with a low cost structure. It owns huge reserves of natural gas and has the proven ability to economically develop reserves. EQT has announced its 2015 CAPEX plan worth $2.5 billion with proposals to drill 181 more wells in the Marcellus Shale which is one of the most prolific plays in the US. EQT enjoys healthy growth prospects and this makes it a valuable long-term investment. The consensus target price and the relative valuation show that EQT is an attractive investment based on its current price. Scalper1 News

Scalper1 News