Scalper1 News

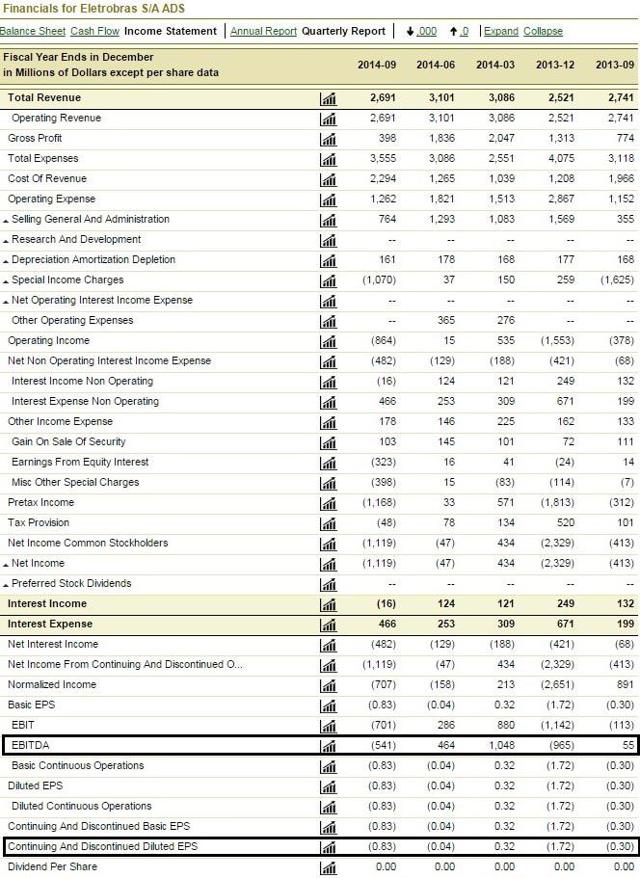

Eletrobras is selling well below its assets value. The firm is largely unprofitable. I am worried about its large debt load. Eletrobras (NYSE: EBR ) is a leader in the generation and the transmission of electric power in Brazil. In fact, it provides electricity to the Brazilian people through its 180 power plants. With these extensive operations, the firm is responsible for 34% of the total energy generation in Brazil. The company also owns 61,534 kilometers of transmission lines. It represents 50% of the total transmission lines in Brazil. Briefly, Eletrobras is a major player in the energy generation in Brazil. An electric dam owned by Eletrobras ( Source ) Like many companies in Brazil, Eletrobras appears undervalued at the first look. In fact, the firm has a price to book ratio of only 0.132. Briefly, it means that if Eletrobras sells its assets and gives the proceeds back to its shareholders, investors would instantly have a return of 750%. On the other hand, there are many reasons for a such discount. Firstly, the company is losing money almost every quarter. Moreover, even the EBITDA figures were negative during the Q3 2014 and Q4 2013. Income Statement (click to enlarge) ( Source ) As the table shows, the firm loses $695 million per quarter on average. Furthermore, it has an EBITDA of $2.2 million per quarter on average. In addition to these bad numbers, the firm has a huge debt load. Indeed, Eletrobras has a debt totaling $13,691 million. Based on the trailing twelve months EBITDA, the company has a monstrous debt to EBITDA ratio of 2,281. Personally, it is the highest debt to EBITDA ratio that I ever seen. Consequently, I am worried about the ability of the company to respect its financial obligations. This affirmation is corroborate by the following statement: In the future, added capitalization may be needed. But for the short term, we won’t need it. ( Source ) It simply means that the company won’t run out of money this year or next, but may need more capital in the future. Finally, I am worried about the real earnings power of the firm. Actually, Brazil’s power tariffs are among the highest in the world even though the country gets about 80% of its electricity from hydro. Effectively, this energy source is cheaper than natural gas or oil. Despite these high prices, the firm is unprofitable. In conclusion, Eletrobras seems to be undervalued at first look. After an in-depth analysis of the income statement, it is possible to conclude that the company is a mess. In fact, its weak earnings combined with a huge debt load will eventually create serious problems for the company. Ironically, nobody talks about these problems on Seeking Alpha. Disclaimer : This article is in no way a recommendation to buy or sell any stock mentioned. These are only my personal opinions and you should do your own homework. Only you are responsible for what you trade. Scalper1 News

Eletrobras is selling well below its assets value. The firm is largely unprofitable. I am worried about its large debt load. Eletrobras (NYSE: EBR ) is a leader in the generation and the transmission of electric power in Brazil. In fact, it provides electricity to the Brazilian people through its 180 power plants. With these extensive operations, the firm is responsible for 34% of the total energy generation in Brazil. The company also owns 61,534 kilometers of transmission lines. It represents 50% of the total transmission lines in Brazil. Briefly, Eletrobras is a major player in the energy generation in Brazil. An electric dam owned by Eletrobras ( Source ) Like many companies in Brazil, Eletrobras appears undervalued at the first look. In fact, the firm has a price to book ratio of only 0.132. Briefly, it means that if Eletrobras sells its assets and gives the proceeds back to its shareholders, investors would instantly have a return of 750%. On the other hand, there are many reasons for a such discount. Firstly, the company is losing money almost every quarter. Moreover, even the EBITDA figures were negative during the Q3 2014 and Q4 2013. Income Statement (click to enlarge) ( Source ) As the table shows, the firm loses $695 million per quarter on average. Furthermore, it has an EBITDA of $2.2 million per quarter on average. In addition to these bad numbers, the firm has a huge debt load. Indeed, Eletrobras has a debt totaling $13,691 million. Based on the trailing twelve months EBITDA, the company has a monstrous debt to EBITDA ratio of 2,281. Personally, it is the highest debt to EBITDA ratio that I ever seen. Consequently, I am worried about the ability of the company to respect its financial obligations. This affirmation is corroborate by the following statement: In the future, added capitalization may be needed. But for the short term, we won’t need it. ( Source ) It simply means that the company won’t run out of money this year or next, but may need more capital in the future. Finally, I am worried about the real earnings power of the firm. Actually, Brazil’s power tariffs are among the highest in the world even though the country gets about 80% of its electricity from hydro. Effectively, this energy source is cheaper than natural gas or oil. Despite these high prices, the firm is unprofitable. In conclusion, Eletrobras seems to be undervalued at first look. After an in-depth analysis of the income statement, it is possible to conclude that the company is a mess. In fact, its weak earnings combined with a huge debt load will eventually create serious problems for the company. Ironically, nobody talks about these problems on Seeking Alpha. Disclaimer : This article is in no way a recommendation to buy or sell any stock mentioned. These are only my personal opinions and you should do your own homework. Only you are responsible for what you trade. Scalper1 News

Scalper1 News