Scalper1 News

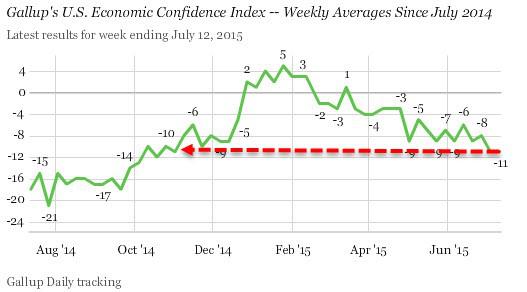

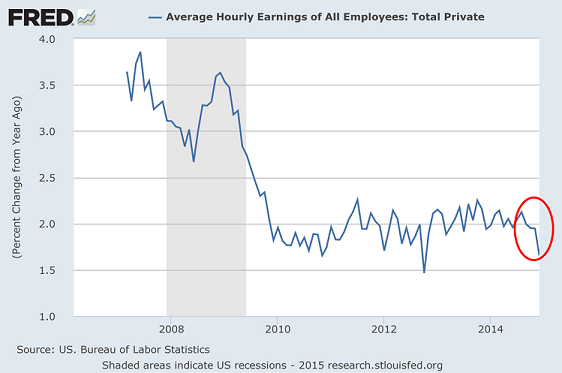

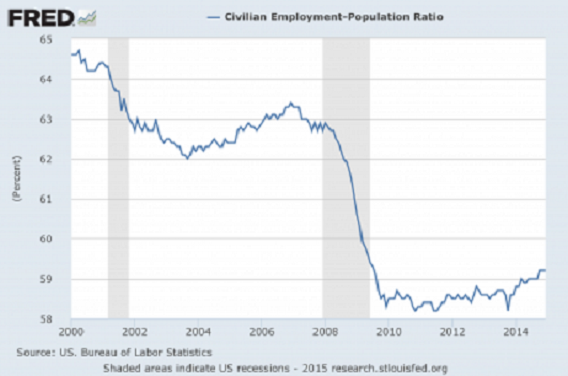

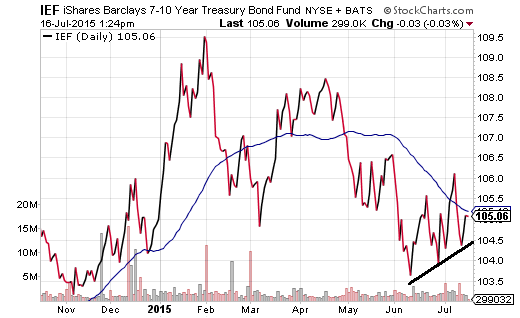

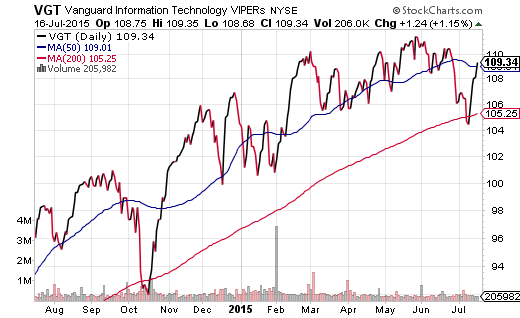

Both wage growth and employment have shown lackluster improvement since the end of the Great Recession in mid-2009. Americans do not believe the economy is improving because they are not earning more money or securing higher-paying employment. The weaker the economic picture, the more likely the stock bull will prevail. Over the past century, the U.S. stock market typically turned down prior to the onset of a recession. You did not need to predict economic contraction; rather, you monitored the Dow and the S&P 500 because the benchmarks acted like leading indicators of bad times ahead. (Investors checked the market internals to get a sense for whether or not stocks themselves might “roll over.”) Stocks demonstrated their predictive powers as recently as October of 2007. The bear market eroded 20%-30% of value before the National Bureau of Economic Research (NBER) even acknowledged the recession’s inception date (12/07) in October of 2008. On the flip side, U.S. equities in today’s world do an atrocious job at recognizing economic sluggishness. The skepticism of chief financial officers (CFOs) at the largest corporations just hit two-year lows. Small business optimism registered its worst reading in 15 months. Meanwhile, you’d have to travel back to November of 2014 to find the sort of pessimism that exists today on the part of the American public. “Gary,” you protest. “People do not always act based upon the way that they feel.” Just the facts, then? The industrial sector – an economic segment that incorporates manufacturing, mining, and utilities – posted its weakest year-over-year (YOY) growth in more than five years. Wholesale sales (YOY) have been in steady decline since 2011, contracting 3.4% in June. Retail sales plummeted in June as well. (No snow. Was it just too hot outside?) And perhaps most importantly, both wage growth and employment (as a function of the population) have shown lackluster improvement since the end of the Great Recession in mid-2009. The take-home is twofold. First, Americans do not believe the economy is improving because they are not earning more money or securing higher-paying employment. For instance, the erosion of roughly one-and-a-half million higher-paying manufacturing jobs has been supplanted by the same number of lower-paying waiter/bartender positions. This dynamic hardly represents economic well-being. Second, the weaker the economic picture, the more likely the stock bull will prevail. In fact, the entire reason that the Federal Reserve needed to enact three rounds of electronic money creation via quantitative easing ($3.75 trillion in “QE”) on top of six-and-a-half years of zero percent overnight lending rates is because the economy has been too weak to tighten borrowing costs. Ironically, Fed chairwoman Yellen maintains that she anticipates hiking rates some time in 2015. Even though annual economic growth throughout the recovery has been stuck near the 2% level? Even as the Fed has downgraded its own expectations for economic expansion for the seventh consecutive year? Even as the the Fed has overestimated the pace of expansion in each of the last seven years? The bond market via the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ) is not entirely sure if overnight lending rates will be bumped up or not. The fact that the slope of the 50-day moving average has turned lower here in 2015 suggests higher yields in the future, in much the same way that the announcement of QE tapering sent bond yields skyrocketing in 2013. However, IEF’s higher lows over the past five weeks coupled with strong resistance for the 10-year yield near 2.5% may suggest otherwise. Even more intriguing is the likelihood that the pace of any rate hikes may be more important than the timing of the first shot. September? Doubtful. December. Probably. Yet fed funds futures have only priced in a rate of 0.75% by the end of 2016. Only three rate hikes over the next 18 months? Or maybe it will be six at 0.125% so that the pace is even slower than the seemingly preordained quarter-point moves. (You heard the concept of one-eighth of a point here first!) Impressively, stocks continue to benefit from every economic downgrade as well as the lowered expectations for the rate hike timeline. If the European Central Bank (ECB) in Europe can successfully kick Greek debt woes down the pathway – if Chinese authorities can successfully decree that “thou shalt buy-n-hold Shanghai shares” – U.S. stocks may not have much too fear. Indeed, the uptrends for core holdings like the iShares S&P 100 ETF (NYSEARCA: OEF ), the Health Care Select Sect SPDR ETF (NYSEARCA: XLV ) and the Vanguard Information Technology ETF (NYSEARCA: VGT ) remain intact. At the same time, we’re holding a larger-than-usual amount in cash/cash equivalents (15%) in most portfolios. Debt-fueled excess in Greece, Puerto Rico and China gave us a peek of the challenges that central banks around the world will be facing. Global economic deceleration and sky-high U.S. valuations are another. We anticipate an opportunity in the 2nd half of 2015 to buy quality assets at significantly lower prices. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Both wage growth and employment have shown lackluster improvement since the end of the Great Recession in mid-2009. Americans do not believe the economy is improving because they are not earning more money or securing higher-paying employment. The weaker the economic picture, the more likely the stock bull will prevail. Over the past century, the U.S. stock market typically turned down prior to the onset of a recession. You did not need to predict economic contraction; rather, you monitored the Dow and the S&P 500 because the benchmarks acted like leading indicators of bad times ahead. (Investors checked the market internals to get a sense for whether or not stocks themselves might “roll over.”) Stocks demonstrated their predictive powers as recently as October of 2007. The bear market eroded 20%-30% of value before the National Bureau of Economic Research (NBER) even acknowledged the recession’s inception date (12/07) in October of 2008. On the flip side, U.S. equities in today’s world do an atrocious job at recognizing economic sluggishness. The skepticism of chief financial officers (CFOs) at the largest corporations just hit two-year lows. Small business optimism registered its worst reading in 15 months. Meanwhile, you’d have to travel back to November of 2014 to find the sort of pessimism that exists today on the part of the American public. “Gary,” you protest. “People do not always act based upon the way that they feel.” Just the facts, then? The industrial sector – an economic segment that incorporates manufacturing, mining, and utilities – posted its weakest year-over-year (YOY) growth in more than five years. Wholesale sales (YOY) have been in steady decline since 2011, contracting 3.4% in June. Retail sales plummeted in June as well. (No snow. Was it just too hot outside?) And perhaps most importantly, both wage growth and employment (as a function of the population) have shown lackluster improvement since the end of the Great Recession in mid-2009. The take-home is twofold. First, Americans do not believe the economy is improving because they are not earning more money or securing higher-paying employment. For instance, the erosion of roughly one-and-a-half million higher-paying manufacturing jobs has been supplanted by the same number of lower-paying waiter/bartender positions. This dynamic hardly represents economic well-being. Second, the weaker the economic picture, the more likely the stock bull will prevail. In fact, the entire reason that the Federal Reserve needed to enact three rounds of electronic money creation via quantitative easing ($3.75 trillion in “QE”) on top of six-and-a-half years of zero percent overnight lending rates is because the economy has been too weak to tighten borrowing costs. Ironically, Fed chairwoman Yellen maintains that she anticipates hiking rates some time in 2015. Even though annual economic growth throughout the recovery has been stuck near the 2% level? Even as the Fed has downgraded its own expectations for economic expansion for the seventh consecutive year? Even as the the Fed has overestimated the pace of expansion in each of the last seven years? The bond market via the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ) is not entirely sure if overnight lending rates will be bumped up or not. The fact that the slope of the 50-day moving average has turned lower here in 2015 suggests higher yields in the future, in much the same way that the announcement of QE tapering sent bond yields skyrocketing in 2013. However, IEF’s higher lows over the past five weeks coupled with strong resistance for the 10-year yield near 2.5% may suggest otherwise. Even more intriguing is the likelihood that the pace of any rate hikes may be more important than the timing of the first shot. September? Doubtful. December. Probably. Yet fed funds futures have only priced in a rate of 0.75% by the end of 2016. Only three rate hikes over the next 18 months? Or maybe it will be six at 0.125% so that the pace is even slower than the seemingly preordained quarter-point moves. (You heard the concept of one-eighth of a point here first!) Impressively, stocks continue to benefit from every economic downgrade as well as the lowered expectations for the rate hike timeline. If the European Central Bank (ECB) in Europe can successfully kick Greek debt woes down the pathway – if Chinese authorities can successfully decree that “thou shalt buy-n-hold Shanghai shares” – U.S. stocks may not have much too fear. Indeed, the uptrends for core holdings like the iShares S&P 100 ETF (NYSEARCA: OEF ), the Health Care Select Sect SPDR ETF (NYSEARCA: XLV ) and the Vanguard Information Technology ETF (NYSEARCA: VGT ) remain intact. At the same time, we’re holding a larger-than-usual amount in cash/cash equivalents (15%) in most portfolios. Debt-fueled excess in Greece, Puerto Rico and China gave us a peek of the challenges that central banks around the world will be facing. Global economic deceleration and sky-high U.S. valuations are another. We anticipate an opportunity in the 2nd half of 2015 to buy quality assets at significantly lower prices. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Scalper1 News