Scalper1 News

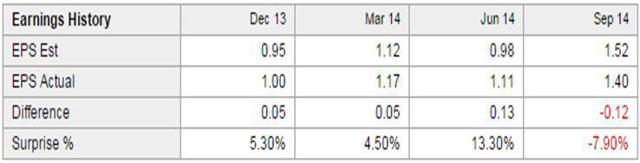

Summary Company’s long-term performance will be positively affected by planned growth investments. Growth investments will drive its rate base and earnings growth in the long run. DUK remains committed to achieving its targeted dividend payout ratio of 65%-70%. I reiterate my bullish stance on Duke Energy (NYSE: DUK ). In this article, I will discuss in more detail the ongoing capital expenditures that the company is making, which will portend well for its financial performance. Also, I will briefly discuss the 4Q’14 earnings outlook. DUK has been progressing well with its healthy capital expenditures in regulated operations. The company’s planned capital expenditures for the next five years remain healthy, and I believe DUK will deliver decent earnings growth in the long run. Moreover, the effect of the healthy earnings growth will improve its cash flow base, due to which the company will make hefty dividend payments in the long run. The stock offers an attractive dividend yield of 3.6%, which makes it a good investment option for dividend-seeking investors. Smart Growth Investments set to Improve DUK’s Financial Performance U.S. utility stocks delivered healthy performances in 2014. Moving forward, I believe 2015 will be another good year for the utility sector. As far as DUK is concerned, the company has carved out its plans to deliver a healthy performance in the long term through acceleration in capital expenditure for long-term growth generating projects. As per its growth plans, focused on regulated operations, the company is planning to spend approximately $16-$20 billion on several growth projects from 2014 to 2018, focused on its new power generation projects. The company revealed that it will be constructing three major generation projects in Florida, with an investment of approximately $1.9 billion . Also, DUK is planning to build a 1,640MW joint cycle plant worth $1.5 billion. In addition, the company has been making progress with its two new combustion turbine plants in Suwannee, which are expected to be in service by the end of 2018. Moreover, regulators have approved DUK’s project to build a 750MW Lee natural gas plant in South Carolina, which will start providing services by the end of 2017. The value of these growth investments lies in the betterment of the company’s power generation capacity due to a significant improvement in regulated operations, which will portend well for its rate base and earnings growth in the long run. Along with power generation projects, DUK has been gradually increasing its renewable energy portfolio. So far, the company is progressing well with the constructions of its 400MW wind energy project and 100MW solar project. DUK has recently acquired a 20MW solar project from Geenex and ET solar Energy Corporation; the project’s site, being located in Dominion North Carolina Power’s service area, will allow the company to generate revenue by selling electricity generated from the project for a period of 15 years. In future, DUK will be making more investments in its renewable generation projects. All these renewable energy generation investments will not only diversify the company’s generation mix, but will help it meet environmental standards. I believe DUK’s increased focus on renewable energy sources will deliver a significant upside to the company’s financial performance in the long run. In addition, DUK is actively evaluating all growth opportunities in international markets to generate growth in the long run. Also, DUK is conducting a strategic examination of international operations to get tax benefits of approximately $1.7 billion . The company’s strategic overview of international operations is still in progress, but by the time DUK will start pursuing tax saving initiatives for its international operations, its stock price will be positively affected. Owing to DUK’s healthy capital expenditures for the next five years, active investments in renewable energy resources and international growth opportunities, I believe the company’s earnings will be positively affected in the long term. Analysts are expecting that DUK’s long-term earnings will grow at approximately 4.76% , better than Southern Company’s (NYSE: SO ) earnings growth of 3.63% . The company is scheduled to report its 4Q’14 earnings next month. The company will provide an update on its future capital expenditure outlook; any increases in planned capital expenditures will positively affect the company’s growth potential and stock price. Also, the company will provide the 1Q’15 and full year 2015 earnings guidance. Analysts are expecting DUK to report an EPS of $0.88 for 4Q’14. In the last four quarters, the company reported three earnings beats. The one earnings miss was due to an impairment charge related to Midwest assets. I believe that as the company has finalized the sale of Midwest assets, it will report strong earnings for 4Q’15. The following table shows the actual EPS and consensus EPS estimates for the last four quarters. (click to enlarge) Source: Yahoofinance.com Healthy Returns DUK has been sharing its success with shareholders through dividends. The company recently announced a quarterly dividend payment of $0.795 , which marked its 85th consecutive year of dividend payments. The company currently offers a healthy dividend yield of 3.60% . The company’s impressive cash flows have been backing these impressive dividend payments, as shown below. DUK’s healthy growth prospects indicate that its cash flow productivity will improve in the years ahead, helping it affirm its commitment to rewarding shareholders through dividend payments. Owing to its ability to pay dividends consistently in upcoming years, I believe DUK remains a good investment option for shareholders. Moreover, the company can use $2.8 billion in cash proceeds from the Midwest assets sale to repurchase shares or boost dividends. Owing to DUK’s shareholder-friendly cash return policy, I believe the company will utilize all growth prospects that could support its healthy cash return policy in order to ensure consistent dividend increases in the years ahead. The following table shows the ongoing increases in dividend per share, ROE, dividend payout ratio and dividend coverage for the company, for 2012 and 2013. The table also includes my estimated figures for 2014 and 2015. (Note *Dividend Coverage Ratio = Operating Cash Flow/Annual Dividends) Dividend Per Share Dividend Payout Dividend Coverage ROE 2012 $3.03 70% 3x 9.5% 2013 $3.12 71.7% 2.9x 6.3% 2014(E) $3.15 69.6% 3.2x 7.6% 2015(E) $3.25 68.7% 3.8x 7.7% Source: Company’s Reports and Equity watch’s Calculations Using Estimates Conclusion DUK’s long-term performance will be positively affected by planned growth investments. The growth investments, directed at improving the company’s operational performance, will drive its rate base and earnings growth in the long run. Also, DUK’s healthy growth prospects will portend well for the betterment of its cash flow base, which will allow the company to consistently increase dividends. Moreover, DUK remains committed to achieving its targeted dividend payout ratio of 65%-70% . Due to the aforementioned factors, I remain bullish on DUK. Scalper1 News

Summary Company’s long-term performance will be positively affected by planned growth investments. Growth investments will drive its rate base and earnings growth in the long run. DUK remains committed to achieving its targeted dividend payout ratio of 65%-70%. I reiterate my bullish stance on Duke Energy (NYSE: DUK ). In this article, I will discuss in more detail the ongoing capital expenditures that the company is making, which will portend well for its financial performance. Also, I will briefly discuss the 4Q’14 earnings outlook. DUK has been progressing well with its healthy capital expenditures in regulated operations. The company’s planned capital expenditures for the next five years remain healthy, and I believe DUK will deliver decent earnings growth in the long run. Moreover, the effect of the healthy earnings growth will improve its cash flow base, due to which the company will make hefty dividend payments in the long run. The stock offers an attractive dividend yield of 3.6%, which makes it a good investment option for dividend-seeking investors. Smart Growth Investments set to Improve DUK’s Financial Performance U.S. utility stocks delivered healthy performances in 2014. Moving forward, I believe 2015 will be another good year for the utility sector. As far as DUK is concerned, the company has carved out its plans to deliver a healthy performance in the long term through acceleration in capital expenditure for long-term growth generating projects. As per its growth plans, focused on regulated operations, the company is planning to spend approximately $16-$20 billion on several growth projects from 2014 to 2018, focused on its new power generation projects. The company revealed that it will be constructing three major generation projects in Florida, with an investment of approximately $1.9 billion . Also, DUK is planning to build a 1,640MW joint cycle plant worth $1.5 billion. In addition, the company has been making progress with its two new combustion turbine plants in Suwannee, which are expected to be in service by the end of 2018. Moreover, regulators have approved DUK’s project to build a 750MW Lee natural gas plant in South Carolina, which will start providing services by the end of 2017. The value of these growth investments lies in the betterment of the company’s power generation capacity due to a significant improvement in regulated operations, which will portend well for its rate base and earnings growth in the long run. Along with power generation projects, DUK has been gradually increasing its renewable energy portfolio. So far, the company is progressing well with the constructions of its 400MW wind energy project and 100MW solar project. DUK has recently acquired a 20MW solar project from Geenex and ET solar Energy Corporation; the project’s site, being located in Dominion North Carolina Power’s service area, will allow the company to generate revenue by selling electricity generated from the project for a period of 15 years. In future, DUK will be making more investments in its renewable generation projects. All these renewable energy generation investments will not only diversify the company’s generation mix, but will help it meet environmental standards. I believe DUK’s increased focus on renewable energy sources will deliver a significant upside to the company’s financial performance in the long run. In addition, DUK is actively evaluating all growth opportunities in international markets to generate growth in the long run. Also, DUK is conducting a strategic examination of international operations to get tax benefits of approximately $1.7 billion . The company’s strategic overview of international operations is still in progress, but by the time DUK will start pursuing tax saving initiatives for its international operations, its stock price will be positively affected. Owing to DUK’s healthy capital expenditures for the next five years, active investments in renewable energy resources and international growth opportunities, I believe the company’s earnings will be positively affected in the long term. Analysts are expecting that DUK’s long-term earnings will grow at approximately 4.76% , better than Southern Company’s (NYSE: SO ) earnings growth of 3.63% . The company is scheduled to report its 4Q’14 earnings next month. The company will provide an update on its future capital expenditure outlook; any increases in planned capital expenditures will positively affect the company’s growth potential and stock price. Also, the company will provide the 1Q’15 and full year 2015 earnings guidance. Analysts are expecting DUK to report an EPS of $0.88 for 4Q’14. In the last four quarters, the company reported three earnings beats. The one earnings miss was due to an impairment charge related to Midwest assets. I believe that as the company has finalized the sale of Midwest assets, it will report strong earnings for 4Q’15. The following table shows the actual EPS and consensus EPS estimates for the last four quarters. (click to enlarge) Source: Yahoofinance.com Healthy Returns DUK has been sharing its success with shareholders through dividends. The company recently announced a quarterly dividend payment of $0.795 , which marked its 85th consecutive year of dividend payments. The company currently offers a healthy dividend yield of 3.60% . The company’s impressive cash flows have been backing these impressive dividend payments, as shown below. DUK’s healthy growth prospects indicate that its cash flow productivity will improve in the years ahead, helping it affirm its commitment to rewarding shareholders through dividend payments. Owing to its ability to pay dividends consistently in upcoming years, I believe DUK remains a good investment option for shareholders. Moreover, the company can use $2.8 billion in cash proceeds from the Midwest assets sale to repurchase shares or boost dividends. Owing to DUK’s shareholder-friendly cash return policy, I believe the company will utilize all growth prospects that could support its healthy cash return policy in order to ensure consistent dividend increases in the years ahead. The following table shows the ongoing increases in dividend per share, ROE, dividend payout ratio and dividend coverage for the company, for 2012 and 2013. The table also includes my estimated figures for 2014 and 2015. (Note *Dividend Coverage Ratio = Operating Cash Flow/Annual Dividends) Dividend Per Share Dividend Payout Dividend Coverage ROE 2012 $3.03 70% 3x 9.5% 2013 $3.12 71.7% 2.9x 6.3% 2014(E) $3.15 69.6% 3.2x 7.6% 2015(E) $3.25 68.7% 3.8x 7.7% Source: Company’s Reports and Equity watch’s Calculations Using Estimates Conclusion DUK’s long-term performance will be positively affected by planned growth investments. The growth investments, directed at improving the company’s operational performance, will drive its rate base and earnings growth in the long run. Also, DUK’s healthy growth prospects will portend well for the betterment of its cash flow base, which will allow the company to consistently increase dividends. Moreover, DUK remains committed to achieving its targeted dividend payout ratio of 65%-70% . Due to the aforementioned factors, I remain bullish on DUK. Scalper1 News

Scalper1 News