Scalper1 News

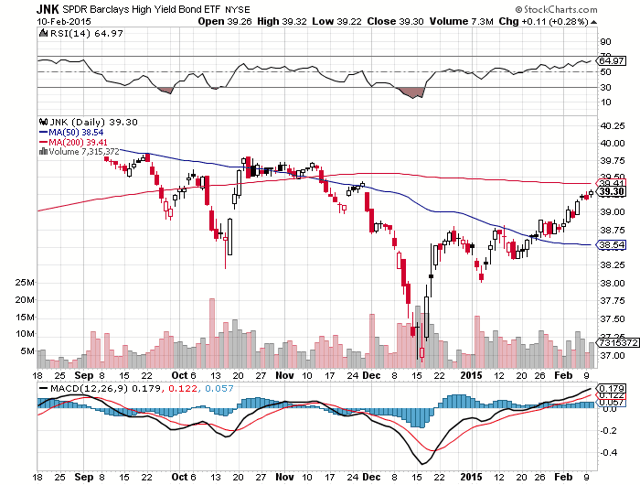

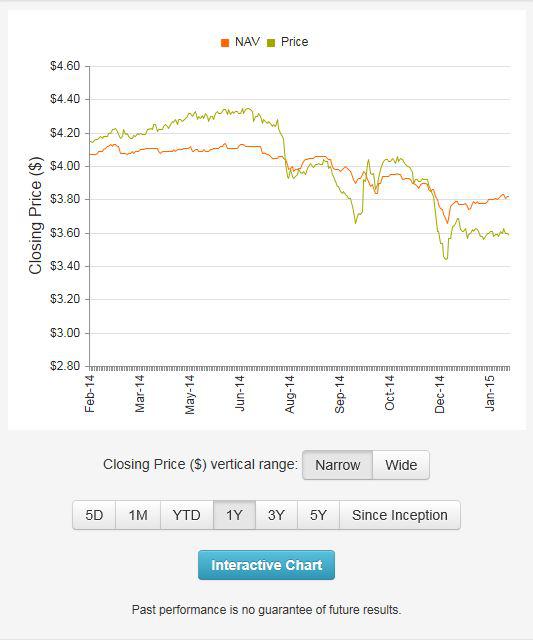

High yield bonds are rebounding and still offer generous yields. The Dreyfus High Yield Strategies Fund is trading at a significant discount to net asset value. With a yield of nearly 9.7% and a discount of nearly 6%, this closed end fund looks particularly attractive now. The Dreyfus High Yield Strategies Fund (NYSE: DHF ) is a closed end fund that invests in higher yielding bonds. As of December 31, 2014, this fund has around 221 holdings, which indicates it is well-diversified. It is also invested in a broad range of industries which includes telecommunications, consumer discretionary, healthcare, and others. This diversification helps reduce potential downside risks. Some of the top ten holdings in this fund include First Data and Sprint Nextel (NYSE: S ) bonds. Duration risk is a potential downside for bond investors, however, this fund has an average duration of just 3.93 years, which mitigates this potential risk. (click to enlarge) The SPDR Barclays High Yield Bond Fund (NYSEARCA: JNK ) is a well-known way for investors to buy high yield bonds. As the chart above shows, junk bonds experienced a decline in mid-December over concerns that some energy companies could be more likely to default due to the plunge in oil prices. Those concerns appear overblown and oil has firmed up in the past few weeks. The Dreyfus High Yield Strategies Fund has only about 10% of its portfolio in the energy sector, so I believe that with roughly 90% of it being invested in other sectors, the risks here are mitigated. While some energy companies might be more challenged, many other industries are benefiting from lower oil prices, which helps offset this potential risk. Over the past 52 weeks, this fund has traded at a premium to net asset value or “NAV,” because it offers very limited duration risk and because of the high yield. For the past year, this fund has typically traded at a nearly 1% premium to net asset value. As of February 9, the net asset value was reported at $3.82, and yet the closing share price was just about $3.60. That means this fund is trading for nearly a 6% discount to net asset value. Since this fund usually trades for about a 1% premium, that means the current discount of nearly 6% is more like getting 7% off of what investors have historically paid. The chart of historical premium/discount information below shows that it is rare for this to trade for the large discount that it has now: This fund offers a yield of about 9.7% and it pays a monthly dividend at a rate of 2.9 cents per share. For many income investors, getting paid every month (as opposed to quarterly) is attractive because it means you won’t have to wait long to get paid. This fund typically goes ex-dividend around the 7th of each month and it typically makes the payment around the 25th of each month. Here are some key points for the Dreyfus High Yield Strategies Fund: Current share price: $3.60 The 52 week range is $3.35 to $4.35 Annual dividend: 2.9 cents per month which yields about 9.7% Data is sourced from Yahoo Finance. No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor. Disclosure: The author is long DHF. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

High yield bonds are rebounding and still offer generous yields. The Dreyfus High Yield Strategies Fund is trading at a significant discount to net asset value. With a yield of nearly 9.7% and a discount of nearly 6%, this closed end fund looks particularly attractive now. The Dreyfus High Yield Strategies Fund (NYSE: DHF ) is a closed end fund that invests in higher yielding bonds. As of December 31, 2014, this fund has around 221 holdings, which indicates it is well-diversified. It is also invested in a broad range of industries which includes telecommunications, consumer discretionary, healthcare, and others. This diversification helps reduce potential downside risks. Some of the top ten holdings in this fund include First Data and Sprint Nextel (NYSE: S ) bonds. Duration risk is a potential downside for bond investors, however, this fund has an average duration of just 3.93 years, which mitigates this potential risk. (click to enlarge) The SPDR Barclays High Yield Bond Fund (NYSEARCA: JNK ) is a well-known way for investors to buy high yield bonds. As the chart above shows, junk bonds experienced a decline in mid-December over concerns that some energy companies could be more likely to default due to the plunge in oil prices. Those concerns appear overblown and oil has firmed up in the past few weeks. The Dreyfus High Yield Strategies Fund has only about 10% of its portfolio in the energy sector, so I believe that with roughly 90% of it being invested in other sectors, the risks here are mitigated. While some energy companies might be more challenged, many other industries are benefiting from lower oil prices, which helps offset this potential risk. Over the past 52 weeks, this fund has traded at a premium to net asset value or “NAV,” because it offers very limited duration risk and because of the high yield. For the past year, this fund has typically traded at a nearly 1% premium to net asset value. As of February 9, the net asset value was reported at $3.82, and yet the closing share price was just about $3.60. That means this fund is trading for nearly a 6% discount to net asset value. Since this fund usually trades for about a 1% premium, that means the current discount of nearly 6% is more like getting 7% off of what investors have historically paid. The chart of historical premium/discount information below shows that it is rare for this to trade for the large discount that it has now: This fund offers a yield of about 9.7% and it pays a monthly dividend at a rate of 2.9 cents per share. For many income investors, getting paid every month (as opposed to quarterly) is attractive because it means you won’t have to wait long to get paid. This fund typically goes ex-dividend around the 7th of each month and it typically makes the payment around the 25th of each month. Here are some key points for the Dreyfus High Yield Strategies Fund: Current share price: $3.60 The 52 week range is $3.35 to $4.35 Annual dividend: 2.9 cents per month which yields about 9.7% Data is sourced from Yahoo Finance. No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor. Disclosure: The author is long DHF. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News