Scalper1 News

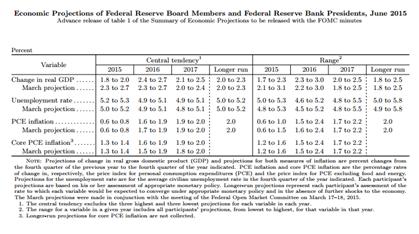

Yesterday a very bearish piece was published on XLF. But I think the author’s arguments are factually incorrect. XLF should perform well as rates normalize. Yesterday, fellow SA author James Stefurak published a piece on the F inancial Select Sector SPDR ETF (NYSEARCA: XLF ), explaining that now is the time to sell given that he sees 20%+ downside for the ETF. A variety of reasons are given for this bearishness but given that I steadfastly disagree with both the reasoning and final conclusion of the piece, please accept this article as my humble and well-intentioned rebuttal. The first point given for why XLF is doomed is concentration. Like most ETFs, XLF has a few key names that make up a significant proportion of the fund. This is normal and even if it wasn’t, the top three names only make up 25% of the fund. The author says if “something goes awry” with one of the top holdings the XLF will tank. That is, of course, true but that’s true of the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as well or any other fund. I’m not sure what qualifies as “something going awry” but the author seems to imply that would mean a total liquidation of the holding. Not sure about you but playing for JPMorgan (NYSE: JPM ) or Wells Fargo (NYSE: WFC ) to go out of business and sink the XLF is probably not the highest probability trade I’ve heard of. The XLF isn’t really all that concentrated and besides, concentration is not a reason to sell by itself. If that were the case then all exchange-traded products would be off limits. Next up is the housing recovery and here, I see some efficacy in the arguments made. It is true the housing market is having a tough time producing sales due to a lack of inventory and high prices. This will crimp earnings for the big mortgage players going forward so the author is right about that. Where we differ is in whether or not this information is priced in. The author seems to think the market doesn’t yet know about this information but this has been going on for a year or more now; the market is well aware that mortgage originations are weak. He also draws comparisons to the financial crisis but these are quite short-sighted because the banking landscape is a completely different world than it was in 2008. Capital levels and controls are infinitely stronger and more robust and with regulators watching every move large banks make, the idea of another 2008 style meltdown is pretty far-fetched. Derivative exposure is the next reason to sell I’ll touch on here. This is one that bears have been pointing to forever as a reason that the world is going to explode. Yes, the dollar values are huge in the derivative market but that doesn’t mean that banks are on the hook for a quadrillion dollars in losses if the world economy sneezes. This “reason” for a selloff is ridiculous and has been touted for years to no avail. The derivative market is not a reason to sell because derivatives to a large degree are hedging instruments. There is no possible scenario where they all come due at once which is what bears continuously tout as the reason the stock market will collapse. It’s beyond the realm of possibility and should be ignored. Finally, the author claims that many financials are actually negatively correlated to interest rates and quotes this as yet another reason to sell. I was dumbfounded when I read this because regardless of whatever evidence may be presented, the market is telling you otherwise and that is all that matters. You don’t have to take my word for it; here are just three examples of where the financials rallied this year as rates moved up ( here , here and here ). It is important to note that this is not my opinion; this is hard evidence that the market likes when rates move up for financials. Presenting anything besides this isn’t intellectually honest. On the valuation piece, the author makes assumptions that I find entirely too bearish without presenting any basis for how the numbers were chosen. This removes the efficacy of the price target because the extreme bearishness has no basis presented. To quote the author: “We have a 12-month price target for XLF at $19.75 which represents an approximate 20% discount to current share price. This downside is conservative. We modeled various assumptions including equity market selloffs (12% U.S. equity market selloff), interest rate rises (the 3-month LIBOR at 35 basis points, the 30-year fixed mortgages of 4.50%, the U.S 10-year Treasury above 3%) and U.S. unemployment rate moving higher (to 5.8%, U-6 rate up to 11.3%) and a bottoming of the delinquency rate on Commercial Real Estate (FRED’s ‘DRCR’).” Based on what? A 12% selloff in equities would produce a sizable selloff in XLF but that’s true of any stock fund; that is not a reason to sell XLF specifically. Rates rising would be a positive, not a negative, as I already outlined. And unemployment is moving up towards 5.8%? Again, based on what? The Federal Reserve is projecting 5% out to at least 2017 so no offense to the author, but I’ll stick with that. Wrapping up, I see very little reason to sell XLF based upon the forecasts of the author’s piece. The evidence presented largely lacks substance in my view and in particular, the section on valuation. If equities in general sell off, of course XLF will go down. But other than that, forecasts for economic doom and gloom are not a reason to sell XLF. Before you run out and dump your XLF – which I think will perform very well as rates rise – please make sure you look at both sides of the argument. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am long several names in the XLF but not long the fund itself. Scalper1 News

Yesterday a very bearish piece was published on XLF. But I think the author’s arguments are factually incorrect. XLF should perform well as rates normalize. Yesterday, fellow SA author James Stefurak published a piece on the F inancial Select Sector SPDR ETF (NYSEARCA: XLF ), explaining that now is the time to sell given that he sees 20%+ downside for the ETF. A variety of reasons are given for this bearishness but given that I steadfastly disagree with both the reasoning and final conclusion of the piece, please accept this article as my humble and well-intentioned rebuttal. The first point given for why XLF is doomed is concentration. Like most ETFs, XLF has a few key names that make up a significant proportion of the fund. This is normal and even if it wasn’t, the top three names only make up 25% of the fund. The author says if “something goes awry” with one of the top holdings the XLF will tank. That is, of course, true but that’s true of the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as well or any other fund. I’m not sure what qualifies as “something going awry” but the author seems to imply that would mean a total liquidation of the holding. Not sure about you but playing for JPMorgan (NYSE: JPM ) or Wells Fargo (NYSE: WFC ) to go out of business and sink the XLF is probably not the highest probability trade I’ve heard of. The XLF isn’t really all that concentrated and besides, concentration is not a reason to sell by itself. If that were the case then all exchange-traded products would be off limits. Next up is the housing recovery and here, I see some efficacy in the arguments made. It is true the housing market is having a tough time producing sales due to a lack of inventory and high prices. This will crimp earnings for the big mortgage players going forward so the author is right about that. Where we differ is in whether or not this information is priced in. The author seems to think the market doesn’t yet know about this information but this has been going on for a year or more now; the market is well aware that mortgage originations are weak. He also draws comparisons to the financial crisis but these are quite short-sighted because the banking landscape is a completely different world than it was in 2008. Capital levels and controls are infinitely stronger and more robust and with regulators watching every move large banks make, the idea of another 2008 style meltdown is pretty far-fetched. Derivative exposure is the next reason to sell I’ll touch on here. This is one that bears have been pointing to forever as a reason that the world is going to explode. Yes, the dollar values are huge in the derivative market but that doesn’t mean that banks are on the hook for a quadrillion dollars in losses if the world economy sneezes. This “reason” for a selloff is ridiculous and has been touted for years to no avail. The derivative market is not a reason to sell because derivatives to a large degree are hedging instruments. There is no possible scenario where they all come due at once which is what bears continuously tout as the reason the stock market will collapse. It’s beyond the realm of possibility and should be ignored. Finally, the author claims that many financials are actually negatively correlated to interest rates and quotes this as yet another reason to sell. I was dumbfounded when I read this because regardless of whatever evidence may be presented, the market is telling you otherwise and that is all that matters. You don’t have to take my word for it; here are just three examples of where the financials rallied this year as rates moved up ( here , here and here ). It is important to note that this is not my opinion; this is hard evidence that the market likes when rates move up for financials. Presenting anything besides this isn’t intellectually honest. On the valuation piece, the author makes assumptions that I find entirely too bearish without presenting any basis for how the numbers were chosen. This removes the efficacy of the price target because the extreme bearishness has no basis presented. To quote the author: “We have a 12-month price target for XLF at $19.75 which represents an approximate 20% discount to current share price. This downside is conservative. We modeled various assumptions including equity market selloffs (12% U.S. equity market selloff), interest rate rises (the 3-month LIBOR at 35 basis points, the 30-year fixed mortgages of 4.50%, the U.S 10-year Treasury above 3%) and U.S. unemployment rate moving higher (to 5.8%, U-6 rate up to 11.3%) and a bottoming of the delinquency rate on Commercial Real Estate (FRED’s ‘DRCR’).” Based on what? A 12% selloff in equities would produce a sizable selloff in XLF but that’s true of any stock fund; that is not a reason to sell XLF specifically. Rates rising would be a positive, not a negative, as I already outlined. And unemployment is moving up towards 5.8%? Again, based on what? The Federal Reserve is projecting 5% out to at least 2017 so no offense to the author, but I’ll stick with that. Wrapping up, I see very little reason to sell XLF based upon the forecasts of the author’s piece. The evidence presented largely lacks substance in my view and in particular, the section on valuation. If equities in general sell off, of course XLF will go down. But other than that, forecasts for economic doom and gloom are not a reason to sell XLF. Before you run out and dump your XLF – which I think will perform very well as rates rise – please make sure you look at both sides of the argument. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am long several names in the XLF but not long the fund itself. Scalper1 News

Scalper1 News