Scalper1 News

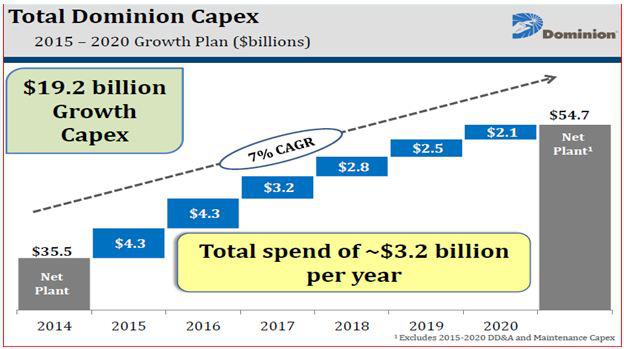

Summary Company’s accelerated investments in growth-generating projects are expected to drive earnings trajectory and revenue base in upcoming years. Sturdy investments will improve company’s free cash flow productivity. Free cash flow productivity will help increase dividends in coming years. Dominion Resources (NYSE: D ) has carved out its plan to excel in the long term through its heavy investments in several growth projects, directed at improving its infrastructure and expanding power generation capacity. As the company is actively pursuing growth projects, the future outlook of D’s revenues growth looks impressive. Also, healthy growth prospects of these projects will significantly improve the company’s free cash flow productivity, which will in turn enable D’s shareholders to enjoy secure and sustainable dividends. The company will continue to enjoy strong earnings growth due to its hefty investments in these long-term growth-generating projects. In addition, the stock currently offers a healthy dividend yield of 3.55%, which makes it attractive for dividend-seeking investors. Powerful Investments = Secure Long Term The U.S. utility sector has exited 2014 with healthy results, as utility companies are investing heavily towards infrastructure improvement and the expansion of its generation capacity. I believe the sector will deliver a much-improved performance throughout 2015 as well. As far as D is concerned, the company has laid out its $19.2 billion capital expenditure (CAPEX) plan, which involves spending approximately $3.2billion/year over the next six years in several long-term growth-generating projects, shown in the graph below. Source: Analyst Day Meeting Slide Presentation Under the $19.2 billion growth CAPEX plan, D has significant growth projects, such as solar, offshore wind, liquefied gas export and construction of more pipelines. As far as the company’s solar projects are concerned, D has laid out its plan to construct several solar projects in Virginia for $700 million . The facilities where D is planning to invest $700 million will enable it to power 100,000 homes and are expected to be operational by 2020. Moreover, these facilities will produce approximately 400MW of solar energy, bringing D’s total solar energy generation capacity to 744MW. Owing to the recent increase in regulatory restriction by the government to lower carbon emissions while producing electricity, I believe the company’s increased focus on generating solar energy is commendable. Moreover, Virginia solar assets are regulated, which means increased solar investments in Virginia will bring healthy rate base growth for D, helping its revenues improve and cash flows to grow at a decent pace. Moreover, the company has received regulatory approval to begin construction on its promising gas generating project “The Cove Point Liquefaction Project”. The project is expected to be operational in late 2017, and by far, its facilities in Maryland are complete, 74% from engineering and 77% from procurement prospects. Owing to the fact that the Cove Point Liquefaction Project will enable D to export LNG outside Louisiana and Texas, I believe the completion of this project will boost the company’s financial performance. D has already entered into a 20-year LNG delivery agreement with Gail India and Japan’s Sumitomo Corporation, which will mean significant upside for the company’s top-line and bottom-line numbers. Along with Cove Point, there’s a lot of work going on building a natural gas infrastructure. In a 550-miles natural gas project, Atlantic Cost Pipeline (ACP), where the company owns a 45% stake, almost 55% of procurement has been completed. And by the time the ACP project will be operational by late-2018, D will be able to purchase significant capacity of pipeline to transport natural gas through 20-year take or pay contracts. The significance of the ACP project lies in improving the company’s natural gas transmission capacity, which means more upside for its future earnings and revenue base. Owing to the healthy growth prospects of D’s robust investments, the company believes that over the next six years, these long-term growth-generating projects will drive 6%-7% of its earnings growth/year. Also, analysts have anticipated that over the next five years, D’s earnings will grow at an average annual rate of 5.79% Secure and Sustainable Dividends D has a long history of making healthy cash returns to its income-seeking investors through hefty dividend payments. As a matter of fact, the company’s healthy earnings growth prospects have been helping it generate strong cash flows, which have been backing its dividend payment policy. D currently offers an attractive dividend yield of 3.55% . As the company’s healthy growth projects have accelerated its cash flows, D recently announced a quarterly dividend payment of 64.75 cents , which results in a yearly dividend rate of $2.59/share. And this new dividend rate corresponds with an increase of 8% from the 2014 dividend rate. Along with approving the dividend increase for 2015, the company’s board has given their consent to maintain the dividend increase at the 2015 growth level for upcoming years, enabling it to achieve a compound annual dividend growth rate of 22% in the next five years. The longevity of D’s healthy growth projects highlight that the healthy dividend payments will make the management’s anticipated payout ratio of 70%-75% achievable in 2015. The following table shows the company’s healthy dividend per share and dividend payout ratios for the last three years and for the years ahead, based on my estimates. 2012 2013 2014 2015(NYSE: E ) 2016( E ) Dividend Per Share $2.11 $2.25 $2.40 $2.59 $2.80 Dividend Payout Ratio 69% 69% 70% 71% 76% Source: Company’s Yearly Earnings Reports & Equity Watch Estimates Risks The company’s future growth prospects are exposed to increased risk of regulatory restrictions, power and gas price deterioration and adverse commodity prices fluctuations. Moreover, unfavorable economic changes and the management’s mishandling could undermine the potential of D’s heavy investments in several growth projects, affecting its future stock price performance. Conclusion I am bullish on D. The company’s accelerated investments in growth-generating projects are expected to drive its earnings trajectory and revenue base in upcoming years. Moreover, these sturdy investments will improve the company’s free cash flow productivity, helping it to increase dividends in the coming years. I recommend long-term growth-seeking investors buy D, as the company offers secure long-term growth. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Company’s accelerated investments in growth-generating projects are expected to drive earnings trajectory and revenue base in upcoming years. Sturdy investments will improve company’s free cash flow productivity. Free cash flow productivity will help increase dividends in coming years. Dominion Resources (NYSE: D ) has carved out its plan to excel in the long term through its heavy investments in several growth projects, directed at improving its infrastructure and expanding power generation capacity. As the company is actively pursuing growth projects, the future outlook of D’s revenues growth looks impressive. Also, healthy growth prospects of these projects will significantly improve the company’s free cash flow productivity, which will in turn enable D’s shareholders to enjoy secure and sustainable dividends. The company will continue to enjoy strong earnings growth due to its hefty investments in these long-term growth-generating projects. In addition, the stock currently offers a healthy dividend yield of 3.55%, which makes it attractive for dividend-seeking investors. Powerful Investments = Secure Long Term The U.S. utility sector has exited 2014 with healthy results, as utility companies are investing heavily towards infrastructure improvement and the expansion of its generation capacity. I believe the sector will deliver a much-improved performance throughout 2015 as well. As far as D is concerned, the company has laid out its $19.2 billion capital expenditure (CAPEX) plan, which involves spending approximately $3.2billion/year over the next six years in several long-term growth-generating projects, shown in the graph below. Source: Analyst Day Meeting Slide Presentation Under the $19.2 billion growth CAPEX plan, D has significant growth projects, such as solar, offshore wind, liquefied gas export and construction of more pipelines. As far as the company’s solar projects are concerned, D has laid out its plan to construct several solar projects in Virginia for $700 million . The facilities where D is planning to invest $700 million will enable it to power 100,000 homes and are expected to be operational by 2020. Moreover, these facilities will produce approximately 400MW of solar energy, bringing D’s total solar energy generation capacity to 744MW. Owing to the recent increase in regulatory restriction by the government to lower carbon emissions while producing electricity, I believe the company’s increased focus on generating solar energy is commendable. Moreover, Virginia solar assets are regulated, which means increased solar investments in Virginia will bring healthy rate base growth for D, helping its revenues improve and cash flows to grow at a decent pace. Moreover, the company has received regulatory approval to begin construction on its promising gas generating project “The Cove Point Liquefaction Project”. The project is expected to be operational in late 2017, and by far, its facilities in Maryland are complete, 74% from engineering and 77% from procurement prospects. Owing to the fact that the Cove Point Liquefaction Project will enable D to export LNG outside Louisiana and Texas, I believe the completion of this project will boost the company’s financial performance. D has already entered into a 20-year LNG delivery agreement with Gail India and Japan’s Sumitomo Corporation, which will mean significant upside for the company’s top-line and bottom-line numbers. Along with Cove Point, there’s a lot of work going on building a natural gas infrastructure. In a 550-miles natural gas project, Atlantic Cost Pipeline (ACP), where the company owns a 45% stake, almost 55% of procurement has been completed. And by the time the ACP project will be operational by late-2018, D will be able to purchase significant capacity of pipeline to transport natural gas through 20-year take or pay contracts. The significance of the ACP project lies in improving the company’s natural gas transmission capacity, which means more upside for its future earnings and revenue base. Owing to the healthy growth prospects of D’s robust investments, the company believes that over the next six years, these long-term growth-generating projects will drive 6%-7% of its earnings growth/year. Also, analysts have anticipated that over the next five years, D’s earnings will grow at an average annual rate of 5.79% Secure and Sustainable Dividends D has a long history of making healthy cash returns to its income-seeking investors through hefty dividend payments. As a matter of fact, the company’s healthy earnings growth prospects have been helping it generate strong cash flows, which have been backing its dividend payment policy. D currently offers an attractive dividend yield of 3.55% . As the company’s healthy growth projects have accelerated its cash flows, D recently announced a quarterly dividend payment of 64.75 cents , which results in a yearly dividend rate of $2.59/share. And this new dividend rate corresponds with an increase of 8% from the 2014 dividend rate. Along with approving the dividend increase for 2015, the company’s board has given their consent to maintain the dividend increase at the 2015 growth level for upcoming years, enabling it to achieve a compound annual dividend growth rate of 22% in the next five years. The longevity of D’s healthy growth projects highlight that the healthy dividend payments will make the management’s anticipated payout ratio of 70%-75% achievable in 2015. The following table shows the company’s healthy dividend per share and dividend payout ratios for the last three years and for the years ahead, based on my estimates. 2012 2013 2014 2015(NYSE: E ) 2016( E ) Dividend Per Share $2.11 $2.25 $2.40 $2.59 $2.80 Dividend Payout Ratio 69% 69% 70% 71% 76% Source: Company’s Yearly Earnings Reports & Equity Watch Estimates Risks The company’s future growth prospects are exposed to increased risk of regulatory restrictions, power and gas price deterioration and adverse commodity prices fluctuations. Moreover, unfavorable economic changes and the management’s mishandling could undermine the potential of D’s heavy investments in several growth projects, affecting its future stock price performance. Conclusion I am bullish on D. The company’s accelerated investments in growth-generating projects are expected to drive its earnings trajectory and revenue base in upcoming years. Moreover, these sturdy investments will improve the company’s free cash flow productivity, helping it to increase dividends in the coming years. I recommend long-term growth-seeking investors buy D, as the company offers secure long-term growth. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News