Scalper1 News

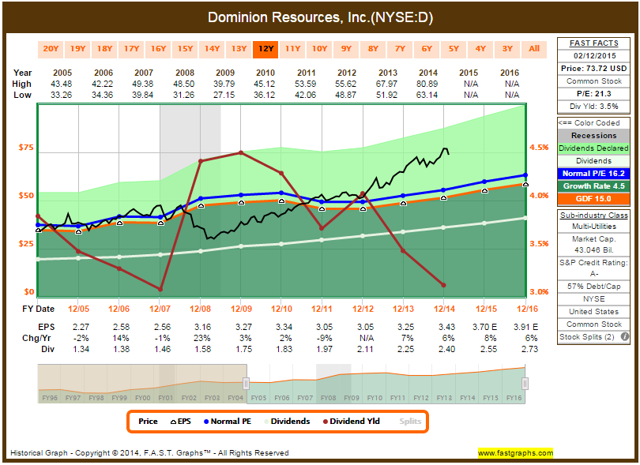

The utility sector is generally known as a collection of high yield, slow growth companies. Dominion Resources has been a top performer in the sector with an attractive growth rate and dividend yield. Dominion Resources recently announced a boost to the dividend and guided for a higher payout ratio going forward. This article will discuss the current valuation levels for the company and determine if it is worth adding to my dividend growth portfolio. As an avid reader of the dividend growth investing strategy on Seeking Alpha, it’s apparent that many investors using this method have a fond appreciation for utility companies in their portfolios. The consistency of earnings and reliable nature of a long-term, slow and steady growth rate make these companies a great cornerstone for long-term buy and hold investors. One utility that is a great example of this slow and steady growth is Dominion Resources (NYSE: D ). Here is the company description from Dominion’s website: Dominion is one of the nation’s largest producers and transporters of energy, with a portfolio of approximately 24,600 megawatts of generation, 12,400 miles of natural gas transmission, gathering and storage pipeline and 6,455 miles of electric transmission lines. Dominion operates one of the nation’s largest natural gas storage systems with 949 billion cubic feet of storage capacity and serves utility and retail energy customers in 12 states. Dominion has a long history of providing outstanding total returns for investors. The company has a 10-year dividend growth rate of 6.3%, a 10-year earnings growth rate of 4.5%, and during that time has provided investors with 12.4% annual total returns with dividends reinvested. While the past has been great, the future may be even better. On February 9th, the company announced an 8% increase in the quarterly dividend from $0.60 to $0.6475 per share, and stated its intentions to increase the dividend payout ratio from a range of 65-70% of earnings to 70-75% through the end of the decade. Dominion also held its Investor and Analyst Meeting on February 9th, with management providing an overview of operations and expectations for the future. During this meeting presentation, management provided guidance for 6-7% earnings growth and 8% dividend growth through 2020, both of which exceed rates seen over the last decade. With a current yield of around 3.55%, investors buying for the long term can lock in an attractive yield growing at a high rate for a utility company. However, in the short term, the stock appears to be trading at a rich valuation compared to historical levels. (click to enlarge) Compared to a normal PE of 16.2 over the last decade, the current ratio of 21.3 would indicate that shares are trading at a 30% premium to normal values. The current yield shown has not yet updated to the newly announced dividend rate, but the 3.55% yield at that payout is still low compared to historical levels. Much of this premium being paid by the market is due to U.S. Treasuries trading at historically low levels, which is driving income seeking investors into equities as they search for yield. I discussed this in a recent article covering the utility sector , and a similar situation is being seen in the REIT sector as well. This trend has been reversing in recent weeks, as the Treasury rate has rebounded and the utility sector, as shown by the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ), has sold off. 10 Year Treasury Rate data by YCharts Circling back to Dominion, it appears that the share price was driven up by macro factors, as the sector traded higher on the weaker Treasury rate. With that rate appearing to be normalizing, there could be some continued short-term pain for Dominion investors. Dominion is a great company with multiple drivers leading to continued growth. I think it deserves a spot in my portfolio as a core holding, but the valuation appears stretched at current prices. This is a company I hope to own, and it has been added to my watch list for my dividend growth portfolio . I will be looking for an entry point at around $65, which would provide a dividend yield of 4% that would pair quite nicely with an 8% dividend growth rate going forward. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am a Civil Engineer by trade and am not a professional investment adviser or financial analyst. This article is not an endorsement for the stocks mentioned. Please perform your own due diligence before you decide to trade any securities or other products. Scalper1 News

The utility sector is generally known as a collection of high yield, slow growth companies. Dominion Resources has been a top performer in the sector with an attractive growth rate and dividend yield. Dominion Resources recently announced a boost to the dividend and guided for a higher payout ratio going forward. This article will discuss the current valuation levels for the company and determine if it is worth adding to my dividend growth portfolio. As an avid reader of the dividend growth investing strategy on Seeking Alpha, it’s apparent that many investors using this method have a fond appreciation for utility companies in their portfolios. The consistency of earnings and reliable nature of a long-term, slow and steady growth rate make these companies a great cornerstone for long-term buy and hold investors. One utility that is a great example of this slow and steady growth is Dominion Resources (NYSE: D ). Here is the company description from Dominion’s website: Dominion is one of the nation’s largest producers and transporters of energy, with a portfolio of approximately 24,600 megawatts of generation, 12,400 miles of natural gas transmission, gathering and storage pipeline and 6,455 miles of electric transmission lines. Dominion operates one of the nation’s largest natural gas storage systems with 949 billion cubic feet of storage capacity and serves utility and retail energy customers in 12 states. Dominion has a long history of providing outstanding total returns for investors. The company has a 10-year dividend growth rate of 6.3%, a 10-year earnings growth rate of 4.5%, and during that time has provided investors with 12.4% annual total returns with dividends reinvested. While the past has been great, the future may be even better. On February 9th, the company announced an 8% increase in the quarterly dividend from $0.60 to $0.6475 per share, and stated its intentions to increase the dividend payout ratio from a range of 65-70% of earnings to 70-75% through the end of the decade. Dominion also held its Investor and Analyst Meeting on February 9th, with management providing an overview of operations and expectations for the future. During this meeting presentation, management provided guidance for 6-7% earnings growth and 8% dividend growth through 2020, both of which exceed rates seen over the last decade. With a current yield of around 3.55%, investors buying for the long term can lock in an attractive yield growing at a high rate for a utility company. However, in the short term, the stock appears to be trading at a rich valuation compared to historical levels. (click to enlarge) Compared to a normal PE of 16.2 over the last decade, the current ratio of 21.3 would indicate that shares are trading at a 30% premium to normal values. The current yield shown has not yet updated to the newly announced dividend rate, but the 3.55% yield at that payout is still low compared to historical levels. Much of this premium being paid by the market is due to U.S. Treasuries trading at historically low levels, which is driving income seeking investors into equities as they search for yield. I discussed this in a recent article covering the utility sector , and a similar situation is being seen in the REIT sector as well. This trend has been reversing in recent weeks, as the Treasury rate has rebounded and the utility sector, as shown by the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ), has sold off. 10 Year Treasury Rate data by YCharts Circling back to Dominion, it appears that the share price was driven up by macro factors, as the sector traded higher on the weaker Treasury rate. With that rate appearing to be normalizing, there could be some continued short-term pain for Dominion investors. Dominion is a great company with multiple drivers leading to continued growth. I think it deserves a spot in my portfolio as a core holding, but the valuation appears stretched at current prices. This is a company I hope to own, and it has been added to my watch list for my dividend growth portfolio . I will be looking for an entry point at around $65, which would provide a dividend yield of 4% that would pair quite nicely with an 8% dividend growth rate going forward. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am a Civil Engineer by trade and am not a professional investment adviser or financial analyst. This article is not an endorsement for the stocks mentioned. Please perform your own due diligence before you decide to trade any securities or other products. Scalper1 News

Scalper1 News