Scalper1 News

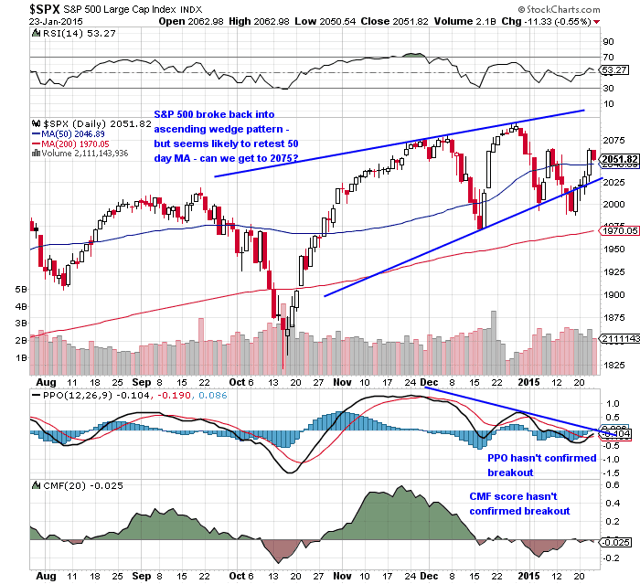

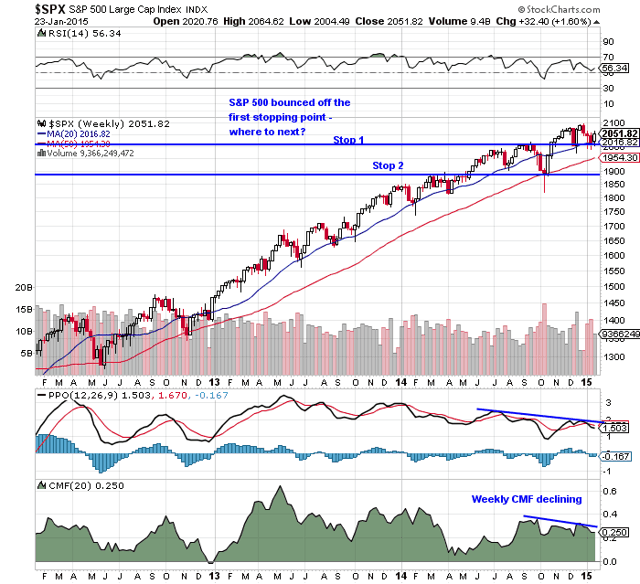

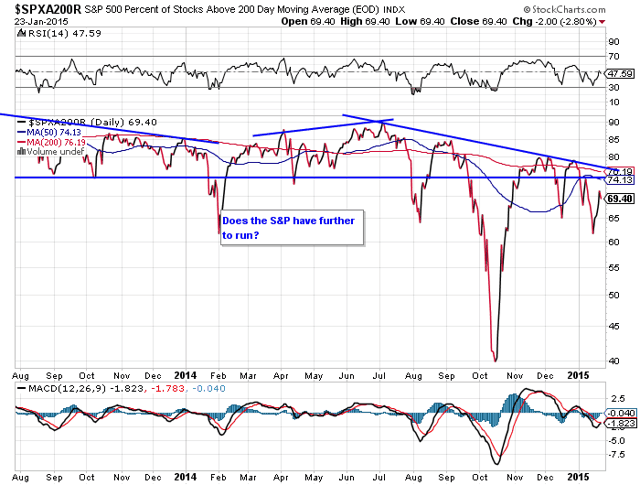

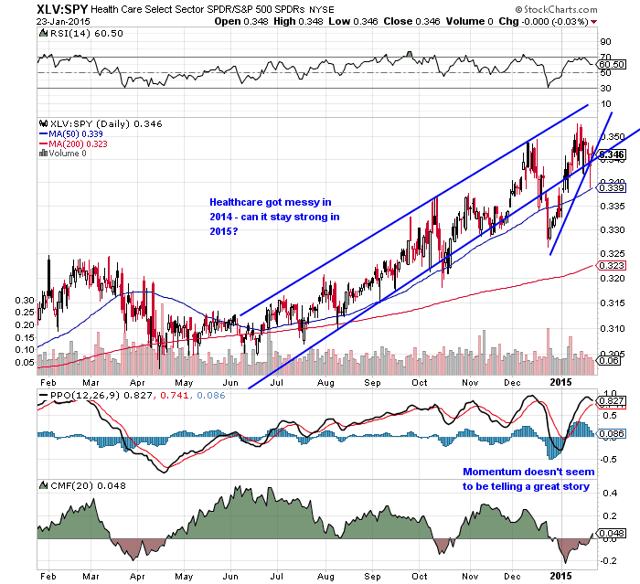

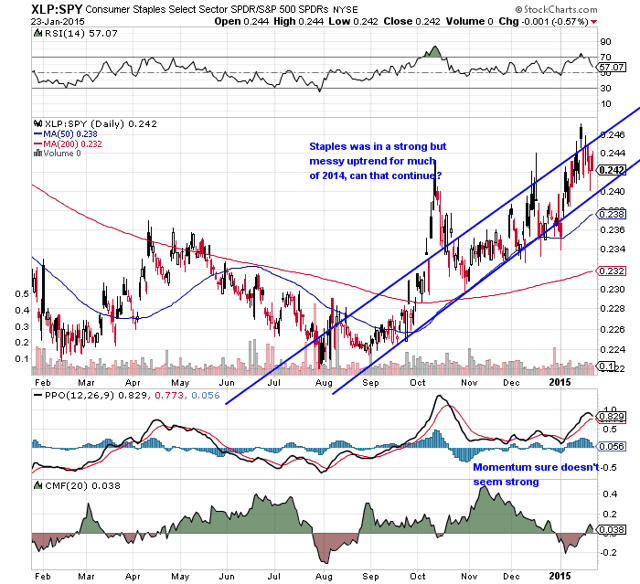

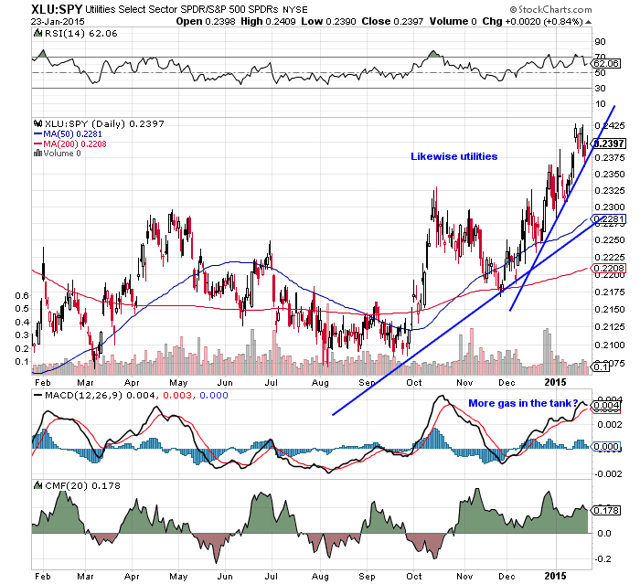

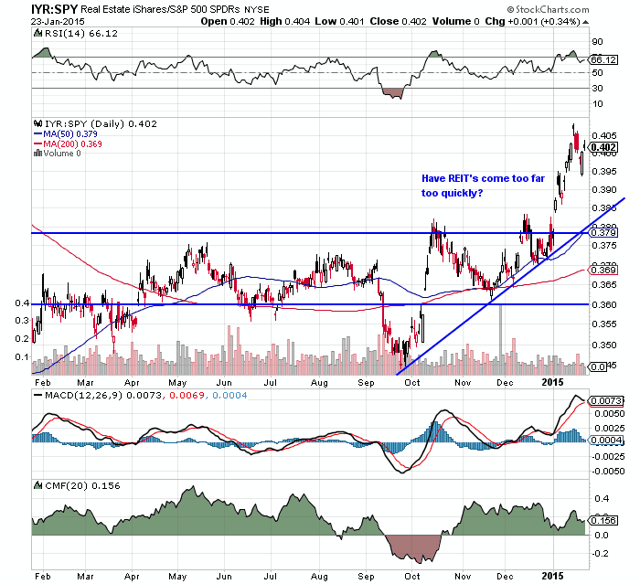

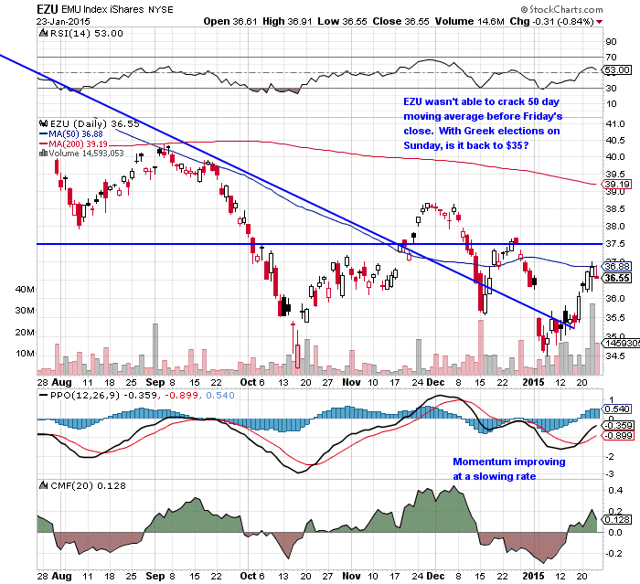

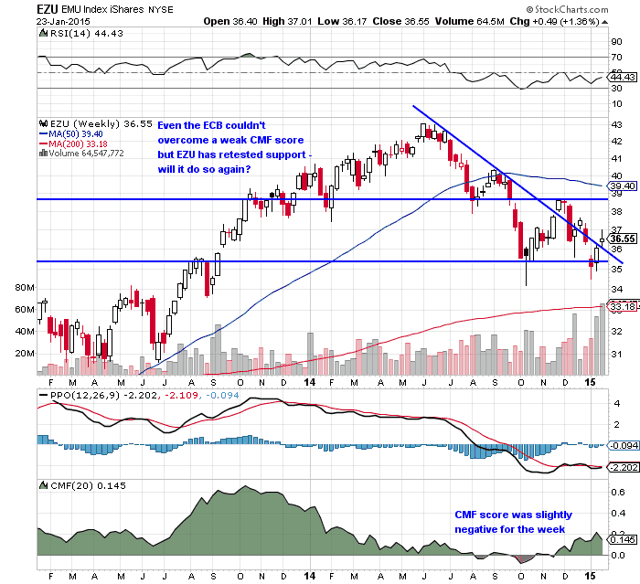

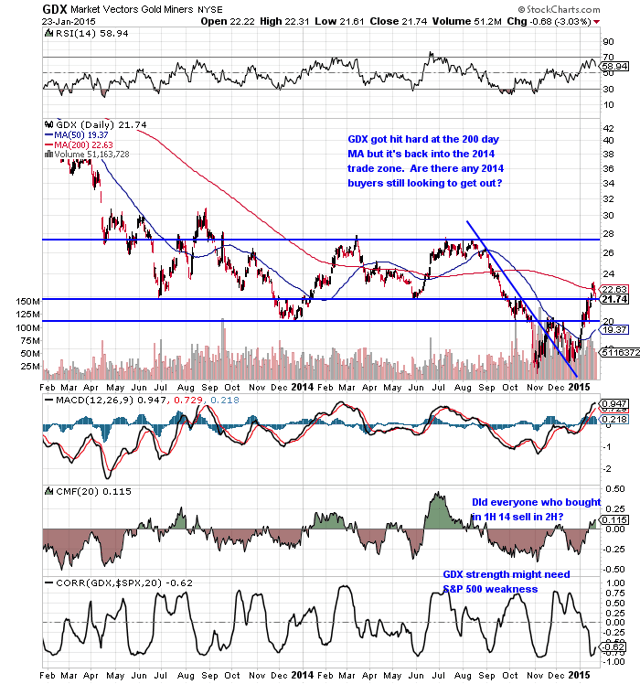

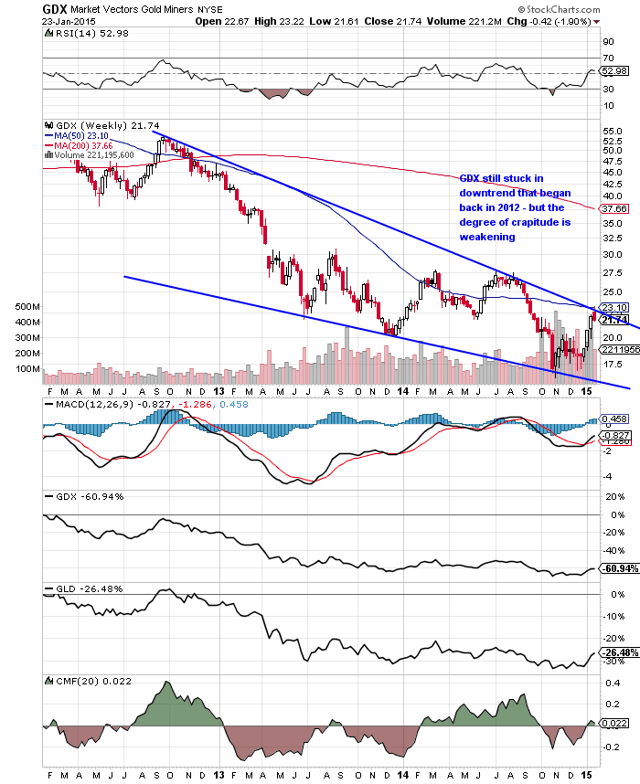

Summary SunAmerica Focused Dividend has turned it around in 2015, are the Dogs of the Dow back? Can active managers catch up after a disastrous 2014? Can the Goldbugs find a way to shine in 2015? It has only been three weeks since our posting on SunAmerica Focused Dividend (MUTF: FDSAX ) and while the ‘Dogs of the Dow’ may have continued to slumber since then, something is definitely working for the fund. In the 7th percentile on a YTD basis, the fund has delivered a solid 2.79% return since our posting compared to 1.55% for the S&P 500 and .82% for the Russell 1000 Value iShares. While we always like to see ourselves proven right (who doesn’t?), the reasons why FDSAX has outperformed so far in 2015 could spell more trouble for active management in the year to come. The secret to FDSAX’s strong performance in 2015 really isn’t that hard to figure out; just head over to Morningstar.com and check it out. What’s in the secret sauce? Well it’s not the Dogs of the Dow although only 4 of the Dogs it holds are underperforming the Dow Jones Industrial Average so far this year. The secret to their success; video games and cigarettes or put another way a deeply discounted retailer (Gamestop (NYSE: GME )) and the 4 largest remaining cigarettes manufactures in the world, the foundations of the consumer staples category. What’s made FDSAX so successful is that incredible difference in performance between the different sectors of the market with a spread of nearly 800 bps between utilities (the Utilities Select Sector SPDR ETF ( XLU) – up 4.07%) and financials (the Financial Select Sector SPDR ETF ( XLF) – down 3.88%) in 2015. For the same period of 16 trade days at the start of 2014, the spread between healthcare and consumer cyclicals was only 594 bps. If the trend continues, 2015 is shaping up to be another year that separates the true active managers from the closer indexers. Let’s start by taking a look at the broader market to see what we can make of the situation. Starting with a daily chart, the S&P 500 was pulled back into the late 2014 ascending wedge on the promise of the new ECB QE program along with a spate of negative economic reports here at home that lite the hope that the Fed’s anticipated rate hike program is on hold. (click to enlarge) While Thursday’s price action was a welcome change, all things considered the weekly action was unimpressive. The volume heading into Thursday was steadily diminishing and Friday’s close just off the lows failed to confirm the move higher. Today’s election of a new leftist government in Greece probably won’t help the open on Monday. As of press time (10:30), the VIX futures had jumped although we backing off the highs. On a weekly basis, you can see the S&P bounced off the first potential stopping out point, but we’ll need to see follow through this week to confirm whether this is just a bounce off one day’s positive news. The fact that the news that lifted the market originated overseas rather than here doesn’t strike me as particularly positive. (click to enlarge) What’s more worrying for trying to separate the closet cases from the true active managers is that the internal make-up of the market doesn’t show any signs of improving although the recent trend towards defensive sectors might be running out of steam. First let’s start with this chart showing the percentage of stocks above their 200 day moving average. You can see that the percentage is way off, even after Thursday’s big one day spike but you have to consider what did well versus what lagged last week. (click to enlarge) Sector wise, Healthcare and Financials make up nearly 30% of the S&P 500 and both lagged noticeably; the financials have been hit hard on weak earnings and healthcare stocks are showing signs that they’re running on fumes after so many years of strong performance. That strong performance is probably the biggest detractor to stronger returns going forward as long term investors have serious gains to protect. Consumer defensive’s and healthcare stocks also underperformed for the week although they make up a much smaller portion of the index at a little more than 12% while high flying REIT’s make up only around 2%. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) For the S&P 500 to really breadth stabilize and give the market a fighting chance to making serious gains, the last need to become the first. Consumer cyclicals and industrials make up over 22% of the S&P 500 and have had…well mixed performance following tough 2014’s. And the best that can be said about energy stocks is that they haven’t gotten lot worse. This is why market prognosticators always say defensive-led rallies are doomed to failure in the long run. They make up such a relatively small part of the market that as long as they’re pulling the market higher, the advance will be tepid and unstable. Goldbugs Take Heart: What about the Yinzer Analyst’s favorite wager of 2015, European equities? Well you can see that the unhedged iShares MSCI EMU ETF ( EZU) managed a decent advance for the week although it underperformed SPY, up 1.36% to 1.66%. On a daily chart basis, the advance off a retesting of the downtrend line was confirmed by a shift in momentum and the sharp rise in the CMF (20) score although the failure to break above the 50 day moving average was disheartening. (click to enlarge) On a weekly basis, the sharp uptick in volume was offset by a middling CMF score for the week leading to a decline in the CMF 20 and failing to confirm the breakout. With Sunday’s election in Greece, the most likely direction will be lower to retest the downtrend line. (click to enlarge) Who has enjoyed a seriously strong and undeniably positive start to 2015 are the gold miners. After so many bad years, could the global uncertainty over deflation and equity weakness here at home be ready to push the miners back towards their 2014 highs? Take a look at the daily chart below, you can see the Market Vectors Gold Miners ETF ( GDX) managed to push back into its 2014 trading range before getting stuck at the 200 day moving average, but the real handicap for the week wasn’t profit taking (we hope) or covering old losses, but a positive week for the S&P 500. Despite the best efforts of the Permanent Portfolio Fund (MUTF: PRPFX ) which is killing it in 2015, gold has lost its luster for most investors and the miners especially aren’t playing a big role in their portfolios anytime soon. But hey, room to grow right? (click to enlarge) Longer term, the miners are still stuck in the falling wedge pattern that has been guiding its destiny ever downwards since 2012. This week GDX ran smack into the upper boundary and managed to push through it before running out of steam and closing below the trend line. For those gold bugs out there, take heart. Volume was lower on the week and didn’t damage the uptrend line while the MACD seems to be in the early stages of rolling over to turn positive. Even if the move turns out to be another false rally, take heart goldbugs, the pattern continues to narrow indicating a breakout could be in the cards later in 2015. (click to enlarge) That’s it for the Yinzer Analyst tonight; he’s going to need his rack time before getting up to clear some snow. But tomorrow is a new day and another change to make some money, make sure you’re ready for whichever way the market bends. Scalper1 News

Summary SunAmerica Focused Dividend has turned it around in 2015, are the Dogs of the Dow back? Can active managers catch up after a disastrous 2014? Can the Goldbugs find a way to shine in 2015? It has only been three weeks since our posting on SunAmerica Focused Dividend (MUTF: FDSAX ) and while the ‘Dogs of the Dow’ may have continued to slumber since then, something is definitely working for the fund. In the 7th percentile on a YTD basis, the fund has delivered a solid 2.79% return since our posting compared to 1.55% for the S&P 500 and .82% for the Russell 1000 Value iShares. While we always like to see ourselves proven right (who doesn’t?), the reasons why FDSAX has outperformed so far in 2015 could spell more trouble for active management in the year to come. The secret to FDSAX’s strong performance in 2015 really isn’t that hard to figure out; just head over to Morningstar.com and check it out. What’s in the secret sauce? Well it’s not the Dogs of the Dow although only 4 of the Dogs it holds are underperforming the Dow Jones Industrial Average so far this year. The secret to their success; video games and cigarettes or put another way a deeply discounted retailer (Gamestop (NYSE: GME )) and the 4 largest remaining cigarettes manufactures in the world, the foundations of the consumer staples category. What’s made FDSAX so successful is that incredible difference in performance between the different sectors of the market with a spread of nearly 800 bps between utilities (the Utilities Select Sector SPDR ETF ( XLU) – up 4.07%) and financials (the Financial Select Sector SPDR ETF ( XLF) – down 3.88%) in 2015. For the same period of 16 trade days at the start of 2014, the spread between healthcare and consumer cyclicals was only 594 bps. If the trend continues, 2015 is shaping up to be another year that separates the true active managers from the closer indexers. Let’s start by taking a look at the broader market to see what we can make of the situation. Starting with a daily chart, the S&P 500 was pulled back into the late 2014 ascending wedge on the promise of the new ECB QE program along with a spate of negative economic reports here at home that lite the hope that the Fed’s anticipated rate hike program is on hold. (click to enlarge) While Thursday’s price action was a welcome change, all things considered the weekly action was unimpressive. The volume heading into Thursday was steadily diminishing and Friday’s close just off the lows failed to confirm the move higher. Today’s election of a new leftist government in Greece probably won’t help the open on Monday. As of press time (10:30), the VIX futures had jumped although we backing off the highs. On a weekly basis, you can see the S&P bounced off the first potential stopping out point, but we’ll need to see follow through this week to confirm whether this is just a bounce off one day’s positive news. The fact that the news that lifted the market originated overseas rather than here doesn’t strike me as particularly positive. (click to enlarge) What’s more worrying for trying to separate the closet cases from the true active managers is that the internal make-up of the market doesn’t show any signs of improving although the recent trend towards defensive sectors might be running out of steam. First let’s start with this chart showing the percentage of stocks above their 200 day moving average. You can see that the percentage is way off, even after Thursday’s big one day spike but you have to consider what did well versus what lagged last week. (click to enlarge) Sector wise, Healthcare and Financials make up nearly 30% of the S&P 500 and both lagged noticeably; the financials have been hit hard on weak earnings and healthcare stocks are showing signs that they’re running on fumes after so many years of strong performance. That strong performance is probably the biggest detractor to stronger returns going forward as long term investors have serious gains to protect. Consumer defensive’s and healthcare stocks also underperformed for the week although they make up a much smaller portion of the index at a little more than 12% while high flying REIT’s make up only around 2%. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) For the S&P 500 to really breadth stabilize and give the market a fighting chance to making serious gains, the last need to become the first. Consumer cyclicals and industrials make up over 22% of the S&P 500 and have had…well mixed performance following tough 2014’s. And the best that can be said about energy stocks is that they haven’t gotten lot worse. This is why market prognosticators always say defensive-led rallies are doomed to failure in the long run. They make up such a relatively small part of the market that as long as they’re pulling the market higher, the advance will be tepid and unstable. Goldbugs Take Heart: What about the Yinzer Analyst’s favorite wager of 2015, European equities? Well you can see that the unhedged iShares MSCI EMU ETF ( EZU) managed a decent advance for the week although it underperformed SPY, up 1.36% to 1.66%. On a daily chart basis, the advance off a retesting of the downtrend line was confirmed by a shift in momentum and the sharp rise in the CMF (20) score although the failure to break above the 50 day moving average was disheartening. (click to enlarge) On a weekly basis, the sharp uptick in volume was offset by a middling CMF score for the week leading to a decline in the CMF 20 and failing to confirm the breakout. With Sunday’s election in Greece, the most likely direction will be lower to retest the downtrend line. (click to enlarge) Who has enjoyed a seriously strong and undeniably positive start to 2015 are the gold miners. After so many bad years, could the global uncertainty over deflation and equity weakness here at home be ready to push the miners back towards their 2014 highs? Take a look at the daily chart below, you can see the Market Vectors Gold Miners ETF ( GDX) managed to push back into its 2014 trading range before getting stuck at the 200 day moving average, but the real handicap for the week wasn’t profit taking (we hope) or covering old losses, but a positive week for the S&P 500. Despite the best efforts of the Permanent Portfolio Fund (MUTF: PRPFX ) which is killing it in 2015, gold has lost its luster for most investors and the miners especially aren’t playing a big role in their portfolios anytime soon. But hey, room to grow right? (click to enlarge) Longer term, the miners are still stuck in the falling wedge pattern that has been guiding its destiny ever downwards since 2012. This week GDX ran smack into the upper boundary and managed to push through it before running out of steam and closing below the trend line. For those gold bugs out there, take heart. Volume was lower on the week and didn’t damage the uptrend line while the MACD seems to be in the early stages of rolling over to turn positive. Even if the move turns out to be another false rally, take heart goldbugs, the pattern continues to narrow indicating a breakout could be in the cards later in 2015. (click to enlarge) That’s it for the Yinzer Analyst tonight; he’s going to need his rack time before getting up to clear some snow. But tomorrow is a new day and another change to make some money, make sure you’re ready for whichever way the market bends. Scalper1 News

Scalper1 News