Scalper1 News

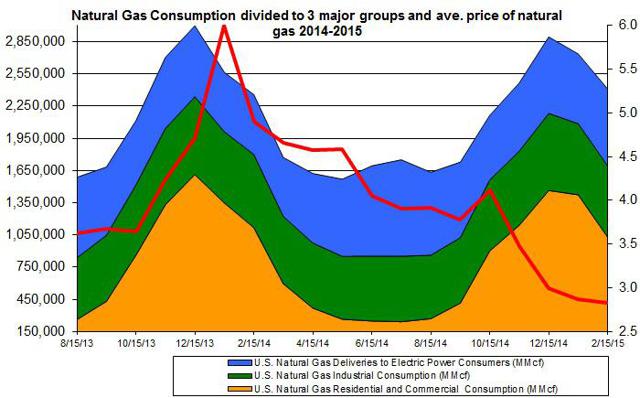

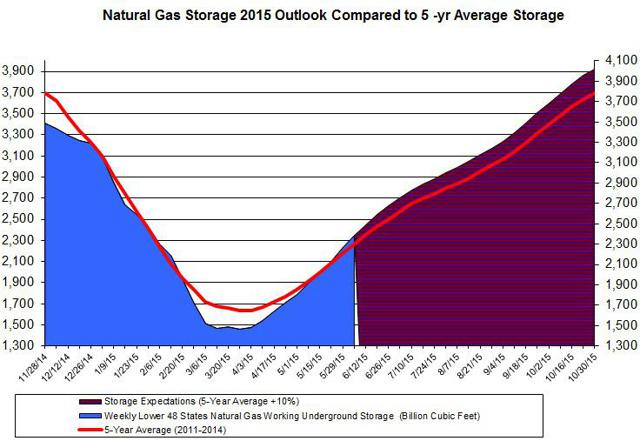

The weather is expected to remain hotter than normal and drive up the demand for natural gas in the power sector. The natural gas storage buildup is still expected to reach higher-than-normal level by the end of the injection season. The injections to storage are still expected to be higher than normal in the coming weeks. The natural gas market started to heat up again as shares of United States Natural Gas ETF (NYSEARCA: UNG ) climbed back up to the $13 mark. It’s still too early to portray the recent bump in the price of natural gas as a recovery, but UNG still has a silver lining in the short term – the ongoing rise in demand for natural gas in the power sector. The weather is expected to heat up. This suggests the consumption of natural gas, at least in the power sector, could keep ramping up. Despite the expected rise in demand for natural gas in the power sector, which accounts for around a third of total U.S. consumption during the year but close to 45% of total demand between April and October, it may not be enough to drive up the price of UNG much higher than its current levels. (click to enlarge) Source of data taken from EIA For one, the injections to storage are still projected to remain higher than normal in the coming weeks. And the storage, which is currently nearly 2% higher than the 5-year average, is expected to reach 3,900 by the end of the October, as you can see in the chart below: (click to enlarge) Source of data taken from EIA Last week, the injection to storage was 111 Bcf – only 2 Bcf lower than market expectations. Looking forward, the market estimates were slightly revised down; even though they still project higher-than-normal injections in the coming weeks, these injections are slightly lower than previous estimates. The higher pace of injection is still driven by the stable production , which, despite the low price of natural gas, remained around 6% higher than last year. The number of operating natural gas rigs has stabilized at 221, as of last week based on the estimates of Baker Hughes (NYSE: BHI ). This number hasn’t changed a whole lot since April. Nonetheless, the warmer weather could bring down the injections to storage in the coming weeks – this could lead to a downward revision of the storage outlook in the coming weeks. In the next couple of weeks, the current weather projections suggest another heat-wave mainly in the West Coast and Southeast. This forecast is also supported by the expected higher-than-normal U.S. average cooling degree days for the week. Last week, total consumption grew by 3.1%; the power sector’s demand rose by 13.3% week over week. The rise in demand was offset by lower consumption in the residential/commercial sectors, which during the injection season accounts for only 20% of total demand – during the year, these sectors account for over a third of total demand. The higher temperatures in the coastal regions are likely to keep driving up the demand for natural gas in the power sector, which could also, in turn, allow short-term rallies for UNG. Despite the expected higher demand in the power sector, the storage is still projected to reach a high level, relative to the 5-year average, by the end of the injection season. For more see: On the Contango in Natural Gas Market Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

The weather is expected to remain hotter than normal and drive up the demand for natural gas in the power sector. The natural gas storage buildup is still expected to reach higher-than-normal level by the end of the injection season. The injections to storage are still expected to be higher than normal in the coming weeks. The natural gas market started to heat up again as shares of United States Natural Gas ETF (NYSEARCA: UNG ) climbed back up to the $13 mark. It’s still too early to portray the recent bump in the price of natural gas as a recovery, but UNG still has a silver lining in the short term – the ongoing rise in demand for natural gas in the power sector. The weather is expected to heat up. This suggests the consumption of natural gas, at least in the power sector, could keep ramping up. Despite the expected rise in demand for natural gas in the power sector, which accounts for around a third of total U.S. consumption during the year but close to 45% of total demand between April and October, it may not be enough to drive up the price of UNG much higher than its current levels. (click to enlarge) Source of data taken from EIA For one, the injections to storage are still projected to remain higher than normal in the coming weeks. And the storage, which is currently nearly 2% higher than the 5-year average, is expected to reach 3,900 by the end of the October, as you can see in the chart below: (click to enlarge) Source of data taken from EIA Last week, the injection to storage was 111 Bcf – only 2 Bcf lower than market expectations. Looking forward, the market estimates were slightly revised down; even though they still project higher-than-normal injections in the coming weeks, these injections are slightly lower than previous estimates. The higher pace of injection is still driven by the stable production , which, despite the low price of natural gas, remained around 6% higher than last year. The number of operating natural gas rigs has stabilized at 221, as of last week based on the estimates of Baker Hughes (NYSE: BHI ). This number hasn’t changed a whole lot since April. Nonetheless, the warmer weather could bring down the injections to storage in the coming weeks – this could lead to a downward revision of the storage outlook in the coming weeks. In the next couple of weeks, the current weather projections suggest another heat-wave mainly in the West Coast and Southeast. This forecast is also supported by the expected higher-than-normal U.S. average cooling degree days for the week. Last week, total consumption grew by 3.1%; the power sector’s demand rose by 13.3% week over week. The rise in demand was offset by lower consumption in the residential/commercial sectors, which during the injection season accounts for only 20% of total demand – during the year, these sectors account for over a third of total demand. The higher temperatures in the coastal regions are likely to keep driving up the demand for natural gas in the power sector, which could also, in turn, allow short-term rallies for UNG. Despite the expected higher demand in the power sector, the storage is still projected to reach a high level, relative to the 5-year average, by the end of the injection season. For more see: On the Contango in Natural Gas Market Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News