Scalper1 News

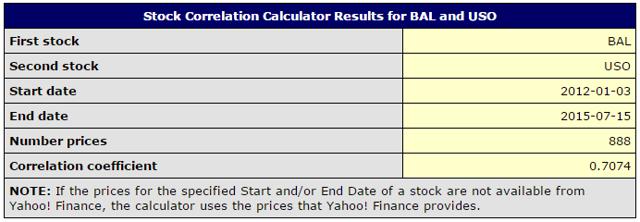

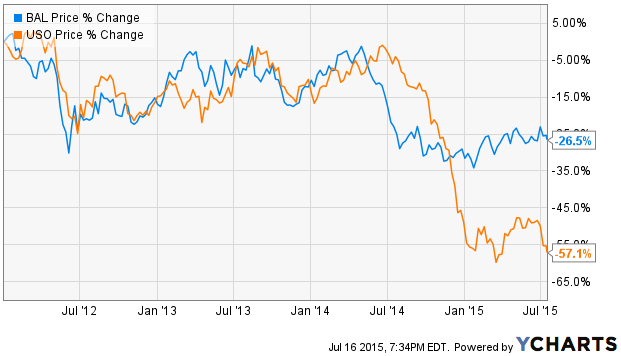

Summary We compared the top oil and cotton ETFs; BAL and USO. Updated on global supply and demand. Events that could influence the short-term price of cotton. In this article on cotton we are going to focus on oil prices vs. cotton prices. Polyester is a competitor of cotton and lower oil prices allow for lower polyester prices. How much does cotton correlate to oil prices? That is a hard question to answer, especially given the large swings cotton has seen over the past decade. These swings skew correlation data and are caused by other events, namely China’s build out of cotton reserves in 2011. What I will seek to do is remove those years from the data and see if there is a correlation or not. For purposes of correlation we will take a look at January 2012 to present. Today we will focus our discussion around the iPath Dow Jones-UBS Cotton Total Return Sub-Index ETN (NYSEARCA: BAL ). BAL correlates perfectly to the price of cotton. For more information on BAL and its perfect correlation to the sub index in which it tracks, please view this article . With reasonable fees and proper tracking it is your best vehicle to use when trading cotton. Below is a table comparing BAL to the United States Oil ETF, LP (NYSEARCA: USO ): (click to enlarge) Chart obtained from buyupside.com An even more interesting take on the data is when you compare the two ETFs side by side in a single chart. Notice the large drop in oil prices beginning in July of 2014. Despite the continuing plunge in oil prices, cotton fared well over the last year. The following table from iPath provides other correlations to BAL. (click to enlarge) The results show that cotton correlates to the price of oil more than any other index. There are many variances and the correlation is far from perfect, but significant enough to point out. The Outlook for Cotton In previous articles we reviewed the 2015 outlook for cotton ( see here ). Last month we took a look at how the flooding in Texas was providing temporary price support to cotton ( see here ). I believe the flooding in Texas only delayed planting and shouldn’t cause any substantial decrease in supply. Pricing did respond to this event but has since trended back down. Last week the World Agriculture Supply and Demand Estimates (WASDE) raised their midpoint average price received to 62 cents per pound, with a high of 70 cents and a low of 58 cents respectively. Now this does not provide much of an opportunity for investor as cotton is currently trading at around 65 cents per pound. Global Factors The global supply and demand estimates still indicate lower consumption and higher ending inventory (stocks). China has led the drop in consumption due to strong competition from polyester amid the low oil prices we talked about above. China continues to be a dominate force behind cotton prices. They have the world’s largest inventory of cotton and are the largest consumer followed by India. Both of these countries export the majority of cotton they consume after manufacturing it into various clothing and discretionary items. The global economy, especially that of the United States and other consumer nations, should remain on the watch list of any cotton investor. Consumption aids in the demand for cotton. Production (click to enlarge) Table retrieved from the U.S. Dept. of Agriculture Farmers around the world continue to choose more profitable crops over cotton, especially here in the United States. I predicted this in my 2015 outlook for cotton. It really is a no brainer if you think about it. If you have multiple businesses to choose from, you would pick the one you think would be the most successful; the same thing farmers do. Conclusion I would say the biggest catalyst for cotton in the short-term would be a rebound in oil prices. Other possible events include natural disasters such as a hurricane hitting Texas. On simply a supply and demand perspective current market conditions look slightly weak. I look forward to continuing coverage on BAL and will put together a 2016 outlook within the next several months. If anything changes you can expect an update about it here on Seeking Alpha. I am assigning a neutral rating on BAL going forward and I do not see any reasons, other than those mentioned about, to recommend it as a buy at this time. Going into 2016 I see a slight trend upward as farmers balance stocks and hopefully global consumption picks up. Thank you for reading and I wish you a profitable rest of 2015. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary We compared the top oil and cotton ETFs; BAL and USO. Updated on global supply and demand. Events that could influence the short-term price of cotton. In this article on cotton we are going to focus on oil prices vs. cotton prices. Polyester is a competitor of cotton and lower oil prices allow for lower polyester prices. How much does cotton correlate to oil prices? That is a hard question to answer, especially given the large swings cotton has seen over the past decade. These swings skew correlation data and are caused by other events, namely China’s build out of cotton reserves in 2011. What I will seek to do is remove those years from the data and see if there is a correlation or not. For purposes of correlation we will take a look at January 2012 to present. Today we will focus our discussion around the iPath Dow Jones-UBS Cotton Total Return Sub-Index ETN (NYSEARCA: BAL ). BAL correlates perfectly to the price of cotton. For more information on BAL and its perfect correlation to the sub index in which it tracks, please view this article . With reasonable fees and proper tracking it is your best vehicle to use when trading cotton. Below is a table comparing BAL to the United States Oil ETF, LP (NYSEARCA: USO ): (click to enlarge) Chart obtained from buyupside.com An even more interesting take on the data is when you compare the two ETFs side by side in a single chart. Notice the large drop in oil prices beginning in July of 2014. Despite the continuing plunge in oil prices, cotton fared well over the last year. The following table from iPath provides other correlations to BAL. (click to enlarge) The results show that cotton correlates to the price of oil more than any other index. There are many variances and the correlation is far from perfect, but significant enough to point out. The Outlook for Cotton In previous articles we reviewed the 2015 outlook for cotton ( see here ). Last month we took a look at how the flooding in Texas was providing temporary price support to cotton ( see here ). I believe the flooding in Texas only delayed planting and shouldn’t cause any substantial decrease in supply. Pricing did respond to this event but has since trended back down. Last week the World Agriculture Supply and Demand Estimates (WASDE) raised their midpoint average price received to 62 cents per pound, with a high of 70 cents and a low of 58 cents respectively. Now this does not provide much of an opportunity for investor as cotton is currently trading at around 65 cents per pound. Global Factors The global supply and demand estimates still indicate lower consumption and higher ending inventory (stocks). China has led the drop in consumption due to strong competition from polyester amid the low oil prices we talked about above. China continues to be a dominate force behind cotton prices. They have the world’s largest inventory of cotton and are the largest consumer followed by India. Both of these countries export the majority of cotton they consume after manufacturing it into various clothing and discretionary items. The global economy, especially that of the United States and other consumer nations, should remain on the watch list of any cotton investor. Consumption aids in the demand for cotton. Production (click to enlarge) Table retrieved from the U.S. Dept. of Agriculture Farmers around the world continue to choose more profitable crops over cotton, especially here in the United States. I predicted this in my 2015 outlook for cotton. It really is a no brainer if you think about it. If you have multiple businesses to choose from, you would pick the one you think would be the most successful; the same thing farmers do. Conclusion I would say the biggest catalyst for cotton in the short-term would be a rebound in oil prices. Other possible events include natural disasters such as a hurricane hitting Texas. On simply a supply and demand perspective current market conditions look slightly weak. I look forward to continuing coverage on BAL and will put together a 2016 outlook within the next several months. If anything changes you can expect an update about it here on Seeking Alpha. I am assigning a neutral rating on BAL going forward and I do not see any reasons, other than those mentioned about, to recommend it as a buy at this time. Going into 2016 I see a slight trend upward as farmers balance stocks and hopefully global consumption picks up. Thank you for reading and I wish you a profitable rest of 2015. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News