Scalper1 News

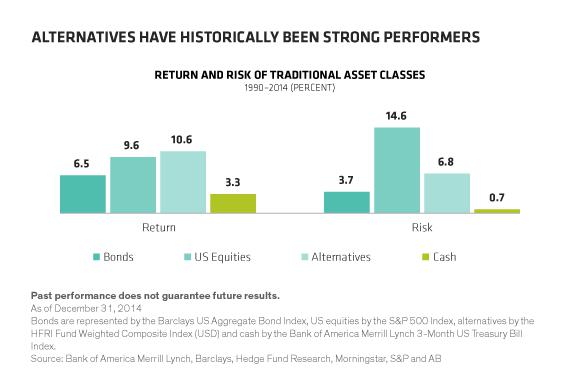

By Richard Brink, Christine Johnson Investors who chose alternatives for downside protection in recent years have been frustrated with their performance. We think the problems were an unfavorable market environment and the unique challenges of manager selection for alternatives. In May 2013, the market’s “taper tantrum” in reaction to announced changes in U.S. monetary policy pushed bond yields up; stocks stumbled briefly before continuing to pile up strong returns. For many investors, this heightened concerns about extended market valuations and an impending interest-rate increase. Taking a page from the typical playbook, many investors looked toward long/short equity strategies and nontraditional bonds as ways to protect against potential market downside. But in 2014, playing defense didn’t pay off: U.S. equity markets gained another 14% and bond yields fell. Long/short equity strategies, on average, returned 4%. That experience left many investors disappointed with alternatives-both equity-oriented and fixed income-oriented. It hardly came as a surprise when investors shifted money out of alternatives early in 2015, moving it into core fixed-income funds and international equities-mostly through passive exchange-traded funds (ETFs). The Long-Term Value of Alternatives We think investors were right in looking to alternatives for protection against potential downturns. Alternatives have provided better returns than stocks, bonds or cash over the past 25 or so years, with less than half the volatility of stocks ( Display ). And long-term data show that incorporating alternatives in a traditional portfolio may enhance returns and reduce risk. If that’s the case, what went wrong in 2014? We think the problem was twofold. First, a good portion of alternatives’ poor performance stemmed from the multiyear, largely uninterrupted bull-market run. This extended rally rendered the long-term benefit of “hedging” with alternatives somewhat moot. Second, many investors bought the right idea of alternatives: participation in all markets with downside protection. But in many cases, they didn’t buy the specific behavior in an alternative that was the best fit for their portfolio and risk/return preferences. It’s not an easy selection process. There are thousands of different alternative strategies to choose from and a lot of dispersion among managers within alternative categories. It’s not enough to simply buy a top performer from a seemingly relevant category. It’s critical to have specific characteristics in mind: Exactly how much downside protection do you want? And how much participation in up markets are you looking for? Once you know your objectives, you can start doing the homework to zero in on a strategy and manager that aligns with them. What’s in an Alternative Category? Everything One of the challenges to finding the right fit is that alternative categories have a lot more variety than their traditional equivalents. They just don’t provide as much help in narrowing down the decision. Take Morningstar indices. They have about 40 different categories for traditional, or long-only, equities. There are categories for different geographies, market capitalization ranges, styles and even sectors. For long/short equities, there’s only one category. If an investor wants to find the right long/short equity strategy, it takes a lot of legwork to uncover the one with the best fit. Without that, investors are at the mercy of manager dispersion. Three Levers That Create Manager Dispersion What creates such big dispersion among alternative managers? We think three levers are at play: style, market risk and approach. We talked about the first lever already: the traditional style buckets of geography, investment approach, market capitalization and industry/sector make for a lot of differences. The second lever is how much overall market risk and sensitivity a manager has-a lot or a little-and how much it varies depending on conditions. The third lever is the approach a manager uses to create the portfolio’s overall market exposure. For example, does the manager use cash, market hedges or short positions in individual stocks? What mix of these instruments does the manager use, and in what environments? All three elements and their combinations can vary to define your experience with a specific alternative manager’s approach. Conducting three-dimensional research to gain a clear understanding of the levers-and which settings are best for you-is the key to choosing the right alternative manager. And the need to make that choice is rather pressing today, in our view. There aren’t a lot of broad cheap areas in capital markets today, and we expect more modest returns and higher volatility ahead for both stocks and bonds. Relying on broad market returns alone isn’t likely to be as rewarding in the years to come, and alternatives can play a key role in enhancing a portfolio’s risk/return profile. The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Scalper1 News

By Richard Brink, Christine Johnson Investors who chose alternatives for downside protection in recent years have been frustrated with their performance. We think the problems were an unfavorable market environment and the unique challenges of manager selection for alternatives. In May 2013, the market’s “taper tantrum” in reaction to announced changes in U.S. monetary policy pushed bond yields up; stocks stumbled briefly before continuing to pile up strong returns. For many investors, this heightened concerns about extended market valuations and an impending interest-rate increase. Taking a page from the typical playbook, many investors looked toward long/short equity strategies and nontraditional bonds as ways to protect against potential market downside. But in 2014, playing defense didn’t pay off: U.S. equity markets gained another 14% and bond yields fell. Long/short equity strategies, on average, returned 4%. That experience left many investors disappointed with alternatives-both equity-oriented and fixed income-oriented. It hardly came as a surprise when investors shifted money out of alternatives early in 2015, moving it into core fixed-income funds and international equities-mostly through passive exchange-traded funds (ETFs). The Long-Term Value of Alternatives We think investors were right in looking to alternatives for protection against potential downturns. Alternatives have provided better returns than stocks, bonds or cash over the past 25 or so years, with less than half the volatility of stocks ( Display ). And long-term data show that incorporating alternatives in a traditional portfolio may enhance returns and reduce risk. If that’s the case, what went wrong in 2014? We think the problem was twofold. First, a good portion of alternatives’ poor performance stemmed from the multiyear, largely uninterrupted bull-market run. This extended rally rendered the long-term benefit of “hedging” with alternatives somewhat moot. Second, many investors bought the right idea of alternatives: participation in all markets with downside protection. But in many cases, they didn’t buy the specific behavior in an alternative that was the best fit for their portfolio and risk/return preferences. It’s not an easy selection process. There are thousands of different alternative strategies to choose from and a lot of dispersion among managers within alternative categories. It’s not enough to simply buy a top performer from a seemingly relevant category. It’s critical to have specific characteristics in mind: Exactly how much downside protection do you want? And how much participation in up markets are you looking for? Once you know your objectives, you can start doing the homework to zero in on a strategy and manager that aligns with them. What’s in an Alternative Category? Everything One of the challenges to finding the right fit is that alternative categories have a lot more variety than their traditional equivalents. They just don’t provide as much help in narrowing down the decision. Take Morningstar indices. They have about 40 different categories for traditional, or long-only, equities. There are categories for different geographies, market capitalization ranges, styles and even sectors. For long/short equities, there’s only one category. If an investor wants to find the right long/short equity strategy, it takes a lot of legwork to uncover the one with the best fit. Without that, investors are at the mercy of manager dispersion. Three Levers That Create Manager Dispersion What creates such big dispersion among alternative managers? We think three levers are at play: style, market risk and approach. We talked about the first lever already: the traditional style buckets of geography, investment approach, market capitalization and industry/sector make for a lot of differences. The second lever is how much overall market risk and sensitivity a manager has-a lot or a little-and how much it varies depending on conditions. The third lever is the approach a manager uses to create the portfolio’s overall market exposure. For example, does the manager use cash, market hedges or short positions in individual stocks? What mix of these instruments does the manager use, and in what environments? All three elements and their combinations can vary to define your experience with a specific alternative manager’s approach. Conducting three-dimensional research to gain a clear understanding of the levers-and which settings are best for you-is the key to choosing the right alternative manager. And the need to make that choice is rather pressing today, in our view. There aren’t a lot of broad cheap areas in capital markets today, and we expect more modest returns and higher volatility ahead for both stocks and bonds. Relying on broad market returns alone isn’t likely to be as rewarding in the years to come, and alternatives can play a key role in enhancing a portfolio’s risk/return profile. The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Scalper1 News

Scalper1 News