Scalper1 News

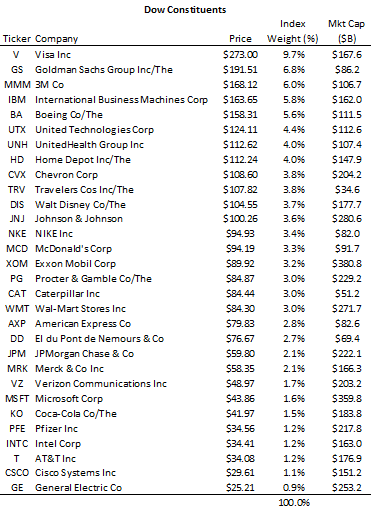

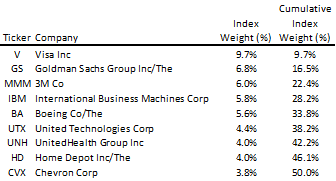

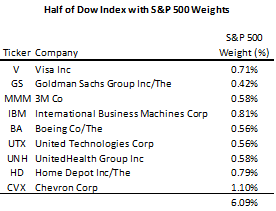

The oft referenced Dow closed at its all-time high on Friday. The Dow, which uses a price weighting methodology, might not be representative of your portfolio. Broadly diversified, capitalization-weighted indices should correlate more with a highly diversified portfolio. The Dow Jones Industrial Average (NYSEARCA: DIA ) closed at its all-time high on Friday of 18,144. This new record will be a talking point on the nightly news, and around the dinner table this weekend. My sister-in-law, knowing that I work in investment management, brought Dow 18,000 up to me in the last week. While it is very nice of her to engage me in conversation about one of my favorite topics – the financial markets – talk of the Dow to me is like nails on a chalkboard. Why? The Dow got its start in the late 1800s as a means of synthesizing the movements of industrial stocks into a single number. While its price-weighting and narrow coverage universe of thirty stocks are now anachronistic in the days of computerized calculations and alternative weightings, the Dow has retained its status as a stock market bellwether. To understand my aversion to references about the Dow, I have tabled the current thirty constituents with their market price, market capitalization, and index weight below: Source: Dow Jones, Bloomberg You will notice above that the index weights are based on the stock price. A company worth $100B could have a stock price worth $1 and 100 billion shares outstanding, or have a stock price worth $1B and one hundred shares outstanding. A company with a stock price of $1B would dominate a price-weighted index. Exxon Mobil (NYSE: XOM ) has the largest market capitalization of any of the index constituents, but has only the fifteenth largest weighting amongst the constituents. General Electric (NYSE: GE ) has the smallest weighting in the Dow despite having the fifth largest capitalization. Exxon is the second largest constituent amongst the five hundred companies that make up the S&P 500. General Electric is the seventh largest constituent in that index. In fact, the nine companies tabled below make up half of the weight of the Dow. Source: Dow Jones, Bloomberg In the capitalization-weighted S&P 500, these same nine companies make up just over six percent of the index. Source: Standard and Poor’s, Bloomberg Half of the daily movement in the Dow is going to be driven by just these nine companies. Those same companies are going to account for just six percent of the variability of the S&P 500 (NYSEARCA: SPY ). Despite its analytical shortcomings, the Dow is still an oft referenced benchmark. Unless your portfolio is heavily weighted to the largest Dow components and their relatively high share prices, it is probably a bad representation of your domestic equity exposure. I will have to send this article to my sister-in-law. Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: The author is long SPY. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

The oft referenced Dow closed at its all-time high on Friday. The Dow, which uses a price weighting methodology, might not be representative of your portfolio. Broadly diversified, capitalization-weighted indices should correlate more with a highly diversified portfolio. The Dow Jones Industrial Average (NYSEARCA: DIA ) closed at its all-time high on Friday of 18,144. This new record will be a talking point on the nightly news, and around the dinner table this weekend. My sister-in-law, knowing that I work in investment management, brought Dow 18,000 up to me in the last week. While it is very nice of her to engage me in conversation about one of my favorite topics – the financial markets – talk of the Dow to me is like nails on a chalkboard. Why? The Dow got its start in the late 1800s as a means of synthesizing the movements of industrial stocks into a single number. While its price-weighting and narrow coverage universe of thirty stocks are now anachronistic in the days of computerized calculations and alternative weightings, the Dow has retained its status as a stock market bellwether. To understand my aversion to references about the Dow, I have tabled the current thirty constituents with their market price, market capitalization, and index weight below: Source: Dow Jones, Bloomberg You will notice above that the index weights are based on the stock price. A company worth $100B could have a stock price worth $1 and 100 billion shares outstanding, or have a stock price worth $1B and one hundred shares outstanding. A company with a stock price of $1B would dominate a price-weighted index. Exxon Mobil (NYSE: XOM ) has the largest market capitalization of any of the index constituents, but has only the fifteenth largest weighting amongst the constituents. General Electric (NYSE: GE ) has the smallest weighting in the Dow despite having the fifth largest capitalization. Exxon is the second largest constituent amongst the five hundred companies that make up the S&P 500. General Electric is the seventh largest constituent in that index. In fact, the nine companies tabled below make up half of the weight of the Dow. Source: Dow Jones, Bloomberg In the capitalization-weighted S&P 500, these same nine companies make up just over six percent of the index. Source: Standard and Poor’s, Bloomberg Half of the daily movement in the Dow is going to be driven by just these nine companies. Those same companies are going to account for just six percent of the variability of the S&P 500 (NYSEARCA: SPY ). Despite its analytical shortcomings, the Dow is still an oft referenced benchmark. Unless your portfolio is heavily weighted to the largest Dow components and their relatively high share prices, it is probably a bad representation of your domestic equity exposure. I will have to send this article to my sister-in-law. Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: The author is long SPY. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News