Scalper1 News

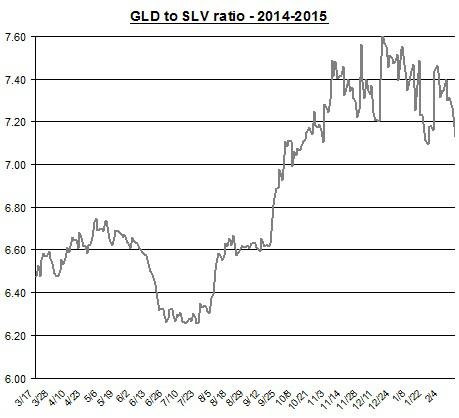

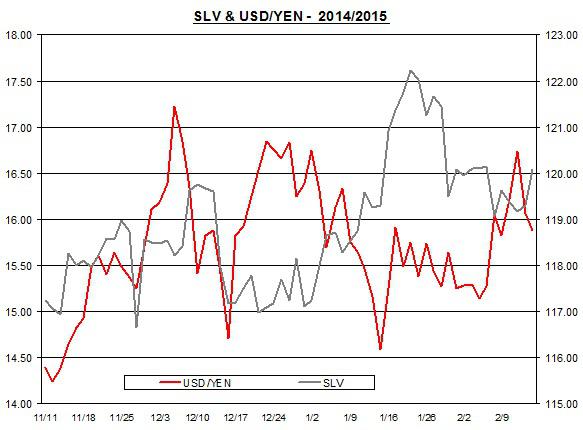

Summary The price of SLV remained flat in the past several weeks. Let’s examine the changes in the supply for silver and its relation to SLV. The recent news from Greece could also play in favor of SLV. The recovery of the iShares Silver Trust ETF (NYSEARCA: SLV ) came to a halt in recent weeks as its price remained around $16 during most of February. Do the expected changes in the supply for silver likely to impact the price of SLV in the near term? Also, how do the latest market developments play out for SLV? Even though the SPDR Gold Trust ETF (NYSEARCA: GLD ) has outperformed SLV during the past year, the ratio between the two remained in the 7.2-7.6 range in recent weeks. The relation between the two tends to be strong and positive. Source of data: Google Finance If the price of GLD were to resume its rally, this could also start to push back up SLV. Besides the changes in the demand for silver and gold for investment purposes, let’s review the expected changes in the supply for silver. Does silver supply matter? One issue that continues to resurface is around the changes on the supply side of silver. In the past few years, the silver production has picked up. In 2012 , production reached 792 million oz; in 2013, output was 819.6 million oz; and for last year , current estimates for the silver production were around 868 million oz – nearly 6% gain year over year. This year, however, HSBC (NYSE: HSBC ) projects silver production to slip to 850 million oz, which represents a 2% fall compared to 2014. After all, some silver producers such as Pan American Silver (NASDAQ: PAAS ) have higher all-in sustaining costs than the price of silver. This is likely to force such companies to slow down their production or, at the very least, slash capex for future growth. Further, silver scrap, which accounted for nearly 16% of total supply back in 2013, is also expected to come down in 2015 compared to the previous year. Will these developments be enough to push back up the price of SLV? As I pointed out in the past, the changes in the physical world of silver have a secondary role in the actual price of SLV. Don’t get me wrong. The sudden drop in supply of silver could push up SLV prices. But the big mover for SLV will remain the changes in the demand on paper for silver. Since silver has industrial use and also investment use, a drop in supply of silver doesn’t have a strong impact on the latter, only the former. If changes in physical demand and supply of silver had a strong impact on SLV prices, then we should have seen a much better match between the changes in supply/demand and prices. Case in point, back in 2012, the physical demand for silver was 954.4 million oz – this was well below the supply for silver. Then in 2013, the physical demand was higher than the supply. But silver prices only came down in 2013 compared to 2012. Moreover, it’s hard to consider the changes in supply/demand for silver as the driving force behind the price of SLV back in 2008-2011 when in fact the global economy only cooled down the demand for silver for industrial fabrication. Looking forward, the World Bank still expects the price of silver to remain around $18 in the coming years. But this outlook could change especially if the U.S. dollar resumes its rally and if the interest rates in the U.S. pick up again. The upcoming release of the minutes of the FOMC meeting from last month may provide some additional insight behind the latest meeting and shed some light on the FOMC’s next move vis-à-vis its rate hike. The recent economic reports in the U.S. were mostly positive, including the non-farm payroll and JOLTS reports. They have increased the odds the market gives for the FOMC to raise rates in the middle of the year. Also, the U.S. dollar didn’t do much in recent weeks against the yen. The linear correlation between SLV and U.S. dollar/yen was mid-strong at -0.51 during the past month. Source of data: Bloomberg If the U.S. dollar were to resume its rally, this could have a negative impact on the price of SLV, or at the very least curb down the rise in SLV. The Greek debt The ongoing debt problems of Greece could still play in favor of precious metals, including SLV. It’s unclear when the Greeks will run out of money, but it’s not going to last long (some estimated it could be as soon as March ). Despite the little progress achieved last week in the Euro group meetings, a possibility of a Greek exit remain low, for now. This week, the second round of Euro group meetings will take place. Greece will look toward a reduction in debt, extend debt maturities and a lower fiscal surplus than the 4.5% mandated from next year. The state elections in Hamburg , Germany, ended and now that they are behind Merkel, the Germans might be more open to reach a compromise with Greece. But as long as the uncertainty in the markets remains high and a possible Greek exit is still in a possibility, the demand for investments such as SLV is likely to rise. The expected fall in the supply for silver is likely to have a minor role in the progress of SLV. The changes in demand for silver for investment purposes will remain the main driving force behind SLV. For now, the uncertainty in Europe could play in favor of SLV. But if the U.S. dollar were to start rising again, and if the interest rates in the U.S. also pick up, these factors could push back down SLV. For more see: Will Higher Physical Demand for Silver Drive Up SLV? Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The price of SLV remained flat in the past several weeks. Let’s examine the changes in the supply for silver and its relation to SLV. The recent news from Greece could also play in favor of SLV. The recovery of the iShares Silver Trust ETF (NYSEARCA: SLV ) came to a halt in recent weeks as its price remained around $16 during most of February. Do the expected changes in the supply for silver likely to impact the price of SLV in the near term? Also, how do the latest market developments play out for SLV? Even though the SPDR Gold Trust ETF (NYSEARCA: GLD ) has outperformed SLV during the past year, the ratio between the two remained in the 7.2-7.6 range in recent weeks. The relation between the two tends to be strong and positive. Source of data: Google Finance If the price of GLD were to resume its rally, this could also start to push back up SLV. Besides the changes in the demand for silver and gold for investment purposes, let’s review the expected changes in the supply for silver. Does silver supply matter? One issue that continues to resurface is around the changes on the supply side of silver. In the past few years, the silver production has picked up. In 2012 , production reached 792 million oz; in 2013, output was 819.6 million oz; and for last year , current estimates for the silver production were around 868 million oz – nearly 6% gain year over year. This year, however, HSBC (NYSE: HSBC ) projects silver production to slip to 850 million oz, which represents a 2% fall compared to 2014. After all, some silver producers such as Pan American Silver (NASDAQ: PAAS ) have higher all-in sustaining costs than the price of silver. This is likely to force such companies to slow down their production or, at the very least, slash capex for future growth. Further, silver scrap, which accounted for nearly 16% of total supply back in 2013, is also expected to come down in 2015 compared to the previous year. Will these developments be enough to push back up the price of SLV? As I pointed out in the past, the changes in the physical world of silver have a secondary role in the actual price of SLV. Don’t get me wrong. The sudden drop in supply of silver could push up SLV prices. But the big mover for SLV will remain the changes in the demand on paper for silver. Since silver has industrial use and also investment use, a drop in supply of silver doesn’t have a strong impact on the latter, only the former. If changes in physical demand and supply of silver had a strong impact on SLV prices, then we should have seen a much better match between the changes in supply/demand and prices. Case in point, back in 2012, the physical demand for silver was 954.4 million oz – this was well below the supply for silver. Then in 2013, the physical demand was higher than the supply. But silver prices only came down in 2013 compared to 2012. Moreover, it’s hard to consider the changes in supply/demand for silver as the driving force behind the price of SLV back in 2008-2011 when in fact the global economy only cooled down the demand for silver for industrial fabrication. Looking forward, the World Bank still expects the price of silver to remain around $18 in the coming years. But this outlook could change especially if the U.S. dollar resumes its rally and if the interest rates in the U.S. pick up again. The upcoming release of the minutes of the FOMC meeting from last month may provide some additional insight behind the latest meeting and shed some light on the FOMC’s next move vis-à-vis its rate hike. The recent economic reports in the U.S. were mostly positive, including the non-farm payroll and JOLTS reports. They have increased the odds the market gives for the FOMC to raise rates in the middle of the year. Also, the U.S. dollar didn’t do much in recent weeks against the yen. The linear correlation between SLV and U.S. dollar/yen was mid-strong at -0.51 during the past month. Source of data: Bloomberg If the U.S. dollar were to resume its rally, this could have a negative impact on the price of SLV, or at the very least curb down the rise in SLV. The Greek debt The ongoing debt problems of Greece could still play in favor of precious metals, including SLV. It’s unclear when the Greeks will run out of money, but it’s not going to last long (some estimated it could be as soon as March ). Despite the little progress achieved last week in the Euro group meetings, a possibility of a Greek exit remain low, for now. This week, the second round of Euro group meetings will take place. Greece will look toward a reduction in debt, extend debt maturities and a lower fiscal surplus than the 4.5% mandated from next year. The state elections in Hamburg , Germany, ended and now that they are behind Merkel, the Germans might be more open to reach a compromise with Greece. But as long as the uncertainty in the markets remains high and a possible Greek exit is still in a possibility, the demand for investments such as SLV is likely to rise. The expected fall in the supply for silver is likely to have a minor role in the progress of SLV. The changes in demand for silver for investment purposes will remain the main driving force behind SLV. For now, the uncertainty in Europe could play in favor of SLV. But if the U.S. dollar were to start rising again, and if the interest rates in the U.S. also pick up, these factors could push back down SLV. For more see: Will Higher Physical Demand for Silver Drive Up SLV? Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News