Scalper1 News

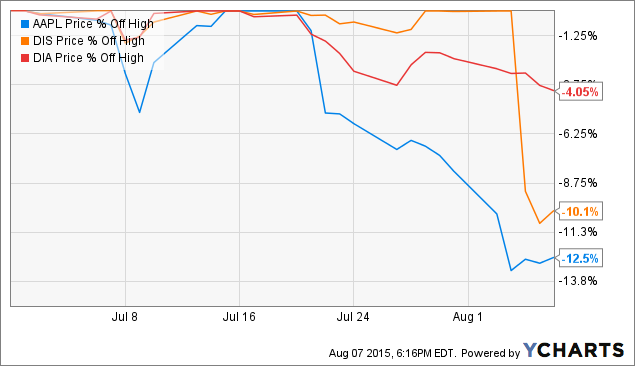

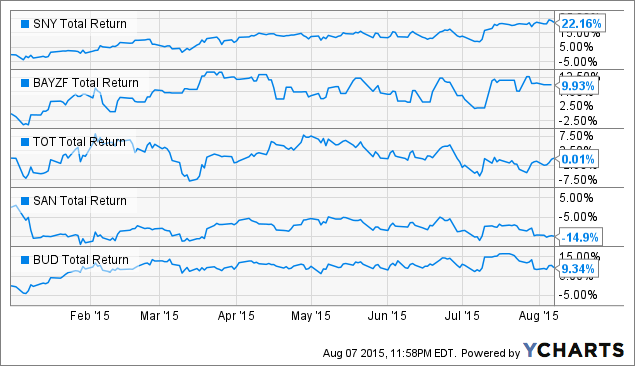

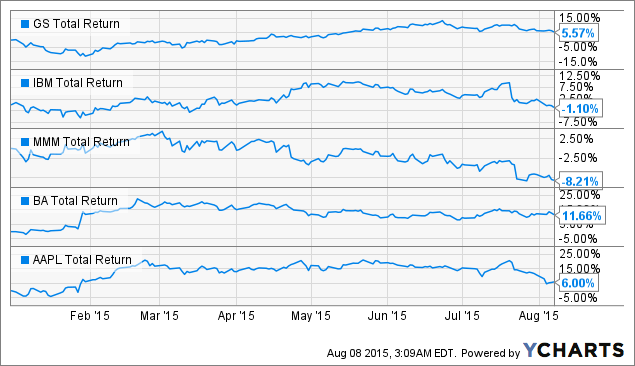

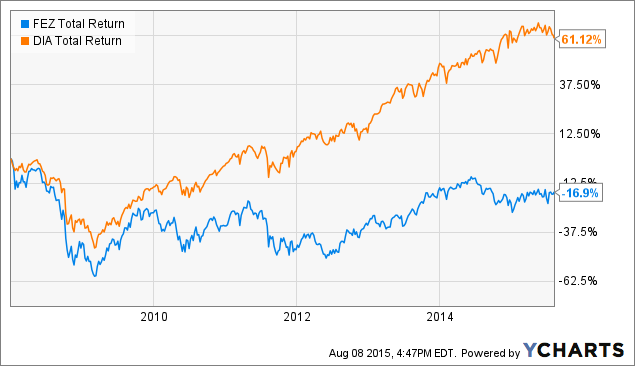

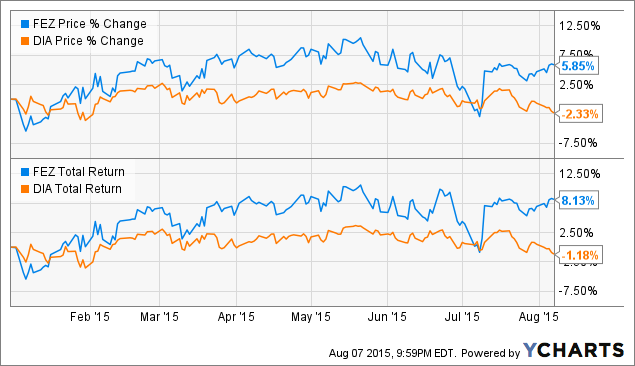

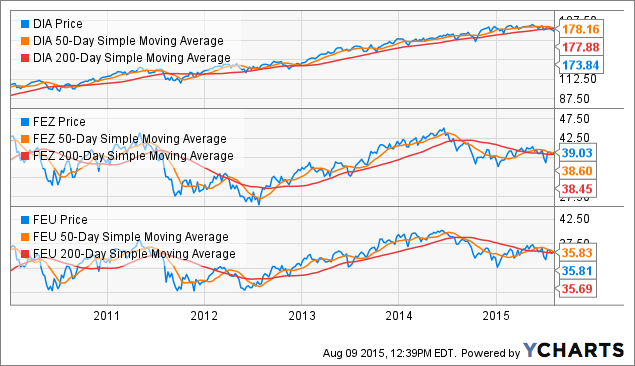

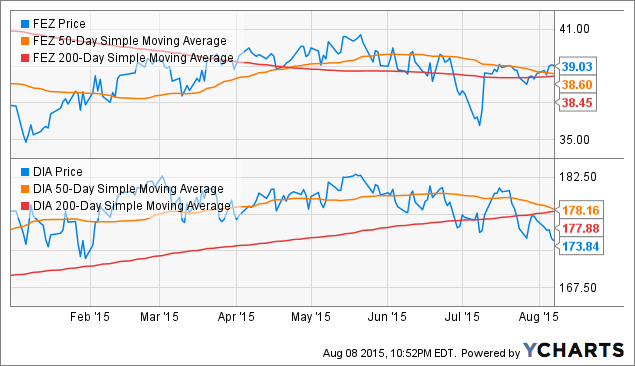

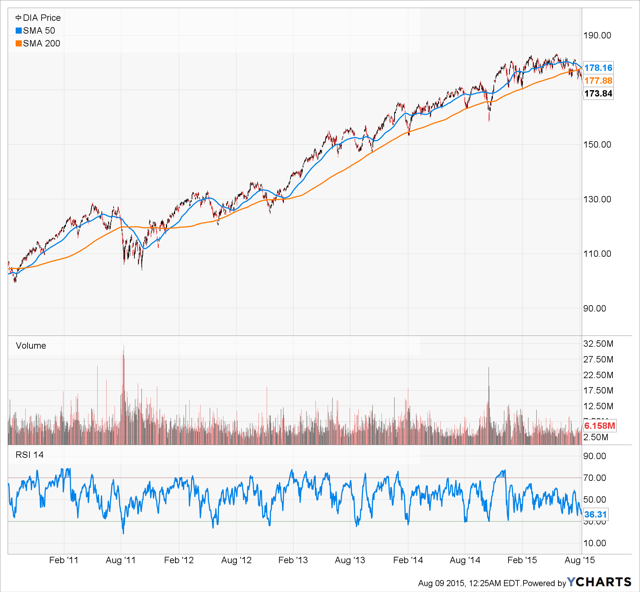

Summary European turnaround is being reflected through strong numbers for both manufacturing and consumer strength, setting up a post crisis rally similar to those seen after the previous two Greek bailouts. U.S. Markets have shown significant fear and weakness recently, wiping out massive gains from many of America’s largest companies, reflected by the significant losses sustained in most the Dow Jones. Goldman Sachs recently issued a report upgrading Europe to a Buy, and predicting European equities would outperform U.S. equities, which thus far has proven the case year to date. Comparing the DIA and FEZ, investors can clearly see the DIA’s chart is testing dangerous technical levels (potential death cross), while the FEZ is quietly rebounding toward the upside. With a strong dollar, weak Euro, low commodity prices, and zero rates, European QE should be enough to fuel economic growth, making FEZ’s additional yield and upside an attractive alternative. Introduction & Thesis Europe has faded into the shadows this summer, putting the American economy back into focus for investors right in time for what has thus far turned out to be a volatile and bearish earnings season, wiping out 100’s of Billions of dollars off some of America’s largest companies market caps. With Europe starting out the year strong on expectations of a long awaited turnaround fueled by a perfect storm of accommodative macro factors (QE, Low Euro, Low rates etc.), the trade lost much of its momentum quickly as another chapter in the Greek saga unfolded over the first 6 months of the year. As U.S. markets continue to struggle, it may be time to reconsider Europe (specifically the Euro Zone), and use it as a defensive position that also offers great yield, and forward looking growth. With that being said, those investors who utilize ETFs for passive or index based strategies, as well as yield hungry income focused investors looking to diversify their holdings, should consider trimming exposure to the SPDR Dow Jones Industrial Composite ETF (NYSEARCA: DIA ), any similar ETF product representing the U.S. Dow Jones Industrial Average, or domestic large cap multinationals in general, and allocate that portion to the SPDR Euro Stoxx 50 ETF (NYSEARCA: FEZ ), or at the very least selected names from the group. FEZ tracks the Euro Stoxx 50 Index on a market cap weighted, cost efficient basis that offers investors a cheap, and well diversified piece of exposure into the Euro zone’s largest and most stable companies. Keep in mind this fund does NOT include countries outside of the currency union such as the United Kingdom, Norway, or Switzerland. Instead, this move is a pure 3 part play on the continued recovery of the European Monetary Union’s various economies, a weaker and more turbulent U.S. equity market, and a successful outcome to Mr. Draghi’s long over due version of a Quantitative Easing program, “EU QE”. Countries such as the U.K., outside the Euro Zone nations, have had stronger recoveries that look more in line with the U.S. (A more detailed list of the fundamental drivers are listed later in the analysis, a long with suggestions on how to trade this theme). With some of this year’s largest gainers in the Dow like Apple (NASDAQ: AAPL ) & Disney (NYSE: DIS ) taking 12% and 10% hits respectively from their recent record highs, a long with the Dow dropping 4% into negative YTD territory, all in just a matter of days, investors are worried these may be signs of a long awaited broad market correction. The fears of a prolonged fairly uninterrupted 7 year bull market, slowing growth, in China, in addition to speculation over the Fed’s first rate hike since 2006, gives investors plenty of issues to worry about. Weak forward guidance across most industries, especially large domestic multi national companies with exposure to a strong dollar, and a trigger happy investor who’s loaded with profit bullets, in combination has pushed this over extended period of market consolidation into negative territory. We have already seen the spillage into the semiconductor space, as well as other high beta sectors across the S&P 500 starting to weaken, investors are now left with difficult decisions to make, in the event the floor falls through, and prices tank. These are signs that investors are taking gains from their best winners, and playing defense until the outlook and climate is more clear. With bond yields flattening, investors have few safe havens to seek. The analysis below will show just why the growth, yield, and risk / reward profile of FEZ is a great way to rebalance some risk over the pond, and at the same time earn above average streams of continued income from FEZ’s impressive yield. The analysis is meant to provide a way to mitigate looming risks in domestic markets, capture the growing opportunity in Europe, and provide a solid alternative that can be held for a range of time, while providing diversity, growth, and most of all income in the face of turbulence and uncertainty. If the U.S. downtrend doesn’t pivot, and Europe continues to strengthen, this capital rotation will add significant risk adjusted returns to your overall portfolio, both in the medium and long term. Valuation Comparison: Risk, Fundamentals, & Distributions Before we delve into the various reasons why I feel Europe offers a certain level of safety over the U.S., lets take a look at the numbers between the two ETFs. Below we will examine both the Risk and Fundamental metrics between the two funds. Side by Side Comparison of Metrics (source: Ycharts) RISK INFO FEZ DIA Beta 1.562 0.9254 Max Drawdown ((All)) 66.12% 53.77% Historical Sharpe (10y) 0.2463 0.5848 30-Day Rolling Volatility 26.52% 11.92% Daily Value at Risk (VAR)1% 5.51% 3.28% Monthly Value at Risk 1% 18.97% 13.08% (for any terms above unfamiliar to you, you can access simple definitions at www.investopedia.com ) The first items above are some of the statistical risk metrics related to each fund’s volatility and momentum. We see significant differences between the two, reflected in FEZ’s higher beta, volatility, and variances, relative to the DIA. With that being said, one must keep in mind the DIA has enjoyed a multi year, liquidity driven bull market, on the back of many years of cheap liquidity from the Federal Reserve’s QE program, which also brought stability to a crippled economy. While Europe on the other hand has seen essentially the opposite, making them more volatile. On the other side of the pond, we have seen Europe struggle since the 2008 global recession. There have been periods of hope (such as 2013- mid 2014), where a turnaround seemed in place, only to be reversed by a continued struggle with the EU’s weakest nations, and their struggles with extreme austerity and stagnant growth (mainly Greece). Never the less, this beta and volatility provides investors with upside potential, mitigated by a 3.1% dividend yield (compared to the DIA’s 1.78%). The next section really begins to highlight the upside opportunity. (source: Ycharts) FUNDAMENTALS FEZ DIA Dividend Yield TTM (8-6-15) 3.10% 1.78% Weighted Average PE Ratio 19.46 15.68 Weighted Average Price to Sales Ratio 1.043 1.74 Weighted Average Price to Book Ratio 1.541 3.071 Weighted Median ROE 12.08% 28.48% Weighted Median ROA 3.80% 8.87% Forecasted Dividend Yield 3.31% 2.59% Forecasted PE Ratio 15.65 16.5 Forecasted Price to Sales Ratio 0.8187 1.666 Forecasted Price to Book Ratio 1.562 2.768 As U.S. markets continue to slide, investors looking for protection through diversity, growth, and yield will be looking for new opportunities to park their cash, especially outside the U.S. where the sun is quickly fading away. While the DIA has significantly outperformed on an ROE & ROA basis, they lack a strong dividend stream, and further upside potential after years of robust price appreciation and growth. After a multi year run, investors see how quickly the market has reversed, especially after struggling all year to barely stay in the black (record setting consolidation period), and fear is creeping in slowly. With EU QE in full swing, the road is wide open for Europe to speed up, especially now that it seems the U.S. is quickly stalling. When we examine the two based on forecasted P/E, P/S, & Price to book, we see that on a forward basis, Europe’s assets are trading at significantly discounted multiples in comparison, reflecting the difference in performance post crisis. Keeping in mind these are estimates based on a group of stocks, so spending time on estimating 51 different future earnings, we will maintain a broad view, such as the impressive overall yield, and the large spread between FEZ’s 3.10% with DIA’s 1.78%. When we examine performance over a variety of periods, we see the additional yield over long periods of time creates an immense amount of additional gains (assuming reinvestment of dividends). Distribution Schedule (source: Fidelity) Date Price at Distribution Distribution Amount Yield % of Yearly Distribution 6/19/2015 $38.18 $0.78 2.05% ** TBD 3/20/2015 $39.23 $0.04 0.11% ** TBD 12/19/2014 $37.56 $0.29 0.78% 21.14% 9/19/2014 $41.08 $0.08 0.20% 6.02% 6/20/2014 $43.81 $0.92 2.10% 65.91% 3/21/2014 $41.71 $0.10 0.23% 6.92% 12/20/2013 $40.75 $0.19 0.46% 16.37% 9/20/2013 $38.64 $0.09 0.24% 8.11% 6/21/2013 $32.73 $0.80 2.44% 69.40% 3/15/2013 $34.84 $0.07 0.20% 6.12% Total 2014 $1.39 100.00% Total 2013 $1.15 100.00% Here we see the last two years of distributions, which are paid quarterly. The issue, or opportunity depending on timing, is the uneven nature of the distribution schedule, which goes in line with the dividend payout schedules of the underlying companies (some pay semi annual, or annual). We clearly see the June payment is by far the largest payment, with the December payment following, as those two months include most the population of the underlying companies. It is important for investors to take into account the above distribution schedule when considering their risk reward calculations and trading strategy for the FEZ. Top 5 ETF Components for Each Fund The next area of analysis involves looking a bit into the top holdings of each fund, while distinguishing differences in the structure and construction of the portfolio. We will examine briefly the individual names, and their performance YTD. We also will look at a few other differences, including sector exposure and potential future performance. (Source: ETF.com ) FEZ TOP 5 HOLDINGS WEIGHT% DIA TOP 5 HOLDINGS WEIGHT% Sanofi (NYSE: SNY ) 4.80 Goldman Sachs (NYSE: GS ) 7.89 Bayer AG (OTCPK: BAYZF ) 4.77 IBM (NYSE: IBM ) 6.18 Total SA (NYSE: TOT ) 4.73 3M (NYSE: MMM ) 5.85 Banco Santander (NYSE: SAN ) 4.12 Boeing (NYSE: BA ) 5.29 Anheuser-Busch (NYSE: BUD ) 3.82 Apple Inc ( AAPL ) 4.76 Total % 22.24 % Total % 29.97 % There are a variety of differences between the two funds in terms of construction, sector exposure, and diversification. The first and biggest difference among the two is construction. FEZ is a MARKET CAP weighted fund, while DIA is PRICE weighted. The second difference is the DIA is only made up of 31 stocks, while the FEZ has 51 components to the pie. This makes the DIA more susceptible to single stock risk, as we see the largest holding has nearly a 65% spread between the DIA and FEZ. Next we examine each component, looking at their YTD performance, and brief outlook and description providing an idea of future growth. (Notice from June 1, to about July 10, the markets traded in almost perfect correlation, due to crisis in Greece.) FEZ – Outlook of Top 5 Components Sanofi and Bayer are both healthcare related companies, and have done extremely well (22.16% & 9.93% respectively) YTD. Going forward, both companies offer great products & pipelines, strong distribution channels globally, strong earnings potential, and will most likely continue to outperform the general benchmarks both in Europe and in their respective sectors. Total SA & Banco Santander are the two weak performers of the bunch. Even though Total is showing a flat total return for the year, this is following a nearly 30% decline due to the price of oil in the prior year. On the other hand, one of the most underappreciated banks with a large global presence, Banco Santander, struggles to get the price of its stock to reflect what has been a tremendous run of continued growth and execution across all fronts of the business. My first article in June provides a very detailed write up, and is well worth the time to read, as SAN’s performance highlights many of the same catalyst driving this thesis. Finally Anheuser-Busch InBev, famously known for beers like Budweiser, continues to sell millions of “cold ones” around the world, and shows no sign, or any reason why investors should expect otherwise. With two healthcare companies, an energy company, global retail banking, and consumer discretionary exposure, the top five holdings for FEZ are not only well diversified, but are overweight the very industries poised to benefit from lower rates and a strong dollar. Energy companies will have their day in court again some day. However, on our side of the pond, these same catalyst have been exponentially resulting in negative results on the top and bottom lines of companies across most sectors, as well as forward guidance, leaving investors struggling to find direction, or a safe haven. China may be one of the only mutually negative catalyst the two share. Its easy to see that U.S. Equity Markets find themselves in a dangerous limbo, where things can go either way, as we see through out our analysis, and below. DIA – Outlook of Top 5 Components Goldman Sachs is the world’s most well known, and arguably respected investment banks. Performance has been strong, and out of the 5, stands to gain a benefit from a rising rate environment the U.S. will face when the Federal Reserve raises rates. Boeing is one of the world’s top two aviation aircraft manufacturers, among other things such as aerospace defense. Performance and execution has remained strong, and issues with labor unions and stalled contracts have not returned. With a healthy backlog and a strong airlines sector continuing to order planes, Boeing’s outlook is bright. IBM and 3M represent the classic and decades old nature of the Dow. Both companies have struggled in their own ways to keep reinventing themselves to grow top line figures in a meaningful way. With tougher economic conditions, both companies have taken significant hits over the last month, exposing their weak investor sentiment, and buyback fueled anemic growth that has trended downwards for multiple quarters. Lastly Apple is the world’s most successful OEM, and doesn’t need an introduction. The main issue lately with Apple has been the massive loss in market cap over the course of days, following what was in my opinion a strong earnings report. Due to fears in Chinese demand, and a lack of vision provided into a more diversified revenue stream, Apple is in correction territory, and has brought the entire ecosystem of suppliers down with them. The charts and mixed sentiments indicate a difficult few months until the launch of the next iPhone this fall, or some kind of evidence easing China related fears can put a floor in the stock. In my humble opinion, this is the one Dow component worth buying, but market troubles indicate patience should be exhibited. This indication for the world’s largest company by a wide margin, shows an overall distrust in the future strength of the global consumer. The Dow has a completely different make up in terms of sectors in their top 5, and worse of all, the industries with the weakest performance make up a significant portion of the overall pie (examples: Industrials 27%). FEZ’s largest sector is healthcare, which is more recession proof and benefits from many positive catalyst, as well as stable demand, which will make a difference when the waters are choppy, and global growth remains anemic. Historic Performance The purpose of looking at the next set of graphs is to examine FEZ’s growth pre and post recession relative to the DIA. We will clearly see that Europe pre crisis was growing leaps and bounds over the U.S., but on the other end, has yet to fully recover due to the drastically different economies that make up the multi nation currency union. With very bearish market signals in the U.S., and Europe still way below pre-crisis highs, rebalancing capital over the pond currently offers both the drastically different (and much needed) yield both for income and protection, as well as upside potential. We will examine each point in time separately below. (2002 – Present) – Overview Look Above we see the two main catalyst that makes this trade attractive in broad view. The main catalyst that makes FEZ an attractive option for DGI investors, especially investors either restricted to ETFs, or prefer the embedded diversity they offer, is the 3% yield. As we can see, over time, that yield has made a significant difference. In fact, over the roughly 13 year period we are examining above, the spread between price and total return (assuming reinvested dividends), is roughly 86% (139%-56%), a 130% (86/56) difference between price and total return for FEZ. Compare that to the DIA, where the spread is 75% (184%-109%), but is only a 65% (75/109) difference in return. We clearly see the additional yield makes up for the additional risk incurred both from the inherent issues the Euro Zone nations face, as well as the beta and variances associated with FEZ. Below we will examine the above results, on a pre and post crisis basis, which will reveal the potential upside, and reversal in trend that may occur very soon (if not already occurring). Keep in mind Europe has significant room to the upside, to just break even with pre crisis levels. After 7 years, even if those levels were overvalued, by now, the fair value of the continent’s strongest companies are undervalued based on even the most conservative estimates and growth rates (this was reflected in the valuation multiples examined in the Fundamentals section). Pre Crisis (2002- Jan 1 2008) FEZ Total Return Price data by YCharts Before the world had experienced the consequences of careless credit practices, Europe was leveraging their way to growth at a much faster pace than the U.S. as we see above in the chart. In fact, on a total return basis, over just half a decade, the FEZ returned over 1.1xs that of the DIA, on a total return basis (again, you have to love that yield). Fueled by historically weaker nations leveraging consumption (to this day we see the unfortunate aftermath), Europe was caught skinny dipping in broad daylight when the tide receded. That is evident by the results below, post crash, and the extended credit crisis still half resolved half a decade later. There is no question below that Europe has significant ground to make up, 40% for FEZ from the top roughly, which even at a 5% growth rate a year, by now should have been exceeded. Economic value, and political or structural issues affecting the prices of their capital markets has been acted as a poison pill to accessing success. With many of the lose ends getting tied (as seen through empirical evidence in the latest economic reports), the upside, and the spread closing below, is an attractive bargain for investors looking to flee the up coming volatility here in the U.S . That reversal in strength can occur quickly of both economies remain on the same path. Europe’s upside may finally be realized. Post Crisis (Jan 1 2008- Present) From what we see above, if one were to look at just the last few months on the chart, we can already see that divergence in full swing. The chart ends looking like the FEZ has made somewhat of a bottom with an upward trend beginning, and the DIA looks like it topped, and is hanging off a cliff deciding which direction its going to take, and most likely travel in a hurry. The evidence behind catching this macro level shift may lie in the next section.. This is Where We Get to the Point Summary of Investment Thesis & Related Items After a long analysis of a variety of factors above, it would seem prudent to review the basic fundamentals underlying this macro economically driven investment thesis. We conducted an extensive review of both continent’s economies, and described briefly their rise pre crisis, as well as recoveries post crisis, to develop an idea of the bigger picture, and highlight the potential upside and downside going forward. The construction of each ETF, associated risks and fundamentals, as well as historic performance, allowed us to see take a look inside each product, ensuring both quality and functionality would translate into the capabilities we need to make this a successful trade. With that said, we will go ahead and review the main factors driving this thesis: U.S. markets have shown great weakness in the face of multiple headwinds coming from every direction. Headwinds such as extreme weakness from China and a strong dollar will most likely continue to push investors hands toward the sell button, especially based on the chart’s bearish technical signals such as a death cross forming in the DIA. With a raging multi year bull market backed by the Federal Reserve’s massive QE program, a looming rate hike will add to further market pressure, while delaying past September may only give markets a temporary cushion, but reverting back to weakness on seriously declining market fundamentals (U.S. issues have been discussed through out article). With Europe historically rallying after both Greek bailouts were finalized (2010, 2012), the economic stars have aligned under strong fundamentals, and quantitative results provided in the Markit link to most recent PMI results. The European trade will continue to gain long lost momentum, as U.S. institutional investors flee a long feared and somewhat expected downturn, for economic opportunity that reflects more in line with the environment that lead to the U.S. market’s immense bull run and recovery. With 40% upside left from all time highs, FEZ offers investors both exposure to the largest companies of Europe, who best withstand the volatile nature of that economy, and have diverse demographic exposure with respect to revenue (strong global presences). The 3% yield, and rather defined trading range with identifiable downside risk and upside opportunity, as well as historic evidence of breakout capabilities exhibited both in 2010, and 2013, following the 1st and 2nd bailouts of Greece, make the trade attractive for a variety of investor needs. Often investors may not have the capabilities to invest in foreign markets in a cost efficient manner, FEZ removes the cost while giving investors exposure to the market with the most growth opportunity, while experiencing the benefit of a long list of Macro opportunities from a Low Euro, rates, oil, and the ECB pouring 80B in liquidity each month. The above are just off hand some of the obvious benefits that would be derived from the added exposure of FEZ. It may seem like I have a very bearish outlook on U.S. markets, but I clearly want to state that is not the case. U.S. equity markets still remain the best place for an investor to generate wealth over the long run, but investors tend to forget, Europe offers tremendous opportunity as well. The issues I keep covering and repeating are issues that may cause the markets to temporarily dysfunction, and with such a long run lacking any type of correction, common logic in the face of all the evidence says that decreasing long U.S. exposure, and increasing EZ exposure presents a well calculated trade exposing the upside potential yet to be realized in Europe, and defend against any gain an impressive yield to protect against weakness at home. Below we take a look at the two from 3 different time periods, with a technical perspective supporting the qualitative issues discussed here today. These charts are meant to display clearly how the movement of the markets support this thesis, both from a YTD and a long term perspective. YTD Performance Performance YTD for Europe has been stronger as was expected, despite the ups and downs, as well as the highly publicized Greek Crisis, which on a chart, clearly shows where Europe is weakest (significant drop after missed June 30 deadline). The next chart will compare the DIA to the FEZ, with technical indicators being the 50 and 200 day moving averages. First we will look at the chart from Jan 1 2010 (which includes both the Greek bailouts as well as the years where the “PIGS”, were an every day acronym used to describe the crippling issues plaguing Europe and their sovereign debt markets, while the U.S. was seeing record gains across the board. 5 Year & YTD Technical Chart – DIA in Danger, FEZ Breaking out Jan 1 2010 – Present As we can clearly see above, Europe’s struggle to maintain an adequate rally based on what was a roaring U.S. market, and an unstable as well as unproven European turnaround. With sign of weakness (especially the infamous Greek bailouts), the selling was almost immediate, and drastic. The graph represents the real upside opportunity Europe offers over the U.S. at the present moment. The SPDR STOXX Europe 50 ETF (NYSEARCA: FEU ) represents the same territories, but in addition includes every nation in the European Union (such as the U.K. and Switzerland), which has been included for additional comparison. As we can see, there is almost a direct correlation between FEU and FEZ, incase anyone was wondering why one over the other. I would like investors to compare each downturn (which were all related to issues similar to the Greek Crisis we witnessed this year), and examine the corresponding periods after agreements/bailouts were granted. Each period (2010 & 2012) were followed by SIGNIFICANT rallies. This is because investors have been anxiously waiting for Europe to catch up to the U.S. The fundamental difference was the absence of key economic drivers such as; 0 rates, a historically weak Euro/Dollar, and commodity prices such as oil, at recession level lows, and so on. The combination of those factors, with the disruption of a recovery that was well in place from 2013 until mid 2014 (one that included Greece as well), before talks of anti austerity politics and elections came to surface, presents near term future upside opportunity across the Euro Zone. With the noise level down in Europe, and a 3rd bailout essentially a matter of crossing Ts and dotting Is, the setup looks perfect for another breakout rally. The numbers and factors we will discuss in the last section provide the necessary quantitative proof on top of the aforementioned patterns described above, that this trend has a high probability of producing value both in the long and short term horizon. On the opposite end here in the States, we have enjoyed 7 years of relatively smooth sailing upwards, feeling like we are reaching the end of the road as the Fed gets ready to raise rates for the first time in nearly a decade. The DIA chart at the end looks like a cliff hanger, as we will see below. YTD Chart – Here comes the Death Cross As we see above, on just price performance, YTD FEZ has outperformed by over (8%, over 9% including dividends). Furthermore, the technicals are pointing to a death cross about to occur, something unseen in the Dow since 2011 (also the last real correction for U.S. Markets), as we will further discuss in the conclusion section. Here we will focus on the very short term picture (especially the last 45 days). With traders on edge, I expect the 50 day to actually cross with the 200 day (could be as soon as mid month), and experience an extended selloff with lower lows, lower highs continuing as a trend It could be very possible to see the Dow below 17K, which will force the hand of money managers into defensive mode. Hedge Funds do not have the luxury of holding cash (or at least do not move to cash positions for very long), and will need to find both safety and growth for their client’s wealth. With a 3rd straight year of under performance as a group, I expect institutional investors to chase opportunity across the pond, and avoid what seems to be a setup for a messy back half of the year. With Europe still not having shown enough proof to investors on a long term basis, that rotation will most likely go into large cap stable names, which is exactly what the FEZ represents. As we just saw it bounce off its own 50 & 200 Day averages, I expect it to continue to trend upwards, as more capital will have no choice (since bond aren’t a viable option), to fly to Europe for safety. If we do see any weakness out of Europe, I would take it as a buying opportunity. The catalyst and figures are pointing to exact opposite directions for the U.S. and Europe, and below we will quickly review those items, before we conclude our analysis. Goldman Report & Catalyst for Both Continents Goldman Sachs recently issued a note stating that European Equities should be purchased at the expense of domestic equities on the back of the same fundamental catalyst described here in the article. Below we will outline some key bullet points both for the U.S. and EZ. PMI data comes directly from Markit Ltd (NASDAQ: MRKT ). I suggest investors click here, and go through each county’s as well as the group’s latest figures to gain a firm understanding of the current economic state of Euro Zone (considering most investors at least know the domestic figures). For the sake of simplicity, I will summarize bullet points for both Europe and the U.S., taking into account current state of economies, quantitative figures, and qualitative factors that will impact the short and medium term outlooks of the two continents. I also have provided a link here to Markit’s latest economic outlook for the Eurozone nations. United States PMI Results : Manufacturing PMI: Sharpest rise in 3 months at 53.8, but is still maintaining a trend of declining activity, due to input cost inflation, slowing economic growth, and a strong dollar affecting exports. Manufacturing hiring has also slowed, pointing to a cautious outlook. Services PMI – Another bounce back month, in the area of majority for U.S. GDP, clocked in 57.7, ending a down trend that saw 5 month low in June. There was still little to be excited about as this was measured as the slowest rate of expansion since January, but never the less, was a pick up in activity. The outlook again was cautiously optimistic, citing the same concerns the article highlights for U.S. economic activity. The one item this will certainly affect is the Federal Reserve’s monetary policy decisions. Europe Manufacturing PMI – Manufacturing PMI for the Eurozone nations came in at 52.3, but not without their share of improvement and failures. Germany continues to suffer from China’s slowing growth, as manufacturing stands at a halt, not ticking either direction with any vigor. On the other hand, the Netherlands (another strong industrial economy) showed the best growth, a long side Italy who hit a 52 month high, followed by Spain who also came in with stronger numbers. Spanish recovery is key to the overall Eurozone recovery, as they and Italy are must win battles against peripheral weakness from Greece. As of now, that weakness remains contained to the Greek nation. Retail PMI – Here is where investors should pay close attention to the results. PMI for retail grew from 50.4 to 54.2, showing the trickle down effect from EU QE was finally positively impacting citizens. On the inverse from manufacturing data, German citizens recorded a retail PMI figure of 57.7, showing the strength of low unemployment and strong consumer strength. While manufacturing isn’t growing, Germans were still spending heavily on themselves. On the other hand, peripheral nations like Italy are feeling the recovery on the first side of the equation, economic growth (strong manufacturing, increased lending, reversal in unemployment), which should lead to further economic growth and return the consumer to his old glory. After years of austerity, tight budget cuts, and other measures that beat the European consumer into the ground, the resurgence has followed the trend that results from banks such as SAN have indicated; people are starting to borrow, buy, and contribute again to the economic cycle, and stock prices have yet to reflect this very real change in direction. Conclusion: Final Thoughts and Trading Strategy Final Thoughts – DIA Dangers even worse at closer look Focusing all your energy on attempting to call bottoms, or predicting the next bear market crash, is about as useful of a strategy as closing your eyes, and blindly picking stock tickers. Even professionals rarely make these calls, as the amount of moving parts and complexity make it impossible in today’s markets to see things coming clearly. We are really sailing uncharted waters, as the permanent bears have learned the hard way. Every time you will find yourself losing more in opportunity costs, and time, than anything else, instead of being positioned to withstand the rainy days as the come to surface. With that said, their is a significant difference between waiting and searching for crashes and bear markets, and playing a solid and smart defense in times of uncertainty, while also leaving room in case things turn again in a positive direction. This thesis is exactly the essence of that philosophy, smart defense with participation in the upside as well. As we saw in the chart comparisons between the DIA, and FEZ, the DIA is testing extremely dangerous waters essentially forming a death cross (50 Day crossing under 200 Day), while the FEZ seems to be exhibiting resilience. The last time in 2011 when this occurred, we saw significant market losses. The one saving grace, is that we have traded a historically tight range from January until now, leaving the averages time to close in on each other, which makes a breakout in either direction inevitable based on the extreme amount of uncertainty. Below we see just how long it has been since we have had such delicate technical indicators. In August 2011, following the last death cross witnessed, we saw a huge correction, that lasted till about year end 2011. Now again in August (a historically weak month for stocks), 4 years later, we are exactly at the same intersection. If history repeats itself, which there is certainly plenty of reason to believe it could occur, investors will have to wait until Q1 2016 for a turnaround. These next 2 weeks will determine if this trend really holds, and will most likely shift the market one direction or the other in a meaningful way. (click to enlarge) Since 2012, we have had nothing but a straight shot up, pulling back periodically, and bouncing off to new highs each time. If the death cross does occurs and holds, (one of the most reliable and bearish technical signals) there really isn’t much support due to such a prolonged period of consolidation this year. It would be anyone’s guess where the pressure could send the index in the notoriously low volume, bearish month of August. Even if the fed comes in and says September is out of the question, there still may not be enough steam to keep the train going. That is actually the only viable possibility for a quick reversal. I brought this chart and topic back to focus in the conclusion to remind investors that bull markets do end, and they do not send you a letter in the mail warning you that the party may be over for now. In my humble opinion, I just believe this weakness is par for the course, and will work its way out slowly, but not without its share of pain, confusion, fear, and anxiety riddling investors out of some of their profitable positions. I believe diversifying your risk to a growth area of the world poised to make up for many years of lost ground, makes the soundest alternative to keeping all your chips on the table staring danger straight in the face. Europe as a stand alone trade in its own right is wise, a mixture of exposure is responsibly diversifying your risk, and the FEZ does it with tremendous yield, and a predictable trading range. Trading Strategy- A variety of choices I wouldn’t find it reasonable after such a thorough analysis to leave the reader without at least a couple trading ideas to ponder. To be clear, when referring to the floor, I am using the lowest support level I can clearly find, which is about 35, for this year. The ceiling on the chart is about 42, so we have a pretty defined range, and can use a variety of methods to maximize our gains. The support and resistance levels happen to also be the 52 week highs and lows, as the FEZ too has traded rather range bound for the year. FEZ options aren’t very active, but never the less do trade, and have decent open interest. Trimming Large cap or DIA exposure is up to the individual investor’s strategy, so the suggestions focus on where to rotate whatever capital you decide to allocate depending on your investor profile. No Options – One can simply swap positions proportionately, and expect modest growth, having missed the best buying opportunity created by the introduction of capital controls in Greece. After a week of fear driven headlines and entertaining politics, Greece raised the white flag, and FEZ rebounded back up to its rather tight 45 day trading range of 37-38. With the 52 week low of 34.76 and the 52 week high of 41.80, investors must decide the time length in order to estimate the upside potential. If you choose to just buy and hold the ETF, I suggest to monitor carefully, and attempt to buy on weakness, below 38 if possible. This strategy would be best for a long term holder, especially if you plan on exploiting the yield, which is highest in Dec and June. Options and Equity- ( 4-6 months)- If my thesis is correct, we should test 52 week highs rather easily in the back half of the year, especially in Q1 2016. Currently the Feb option contracts look very attractive, but don’t have large trading volumes. The Feb 38 put has a quote of about 2.05, and the 41 call is trading at about 1.28, with open interest of 125 and 268 respectively. The bid/ask spreads are reasonable. Lastly the Feb 35 put (has had trading volume past 2 days), is trading at about 1.27, which provides us with two different options for the short put leg of this strategy. Maximum income trade: A strangle is where you buy or sell a put and a call option on the SAME underlier, with the same expiration, but at different strikes. 1- This trade is meant to take advantage of the defined 52 week range, and maximize income while we wait for those distributions, as well as providing protection on both sides of the trade. In order to minimize the risk of being naked on the call side, make sure you also simultaneously buy the ETF. If you sell the Feb 38 put, you stand a better chance of the contract forcing you to buy, with the premium giving you a cost basis under 36 a share. Then sell the Feb 41 call, which gets you out if we break the 52 week high, and go past 42. Total premium collected is (2.05+1.27) 3.57 or 357 dollars per strangle. 2 – Another way to trade the same short strangle is to sell the Feb 35 put for 1.27 and sell the Feb 41 call for 1.28, essentially adding (1.27+1.28) 2.55 or 255 dollars of premium against an entry point of about 38.50. This is essentially selling both sides of the 1 year trading range. Both strategies work, depending on that day’s trading volume which is relatively thin. You can always enter the equity trade first. The premiums have a lot of time decay left, so they won’t fluctuate too much as the ETF itself has been relatively range bound. The first option provides more premium, but gives you a higher cost basis and a higher probability of getting put. The second one essentially gives you 1 dollar less in premium, but has a small likelihood of getting put, so you would buy the ETF and hope it stays within the range through FEB, so you can collect both dividends, and keep the premium. 3 – If the above seems complicated (and also difficult), you can simply just buy covered calls at a 2:1 ratio, adding the 1.27 to your yield, and hoping for a breakout above the 52 week high. After you are called you are left with half your original position, and have collected twice the amount in distributions. This is another way to hold this position while gaining extra premium, protection, and time to collect that fat payment in June. The main idea behind all the above trades is to protect yourself from losing by buying in at the higher end of the range, but also exploit the rather flat trading range that offers option traders ways to collect premium for extra yield. I personally will be looking to hold this position for over a year, so not only will I examine the options, but I will also anticipate a full year’s worth of distributions. Overall, the above are all trading IDEAS, and are subject to the conditions of the market at the exact time of attempted execution. Since this thesis really appeals to dividend investors for the 3.17% yield FEZ currently pays, the options are a way to significantly add yield and more protection for the position. Its a win win, especially if you intend on owning the ETF for simple and cheap exposure, getting put either way just gives you a better entry price. To wrap it up, it all depends on your level of trading skills, your broker (how well they can execute a trade), market conditions, fees, time length, purpose, and many other factors that ultimately decide how you can achieve the maximum risk reward and income at the same time, while being protected not only in your FEZ position, but in your portfolio in general from the Dow’s recent demise. In Conclusion to this rather lengthy but detailed comparison, I firmly believe, based on the past, present, and future opportunities, results, and catalysts, that a reallocation of capital from U.S. large cap exposure, over to European large cap exposure through the FEZ, presents the best risk/reward relationship in the face of grave danger and uncertainty here in the states. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FEZ over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: We are also long Banco Santander (SAN) This article contains information related to trading equity options. Please be advised on the additional risks involved. Never make a decision without doing your own research. Scalper1 News