Scalper1 News

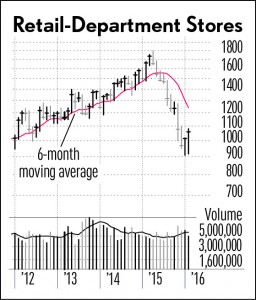

Are department store chains sitting ducks in the new retailing jungle of the Amazon.com ( AMZN )? It seems that in 2016 so far, bullish investors would disagree. IBD’s Retail-Department Stores industry group has a trashy rating for six-month relative price performance — at No. 158 out of 197 groups and subgroups as of Thursday’s newspaper — the group is also up more than 10% since Jan. 1. Only four other groups, including Food-Meat and Mining-Gold, can match that performance. What’s more, a positive trend within the Retail sector is emerging; five more retail subgroups — discount & variety, leisure products, apparel and shoes, restaurants and auto parts — show year-to-date gains of 3% or more. The S&P 500 is down 5%. Macy’s ( M ) has the largest market cap in Retail-Department Stores at $13.6 billion. The 37 RS Rating is wretched. Yet the stock is up more than 23% since Jan. 1. Even with the stout gains, Macy’s is still 41% below its 52-week peak of 73.61. Macy’s continues to see slumping sales; in the past four quarters, they fell 1%, 3%, 5% and 5% below year-ago levels. Yet the big box retailer is still profitable; Wall Street sees earnings in fiscal 2017 (ending in January next year) slipping only 3% to $3.80 a share. That’s still sharply above the $1.29 it pocketed in fiscal 2009 amid the Great Recession. Macy’s has mastered the practice of making every week feel like Black Friday. Customers are bombarded with big-discount coupons nearly every week via email, the Sunday paper or by snail mail. It seems to be working. Its one-day Saturday Sale events have brought loyal customers into its cavernous stores. Macy’s strives for innovation; on Feb. 18 it unveiled a new line of men’s clothing with snowboarding and skateboard superstar Shaun White. The collection pledges to reflect White’s “adrenaline-pumping, eclectic style.” Macy’s has driven its annual pretax margin to the 7% to 8% level over the past five years, up from the 3% to 5% range seen from 2008 to 2011. Nordstrom ( JWN ), No. 2 in market cap at $9.6 billion, has rebounded in recent days following its Q4 report of a fifth quarter in a row of declining EPS (-11% to $1.17, despite a 4% pickup in sales) and is up more than 5% year-to-date. Watch to see if the stock can climb back near its 200-day moving average, near 63 for now. Kohl’s ( KSS ) ($8.7 bil market cap) and Dillard’s ( DDS ) ($3 bil), both forecast to grow FY 2017 profit by 6%, are also struggling to regain their long-term 200-day moving averages. Scalper1 News

Are department store chains sitting ducks in the new retailing jungle of the Amazon.com ( AMZN )? It seems that in 2016 so far, bullish investors would disagree. IBD’s Retail-Department Stores industry group has a trashy rating for six-month relative price performance — at No. 158 out of 197 groups and subgroups as of Thursday’s newspaper — the group is also up more than 10% since Jan. 1. Only four other groups, including Food-Meat and Mining-Gold, can match that performance. What’s more, a positive trend within the Retail sector is emerging; five more retail subgroups — discount & variety, leisure products, apparel and shoes, restaurants and auto parts — show year-to-date gains of 3% or more. The S&P 500 is down 5%. Macy’s ( M ) has the largest market cap in Retail-Department Stores at $13.6 billion. The 37 RS Rating is wretched. Yet the stock is up more than 23% since Jan. 1. Even with the stout gains, Macy’s is still 41% below its 52-week peak of 73.61. Macy’s continues to see slumping sales; in the past four quarters, they fell 1%, 3%, 5% and 5% below year-ago levels. Yet the big box retailer is still profitable; Wall Street sees earnings in fiscal 2017 (ending in January next year) slipping only 3% to $3.80 a share. That’s still sharply above the $1.29 it pocketed in fiscal 2009 amid the Great Recession. Macy’s has mastered the practice of making every week feel like Black Friday. Customers are bombarded with big-discount coupons nearly every week via email, the Sunday paper or by snail mail. It seems to be working. Its one-day Saturday Sale events have brought loyal customers into its cavernous stores. Macy’s strives for innovation; on Feb. 18 it unveiled a new line of men’s clothing with snowboarding and skateboard superstar Shaun White. The collection pledges to reflect White’s “adrenaline-pumping, eclectic style.” Macy’s has driven its annual pretax margin to the 7% to 8% level over the past five years, up from the 3% to 5% range seen from 2008 to 2011. Nordstrom ( JWN ), No. 2 in market cap at $9.6 billion, has rebounded in recent days following its Q4 report of a fifth quarter in a row of declining EPS (-11% to $1.17, despite a 4% pickup in sales) and is up more than 5% year-to-date. Watch to see if the stock can climb back near its 200-day moving average, near 63 for now. Kohl’s ( KSS ) ($8.7 bil market cap) and Dillard’s ( DDS ) ($3 bil), both forecast to grow FY 2017 profit by 6%, are also struggling to regain their long-term 200-day moving averages. Scalper1 News

Scalper1 News