On Mar 7, Zacks Investment Research upgraded Deere & Company DE to a Zacks Rank #1 (Strong Buy). Going by the Zacks model, companies sporting a Zacks Rank #1 have strong chances of outperforming the broader market over the next few quarters.

With positive earnings estimate revisions over the last 30 days and an encouraging guidance for fiscal 2017, Deere emerges as an attractive investment opportunity.

Rising Estimates & Encouraging Guidance

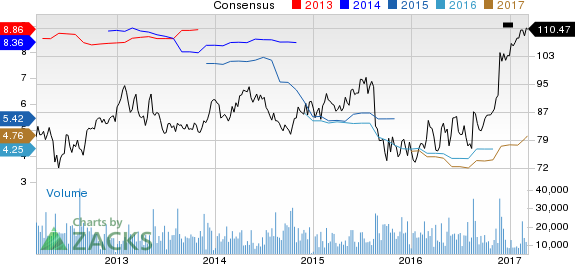

Over the past 30 days, the Zacks Consensus Estimate for Deere rose 8% to $ 4.76 per share for 2017. The company also delivered positive earnings surprises in the last four quarters with an average beat of 60.50%.

Deere & Company Price and Consensus

Deere & Company Price and Consensus | Deere & Company Quote

Despite posting year-over-year decline in its top and bottom lines in first-quarter fiscal 2017, Deere surpassed the Zacks Consensus Estimate on both counts. The company continues to perform well, driven by its durable business model and wide range of revenue sources.

Deere projects total equipment sales to increase about 4% year over year in fiscal 2017 and inch up around 1% in second-quarter fiscal 2017 compared with the year-ago period. For fiscal 2017, it anticipates net sales to be up 4% year over year and projects net income at $ 1.5 billion.

The company’s global agriculture and turf equipment sales are now anticipated to be up roughly 3% in 2017. In South America, industry sales of tractors and combines are now projected to be up 15-20% in fiscal 2017.

In Asia, sales are anticipated to remain flat or increase slightly, with growth in India being the main catalyst. Industry retail sales of turf and utility equipment in the U.S. and Canada are projected to remain flat in fiscal 2017. Further, outlook for the construction and forestry industries remains positive, driven by improvement in fundamentals.

Share Price Performance

Deere outperformed the Zacks categorized Machinery Farm industry over the past one year. The company’s shares gained around 34.2% during this period, compared with roughly 31.2% gain recorded by the industry.

Stocks to Consider

Other well-ranked industrial product stocks are Brady Corp. BRC , Casella Waste Systems, Inc. CWST and ACCO Brands Corporation ACCO . All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Brady Corp. has a positive average earnings surprise of 20.84% for the last four quarters. Casella Waste generated a remarkable positive average earnings surprise of 165.21% over the trailing four quarters. ACCO Brands has delivered an average positive earnings surprise of 24.74% in the past four quarters.

8 Stocks with Huge Profit Potential

Just released: Driverless Cars: Your Roadmap to Mega-Profits Today. In this latest Special Report, Zacks’ Aggressive Growth Strategist Brian Bolan explores a full-blown technological breakthrough in the making – autonomous cars. He also spotlights 8 stocks with tremendous gain potential to feed off this phenomenon. Click to see the stocks right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deere & Company (DE): Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

Acco Brands Corporation (ACCO): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International