Deere & Company DE is scheduled to announce first-quarter fiscal 2017 results on Feb 17, before the opening bell. Last quarter, Deere’s earnings slumped 17% while sales fell 5% year over year. Let’s see how things are shaping up prior to this announcement.

Earnings Whispers

Our proven model shows that Deere has the right combination of the two key ingredients to beat estimates. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat earnings and Deere has the right mix.

Zacks ESP : Deere has an Earnings ESP of +13.73%. This is because the Most Accurate estimate is pegged at 90 cents, while the Zacks Consensus Estimate is pegged lower at 36 cents. This is a meaningful indicator of a likely positive earnings surprise for the company. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Deere currently carries a Zacks Rank #3. The combination of Deere’s favorable Zacks Rank and positive ESP makes us reasonably confident of an earnings beat in the upcoming release.

Conversely, the Sell-rated stocks (#4 or 5) should never be considered going into an earnings announcement.

Surprise History

Deere has outpaced the Zacks Consensus Estimate in each of the trailing four quarters, with an average earnings beat of 58.17%.

Deere & Company Price and EPS Surprise

Deere & Company Price and EPS Surprise | Deere & Company Quote

Factors At Play

Deere projects total equipment sales to decline 4% in first-quarter fiscal 2017, on a year-over-year basis. The projection includes a positive currency-translation effect of about 2% for the quarter.

Low commodity prices and stagnant farm income will continue to dent Deere’s equipment sales. However, the company will benefit from cost saving efforts. These include driven by indirect and direct material cost reduction by leveraging supplier relationships, resourcing and product redesign. Further, reduced headcount, chiefly on the back of voluntary separation initiatives, changes to variable pay structure, lower R&D spending and decreased depreciation related to lower capital investment will lead to lower costs. Further, the company will benefit from the improving trends in construction.

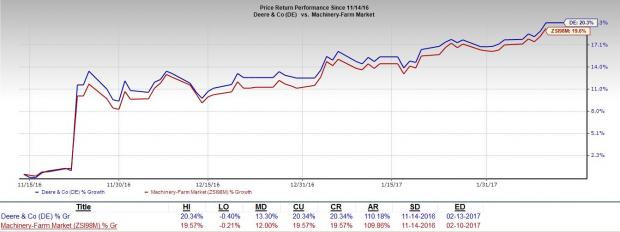

Price Performance

The stock has outpaced the Zacks categorized Machinery-Farm industry, in the past three months. The stock has gained 20.3% while the industry has witnessed an increase of 19.6% in the past three months.

Stocks That Warrant a Look

Here are some stocks worth considering as our model shows that they have the right combination of elements to post an earnings beat this quarter.

Milacron Holdings Corp. MCRN has an Earnings ESP of +11.43% and flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here .

Codexis, Inc. CDXS has an Earnings ESP of +36.36% and carries a Zacks Rank #3.

Greif, Inc. GEF has an Earnings ESP of +8.00% and also has a Zacks Rank #3.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks’ private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $ 10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks’ private trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Greif Bros. Corporation (GEF): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Codexis, Inc. (CDXS): Free Stock Analysis Report

Milacron Holdings Corp. (MCRN): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International