On Feb 22, 2017, we issued an updated research report on Deere & CompanyDE . The company is poised to benefit from its durable business model and a wide range of revenue sources. The improving Brazilian economy also remains a tailwind.

Despite weak global agricultural and construction sectors, Deere continues to perform well driven by the success of developing a more durable business model and a wide range of revenue sources. Deere projects total equipment sales to increase about 4% year over year in fiscal 2017 and inch up roughly 1% in second-quarter fiscal 2017 compared with the year-ago period. For fiscal 2017, it anticipates net sales to be up 4% on a year-over-year basis and estimates net income at $ 1.5 billion.

In Brazil, agriculture production is likely to climb around 8% this year in U.S. dollar terms due to record acreage expansion and yield expectations. In local currency, the value of production is anticipated to be up about 3%. Profitability for Brazilian farmers remains at good levels as crops are sold in dollars.

Further, rates for Moderfrota remain at 8.5% for small- and mid-size farmers, and 10.5% for large farmers. Importantly, the overall budget for Moderfrota has been raised by nearly 50%, from the initial BRL5 billion to BRL7.5 billion. This demonstrates the government’s ongoing commitment to agriculture, thus boosting farmers’ confidence.

In addition, Deere remains optimistic for the long term, based on steady investments in new products and geographies. The company foresees solid profitability on the back of increased global demand for food, shelter and infrastructure.

Deere currently carries a Zacks Rank #2 (Buy).

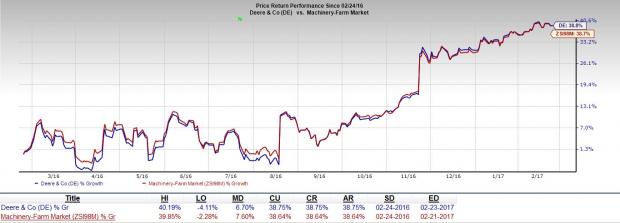

Share Price Performance

In the last one year, Deere’s share price gained 38.8%, in line with the Zacks classified Machinery Farm sub-industry.

Key Picks

Other favorably placed stocks in the sector include Kennametal Inc. KMT , Chart Industries, Inc. GTLS and II-VI Incorporated IIVI . All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Kennametal has an earnings ESP of 9.90% for the trailing four quarters. Chart Industries has an impressive average earnings surprise of 548.51% for the last four quarters, while II-VI Incorporated has an average earnings surprise of 59.23% for the past four quarters.

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2017?

Who wouldn’t? Last year’s market-beating Top 10 portfolio produced 5 double-digit winners. For example, oil and natural gas giant Pioneer Natural Resources and First Republic Bank racked up stellar gains of +44.9% and +44.3% respectively. Now a brand-new list for 2017 has been hand-picked from 4,400 companies covered by the Zacks Rank. See the 2017 Top 10 right now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

II-VI Incorporated (IIVI): Free Stock Analysis Report

Kennametal Inc. (KMT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International