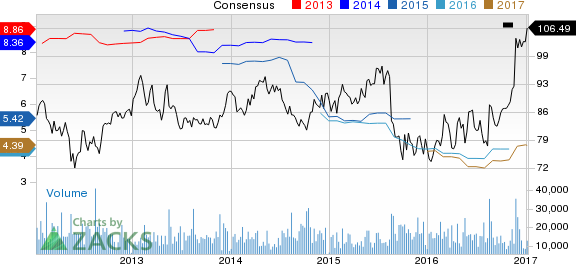

Shares of Deere & Company DE touched a new 52-week high of $ 106.75 on Jan 6, eventually closing tad lower at $ 106.49. The company has a market cap of roughly $ 33.74 billion and average volume of shares traded in the last three months is around 3.16 million.

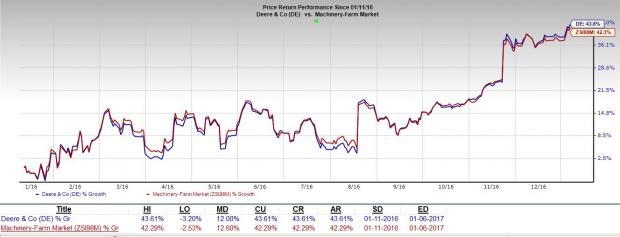

A glimpse at the company’s share price movement reveals an impressive one-year return of approximately 43.6%, better than the S&P 500’s 17.6% gain over the same time frame. Further, the stock has outpaced the Zacks categorized Machinery-Farm industry’s rise of 42.3% over the past one year.

What’s Driving Deere?

Deere & Co., is engaged in the production and distribution of agricultural and forestry equipment, construction equipment and engines worldwide. Despite weak global agricultural and construction sectors, Deere’s net income of $ 1.5 billion in fiscal 2016 was the highest in the last 10 years. The company has benefited from adept execution of its operating plans and disciplined cost management as well as the impact of a broad product portfolio.

Deere has delivered positive earnings surprises in all the last four quarters, the average being 58.17%.

Deere & Company Price and Consensus

Deere & Company Price and Consensus | Deere & Company Quote

Management reiterated its commitment to reduce structural costs by $ 500 million by fiscal 2018. These cost reduction efforts that commenced in Mar 2016 and aided in achieving in excess of $ 90 million reduction in fiscal 2016. The 2017 forecast includes an additional about $ 190 million of structural cost reduction. Roughly one-third of the targeted $ 500 million is likely to be backed by indirect and direct material cost reduction by leveraging supplier relationships, resourcing and product redesign. Further, $ 100 million will stem from reduced headcount, mainly driven by voluntary separation initiatives. Other areas of improvement that have been identified are changes to variable pay structure (especially under trough conditions), lower R&D spending and decreased depreciation related to lower capital investment.

Deere projects a 1.9% increase in total construction investment in the U.S in 2017 and 2.6% increase in government spending. Housing starts are expected to be 1,197 million in 2017. The U.S GDP is estimated to rise 2.0%. The Architecture Billings Index, which is considered a leading indicator of U.S. non-residential construction, has remained above 50 in the recent months, signaling robust conditions ahead for the construction industry. As per Dodge Data & Analytics, total U.S. construction starts for 2017 will advance 5% to $ 713 billion, following gains of 11% in 2015 and an estimated 1% in 2016. The construction industry has now entered a more mature phase of its expansion and construction spending can be anticipated to see moderate gains through 2017 and beyond. Given that Deere is the second-largest seller of construction machinery in the U.S, and is a major supplier to the equipment rental industry, it stands to benefit from the U.S housing recovery.

In India, the economy is growing and the government continues to focus on driving growth in the agricultural sector and improving farm incomes. The value of agricultural production is expected to increase as a result of normal monsoon season after two years of below-average monsoons. These factors are expected to boost industry demand in India. In Asia, sales are anticipated to be flat to up slightly in fiscal 2017, with India being the main catalyst. Machinery demand is showing signs of recovery in Brazil, following a slowing macro and political uncertainty.

In the long term, the company stands to gain from favorable trends, supported by increasing population and rising living standards. Deere has a long-term estimated growth rate of 7.67%.

Deere currently sports a Zacks Rank #1 (Strong Buy).

Other Stocks that Warrant a Look

Some other favorable stocks in the same space include Altra Industrial Motion Corp. AIMC , Actuant Corporation ATU and Codexis, Inc. CDXS . All three of these stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here .

Altra Industrial Motion has a positive average earnings surprise of 8.06% in the last four quarters. Actuant generated a positive average earnings surprise of 11.47% in the trailing four quarters. Codexis has delivered an average positive earnings surprise of 83.33% in the last four quarters.

Now See Our Private Investment Ideas

While the above ideas are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks’ private buys and sells in real time from value to momentum . . . from stocks under $ 10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we’ve called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks’ secret trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Actuant Corporation (ATU): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Codexis, Inc. (CDXS): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International