Scalper1 News

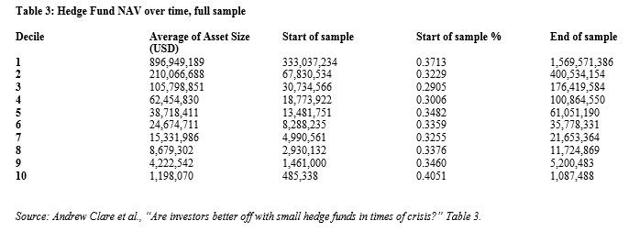

A new report out of the Cass Business School, City University, London, indicates that investors, especially in times of crisis (that is, when the use of the adjective “hedge” in front of “fund” is most apropos), are better off investing with a small fund rather than a large one. This is counter-intuitive, in that it is precisely in times of crisis that the temptation to flee to the larger institutions is most powerful for many investors. Yet the negative statistical correlation between size and performance was largest in three periods within the database of this study, times of crisis: 1999 to 2000, 2003 to 2004, and 2008 to 2010. Why? Largely because of the restrictions that the larger funds place on redemptions. More obviously, diseconomies of scale play a role, and can themselves vary with the business cycle. Size and Time The authors (Andrew Clare, Dirk Nitzsche, Nick Motson) describe their study as based on a more comprehensive database that that of earlier studies along the same lines. Specifically, their database consisted of 7,261 funds and their performance over a twenty year period (1994 to 2014). One important side issue for their study involves the evolution of average industry size over time. Bigger Than It Used to Be (click to enlarge) As the above table shows, the average size of funds has grown, consistently over every decile, through the 20 year period included in the TASS data the authors reviewed. This is what one would expect even before looking at such data, having only a headline-inhabitant’s view of the industry, but it does highlight the issue of whether and to what extent the size/performance relationship itself has varied over the years. Another counter-intuitive finding to emerge from their study: age is also negatively correlated with performance. This seems odd because common sense might indicate that a small fund that has been around for several years (and has remained small) is a fund that has failed to attract investors, likely in turn because it has failed to perform. A large fund may well be a fund that became large because of performance and thus new investment. So … why the negative correlation here? The authors don’t offer a hypothesis. Time and Context They do say, though, that the age/performance relationship is considerably less impressive than the size/performance relationship. Here, again, one has to look at the development of the industry over the 20 years discussed in order to develop a sense of the context for the relationships found in the data. The age/performance relationship was statistically significant in the earlier years of the study’s sample, but by the period since 2003, especially since 2009, this relationship has become “not significantly different from zero.” So the authors focus on the stronger relation of the two they have identified, that between size and performance, and they look at it strategy by strategy, for L/S Equity, Emerging Markets, Event Driven Funds, and Managed Futures. They find considerable variation by strategy. In particular, Managed Futures don’t follow the general rule at all, the relationship between size and performance is positive in that context. It is positive in a way that doesn’t appear “statistically different from zero,” but still … it is not negative. That indicates “that this strategy is less constrained than others by size.” On the other side, the strategy that makes the greatest case for the proposition that petite is sweet is: L/S Equity. Scalper1 News

A new report out of the Cass Business School, City University, London, indicates that investors, especially in times of crisis (that is, when the use of the adjective “hedge” in front of “fund” is most apropos), are better off investing with a small fund rather than a large one. This is counter-intuitive, in that it is precisely in times of crisis that the temptation to flee to the larger institutions is most powerful for many investors. Yet the negative statistical correlation between size and performance was largest in three periods within the database of this study, times of crisis: 1999 to 2000, 2003 to 2004, and 2008 to 2010. Why? Largely because of the restrictions that the larger funds place on redemptions. More obviously, diseconomies of scale play a role, and can themselves vary with the business cycle. Size and Time The authors (Andrew Clare, Dirk Nitzsche, Nick Motson) describe their study as based on a more comprehensive database that that of earlier studies along the same lines. Specifically, their database consisted of 7,261 funds and their performance over a twenty year period (1994 to 2014). One important side issue for their study involves the evolution of average industry size over time. Bigger Than It Used to Be (click to enlarge) As the above table shows, the average size of funds has grown, consistently over every decile, through the 20 year period included in the TASS data the authors reviewed. This is what one would expect even before looking at such data, having only a headline-inhabitant’s view of the industry, but it does highlight the issue of whether and to what extent the size/performance relationship itself has varied over the years. Another counter-intuitive finding to emerge from their study: age is also negatively correlated with performance. This seems odd because common sense might indicate that a small fund that has been around for several years (and has remained small) is a fund that has failed to attract investors, likely in turn because it has failed to perform. A large fund may well be a fund that became large because of performance and thus new investment. So … why the negative correlation here? The authors don’t offer a hypothesis. Time and Context They do say, though, that the age/performance relationship is considerably less impressive than the size/performance relationship. Here, again, one has to look at the development of the industry over the 20 years discussed in order to develop a sense of the context for the relationships found in the data. The age/performance relationship was statistically significant in the earlier years of the study’s sample, but by the period since 2003, especially since 2009, this relationship has become “not significantly different from zero.” So the authors focus on the stronger relation of the two they have identified, that between size and performance, and they look at it strategy by strategy, for L/S Equity, Emerging Markets, Event Driven Funds, and Managed Futures. They find considerable variation by strategy. In particular, Managed Futures don’t follow the general rule at all, the relationship between size and performance is positive in that context. It is positive in a way that doesn’t appear “statistically different from zero,” but still … it is not negative. That indicates “that this strategy is less constrained than others by size.” On the other side, the strategy that makes the greatest case for the proposition that petite is sweet is: L/S Equity. Scalper1 News

Scalper1 News