Scalper1 News

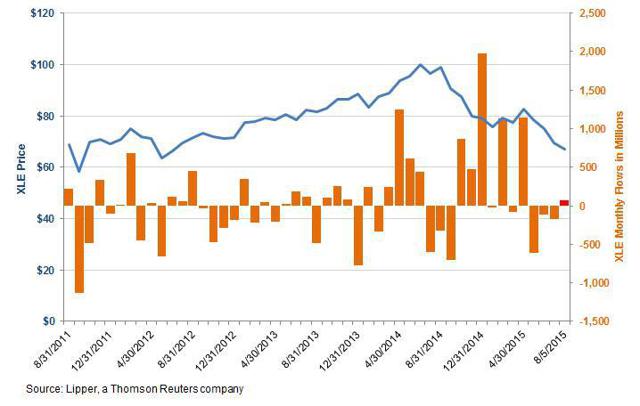

By Jeff Tjornehoj From the start of 2015 to roughly the beginning of May, crude oil prices bounced between $50 and $60 per barrel. But with mounting concerns over China’s slowdown as well as the potential for Iranian crude to hit the market post-sanctions, prices have been in freefall and by August 6 they pierced the $45/bbl support level. But a funny thing has been seen in fund flows data for the oil industry proxy, the Energy Select Sector SPDR ETF (NYSEARCA: XLE ) : flows have picked up. Way up. (click to enlarge) With a year-to-date return of negative 23.4% through August 6, one might have thought investors would flee the equity energy sector’s largest ($11.4 billion) exchange-traded fund, but instead it’s become a contrarian’s playground. Consider this: the 35 months before XLE’s peak price in June 2014 saw cumulative net inflows of just $69 million – barely anything for a fund of this size. But since June 2014, when the price of XLE hit its all-time high of just over $101/share, net inflows have totaled nearly $3.1 billion. For the recent flows week ended August 5, another $74 million was added (red column in chart), despite XLE touching its lowest price in three years. Share this article with a colleague Scalper1 News

By Jeff Tjornehoj From the start of 2015 to roughly the beginning of May, crude oil prices bounced between $50 and $60 per barrel. But with mounting concerns over China’s slowdown as well as the potential for Iranian crude to hit the market post-sanctions, prices have been in freefall and by August 6 they pierced the $45/bbl support level. But a funny thing has been seen in fund flows data for the oil industry proxy, the Energy Select Sector SPDR ETF (NYSEARCA: XLE ) : flows have picked up. Way up. (click to enlarge) With a year-to-date return of negative 23.4% through August 6, one might have thought investors would flee the equity energy sector’s largest ($11.4 billion) exchange-traded fund, but instead it’s become a contrarian’s playground. Consider this: the 35 months before XLE’s peak price in June 2014 saw cumulative net inflows of just $69 million – barely anything for a fund of this size. But since June 2014, when the price of XLE hit its all-time high of just over $101/share, net inflows have totaled nearly $3.1 billion. For the recent flows week ended August 5, another $74 million was added (red column in chart), despite XLE touching its lowest price in three years. Share this article with a colleague Scalper1 News

Scalper1 News