Scalper1 News

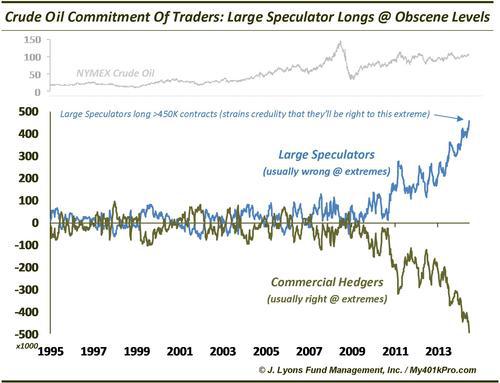

Summary WTI crude oil is in a state of contango, which will cost USO shareholders roughly 17 cents per share this month. The net long position for speculators is still too high. A V-shaped recovery in oil is unlikely. By Ivan Y. WTI and Brent crude oil prices finished 2014 down 46% and 48%, respectively. Besides a surplus in oil, which is expected to be more than 1 million bpd in 2015 for OPEC oil based on current production levels, a rising U.S. Dollar, and negative momentum, there are two other factors that are currently working against investors in The United States Oil ETF, LP (NYSEARCA: USO ). Back to Contango Just a few months ago, WTI oil was in a slight backwardization. This provided a slight benefit to USO shareholders due to the fact that the fund was paying a cheaper price when it rolled over its crude contracts every month. However, WTI oil is currently in a state of contango. Although it is not a big spread, the fund will have to pay a premium when it does its monthly rollovers. Based on Friday’s closing price, the March 2015 contract is 45 cents more expensive than the February 2015 contract. That represents a 0.85% premium and is equivalent to about 17 cents in the share price of USO. If the spread does not change this month, investors should expect USO to deteriorate in value by about 17 cents per share this month. This may not affect short-term traders, but anyone who plans to hold USO for a longer period can consider selling out-of-the-money covered call options to make up for the expected loss. For example, currently, the January (5th week) $23 call is priced at 18 cents on the bid. Selling that call should be sufficient to compensate for the expected contango loss. USO would have to rise by over 15% in order for that call to be in-the-money, so it’s likely to expire worthless. The COT Report Another issue that could put a damper on USO is the fact that speculators, according to the most recent COT report for positions as of December 23, 2014, still have a very high net long position. The so-called speculators (e.g. hedge funds) are not considered to be the smart money in the commodity markets. The report shows that they are net long by 320,337 contracts. That is significantly less than the peak of roughly 450k contracts during last June, but it is still high when compared historically. Prior to 2011, which you can see in the chart below, the net long position had not exceeded 250k contracts, and even 100k during that period was considered to be extremely high. The fact that speculators still have a very high net long position, at least when compared historically, means that there probably needs to be more liquidation before we arrive at a more normalized net long position. Thoughts on Price In hindsight, I was clearly wrong about where the price of oil would bottom. Back in October, I suggested that Brent oil would bottom around $85 (which would’ve been roughly $80 for WTI) because that was Saudi Arabia’s fiscal breakeven point. I completely underestimated the political and competitive risks to that assumption. First, at least in my opinion, one of the primary reasons for oil’s collapse was due to an orchestrated attempt by the U.S. (via Saudi Arabia’s refusal to defend the price) to punish Vladamir Putin for his extra-curricular activities in Ukraine. This is an obvious strategy that works due to the Russian government’s reliance on oil & gas sales for revenue. Second, it is also obvious that Saudi Arabia also wants to curtail the shale oil revolution in the U.S. It seems like every week, some person associated with OPEC will say something that indicates that they will not cut production and will let market forces dictate the price, even if it drops to $20 according to a Saudi oil minister. How many times do they need to keep repeating the same message? That being said, oil has already been pushed down enough to curtail cap-ex spending by many producers. Here are a few examples: Penn West (NYSE: PWE ) cuts 2015 cap-ex by $215 million ConocoPhillips (NYSE: COP ) cuts 2015 cap-ex by 20% Marathon Oil (NYSE: MRO ) cuts 2015 cap-ex by 20% However, low prices probably need to persists for several months at least in order for exploration and production to be cut in the longer-term. It really looks like Saudi Arabia is willing to suffer in the short-term in order to benefit in the long-term. Based on that, a V-shaped rebound in oil is unlikely. Saudi Arabia could, if they wanted to, move the price back up immediately just by making an announcement that they will cut production, but it doesn’t look like they want to do that. I think USO is going to struggle for several more weeks or months. Scalper1 News

Summary WTI crude oil is in a state of contango, which will cost USO shareholders roughly 17 cents per share this month. The net long position for speculators is still too high. A V-shaped recovery in oil is unlikely. By Ivan Y. WTI and Brent crude oil prices finished 2014 down 46% and 48%, respectively. Besides a surplus in oil, which is expected to be more than 1 million bpd in 2015 for OPEC oil based on current production levels, a rising U.S. Dollar, and negative momentum, there are two other factors that are currently working against investors in The United States Oil ETF, LP (NYSEARCA: USO ). Back to Contango Just a few months ago, WTI oil was in a slight backwardization. This provided a slight benefit to USO shareholders due to the fact that the fund was paying a cheaper price when it rolled over its crude contracts every month. However, WTI oil is currently in a state of contango. Although it is not a big spread, the fund will have to pay a premium when it does its monthly rollovers. Based on Friday’s closing price, the March 2015 contract is 45 cents more expensive than the February 2015 contract. That represents a 0.85% premium and is equivalent to about 17 cents in the share price of USO. If the spread does not change this month, investors should expect USO to deteriorate in value by about 17 cents per share this month. This may not affect short-term traders, but anyone who plans to hold USO for a longer period can consider selling out-of-the-money covered call options to make up for the expected loss. For example, currently, the January (5th week) $23 call is priced at 18 cents on the bid. Selling that call should be sufficient to compensate for the expected contango loss. USO would have to rise by over 15% in order for that call to be in-the-money, so it’s likely to expire worthless. The COT Report Another issue that could put a damper on USO is the fact that speculators, according to the most recent COT report for positions as of December 23, 2014, still have a very high net long position. The so-called speculators (e.g. hedge funds) are not considered to be the smart money in the commodity markets. The report shows that they are net long by 320,337 contracts. That is significantly less than the peak of roughly 450k contracts during last June, but it is still high when compared historically. Prior to 2011, which you can see in the chart below, the net long position had not exceeded 250k contracts, and even 100k during that period was considered to be extremely high. The fact that speculators still have a very high net long position, at least when compared historically, means that there probably needs to be more liquidation before we arrive at a more normalized net long position. Thoughts on Price In hindsight, I was clearly wrong about where the price of oil would bottom. Back in October, I suggested that Brent oil would bottom around $85 (which would’ve been roughly $80 for WTI) because that was Saudi Arabia’s fiscal breakeven point. I completely underestimated the political and competitive risks to that assumption. First, at least in my opinion, one of the primary reasons for oil’s collapse was due to an orchestrated attempt by the U.S. (via Saudi Arabia’s refusal to defend the price) to punish Vladamir Putin for his extra-curricular activities in Ukraine. This is an obvious strategy that works due to the Russian government’s reliance on oil & gas sales for revenue. Second, it is also obvious that Saudi Arabia also wants to curtail the shale oil revolution in the U.S. It seems like every week, some person associated with OPEC will say something that indicates that they will not cut production and will let market forces dictate the price, even if it drops to $20 according to a Saudi oil minister. How many times do they need to keep repeating the same message? That being said, oil has already been pushed down enough to curtail cap-ex spending by many producers. Here are a few examples: Penn West (NYSE: PWE ) cuts 2015 cap-ex by $215 million ConocoPhillips (NYSE: COP ) cuts 2015 cap-ex by 20% Marathon Oil (NYSE: MRO ) cuts 2015 cap-ex by 20% However, low prices probably need to persists for several months at least in order for exploration and production to be cut in the longer-term. It really looks like Saudi Arabia is willing to suffer in the short-term in order to benefit in the long-term. Based on that, a V-shaped rebound in oil is unlikely. Saudi Arabia could, if they wanted to, move the price back up immediately just by making an announcement that they will cut production, but it doesn’t look like they want to do that. I think USO is going to struggle for several more weeks or months. Scalper1 News

Scalper1 News