Scalper1 News

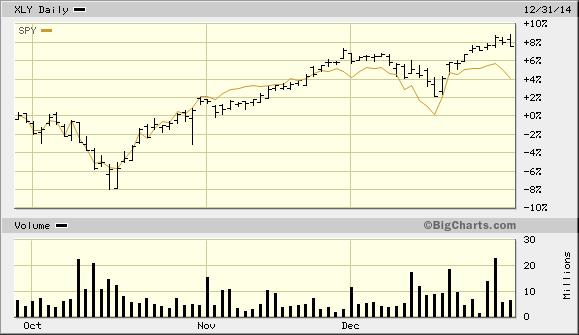

Consumer discretionary stocks underperformed during most of 2014. This trend began to reverse as the year neared its end. I expect this sector to continue to lead in 2015. Let me start the new year by highlighting one of my better forecasts from a few months ago. (I promise I will highlight some of my not-so-good forecasts in the very near future.) SA readers know that I periodically review the risk adjusted performance of the S&P 500 Sector SpyDers to see what sectors are under or over performing and, perhaps, to sniff out bargains or overvaluation. Last September 29th I suggested the Consumer Discretionary Sector ETF (NYSEARCA: XLY ) had lagged the overall market that year. I continued: XLY has been lagging all year. Given the fillip (no pun intended) to consumers’ wallets from lower gasoline prices, I do not expect this underperformance to continue. For outstanding returns at low risk in the near future, I suggest investors look at this sector. I am happy to report that this process is underway. Source: bigcharts.com Keep in mind that not only has XLY nearly doubled the S&P 500 Index (NYSEARCA: SPY ) in recent weeks, but that XLY has a lower beta (less risk) than the broader market. The outperformance is even better than it looks. I expect this trend to continue. Not only have lower oil and gasoline prices helped, but the lower prices will be sticking around for a while, as I make clear here . In addition the economy has picked up steam in recent quarters: 3rd-quarter real GDP grew at a 5% clip, and the 2nd-quarter GDP figures were revised upward. Whatever the outlook for the overall market, investors should continue to expect XLY to outperform on a risk adjusted basis. And while SPY offers a higher dividend yield than XLY (2.21% vs 1.63% respectively) the latter’s payout has been growing faster than the broad market over the past five years. Additional disclosure: Keep in mind I refer to RELATIVE performance, in either advancing or declining markets. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Consumer discretionary stocks underperformed during most of 2014. This trend began to reverse as the year neared its end. I expect this sector to continue to lead in 2015. Let me start the new year by highlighting one of my better forecasts from a few months ago. (I promise I will highlight some of my not-so-good forecasts in the very near future.) SA readers know that I periodically review the risk adjusted performance of the S&P 500 Sector SpyDers to see what sectors are under or over performing and, perhaps, to sniff out bargains or overvaluation. Last September 29th I suggested the Consumer Discretionary Sector ETF (NYSEARCA: XLY ) had lagged the overall market that year. I continued: XLY has been lagging all year. Given the fillip (no pun intended) to consumers’ wallets from lower gasoline prices, I do not expect this underperformance to continue. For outstanding returns at low risk in the near future, I suggest investors look at this sector. I am happy to report that this process is underway. Source: bigcharts.com Keep in mind that not only has XLY nearly doubled the S&P 500 Index (NYSEARCA: SPY ) in recent weeks, but that XLY has a lower beta (less risk) than the broader market. The outperformance is even better than it looks. I expect this trend to continue. Not only have lower oil and gasoline prices helped, but the lower prices will be sticking around for a while, as I make clear here . In addition the economy has picked up steam in recent quarters: 3rd-quarter real GDP grew at a 5% clip, and the 2nd-quarter GDP figures were revised upward. Whatever the outlook for the overall market, investors should continue to expect XLY to outperform on a risk adjusted basis. And while SPY offers a higher dividend yield than XLY (2.21% vs 1.63% respectively) the latter’s payout has been growing faster than the broad market over the past five years. Additional disclosure: Keep in mind I refer to RELATIVE performance, in either advancing or declining markets. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News