Scalper1 News

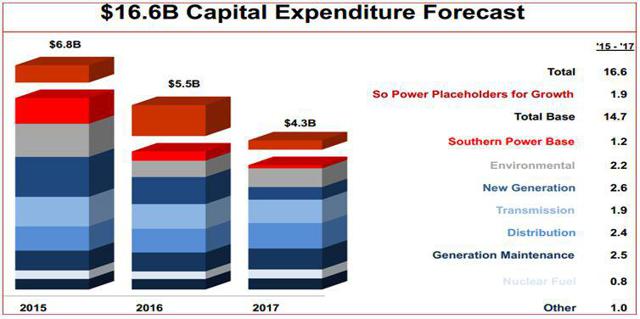

Summary SO’s near-term performance will be pressurized due to construction delays in two main projects. Completion of ongoing construction projects will improve business risk profile and portend well for stock valuation. SO’s ongoing robust investments in several solar projects will also add towards growth of long-term earnings trajectory. Challenges faced by the company due to construction delays and cost overruns will keep pressure on stock valuation. I am downgrading Southern Company (NYSE: SO ) to a ‘hold’ from ‘ buy ‘, due to challenges faced by the company in its construction projects. Despite the fact that the company’s healthy rate base earned from its strong capital investments towards growing operations in a stable and growing industry has been helping its top-line numbers grow, the ongoing construction growth remains a risk to its performance in the near term. I recommend investors to keep track of the ongoing construction projects, as in the near term, ongoing construction delays of the Kemper and Vogtle projects could hurt the company’s stock price performance. Cost overruns and delays in the ongoing projects weighed on the company’s Q4’14 results. Moreover, the ongoing construction challenges will keep pressure on stock valuations, as the company’s business risk profile has inflated due to construction delays and cost overruns. During the Q4’14 conference call, the company introduced its 2015 guidance and lowered its EPS growth range due to construction challenges. Construction Remains a Concern The company’s recent financial performance was adversely affected by cost overruns and delays. In Q4’14, the company registered an after-tax impairment charge of approximately $44 billion. SO reported an EPS of $0.38 for Q4’14, down from $0.48 in Q4’13. The company’s major growth investments in its keynote power plant projects, Kemper and Vogtle, are facing construction delays. The Kemper project is delayed, and is now expected to be in service in 1H’16. Also, the Vogtle project is delayed by 18 months. In fact, the cost overruns on SO’s 582MW coal plant Kemper prevailed in 2014. With a cost increase of $330 million, Kemper’s total construction cost escalated to almost $6.2 billion , as compared to initial estimates of $2.2 billion. As far as the construction of two nuclear plants in Vogtle is concerned, analysts have projected that if the construction of these new nuclear reactors at the Vogtle plant will be delayed just short of three years, the company might spend $8 billion to complete the construction of reactors. Along with the $8 billion construction delay costs, SO might be asked to pay $240 million in damages for falling behind schedule. I believe that in the near term, construction delays on both Kemper and Vogtle projects will weigh on its performance. But in the long run, the completion of these projects will improve SO’s production capacity and will optimize its generation portfolio. Along with its increased investments in competitive business, SO is also investing heavily to expand the generation capacity of its renewable energy generation business. As part of this plan, the company has started building a 131MW solar electricity generating plant in Georgia, which will begin its operation in 2016. This 131MW utility facility will sell electricity to three Georgia Electricity generation companies under a 25-year agreement. Owing to the longevity of the purchase power agreement done by the company, I believe the 131MW facility will deliver a significant upside to the company’s earnings base, upon completion. Moreover, SO has recently acquired two solar projects totaling 99MW from TradeWind Energy in Georgia, which include an 80MW Decatur Parkway Solar Project and a 19MW Decatur Country Solar project. The 80MW generation project, which is planned to commence this month, will sell electricity under the 25-year PPA with Georgia Power. As the projects are covered by long-term contracts, I believe that upon their commencement, both projects will add well towards growing the company’s long-term earnings trajectory. During the Q4’14 conference call, the company’s management provided the 2015 earnings guidance; SO expects the EPS for 2015 to be in a range of $2.72-$2.80/share . Due to cost overruns and delays, the company lowered its earnings growth target range to 3%-4% from 4%-5% for the future. Analysts have anticipated that SO’s earnings will grow by approximately 3.61% over the next 5 years. Along with current investments in long-term growth generating projects, the company will continue to look into all possible opportunities to make more capital investments in several growth generating projects. Also, SO, in the recent Q4’14 conference call, provided its planned 2017 capital expenditures. The company has projected a CAPEX of $16.6 billion for a three-year period from 2015 to 2017, as shown in the chart below. (click to enlarge) Source: Quarterly Earnings Reports Cash Returns SO has a strong history of making healthy cash returns to its shareholders by paying hefty dividends. In fact, due to the company’s hefty dividend payment policy, the stock has earned an attractive dividend yield of 4.60% . Moreover, SO is fully committed to following its healthy dividend payment formula in the years ahead; in the Q4’14 earnings conference call, the company’s Vice President and Chief Financial Officer, Arthur Bettie, said : We feel very confident in our ability to deliver sustainable dividend policy as we have in the past into the future. Owing to the management’s commitment towards making healthy dividend payments and due to its strong strategic growth initiatives directed at improving the company’s cash flow base, I believe that SO’s dividends remain secure. Risks The ongoing increase in construction costs due to delays occurring at both Kemper and Vogtle projects will continue to pressurize the company’s cost base in upcoming years. Moreover, increased environmental expenditure due to regulatory restrictions and decline in power demand due to weather changes are key risks hovering over SO’s future stock price performance. Conclusion I am downgrading SO from a ‘buy’ to ‘hold’ due to ongoing construction challenges. The company’s near-term performance will be pressurized due to construction delays in its two main projects. However, as the company will complete its ongoing construction projects, its business risk profile will improve and portend well for the stock valuation. The company’s ongoing robust investments in several solar projects will also add towards the growth of its long-term earnings trajectory. The ongoing challenges faced by the company due to construction delays and cost overruns will keep pressure on the stock valuation. The stock is currently trading at a lower forward P/E of 15x, as compared to the utility sector’s forward P/E of 16.8x , which I believe is justified due to ongoing construction challenges and an increase in its business risk profile. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary SO’s near-term performance will be pressurized due to construction delays in two main projects. Completion of ongoing construction projects will improve business risk profile and portend well for stock valuation. SO’s ongoing robust investments in several solar projects will also add towards growth of long-term earnings trajectory. Challenges faced by the company due to construction delays and cost overruns will keep pressure on stock valuation. I am downgrading Southern Company (NYSE: SO ) to a ‘hold’ from ‘ buy ‘, due to challenges faced by the company in its construction projects. Despite the fact that the company’s healthy rate base earned from its strong capital investments towards growing operations in a stable and growing industry has been helping its top-line numbers grow, the ongoing construction growth remains a risk to its performance in the near term. I recommend investors to keep track of the ongoing construction projects, as in the near term, ongoing construction delays of the Kemper and Vogtle projects could hurt the company’s stock price performance. Cost overruns and delays in the ongoing projects weighed on the company’s Q4’14 results. Moreover, the ongoing construction challenges will keep pressure on stock valuations, as the company’s business risk profile has inflated due to construction delays and cost overruns. During the Q4’14 conference call, the company introduced its 2015 guidance and lowered its EPS growth range due to construction challenges. Construction Remains a Concern The company’s recent financial performance was adversely affected by cost overruns and delays. In Q4’14, the company registered an after-tax impairment charge of approximately $44 billion. SO reported an EPS of $0.38 for Q4’14, down from $0.48 in Q4’13. The company’s major growth investments in its keynote power plant projects, Kemper and Vogtle, are facing construction delays. The Kemper project is delayed, and is now expected to be in service in 1H’16. Also, the Vogtle project is delayed by 18 months. In fact, the cost overruns on SO’s 582MW coal plant Kemper prevailed in 2014. With a cost increase of $330 million, Kemper’s total construction cost escalated to almost $6.2 billion , as compared to initial estimates of $2.2 billion. As far as the construction of two nuclear plants in Vogtle is concerned, analysts have projected that if the construction of these new nuclear reactors at the Vogtle plant will be delayed just short of three years, the company might spend $8 billion to complete the construction of reactors. Along with the $8 billion construction delay costs, SO might be asked to pay $240 million in damages for falling behind schedule. I believe that in the near term, construction delays on both Kemper and Vogtle projects will weigh on its performance. But in the long run, the completion of these projects will improve SO’s production capacity and will optimize its generation portfolio. Along with its increased investments in competitive business, SO is also investing heavily to expand the generation capacity of its renewable energy generation business. As part of this plan, the company has started building a 131MW solar electricity generating plant in Georgia, which will begin its operation in 2016. This 131MW utility facility will sell electricity to three Georgia Electricity generation companies under a 25-year agreement. Owing to the longevity of the purchase power agreement done by the company, I believe the 131MW facility will deliver a significant upside to the company’s earnings base, upon completion. Moreover, SO has recently acquired two solar projects totaling 99MW from TradeWind Energy in Georgia, which include an 80MW Decatur Parkway Solar Project and a 19MW Decatur Country Solar project. The 80MW generation project, which is planned to commence this month, will sell electricity under the 25-year PPA with Georgia Power. As the projects are covered by long-term contracts, I believe that upon their commencement, both projects will add well towards growing the company’s long-term earnings trajectory. During the Q4’14 conference call, the company’s management provided the 2015 earnings guidance; SO expects the EPS for 2015 to be in a range of $2.72-$2.80/share . Due to cost overruns and delays, the company lowered its earnings growth target range to 3%-4% from 4%-5% for the future. Analysts have anticipated that SO’s earnings will grow by approximately 3.61% over the next 5 years. Along with current investments in long-term growth generating projects, the company will continue to look into all possible opportunities to make more capital investments in several growth generating projects. Also, SO, in the recent Q4’14 conference call, provided its planned 2017 capital expenditures. The company has projected a CAPEX of $16.6 billion for a three-year period from 2015 to 2017, as shown in the chart below. (click to enlarge) Source: Quarterly Earnings Reports Cash Returns SO has a strong history of making healthy cash returns to its shareholders by paying hefty dividends. In fact, due to the company’s hefty dividend payment policy, the stock has earned an attractive dividend yield of 4.60% . Moreover, SO is fully committed to following its healthy dividend payment formula in the years ahead; in the Q4’14 earnings conference call, the company’s Vice President and Chief Financial Officer, Arthur Bettie, said : We feel very confident in our ability to deliver sustainable dividend policy as we have in the past into the future. Owing to the management’s commitment towards making healthy dividend payments and due to its strong strategic growth initiatives directed at improving the company’s cash flow base, I believe that SO’s dividends remain secure. Risks The ongoing increase in construction costs due to delays occurring at both Kemper and Vogtle projects will continue to pressurize the company’s cost base in upcoming years. Moreover, increased environmental expenditure due to regulatory restrictions and decline in power demand due to weather changes are key risks hovering over SO’s future stock price performance. Conclusion I am downgrading SO from a ‘buy’ to ‘hold’ due to ongoing construction challenges. The company’s near-term performance will be pressurized due to construction delays in its two main projects. However, as the company will complete its ongoing construction projects, its business risk profile will improve and portend well for the stock valuation. The company’s ongoing robust investments in several solar projects will also add towards the growth of its long-term earnings trajectory. The ongoing challenges faced by the company due to construction delays and cost overruns will keep pressure on the stock valuation. The stock is currently trading at a lower forward P/E of 15x, as compared to the utility sector’s forward P/E of 16.8x , which I believe is justified due to ongoing construction challenges and an increase in its business risk profile. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News