Scalper1 News

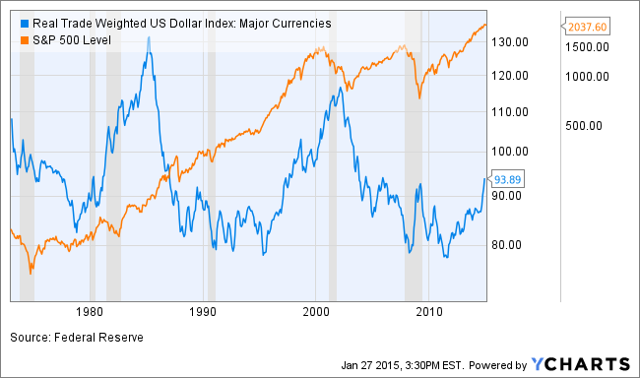

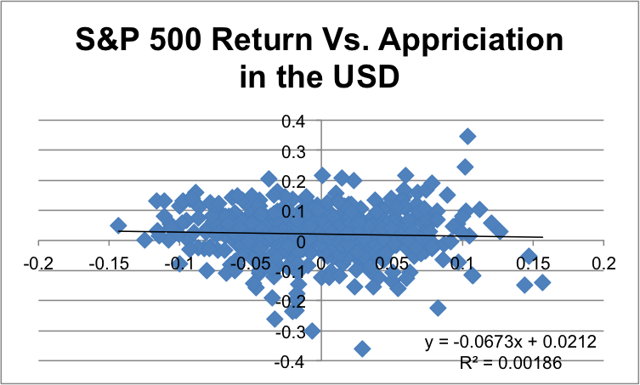

Markets tumbled Tuesday on a number of weak earnings reports. The strong U.S. dollar was a major culprit. Historically, currency changes are not a good predictor of subsequent stock market returns. Investors may wish to consider rebalancing their portfolios, but there is little evidence to suggest a major change in strategy is warranted. Markets had a turbulent Tuesday with earnings reports from firms like Microsoft (NASDAQ: MSFT ), Caterpillar (NYSE: CAT ) and Procter & Gamble (NYSE: PG ) stoking fears that economic growth is slowing. However, a more critical look into these reports suggests that strength in the U.S. dollar is a major culprit. For example, Procter & Gamble reported core earnings of $1.06 versus $1.15 in the previous year, a reduction of nearly 8%. But looking closer net sales were down 4% nearly mirroring a five percentage point impact from foreign exchange. In fact, adjusting for the effects of foreign exchange, volumes were flat (Table 1). While flat growth may be little reason to cheer, it also seems to be scant reason to overreact. As an investor before you react to currency headwinds it is logical to evaluate the effect of a stronger dollar in its historical context. Table 1: P&G’s Net Sales Drivers Oct. – Dec. 2014 Net Sales Drivers Volume Foreign Exchange Price Mix Other* Net Sales Organic Volume Organic Sales Beauty, Hair & Personal Care -2% -4% 1% 0% -1% -6% -2% -1% Grooming -2% -7% 4% 0% 0% -5% -2% 2% Health Care -2% -4% 0% 3% 0% -3% -2% 1% Fabric Care and Home Care 2% -6% 1% 0% -1% -4% 2% 4% Baby, Feminine and Family Care 0% -6% 1% 3% 0% -2% 0% 4% Total P&G 0% -5% 1% 1% -1% -4% 0% 2% *Other includes the sales mix impact of acquisitions/divestitures and rounding impacts necessary to reconcile volume to net sales. Source: Procter and Gamble Earnings Press Release. The stock market is volatile, but so are currencies. Over the past thirty years the dollar has waxed and waned against a basket of foreign currencies (Figure 1). Sometimes the U.S. dollar and the market move upward in lock step, while other times they diverge. Figure 1: The U.S. Dollar vs. The S&P 500 (click to enlarge) Do you see a correlation between the two? I do not and incidentally neither does Excel. The correlation between the dollar index and the S&P 500 (NYSEARCA: SPY ) is -0.211, most likely any correlation is simply an artifact of the dollar being in general more weak over the past ten years while the market has moved up over time. How about if we think about the situation in a different way? What if a rising dollar is associated with subsequent poor performance in the stock market? In other words, since P&G’s last earnings report stemmed from changes in the exchange rate over the past six months what if there was a correlation between the six month appreciation or depreciation of the dollar and subsequent returns in the stock market? These numbers are very easily manipulated in Excel and the correlation between six month past currency moves and three month forward stock market returns is -0.043. There is almost no correlation between the two. To further emphasize the point I created a scatterplot of the two data sets (Figure 2). The R squared of least squares regression is 0.00186, indicating no correlation. Figure 2: Three Month Subsequent S&P 500 Return Vs. Six Month Prior Appreciation in the U.S. Dollar (click to enlarge) Intuitively, this finding makes a great deal of economic sense. Currency moves are a zero sum game. If the dollar goes down against the Euro then U.S. exports are cheaper for Europeans and the reverse is true for imports. While U.S. companies on the whole may suffer because they sell abroad an appreciating dollar also makes assets denominated in dollars more attractive to foreign investors. In aggregate there is little reason to bet on the dollar causing the U.S. market to move up or down. Some market pundits are calling for a correction or worse in the stock market, however, there is no historical evidence to suggest that strength in the U.S. dollar should be correlated with stock market corrections. The S&P 500 closed at 2029 today, about 3% off its all-time intraday high of 2093. While market prognosticators constantly pitch timing the market, moves of less than 10% are impossible to time accurately. By the time the market opened today we were already down 3% from all-time highs. What if the market goes down a total of 10%? First consider that it is only after a move higher that you would know to reenter the market. Then consider that it is equally likely the market’s next move will be up. In a nutshell this explains why timing short-term corrections is a waste of time and money, although investors never seem to learn that this is the case. At the moment currency changes are still rippling through the market. One way to rebalance your portfolio would be to favor domestic stocks that capitalize on cheaper imports and sell their products within the United States. Foreign stocks that are exporters should benefit from the opposite trend and allow for a portfolio that is still balanced between foreign and U.S. based corporations. For example, some U.S. based companies that should see stronger earnings as the result of dollar appreciation are: AutoNation (NYSE: AN ), Costco (NASDAQ: COST ) and Michael Kors Holdings (NYSE: KORS ). These three companies need to import goods from abroad and sell them in the United States (with each having a minimum of 70% of revenues domestically). Foreign stocks that could benefit from a weaker euro include: Siemens ( OTCPK:SIEGY ) and Unilever (NYSE: UN ). Obviously this list is not all-inclusive and depending on whether you expect a weakening or strengthening economy you could favor more or less cyclical companies. Nearly every day market prognosticators try to convince investors to change their investment strategy. While it is difficult to ignore them when the market swoons that is precisely what most successful investors learn to do. It is more gratifying and ultimately more profitable to view short-term market fluctuations as random noise unless you have a compelling reason to think otherwise. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Scalper1 News

Markets tumbled Tuesday on a number of weak earnings reports. The strong U.S. dollar was a major culprit. Historically, currency changes are not a good predictor of subsequent stock market returns. Investors may wish to consider rebalancing their portfolios, but there is little evidence to suggest a major change in strategy is warranted. Markets had a turbulent Tuesday with earnings reports from firms like Microsoft (NASDAQ: MSFT ), Caterpillar (NYSE: CAT ) and Procter & Gamble (NYSE: PG ) stoking fears that economic growth is slowing. However, a more critical look into these reports suggests that strength in the U.S. dollar is a major culprit. For example, Procter & Gamble reported core earnings of $1.06 versus $1.15 in the previous year, a reduction of nearly 8%. But looking closer net sales were down 4% nearly mirroring a five percentage point impact from foreign exchange. In fact, adjusting for the effects of foreign exchange, volumes were flat (Table 1). While flat growth may be little reason to cheer, it also seems to be scant reason to overreact. As an investor before you react to currency headwinds it is logical to evaluate the effect of a stronger dollar in its historical context. Table 1: P&G’s Net Sales Drivers Oct. – Dec. 2014 Net Sales Drivers Volume Foreign Exchange Price Mix Other* Net Sales Organic Volume Organic Sales Beauty, Hair & Personal Care -2% -4% 1% 0% -1% -6% -2% -1% Grooming -2% -7% 4% 0% 0% -5% -2% 2% Health Care -2% -4% 0% 3% 0% -3% -2% 1% Fabric Care and Home Care 2% -6% 1% 0% -1% -4% 2% 4% Baby, Feminine and Family Care 0% -6% 1% 3% 0% -2% 0% 4% Total P&G 0% -5% 1% 1% -1% -4% 0% 2% *Other includes the sales mix impact of acquisitions/divestitures and rounding impacts necessary to reconcile volume to net sales. Source: Procter and Gamble Earnings Press Release. The stock market is volatile, but so are currencies. Over the past thirty years the dollar has waxed and waned against a basket of foreign currencies (Figure 1). Sometimes the U.S. dollar and the market move upward in lock step, while other times they diverge. Figure 1: The U.S. Dollar vs. The S&P 500 (click to enlarge) Do you see a correlation between the two? I do not and incidentally neither does Excel. The correlation between the dollar index and the S&P 500 (NYSEARCA: SPY ) is -0.211, most likely any correlation is simply an artifact of the dollar being in general more weak over the past ten years while the market has moved up over time. How about if we think about the situation in a different way? What if a rising dollar is associated with subsequent poor performance in the stock market? In other words, since P&G’s last earnings report stemmed from changes in the exchange rate over the past six months what if there was a correlation between the six month appreciation or depreciation of the dollar and subsequent returns in the stock market? These numbers are very easily manipulated in Excel and the correlation between six month past currency moves and three month forward stock market returns is -0.043. There is almost no correlation between the two. To further emphasize the point I created a scatterplot of the two data sets (Figure 2). The R squared of least squares regression is 0.00186, indicating no correlation. Figure 2: Three Month Subsequent S&P 500 Return Vs. Six Month Prior Appreciation in the U.S. Dollar (click to enlarge) Intuitively, this finding makes a great deal of economic sense. Currency moves are a zero sum game. If the dollar goes down against the Euro then U.S. exports are cheaper for Europeans and the reverse is true for imports. While U.S. companies on the whole may suffer because they sell abroad an appreciating dollar also makes assets denominated in dollars more attractive to foreign investors. In aggregate there is little reason to bet on the dollar causing the U.S. market to move up or down. Some market pundits are calling for a correction or worse in the stock market, however, there is no historical evidence to suggest that strength in the U.S. dollar should be correlated with stock market corrections. The S&P 500 closed at 2029 today, about 3% off its all-time intraday high of 2093. While market prognosticators constantly pitch timing the market, moves of less than 10% are impossible to time accurately. By the time the market opened today we were already down 3% from all-time highs. What if the market goes down a total of 10%? First consider that it is only after a move higher that you would know to reenter the market. Then consider that it is equally likely the market’s next move will be up. In a nutshell this explains why timing short-term corrections is a waste of time and money, although investors never seem to learn that this is the case. At the moment currency changes are still rippling through the market. One way to rebalance your portfolio would be to favor domestic stocks that capitalize on cheaper imports and sell their products within the United States. Foreign stocks that are exporters should benefit from the opposite trend and allow for a portfolio that is still balanced between foreign and U.S. based corporations. For example, some U.S. based companies that should see stronger earnings as the result of dollar appreciation are: AutoNation (NYSE: AN ), Costco (NASDAQ: COST ) and Michael Kors Holdings (NYSE: KORS ). These three companies need to import goods from abroad and sell them in the United States (with each having a minimum of 70% of revenues domestically). Foreign stocks that could benefit from a weaker euro include: Siemens ( OTCPK:SIEGY ) and Unilever (NYSE: UN ). Obviously this list is not all-inclusive and depending on whether you expect a weakening or strengthening economy you could favor more or less cyclical companies. Nearly every day market prognosticators try to convince investors to change their investment strategy. While it is difficult to ignore them when the market swoons that is precisely what most successful investors learn to do. It is more gratifying and ultimately more profitable to view short-term market fluctuations as random noise unless you have a compelling reason to think otherwise. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Scalper1 News

Scalper1 News