Scalper1 News

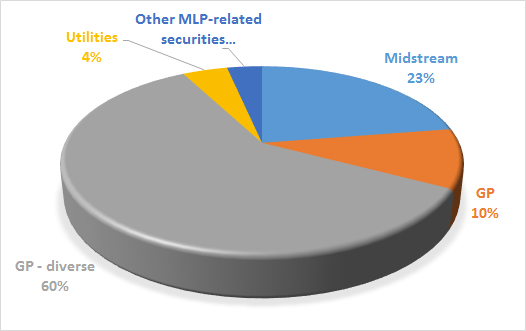

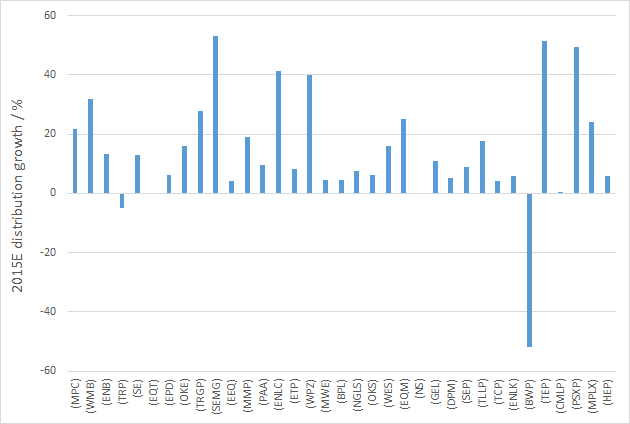

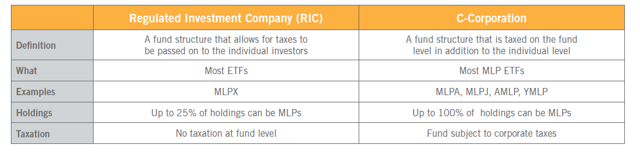

Summary GPs generally exhibit lower yields than MLPs, but can provide higher distribution growth and total return rates. The Global X MLP & Energy Infrastructure ETF is a fund that contains a high proportion of GP or GP-holding companies. This article analyzes the composition and distribution growth profile for this ETF. Introduction The general partners (GP) vs. master limited partnerships (MLPs) question has been addressed recently on Seeking Alpha. In an Oct. 2014 article entitled ” Look At The MLP GP Companies For An Alternate Path To High Total Returns “, author Tim Plaehn explains: The pure-play MLP general partner companies offer a different way to participate in the results of the partnerships they sponsor and manage. The GP companies leverage the growth rates of the LP distributions, providing more of a total return investment potential based on high distribution or dividend growth rates. A similar conclusion was reached by Seeking Alpha author Harry Domash ” General Partners Outperform Their MLPs ” (Aug. 2014). Investors who are uncomfortable with picking individual stocks may prefer owning a basket of funds. Are there any exchange-traded products that own only GPs? The answer is no, but there is a fund that comes close: the Global X MLP & Energy Infrastructure ETF (NYSEARCA: MLPX ). Fund details MLPX appears to be a little-known fund, with only 161 followers on Seeking Alpha. Pertinent fund details are shown in the table below (data from Morningstar ): MLPX Yield (ttm) 3.17% Expense ratio 0.45% Inception Aug. 2013 Assets $106M Avg Vol. 103K No. holdings 40 Avg. Cap $15.2B Annual turnover 29% Morningstar rating NR Composition The 40 constituents of MLPX are given in the table below. Also shown is the % assets, ttm yield, market cap and type of each constituent . The % assets are obtained from the fund’s website while the ttm yield and market cap are obtained from Morningstar. In categorizing the type of company, I have used the classification types in the CBRE Clarion Securities MLP Master List website, which considers these following MLP or MLP-related classes: [i] traditionally structured midstream MLPs, [ii] upstream MLPs, [iii] traditionally structured other MLPs (“other”), [iv] variable distribution MLPs (“variable”), [v] MLP GP holding companies (“GP”), [vi] other publicly-traded companies that own GP interest in an MLP, but the GP stake is not their only asset (“GP – diverse”), and [vii] other MLP-related securities. Name Ticker Assets / % Yield / % Cap / B Type MARATHON PETROLEUM CORP (NYSE: MPC ) 10.17 1.79 30.2 GP – diverse WILLIAMS COS INC (NYSE: WMB ) 9.97 4.50 38.3 GP – diverse ENBRIDGE INC (NYSE: ENB ) 8.83 3.29 36.7 GP – diverse TRANSCANADA CORP (NYSE: TRP ) 8.68 4.43 26.3 GP – diverse CHENIERE ENERGY INC (NYSEMKT: LNG ) 6.95 0.00 16.0 GP – diverse SPECTRA ENERGY CORP (NYSE: SE ) 6.76 4.81 20.7 GP – diverse EQT CORP (NYSE: EQT ) 4.44 0.15 12.0 GP – diverse ONE GAS INC (NYSE: OGS ) 4.34 2.66 2.3 Utilities ENTERPRISE PRODUCTS PARTN (NYSE: EPD ) 4.30 5.23 57.1 Midstream ONEOK INC (NYSE: OKE ) 4.18 6.37 7.9 GP TARGA RESOURCES CORP (NYSE: TRGP ) 4.05 4.12 4.4 GP SEMGROUP CORP-CLASS A (NYSE: SEMG ) 3.78 2.21 2.6 GP – diverse ENBRIDGE ENERGY MANAGEMENT (NYSE: EEQ ) 3.37 0.00 2.0 Other MLP-related securities MAGELLAN MIDSTREAM PARTNERS (NYSE: MMP ) 2.34 4.02 16.0 Midstream PLAINS ALL AMER PIPELINE (NYSE: PAA ) 2.12 7.38 14.6 Midstream ENLINK MIDSTREAM LLC (NYSE: ENLC ) 2.00 3.73 4.2 GP ENERGY TRANSFER PARTNERS (NYSE: ETP ) 1.94 2.10 25.3 Midstream WILLIAMS PARTNERS LP (NYSE: WPZ ) 1.53 7.44 25.3 Midstream MARKWEST ENERGY PARTNERS (NYSE: MWE ) 1.52 6.57 11.0 Midstream BUCKEYE PARTNERS LP (NYSE: BPL ) 1.33 4.47 9.1 Midstream TARGA RESOURCES PARTNERS (NYSE: NGLS ) 0.80 9.96 6.0 Midstream ONEOK PARTNERS LP (NYSE: OKS ) 0.78 9.96 8.6 Midstream WESTERN GAS PARTNERS LP (NYSE: WES ) 0.67 4.80 8.3 Midstream EQT MIDSTREAM PARTNERS LP (NYSE: EQM ) 0.57 2.99 5.6 Midstream NUSTAR ENERGY LP (NYSE: NS ) 0.56 8.38 4.1 Midstream GENESIS ENERGY L.P. (NYSE: GEL ) 0.52 5.53 4.8 Midstream DCP MIDSTREAM PARTNERS LP (NYSE: DPM ) 0.40 10.34 3.5 Midstream SPECTRA ENERGY PARTNERS L (NYSE: SEP ) 0.40 4.65 15.3 Midstream TESORO LOGISTICS LP (NYSE: TLLP ) 0.39 5.17 4.6 Midstream TC PIPELINES LP (NYSE: TCP ) 0.37 5.93 3.7 Midstream SHELL MIDSTREAM PARTNERS (NYSE: SHLX ) 0.31 1.19 5.3 Midstream ENLINK MIDSTREAM PARTNERS (NYSE: ENLK ) 0.29 7.86 6.3 Midstream BOARDWALK PIPELINE PARTNERS (NYSE: BWP ) 0.25 2.84 3.5 Midstream TALLGRASS ENERGY PARTNERS (NYSE: TEP ) 0.22 4.25 2.8 Midstream CRESTWOOD MIDSTREAM PARTNERS (NYSE: CMLP ) 0.20 16.99 1.8 Midstream PHILLIPS 66 PARTNERS LP (NYSE: PSXP ) 0.18 2.50 4.6 Midstream MPLX LP (NYSE: MPLX ) 0.16 3.21 3.8 Midstream HOLLY ENERGY PARTNERS LP (NYSE: HEP ) 0.15 7.33 1.7 Midstream ANTERO MIDSTREAM PARTNERS (NYSE: AM ) 0.15 2.02 3.5 Midstream ENABLE MIDSTREAM PARTNERS (NYSE: ENBL ) 0.06 7.63 6.8 Midstream The allocations of MLPX are depicted in the chart below: As can be seen in the chart above, the majority (60%) of the assets of MLPX are in “GP – diverse” companies, which according to CBRE Clarion Securities are “other publicly-traded companies that own GP interest in an MLP, but the GP stake is not their only asset”. The top 7 holdings of MLPX, namely MPC, WMB, ENB, TRP, LNG, SE and EQT are all classified as “GP – diverse” companies. MLPX also holds a number (10%) of “pure” GP companies such as OKE, TRGP and ENLC, which are classified by CBRE as “companies whose primary assets are G.P. and L.P. interests in their subsidiary MLP.” Consequently, MLPX can be considered to consist of 70% of companies whose GP/LP stake in their subsidiary MLP is either their primary asset or part of their assets. Distribution growth In the past twelve months, MLPX has distributed a total of 51.9 cents. In the twelve months before that, MLPX distributed 38.9 cents. This represents a whopping 33.5% year-on-year distribution growth, on a current 3.17% yield. There is no further dividend history as MLPX has only existed for two years. However, as MLPX is an ETF, it has the ability to control the amount of distributions that it makes, including the capability of providing return-of-capital distributions. Thus, the year-on-year distribution growth of the constituents of MLPX were analyzed in order to determine whether this 33.5% dividend growth was reflective of the distribution growth of the underlying holdings. To calculate this, the recent 24-month dividend history for the 40 constituents of MLPX were extracted from Nasdaq.com , and their year-on-year distribution growth was calculated. The following chart shows the year-on-year distribution growth for the constituents of MLPX. Note that some companies are missing because they either (i) do not pay a dividend (e.g. LNG) or (ii) have less than 2 years of operating history (e.g. SHLX, OGS). As can be seen from the chart above, the year-on-year distribution growth for most of the companies in MLPX is quite robust (with the notable exception of BWP). However, each constituent of MLPX has a different weighting in the index, and therefore a different contribution of distribution growth. I therefore calculated the weighted average of the year-on-year distribution growth of these companies, and the answer came out to 15.6% . I believe that this number (as opposed to 33.5%) better reflects the distribution growth profile for MLPX going forward, if the year-on-year distribution growth for the constituents remains constant. However, considering the current state of oil prices, this may or may not be a true assumption. Performance The following graph shows the total return performance of MLPX versus the ALPS Alerian MLP ETF (NYSEARCA: AMLP ) and the JPMorgan Alerian MLP Index ETN (NYSEARCA: AMJ ) since the inception of MLPX two years ago. MLPX Total Return Price data by YCharts The graph above shows that MLPX, which consists largely of GP-holding companies, handily outperformed AMLP and AMJ, which are funds that hold only midstream MLPs. This reinforces the conclusions offered by Tim Plaehn and Harry Domash presented above. Tax implications I am not a tax expert, so please take the following discussion with a grain of salt. According to Global X , MLPX operates as a Regulated Investment Company (RIC) rather than a C-Corporation. This is because MLPX contains less than 25% of MLPs (the current allocation is 23%). In doing so, it avoids issues common in other MLP ETFs, such as corporate taxes and K-1s, and it is also IRA and 401(k) eligible. The following table is from Global X: (click to enlarge) Conclusion MLPX is a little-followed ETF whose constituents are mostly either GP or GP-holding companies. It contains less than 25% MLPs, which allows it to operate as an RIC rather than as a C-Corporation. While its current yield of 3.17% is lower than either AMLP (7.54%) or AMJ (6.08%), its actual (33.5%) and projected (15.6%) year-on-year distribution growth rates are much higher than those for AMLP (5.5%) or AMJ (2.1%). Moreover, its expense ratio is only 0.45%, compared to 0.85% for the other two funds. Finally, its total return performance since inception two years ago has significantly outpaced those of AMLP and AMJ. Hence, MLPX may be a good choice for investors seeking the total return and distribution growth of GP companies, but who are uncomfortable with picking individual stocks. Besides general equity risk, the main risk of this fund is that its constituents are highly sensitive to commodity prices, and should these continue to fall, it is likely that the share prices of the funds will fall further. Moreover, the distribution growth going forward may also be reduced from historical levels. Disclosure: I am/we are long MLPX. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary GPs generally exhibit lower yields than MLPs, but can provide higher distribution growth and total return rates. The Global X MLP & Energy Infrastructure ETF is a fund that contains a high proportion of GP or GP-holding companies. This article analyzes the composition and distribution growth profile for this ETF. Introduction The general partners (GP) vs. master limited partnerships (MLPs) question has been addressed recently on Seeking Alpha. In an Oct. 2014 article entitled ” Look At The MLP GP Companies For An Alternate Path To High Total Returns “, author Tim Plaehn explains: The pure-play MLP general partner companies offer a different way to participate in the results of the partnerships they sponsor and manage. The GP companies leverage the growth rates of the LP distributions, providing more of a total return investment potential based on high distribution or dividend growth rates. A similar conclusion was reached by Seeking Alpha author Harry Domash ” General Partners Outperform Their MLPs ” (Aug. 2014). Investors who are uncomfortable with picking individual stocks may prefer owning a basket of funds. Are there any exchange-traded products that own only GPs? The answer is no, but there is a fund that comes close: the Global X MLP & Energy Infrastructure ETF (NYSEARCA: MLPX ). Fund details MLPX appears to be a little-known fund, with only 161 followers on Seeking Alpha. Pertinent fund details are shown in the table below (data from Morningstar ): MLPX Yield (ttm) 3.17% Expense ratio 0.45% Inception Aug. 2013 Assets $106M Avg Vol. 103K No. holdings 40 Avg. Cap $15.2B Annual turnover 29% Morningstar rating NR Composition The 40 constituents of MLPX are given in the table below. Also shown is the % assets, ttm yield, market cap and type of each constituent . The % assets are obtained from the fund’s website while the ttm yield and market cap are obtained from Morningstar. In categorizing the type of company, I have used the classification types in the CBRE Clarion Securities MLP Master List website, which considers these following MLP or MLP-related classes: [i] traditionally structured midstream MLPs, [ii] upstream MLPs, [iii] traditionally structured other MLPs (“other”), [iv] variable distribution MLPs (“variable”), [v] MLP GP holding companies (“GP”), [vi] other publicly-traded companies that own GP interest in an MLP, but the GP stake is not their only asset (“GP – diverse”), and [vii] other MLP-related securities. Name Ticker Assets / % Yield / % Cap / B Type MARATHON PETROLEUM CORP (NYSE: MPC ) 10.17 1.79 30.2 GP – diverse WILLIAMS COS INC (NYSE: WMB ) 9.97 4.50 38.3 GP – diverse ENBRIDGE INC (NYSE: ENB ) 8.83 3.29 36.7 GP – diverse TRANSCANADA CORP (NYSE: TRP ) 8.68 4.43 26.3 GP – diverse CHENIERE ENERGY INC (NYSEMKT: LNG ) 6.95 0.00 16.0 GP – diverse SPECTRA ENERGY CORP (NYSE: SE ) 6.76 4.81 20.7 GP – diverse EQT CORP (NYSE: EQT ) 4.44 0.15 12.0 GP – diverse ONE GAS INC (NYSE: OGS ) 4.34 2.66 2.3 Utilities ENTERPRISE PRODUCTS PARTN (NYSE: EPD ) 4.30 5.23 57.1 Midstream ONEOK INC (NYSE: OKE ) 4.18 6.37 7.9 GP TARGA RESOURCES CORP (NYSE: TRGP ) 4.05 4.12 4.4 GP SEMGROUP CORP-CLASS A (NYSE: SEMG ) 3.78 2.21 2.6 GP – diverse ENBRIDGE ENERGY MANAGEMENT (NYSE: EEQ ) 3.37 0.00 2.0 Other MLP-related securities MAGELLAN MIDSTREAM PARTNERS (NYSE: MMP ) 2.34 4.02 16.0 Midstream PLAINS ALL AMER PIPELINE (NYSE: PAA ) 2.12 7.38 14.6 Midstream ENLINK MIDSTREAM LLC (NYSE: ENLC ) 2.00 3.73 4.2 GP ENERGY TRANSFER PARTNERS (NYSE: ETP ) 1.94 2.10 25.3 Midstream WILLIAMS PARTNERS LP (NYSE: WPZ ) 1.53 7.44 25.3 Midstream MARKWEST ENERGY PARTNERS (NYSE: MWE ) 1.52 6.57 11.0 Midstream BUCKEYE PARTNERS LP (NYSE: BPL ) 1.33 4.47 9.1 Midstream TARGA RESOURCES PARTNERS (NYSE: NGLS ) 0.80 9.96 6.0 Midstream ONEOK PARTNERS LP (NYSE: OKS ) 0.78 9.96 8.6 Midstream WESTERN GAS PARTNERS LP (NYSE: WES ) 0.67 4.80 8.3 Midstream EQT MIDSTREAM PARTNERS LP (NYSE: EQM ) 0.57 2.99 5.6 Midstream NUSTAR ENERGY LP (NYSE: NS ) 0.56 8.38 4.1 Midstream GENESIS ENERGY L.P. (NYSE: GEL ) 0.52 5.53 4.8 Midstream DCP MIDSTREAM PARTNERS LP (NYSE: DPM ) 0.40 10.34 3.5 Midstream SPECTRA ENERGY PARTNERS L (NYSE: SEP ) 0.40 4.65 15.3 Midstream TESORO LOGISTICS LP (NYSE: TLLP ) 0.39 5.17 4.6 Midstream TC PIPELINES LP (NYSE: TCP ) 0.37 5.93 3.7 Midstream SHELL MIDSTREAM PARTNERS (NYSE: SHLX ) 0.31 1.19 5.3 Midstream ENLINK MIDSTREAM PARTNERS (NYSE: ENLK ) 0.29 7.86 6.3 Midstream BOARDWALK PIPELINE PARTNERS (NYSE: BWP ) 0.25 2.84 3.5 Midstream TALLGRASS ENERGY PARTNERS (NYSE: TEP ) 0.22 4.25 2.8 Midstream CRESTWOOD MIDSTREAM PARTNERS (NYSE: CMLP ) 0.20 16.99 1.8 Midstream PHILLIPS 66 PARTNERS LP (NYSE: PSXP ) 0.18 2.50 4.6 Midstream MPLX LP (NYSE: MPLX ) 0.16 3.21 3.8 Midstream HOLLY ENERGY PARTNERS LP (NYSE: HEP ) 0.15 7.33 1.7 Midstream ANTERO MIDSTREAM PARTNERS (NYSE: AM ) 0.15 2.02 3.5 Midstream ENABLE MIDSTREAM PARTNERS (NYSE: ENBL ) 0.06 7.63 6.8 Midstream The allocations of MLPX are depicted in the chart below: As can be seen in the chart above, the majority (60%) of the assets of MLPX are in “GP – diverse” companies, which according to CBRE Clarion Securities are “other publicly-traded companies that own GP interest in an MLP, but the GP stake is not their only asset”. The top 7 holdings of MLPX, namely MPC, WMB, ENB, TRP, LNG, SE and EQT are all classified as “GP – diverse” companies. MLPX also holds a number (10%) of “pure” GP companies such as OKE, TRGP and ENLC, which are classified by CBRE as “companies whose primary assets are G.P. and L.P. interests in their subsidiary MLP.” Consequently, MLPX can be considered to consist of 70% of companies whose GP/LP stake in their subsidiary MLP is either their primary asset or part of their assets. Distribution growth In the past twelve months, MLPX has distributed a total of 51.9 cents. In the twelve months before that, MLPX distributed 38.9 cents. This represents a whopping 33.5% year-on-year distribution growth, on a current 3.17% yield. There is no further dividend history as MLPX has only existed for two years. However, as MLPX is an ETF, it has the ability to control the amount of distributions that it makes, including the capability of providing return-of-capital distributions. Thus, the year-on-year distribution growth of the constituents of MLPX were analyzed in order to determine whether this 33.5% dividend growth was reflective of the distribution growth of the underlying holdings. To calculate this, the recent 24-month dividend history for the 40 constituents of MLPX were extracted from Nasdaq.com , and their year-on-year distribution growth was calculated. The following chart shows the year-on-year distribution growth for the constituents of MLPX. Note that some companies are missing because they either (i) do not pay a dividend (e.g. LNG) or (ii) have less than 2 years of operating history (e.g. SHLX, OGS). As can be seen from the chart above, the year-on-year distribution growth for most of the companies in MLPX is quite robust (with the notable exception of BWP). However, each constituent of MLPX has a different weighting in the index, and therefore a different contribution of distribution growth. I therefore calculated the weighted average of the year-on-year distribution growth of these companies, and the answer came out to 15.6% . I believe that this number (as opposed to 33.5%) better reflects the distribution growth profile for MLPX going forward, if the year-on-year distribution growth for the constituents remains constant. However, considering the current state of oil prices, this may or may not be a true assumption. Performance The following graph shows the total return performance of MLPX versus the ALPS Alerian MLP ETF (NYSEARCA: AMLP ) and the JPMorgan Alerian MLP Index ETN (NYSEARCA: AMJ ) since the inception of MLPX two years ago. MLPX Total Return Price data by YCharts The graph above shows that MLPX, which consists largely of GP-holding companies, handily outperformed AMLP and AMJ, which are funds that hold only midstream MLPs. This reinforces the conclusions offered by Tim Plaehn and Harry Domash presented above. Tax implications I am not a tax expert, so please take the following discussion with a grain of salt. According to Global X , MLPX operates as a Regulated Investment Company (RIC) rather than a C-Corporation. This is because MLPX contains less than 25% of MLPs (the current allocation is 23%). In doing so, it avoids issues common in other MLP ETFs, such as corporate taxes and K-1s, and it is also IRA and 401(k) eligible. The following table is from Global X: (click to enlarge) Conclusion MLPX is a little-followed ETF whose constituents are mostly either GP or GP-holding companies. It contains less than 25% MLPs, which allows it to operate as an RIC rather than as a C-Corporation. While its current yield of 3.17% is lower than either AMLP (7.54%) or AMJ (6.08%), its actual (33.5%) and projected (15.6%) year-on-year distribution growth rates are much higher than those for AMLP (5.5%) or AMJ (2.1%). Moreover, its expense ratio is only 0.45%, compared to 0.85% for the other two funds. Finally, its total return performance since inception two years ago has significantly outpaced those of AMLP and AMJ. Hence, MLPX may be a good choice for investors seeking the total return and distribution growth of GP companies, but who are uncomfortable with picking individual stocks. Besides general equity risk, the main risk of this fund is that its constituents are highly sensitive to commodity prices, and should these continue to fall, it is likely that the share prices of the funds will fall further. Moreover, the distribution growth going forward may also be reduced from historical levels. Disclosure: I am/we are long MLPX. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News