Scalper1 News

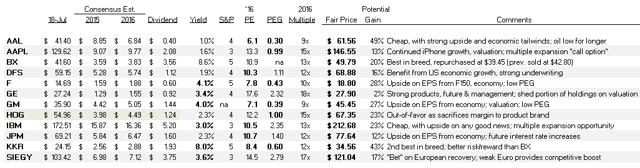

Summary The CTR sold VLO after less than a month following double digit gains. While money was left on the table, the market in this name seemed a little “frothy”. After recently selling BX, the combination of a price drop and company strategic moves prompted the equity to be “welcomed back”; BX is still best-in-breed. AAPL is nearing an inflection point, while IBM may be nearing a breakout. GM is universally hated, but that has to change (or does it). I introduced the ” Conservative Total Return ” or CTR portfolio in August 2014 and try to provide monthly updates. The general philosophy of this method has allowed me to cumulatively beat, since 1999, the S&P 500 by a wide margin. As the market has “evolved”, so have the holdings. While the investments in the CTR are conservative, the portfolio is dynamic (as is the market and its “favorites”). In the June report, I noted broadening the portfolio base to add a transport (American Airlines (NASDAQ: AAL )) and an energy company (Valero (NYSE: VLO )). Unfortunately for the diversification strategy (but fortunate for the portfolio), VLO appreciated significantly and I exited the position. Why did I exit below my target price? Simply put, VLO appreciated fast in a short time. In reviewing my investing mistakes, I have learned that in the past I have been reluctant to sell; waiting for the market to “get it right” and hit my target price. Often my stubbornness has been costly. In recent years (with a lot of prompting from my wife), I have been more prone to take a quick profit as I am skeptical of “one-way elevator rides”. So when VLO jumped more than 10% in less than a month, I decided not to be greedy and took profits. Subsequently, VLO has considered to appreciate. While the greedy side of my wishes I held on, the logical side of me believes the market is over-reacting to perceived good news and is happy I sold. I will continue to monitor VLO and my re-enter if 1) the core value has changed and/or 2) pricing becomes favorable. During the month, I re-entered a favorite (Blackstone- (NYSE: BX )) that I had previously sold for reasons similar to VLO. In that case, BX had become “everyone’s favorite stock”, which always makes me nervous. I sold my position at $42.80 and re-entered at $39.45. While I was absent from the stock, BX made some moves I “approved of”, including accelerating the sale of US single family homes. The worsening energy market also makes it more likely BX will be able to deploy recently raised funds productively (previously I was concerned too much money was chasing too few deals and the funds could underperform). Even while selling (and subsequently adding KKR & Co. (NYSE: KKR )), I maintained BX was “best of breed”. I am happy to once again be holding this winner. An error I made was not being focused enough on the markets during the short-lived Greece/China crisis. I have been looking to increase exposure to financials, but at more attractive prices. Frankly, I wanted to buy Citigroup (NYSE: C ) and missed out. I may still enter C, or another financial, but the post-Q2 earnings response to the group was a little too optimistic for my tastes; there may be another opportunity during the next mini-crises or when enthusiasm pulls back. I am OK with missing an opportunity, if it means not overpaying and having my risk/reward skew too heavily toward risk. The Conservative Total Return Philosophy The essence of the CTR method is to combine a strong value bias with flexibility, opportunism and an ability to assimilate and respond to new information. The core philosophy will always be the same; however, as the economic cycle grows older, identifying the appropriate time to “harvest” becomes increasingly important. In assessing the prospects for all of the portfolio members, I feel good that the risk-reward dynamic is positive and, on a risk-adjusted basis, market beating (taking into account the strong value provided by dividends). Feedback from readers has been a partial motivator in my broadening my market segment exposure. The Individual Stocks The core stocks in the portfolio are (alphabetically): AAL, Apple (OTC: APPL ), Blackstone Discover Financial Services (NYSE: DFS ), Ford, (NYSE: F ), GE, General Motors (NYSE: GM ), Harley Davidson (NYSE: HOG ), International Business Machines (NYSE: IBM ), JPM, KKR and Siemens (OTCPK: SIEGY ). (click to enlarge) As the above chart confirms, my positions will generally have a strong bias toward dividends, reasonable valuation and a moderate (in most cases) PEG. Below are comments summarizing my interest in the equity. The chart also contains the appropriate metrics (valuation, fair value, potential gain). Holdings Apple – APPL has a bit of room to run, whether upward valuation is based on more than iPhone sales will be clarified following Q2 earnings. I believe the watch is a non-event (a disappointment for some bulls) and payments have potential. By the end of the year, AAPL has to demonstrate the catalyst for further appreciation or risk being “dead money” (or worse). I am not a “perma-bull” on APPL (though I use the Company’s products). Blackstone – As noted above, BX was re-introduced at a price reflecting a sold risk/reward opportunity. Still the best of breed, well-funded and poised to profit from market distress and volatility (especially in energy). The harvest of US residential is viewed by the author as a positive. Discover Financial – DFS should be worth more. The stock is trading below levels of Q1, when it announced some bad news. I continue to believe the US economy is very strong, and DFS will benefit (and reflect the growth in higher EPS and stock price). Ford – F has underperformed due to the (predictable) ramp-up of the F150. The industry in general is out of favor, with investors using the excuse de jure to send stock prices lower. Yes China is slowing, but Europe is recovering and the US economy continues to do well. While not quite as cheap as General Motors , F offers nice appreciation potential and is a good “partner” to GM in the portfolio. General Electric (NYSE: GE )- I am thrilled about GE’s medium-term future. The near-term makes me a little nervous as the stock is near fully valued and there is uncertainty with respect to the Alstom and Electrolux transactions. Higher post-GE Capital tax rates also make stock appreciation more challenging. General Motors – Even more than F, GM is the stock everyone loves to hate. Looking at the numbers, it is hard to see much downside (or at least the risk/reward looks very favorable). As with F, China is concerning, but solid progress in Europe and the US should continue. Low gas prices for the foreseeable future put a backstop on highly profitable truck and SUV sales. I believe analysts are too concerned with unit sales and not focused enough on product mix. Harley Davidson – I may have bought HOG too early. However, HOG is an iconic brand and will, over time, garner the premium multiple it deserves (and has held historically). At the current 12.2x forward earnings, it is hard to see much downside (and a lot of upside). Housing prices in the US are rising; historically, HOG sales increases have been incredibly strongly correlated to appreciating housing prices (wealth effect x more retiring baby boomers). International Business Machines – IBM has been a disappointing investment. However, the Company has repositioned and is making solid progress. Improving Europe and progress in “Cloud” should drive a break-out sometime in the next 3 (or at the most three) quarters. Trading at less than 11x forward, there is little downside and much (potential) upside; a 3% dividend provides a bit of a reward for waiting. JPMorgan (NYSE: JPM )- JPM has performed very well, as have the financials. The stock has grown into its valuation and I am confident in twelve months the stock should perform well. As I have mentioned, I would like to add more in the sector, but recently investors have been a bit too eager. Siemens – Continues to be a play on recovering Europe and a weak US dollar. After GE and Honeywell (NYSE: HON ) have performed and appreciated, SIEGY remains a “show me” laggard. It may take a while, but SIEGY should deliver appropriate total returns through the investment period. Position Summary In my opinion, the positions continue to provide a nice balance of innate conservatism, multiple and earnings driven appreciation potential and exposure to a more mature stock market. Please keep in mind that my portfolio also consists of actively managed real estate, index funds (international, emerging markets and domestic) and bond proxies. I this in response to readers who thought the noted stocks were 100% of my investments and lacked diversity (if that were the case, I would agree). The CTR is a portfolio of stocks that in my opinion are conservative (strong reward vs. risk bias) and well positioned to outperform with below-average risk. I own all of the stocks in the CTR (I also own other positions which I consider speculative or otherwise inappropriate to recommend). I appreciate any feedback on individual securities and recommendations on equities to add to the CTR. This article reflects the personal opinions of the author and should not be relied upon or used as a basis in making an investment decision. Investors should always do their own due diligence prior to making an investment decision. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I am/we are long AAL, AAPL, BX, DFS, F, GE, GM, HOG, IBM, JPM, KKR, SIEGY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The CTR sold VLO after less than a month following double digit gains. While money was left on the table, the market in this name seemed a little “frothy”. After recently selling BX, the combination of a price drop and company strategic moves prompted the equity to be “welcomed back”; BX is still best-in-breed. AAPL is nearing an inflection point, while IBM may be nearing a breakout. GM is universally hated, but that has to change (or does it). I introduced the ” Conservative Total Return ” or CTR portfolio in August 2014 and try to provide monthly updates. The general philosophy of this method has allowed me to cumulatively beat, since 1999, the S&P 500 by a wide margin. As the market has “evolved”, so have the holdings. While the investments in the CTR are conservative, the portfolio is dynamic (as is the market and its “favorites”). In the June report, I noted broadening the portfolio base to add a transport (American Airlines (NASDAQ: AAL )) and an energy company (Valero (NYSE: VLO )). Unfortunately for the diversification strategy (but fortunate for the portfolio), VLO appreciated significantly and I exited the position. Why did I exit below my target price? Simply put, VLO appreciated fast in a short time. In reviewing my investing mistakes, I have learned that in the past I have been reluctant to sell; waiting for the market to “get it right” and hit my target price. Often my stubbornness has been costly. In recent years (with a lot of prompting from my wife), I have been more prone to take a quick profit as I am skeptical of “one-way elevator rides”. So when VLO jumped more than 10% in less than a month, I decided not to be greedy and took profits. Subsequently, VLO has considered to appreciate. While the greedy side of my wishes I held on, the logical side of me believes the market is over-reacting to perceived good news and is happy I sold. I will continue to monitor VLO and my re-enter if 1) the core value has changed and/or 2) pricing becomes favorable. During the month, I re-entered a favorite (Blackstone- (NYSE: BX )) that I had previously sold for reasons similar to VLO. In that case, BX had become “everyone’s favorite stock”, which always makes me nervous. I sold my position at $42.80 and re-entered at $39.45. While I was absent from the stock, BX made some moves I “approved of”, including accelerating the sale of US single family homes. The worsening energy market also makes it more likely BX will be able to deploy recently raised funds productively (previously I was concerned too much money was chasing too few deals and the funds could underperform). Even while selling (and subsequently adding KKR & Co. (NYSE: KKR )), I maintained BX was “best of breed”. I am happy to once again be holding this winner. An error I made was not being focused enough on the markets during the short-lived Greece/China crisis. I have been looking to increase exposure to financials, but at more attractive prices. Frankly, I wanted to buy Citigroup (NYSE: C ) and missed out. I may still enter C, or another financial, but the post-Q2 earnings response to the group was a little too optimistic for my tastes; there may be another opportunity during the next mini-crises or when enthusiasm pulls back. I am OK with missing an opportunity, if it means not overpaying and having my risk/reward skew too heavily toward risk. The Conservative Total Return Philosophy The essence of the CTR method is to combine a strong value bias with flexibility, opportunism and an ability to assimilate and respond to new information. The core philosophy will always be the same; however, as the economic cycle grows older, identifying the appropriate time to “harvest” becomes increasingly important. In assessing the prospects for all of the portfolio members, I feel good that the risk-reward dynamic is positive and, on a risk-adjusted basis, market beating (taking into account the strong value provided by dividends). Feedback from readers has been a partial motivator in my broadening my market segment exposure. The Individual Stocks The core stocks in the portfolio are (alphabetically): AAL, Apple (OTC: APPL ), Blackstone Discover Financial Services (NYSE: DFS ), Ford, (NYSE: F ), GE, General Motors (NYSE: GM ), Harley Davidson (NYSE: HOG ), International Business Machines (NYSE: IBM ), JPM, KKR and Siemens (OTCPK: SIEGY ). (click to enlarge) As the above chart confirms, my positions will generally have a strong bias toward dividends, reasonable valuation and a moderate (in most cases) PEG. Below are comments summarizing my interest in the equity. The chart also contains the appropriate metrics (valuation, fair value, potential gain). Holdings Apple – APPL has a bit of room to run, whether upward valuation is based on more than iPhone sales will be clarified following Q2 earnings. I believe the watch is a non-event (a disappointment for some bulls) and payments have potential. By the end of the year, AAPL has to demonstrate the catalyst for further appreciation or risk being “dead money” (or worse). I am not a “perma-bull” on APPL (though I use the Company’s products). Blackstone – As noted above, BX was re-introduced at a price reflecting a sold risk/reward opportunity. Still the best of breed, well-funded and poised to profit from market distress and volatility (especially in energy). The harvest of US residential is viewed by the author as a positive. Discover Financial – DFS should be worth more. The stock is trading below levels of Q1, when it announced some bad news. I continue to believe the US economy is very strong, and DFS will benefit (and reflect the growth in higher EPS and stock price). Ford – F has underperformed due to the (predictable) ramp-up of the F150. The industry in general is out of favor, with investors using the excuse de jure to send stock prices lower. Yes China is slowing, but Europe is recovering and the US economy continues to do well. While not quite as cheap as General Motors , F offers nice appreciation potential and is a good “partner” to GM in the portfolio. General Electric (NYSE: GE )- I am thrilled about GE’s medium-term future. The near-term makes me a little nervous as the stock is near fully valued and there is uncertainty with respect to the Alstom and Electrolux transactions. Higher post-GE Capital tax rates also make stock appreciation more challenging. General Motors – Even more than F, GM is the stock everyone loves to hate. Looking at the numbers, it is hard to see much downside (or at least the risk/reward looks very favorable). As with F, China is concerning, but solid progress in Europe and the US should continue. Low gas prices for the foreseeable future put a backstop on highly profitable truck and SUV sales. I believe analysts are too concerned with unit sales and not focused enough on product mix. Harley Davidson – I may have bought HOG too early. However, HOG is an iconic brand and will, over time, garner the premium multiple it deserves (and has held historically). At the current 12.2x forward earnings, it is hard to see much downside (and a lot of upside). Housing prices in the US are rising; historically, HOG sales increases have been incredibly strongly correlated to appreciating housing prices (wealth effect x more retiring baby boomers). International Business Machines – IBM has been a disappointing investment. However, the Company has repositioned and is making solid progress. Improving Europe and progress in “Cloud” should drive a break-out sometime in the next 3 (or at the most three) quarters. Trading at less than 11x forward, there is little downside and much (potential) upside; a 3% dividend provides a bit of a reward for waiting. JPMorgan (NYSE: JPM )- JPM has performed very well, as have the financials. The stock has grown into its valuation and I am confident in twelve months the stock should perform well. As I have mentioned, I would like to add more in the sector, but recently investors have been a bit too eager. Siemens – Continues to be a play on recovering Europe and a weak US dollar. After GE and Honeywell (NYSE: HON ) have performed and appreciated, SIEGY remains a “show me” laggard. It may take a while, but SIEGY should deliver appropriate total returns through the investment period. Position Summary In my opinion, the positions continue to provide a nice balance of innate conservatism, multiple and earnings driven appreciation potential and exposure to a more mature stock market. Please keep in mind that my portfolio also consists of actively managed real estate, index funds (international, emerging markets and domestic) and bond proxies. I this in response to readers who thought the noted stocks were 100% of my investments and lacked diversity (if that were the case, I would agree). The CTR is a portfolio of stocks that in my opinion are conservative (strong reward vs. risk bias) and well positioned to outperform with below-average risk. I own all of the stocks in the CTR (I also own other positions which I consider speculative or otherwise inappropriate to recommend). I appreciate any feedback on individual securities and recommendations on equities to add to the CTR. This article reflects the personal opinions of the author and should not be relied upon or used as a basis in making an investment decision. Investors should always do their own due diligence prior to making an investment decision. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I am/we are long AAL, AAPL, BX, DFS, F, GE, GM, HOG, IBM, JPM, KKR, SIEGY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News