Scalper1 News

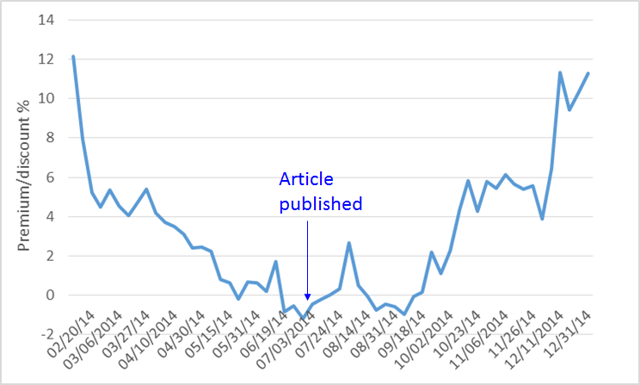

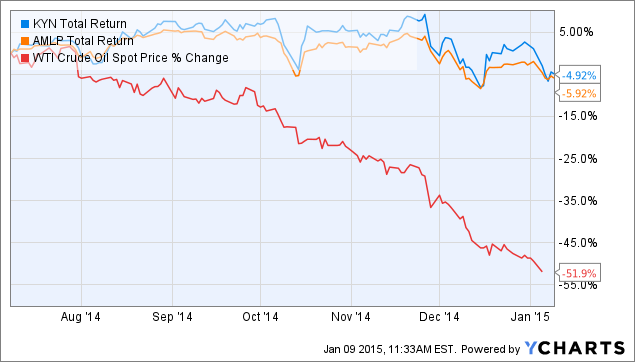

Six months ago, I suggested that investors buy Kayne Anderson MLP Investment Company due to its unusually large deviation from its historical premium/discount value. The KYN-AMLP pairs trade was in positive territory for nearly all of the trade, and actually reached +6% three months into the trade. As a hedged strategy, investors in the KYN-AMLP trade were insulated from fluctuations in the price of oil, but could still benefit from mean reversion in CEF premium/discount values. Six months ago, I made the case to buy Kayne Anderson MLP Investment (NYSE: KYN ) due to its abnormally large deviation from its historical premium/discount value. KYN’s strong outperformance over its benchmark, the Alerian MLP ETF (NYSEARCA: AMLP ), allowed the fund to maintain an average premium of 9% over the last five years. However, its lackluster price performance in early 2014 had caused the KYN to veer into discount territory, something that had not been seen since 2009. Given that KYN had actually outperformed AMLP on a year-to-date NAV basis at the time of the article, I reasoned that mean reversion would cause KYN to outperform its benchmark in the months ahead. Therefore, I suggested for investors to buy KYN (and to sell AMLP). Six months later, the KYN:AMLP ratio has barely changed. However, note that this trade was in positive territory for nearly all of the six months. Moreover, about 3 months into the trade, KYN had actually outperformed AMLP by nearly 6%. (click to enlarge) Part of this reason was due to the reversion of KYN’s discount to its historical mean. In other words, investors in KYN were benefiting simply through premium expansion rather than due to gains or losses of the underlying portfolio. The following chart shows the premium/discount of KYN in 2014 (graph reconstructed from data supplied by Kayne Anderson ). (click to enlarge) Therefore, an investor in the KYN:AMLP pair might have thought to harvest their profits in KYN as its premium reverted higher. While 6% in three months isn’t anything spectacular, keep in mind that this is was a pairs trade, meaning that it is essentially a market neutral strategy that limits downside risk. Moreover, it works out to be annualized profit of 24%, which is similar to the ETW-EXG pairs trade I presented previously. Obviously, both KYN and AMLP have done rather poorly over the past several months as the price of oil tanked. I won’t hide the fact that an investor who bought KYN at the time of publication of the article would be down around 5%. Yet, the investor who swapped his existing shares of AMLP for KYN would have done better than the investor who simply held on to AMLP. (Note that I wouldn’t recommend shorting AMLP outright due to the costs involved). KYN Total Return Price data by YCharts As I have described many times in previous articles, mean reversion of premium/discount values in CEFs is a way to add an extra layer of performance on top of your CEF holdings. Academic research supporting the notion of mean reversion in CEFs is abundant (e.g. here and here ). Scalper1 News

Six months ago, I suggested that investors buy Kayne Anderson MLP Investment Company due to its unusually large deviation from its historical premium/discount value. The KYN-AMLP pairs trade was in positive territory for nearly all of the trade, and actually reached +6% three months into the trade. As a hedged strategy, investors in the KYN-AMLP trade were insulated from fluctuations in the price of oil, but could still benefit from mean reversion in CEF premium/discount values. Six months ago, I made the case to buy Kayne Anderson MLP Investment (NYSE: KYN ) due to its abnormally large deviation from its historical premium/discount value. KYN’s strong outperformance over its benchmark, the Alerian MLP ETF (NYSEARCA: AMLP ), allowed the fund to maintain an average premium of 9% over the last five years. However, its lackluster price performance in early 2014 had caused the KYN to veer into discount territory, something that had not been seen since 2009. Given that KYN had actually outperformed AMLP on a year-to-date NAV basis at the time of the article, I reasoned that mean reversion would cause KYN to outperform its benchmark in the months ahead. Therefore, I suggested for investors to buy KYN (and to sell AMLP). Six months later, the KYN:AMLP ratio has barely changed. However, note that this trade was in positive territory for nearly all of the six months. Moreover, about 3 months into the trade, KYN had actually outperformed AMLP by nearly 6%. (click to enlarge) Part of this reason was due to the reversion of KYN’s discount to its historical mean. In other words, investors in KYN were benefiting simply through premium expansion rather than due to gains or losses of the underlying portfolio. The following chart shows the premium/discount of KYN in 2014 (graph reconstructed from data supplied by Kayne Anderson ). (click to enlarge) Therefore, an investor in the KYN:AMLP pair might have thought to harvest their profits in KYN as its premium reverted higher. While 6% in three months isn’t anything spectacular, keep in mind that this is was a pairs trade, meaning that it is essentially a market neutral strategy that limits downside risk. Moreover, it works out to be annualized profit of 24%, which is similar to the ETW-EXG pairs trade I presented previously. Obviously, both KYN and AMLP have done rather poorly over the past several months as the price of oil tanked. I won’t hide the fact that an investor who bought KYN at the time of publication of the article would be down around 5%. Yet, the investor who swapped his existing shares of AMLP for KYN would have done better than the investor who simply held on to AMLP. (Note that I wouldn’t recommend shorting AMLP outright due to the costs involved). KYN Total Return Price data by YCharts As I have described many times in previous articles, mean reversion of premium/discount values in CEFs is a way to add an extra layer of performance on top of your CEF holdings. Academic research supporting the notion of mean reversion in CEFs is abundant (e.g. here and here ). Scalper1 News

Scalper1 News