Scalper1 News

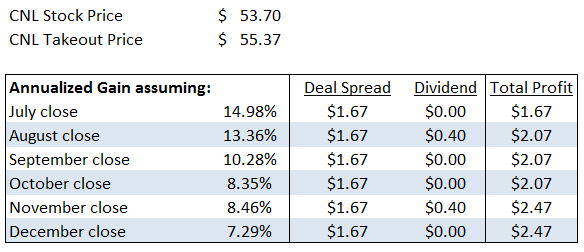

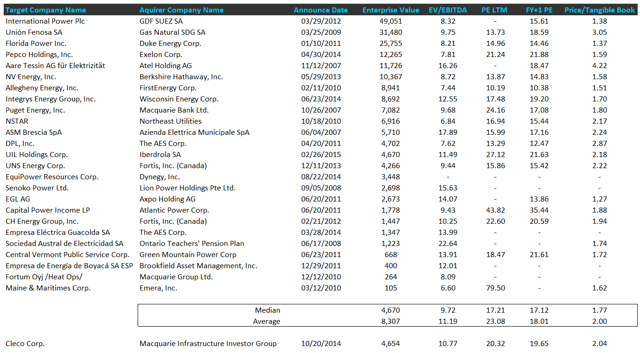

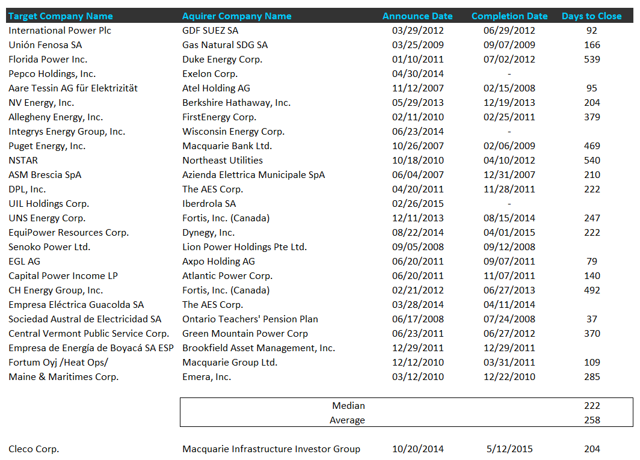

Summary Investors can earn a low-risk 13% annualized return by purchasing the stock at today’s price and waiting for the transaction to close. Mr. Market doesn’t appear to be properly accounting for the merger agreement, which calls for CNL to continue to pay its sizable dividend while shareholders wait for closing. CNL shareholders have already voted on and approved the transaction by a wide margin. Anyone who follows our work knows our typical modus operandi focuses on finding undervalued contrarian investments that offer asymmetric risk/reward opportunities. While we firmly plan to “stick to our knitting,” we occasionally look to supplement our returns with low-risk, high-return (relatively speaking) merger arbitrage opportunities. As Warren Buffett once said: “Give a man a fish, and you feed him for a day. Teach him how to arbitrage and you feed him forever.” We see a compelling risk/reward profile for a merger arbitrage trade of Cleco Inc. (NYSE: CNL ). We believe an investor can earn a low-risk 13% annualized return by purchasing the stock at today’s price and waiting for the transaction to close. Our analysis suggests there is a low probability of the deal not consummating. This outsized return opportunity exists because Mr. Market does not appear to be properly accounting for the merger agreement, which calls for CNL to continue to pay its sizable dividend while shareholders wait for the deal to close. Company overview Cleco Corporation is a regulated electric utility company headquartered in Pineville, Louisiana. CNL is engaged principally in the generation, transmission, distribution, and sale of electricity, primarily in Louisiana. Cleco Power owns 11 generating units with a total nameplate capacity of 3,340 megawatts. Cleco Power serves approximately 286,000 customers in Louisiana through its retail business, and it supplies wholesale power in Louisiana and Mississippi. The Deal On October 20, 2014, CNL announced that it had entered into an agreement to be acquired by an investor group led by Macquarie Infrastructure and Real Assets, British Columbia Investment Management Corporation, and John Hancock Financial. Under the terms of the definitive merger agreement , the investor group will acquire all outstanding shares of CNL for $55.37 per share in cash. The merger agreement also calls for CNL shareholders to continue to receive the sizeable dividend payments until the deal closes. CNL pays a quarterly dividend of $0.40 per share, which equates to a 3.00% yield based on today’s closing price. 10/20/2014 merger press release: “Prior to closing, the transaction is expected to have no impact on Cleco’s dividend. Cleco shareholders will continue to receive dividends at an annualized rate of $1.60 per share until closing.” The Payout We believe an investor can earn a 13% annualized return by purchasing the stock at today’s price and waiting for the transaction to close. With the stock currently trading at $53.70, the relatively large deal spread combined with an attractive dividend payout presents a compelling risk/reward opportunity for a merger arbitrage trade. This outsized return opportunity exists because Mr. Market does not appear to be properly accounting for the merger agreement, which calls for CNL to continue to pay its sizable dividend while shareholders wait for the deal to close. The table below shows that CNL will pay a dividend in August and November if the transaction has not closed by then. The column titled “Total Profit” shows the cumulative profit that will accrue to an investor under the different closing dates. Our estimated annualized return is based on our expectation that the transaction will close by the end of August 2015. We think this is a reasonable estimate based on our research (details below). Keep in mind that the longer the deal takes to close, the lower the annualized return will be because of the time component of the calculation. Low-risk Transaction We believe the CNL transaction has a high probability of closing for the following reasons: – Modest deal size, all cash deal: This transaction is of average size and it calls for the Investor Group to pay CNL shareholders in cash. Given today’s accommodative lending environment, we believe the Investor Group will easily be able to raise the necessary funds. – Shareholder support: CNL shareholders have already voted on and approved the transaction by a wide margin. The merger proposal passed with more than 94% of the votes cast. – Termination fee: The merger agreement calls for the Investor Group to pay CNL $180m if they fail to close the transaction. – Fair valuation for the deal: Regulated utility assets are attractive in a world with extremely low interest rates. Furthermore, M&A activity has led to regulated utility assets becoming increasingly scarce. We analyzed the CNL transaction versus recent comparable deals and found the valuation multiples to be consistent with what investors have been willing to pay for similar assets. (click to enlarge) Source: FactSet Should the deal fail to close, we believe CNL could be sold to a different party for a similar price. This view is based on the recent history of CNL and how the current merger agreement came about. In June 2014, CNL received an unsolicited bid from the Canadian investment group, Borealis Infrastructure. In response, CNL retained Goldman Sachs to run a formal sale process. At the time, press reports said the company was seeking a deal in the range of $61-62 per share. Our research indicates that four different parties made serious overtures for CNL: Macquarie Group, Iberdrola, Borealis Infrastructure, and CenterPoint Energy. Regulatory Approvals Needed CNL still needs to receive the following regulatory approvals before the transaction can close: 1) Hart-Scott-Rodino Antitrust approval: We view this approval as a formality. The Investor Group acquiring CNL is a financial buyer and has no other competing businesses in the operating footprint. The application has already been filed. 2) Federal Communications Commission approval: We think approval of license transfers is a formality. CNL expects to file the application this quarter. 3) Foreign Investment in the United States approval: We think this approval is a formality. The financial buyers are from Canada and Australia. CNL expects to file the application this quarter. 4) Federal Energy Regulatory Commission approval: We expect a timely approval by FERC given the Commission’s stance on similar M&A transactions over the years. The application has already been filed. 5) Louisiana Public Services Commission approval: We expect this approval to take the longest but we believe the LPSC will grant an approval given the accommodative concessions made by the acquiring Investor Group. These concessions include promises to maintain employment levels and employee compensation, a commitment to appoint individuals from Louisiana to the board of directors, and a vow to remain operated by local management and headquartered in Pineville, Louisiana. The merger application was filed with the LPSC in February with a status hearing last month. We analyzed past utility deals that have occurred in Louisiana and found that historically the LPSC has approved these types of transactions (despite the occasional saber rattling). Perryville Energy Partners LLC, Dolet Hills Power Plant Operations, and Cajun Electric Power Cooperative Inc. are all examples of utility transactions that have been allowed to proceed. Utility Transactions Historically Take ~250 Days to Close We analyzed the group of comparable utility transactions cited above and found that average “days to close” was 258 days. It has been 204 days since the definitive agreement was announced. If the transaction closes at the end of August, like we expect, it will be 314 days, which seems reasonable compared to industry history. (click to enlarge) Source: FactSet Conclusion We see a compelling risk/reward profile for a merger arbitrage trade of CNL. We believe an investor can earn a low-risk 13% annualized return by purchasing the stock at today’s price and waiting for the transaction to close. Our analysis suggests there is a low probability of the deal not consummating. This outsized return opportunity exists because Mr. Market does not appear to be properly accounting for the merger agreement, which calls for CNL to continue to pay its sizable dividend while shareholders wait for the deal to close. Should this transaction fail to close, we don’t think investors would suffer a permanent impairment of capital as CNL could likely sell itself for a similar price to a different party. Disclosure: The author is long CNL. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: The author and/or employer may buy or sell shares in any company mentioned, at any time, without notice. The information contained herein is believed to be accurate as of the posting date. Readers should conduct their own verification of any information or analyses contained in this report. The author undertakes no obligation to update this report based on any future events or information. This article represents best efforts to convey a fact-based opinion. Our conclusions may be incorrect. This is not a recommendation to buy or sell any securities. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of the Author. Scalper1 News

Summary Investors can earn a low-risk 13% annualized return by purchasing the stock at today’s price and waiting for the transaction to close. Mr. Market doesn’t appear to be properly accounting for the merger agreement, which calls for CNL to continue to pay its sizable dividend while shareholders wait for closing. CNL shareholders have already voted on and approved the transaction by a wide margin. Anyone who follows our work knows our typical modus operandi focuses on finding undervalued contrarian investments that offer asymmetric risk/reward opportunities. While we firmly plan to “stick to our knitting,” we occasionally look to supplement our returns with low-risk, high-return (relatively speaking) merger arbitrage opportunities. As Warren Buffett once said: “Give a man a fish, and you feed him for a day. Teach him how to arbitrage and you feed him forever.” We see a compelling risk/reward profile for a merger arbitrage trade of Cleco Inc. (NYSE: CNL ). We believe an investor can earn a low-risk 13% annualized return by purchasing the stock at today’s price and waiting for the transaction to close. Our analysis suggests there is a low probability of the deal not consummating. This outsized return opportunity exists because Mr. Market does not appear to be properly accounting for the merger agreement, which calls for CNL to continue to pay its sizable dividend while shareholders wait for the deal to close. Company overview Cleco Corporation is a regulated electric utility company headquartered in Pineville, Louisiana. CNL is engaged principally in the generation, transmission, distribution, and sale of electricity, primarily in Louisiana. Cleco Power owns 11 generating units with a total nameplate capacity of 3,340 megawatts. Cleco Power serves approximately 286,000 customers in Louisiana through its retail business, and it supplies wholesale power in Louisiana and Mississippi. The Deal On October 20, 2014, CNL announced that it had entered into an agreement to be acquired by an investor group led by Macquarie Infrastructure and Real Assets, British Columbia Investment Management Corporation, and John Hancock Financial. Under the terms of the definitive merger agreement , the investor group will acquire all outstanding shares of CNL for $55.37 per share in cash. The merger agreement also calls for CNL shareholders to continue to receive the sizeable dividend payments until the deal closes. CNL pays a quarterly dividend of $0.40 per share, which equates to a 3.00% yield based on today’s closing price. 10/20/2014 merger press release: “Prior to closing, the transaction is expected to have no impact on Cleco’s dividend. Cleco shareholders will continue to receive dividends at an annualized rate of $1.60 per share until closing.” The Payout We believe an investor can earn a 13% annualized return by purchasing the stock at today’s price and waiting for the transaction to close. With the stock currently trading at $53.70, the relatively large deal spread combined with an attractive dividend payout presents a compelling risk/reward opportunity for a merger arbitrage trade. This outsized return opportunity exists because Mr. Market does not appear to be properly accounting for the merger agreement, which calls for CNL to continue to pay its sizable dividend while shareholders wait for the deal to close. The table below shows that CNL will pay a dividend in August and November if the transaction has not closed by then. The column titled “Total Profit” shows the cumulative profit that will accrue to an investor under the different closing dates. Our estimated annualized return is based on our expectation that the transaction will close by the end of August 2015. We think this is a reasonable estimate based on our research (details below). Keep in mind that the longer the deal takes to close, the lower the annualized return will be because of the time component of the calculation. Low-risk Transaction We believe the CNL transaction has a high probability of closing for the following reasons: – Modest deal size, all cash deal: This transaction is of average size and it calls for the Investor Group to pay CNL shareholders in cash. Given today’s accommodative lending environment, we believe the Investor Group will easily be able to raise the necessary funds. – Shareholder support: CNL shareholders have already voted on and approved the transaction by a wide margin. The merger proposal passed with more than 94% of the votes cast. – Termination fee: The merger agreement calls for the Investor Group to pay CNL $180m if they fail to close the transaction. – Fair valuation for the deal: Regulated utility assets are attractive in a world with extremely low interest rates. Furthermore, M&A activity has led to regulated utility assets becoming increasingly scarce. We analyzed the CNL transaction versus recent comparable deals and found the valuation multiples to be consistent with what investors have been willing to pay for similar assets. (click to enlarge) Source: FactSet Should the deal fail to close, we believe CNL could be sold to a different party for a similar price. This view is based on the recent history of CNL and how the current merger agreement came about. In June 2014, CNL received an unsolicited bid from the Canadian investment group, Borealis Infrastructure. In response, CNL retained Goldman Sachs to run a formal sale process. At the time, press reports said the company was seeking a deal in the range of $61-62 per share. Our research indicates that four different parties made serious overtures for CNL: Macquarie Group, Iberdrola, Borealis Infrastructure, and CenterPoint Energy. Regulatory Approvals Needed CNL still needs to receive the following regulatory approvals before the transaction can close: 1) Hart-Scott-Rodino Antitrust approval: We view this approval as a formality. The Investor Group acquiring CNL is a financial buyer and has no other competing businesses in the operating footprint. The application has already been filed. 2) Federal Communications Commission approval: We think approval of license transfers is a formality. CNL expects to file the application this quarter. 3) Foreign Investment in the United States approval: We think this approval is a formality. The financial buyers are from Canada and Australia. CNL expects to file the application this quarter. 4) Federal Energy Regulatory Commission approval: We expect a timely approval by FERC given the Commission’s stance on similar M&A transactions over the years. The application has already been filed. 5) Louisiana Public Services Commission approval: We expect this approval to take the longest but we believe the LPSC will grant an approval given the accommodative concessions made by the acquiring Investor Group. These concessions include promises to maintain employment levels and employee compensation, a commitment to appoint individuals from Louisiana to the board of directors, and a vow to remain operated by local management and headquartered in Pineville, Louisiana. The merger application was filed with the LPSC in February with a status hearing last month. We analyzed past utility deals that have occurred in Louisiana and found that historically the LPSC has approved these types of transactions (despite the occasional saber rattling). Perryville Energy Partners LLC, Dolet Hills Power Plant Operations, and Cajun Electric Power Cooperative Inc. are all examples of utility transactions that have been allowed to proceed. Utility Transactions Historically Take ~250 Days to Close We analyzed the group of comparable utility transactions cited above and found that average “days to close” was 258 days. It has been 204 days since the definitive agreement was announced. If the transaction closes at the end of August, like we expect, it will be 314 days, which seems reasonable compared to industry history. (click to enlarge) Source: FactSet Conclusion We see a compelling risk/reward profile for a merger arbitrage trade of CNL. We believe an investor can earn a low-risk 13% annualized return by purchasing the stock at today’s price and waiting for the transaction to close. Our analysis suggests there is a low probability of the deal not consummating. This outsized return opportunity exists because Mr. Market does not appear to be properly accounting for the merger agreement, which calls for CNL to continue to pay its sizable dividend while shareholders wait for the deal to close. Should this transaction fail to close, we don’t think investors would suffer a permanent impairment of capital as CNL could likely sell itself for a similar price to a different party. Disclosure: The author is long CNL. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: The author and/or employer may buy or sell shares in any company mentioned, at any time, without notice. The information contained herein is believed to be accurate as of the posting date. Readers should conduct their own verification of any information or analyses contained in this report. The author undertakes no obligation to update this report based on any future events or information. This article represents best efforts to convey a fact-based opinion. Our conclusions may be incorrect. This is not a recommendation to buy or sell any securities. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of the Author. Scalper1 News

Scalper1 News