Scalper1 News

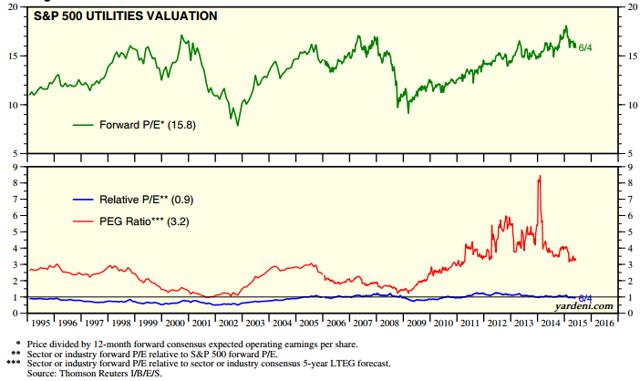

TECO Energy is valued at a substantial discount to its peers based on its forward PEG ratio. TECO Energy offers a current yield of 5.02%. The stigma of its discontinued coal operations along with a dismal dividend growth profile is holding back share prices, but should change with its renewed focus on regulated assets. Are you a value buyer looking for peer undervaluation or are you looking to garner higher income from your invested capital, or a little bit of both? If so, TECO Energy (NYSE: TE ) should be of interest. TE is trading at a comparatively large discount to its anticipated growth rate for the utility sector and the current yield is 5.02%. One measure of fundamental value is the PEG ratio, or price to earnings to earnings growth. Utilities are always on the top of the PEG valuation scale due to slow growth and outsized yields. In most sectors, fair valuation is usually considered at 1.0 for large caps and 1.2 for smaller caps. Over 1.2 is considered overvalued and below 1.0 is undervalued. For utilities, however, it is not uncommon for the PEG ratio to be over 3.0. The PEG ratio for utilities is best used for peer comparisons. One tool that has been used since the early 1970s is the forward PEG ratio, or fundamental valuation based on anticipated 5-yr growth rates and forward earnings estimates. The forward PEG has been one of my personal uppermost due diligence considerations since researching stocks using Value Line in the local library way, way before the internet. The reference librarian got to know me pretty well. However, I digress. Yardeni.com offers an interesting chart of the forward PEG for the utility sector going back 20 years, as represented by the S&P 500 Utility Sector. Below is the chart of the current forward PEG ratio (green line), relative sector P/E to the S&P 500 forward P/E (blue line), and the current forward PEG ratio (red line): (click to enlarge) The current utility sector forward PEG is 3.2 and the average forward P/E is 15.8, reflecting a sector-anticipated growth rate of 4.9%. Enter TECO Energy. The company is going through a transition by selling its coal mining operations to focus solely as a regulated natural gas and electric utility. Its geographic coverage is Tampa Electric (700,000 customers) and Peoples Gas (350,000 customers) in Florida and recently acquired New Mexico Gas (513,000 customers). Earnings per share guidance by management in 2015 is in the $1.08 to $1.10 range, with 2016 consensus estimates of $1.18 to $1.22. Progression in estimates is based on an expansion of its regulated asset base of between 4% and 7%, recent Florida rate case approval with agreed rate increases until 2018, and an allowed ROE in the favorable 10.25% range. TE’s earnings growth rate is offered at between 9.0% and 11.5%, and substantially above the sector average of 4.9%. TECO is trying to sell its coal producing assets in Virginia, Kentucky, and Tennessee. Held as a discontinued asset since third quarter 2014, TECO Coal LLC had a buyer for $80 million in cash and potential future payments of $60 million based on performance targets. However, with the current financial stress of the coal industry, the buyer was unable to acquire the necessary financing and the sale did not close earlier this month. Last week, TE announced a new buyer had stepped in with a 30-day close schedule, but neither terms nor buyers were disclosed. For all intents and purposes, these assets have been written down and the immediate benefit to shareholders from the sale will be a one-time cash inflow of between $0.20 and $0.50 a share. Historically, the coal business has been a large segment of earnings, representing upwards of 30% of net income. As recently as 2011, coal generated over $50 million in income, and coal could be counted on to supply earnings per share of between $0.25 and $0.40 annually. Using the lowest 2016 earnings estimates of $1.13 and the lower project growth rate of 9%, TE’s forward PEG would be 1.7, substantially below the 3.2 of the sector. The current valuation of TE at $17.80 equates to a sector-average forward P/E of 15.7. The undervaluation is based on a much higher growth rate profile. TE’s current yield is 5.02% and represents a substantial income advantage to the sector average 3.5% yield. TE falls in the top tier of utility dividend payers for yield, but offers the disadvantages of a high payout ratio and very low historic dividend growth. While earnings growth is expected to be above average, until the payout ratio declines from around 87% last year to a more comfortable 65% to 70%, investors should not expect dividend growth above a mere nominal level. For example, 3-yr TE dividend growth is 1.3% and 5-yr dividend growth is 1.9%. The best investors should expect over the next three years is inflation-matching dividend growth. However, the current yield of 5.02% should pique the interest of income seekers. Historically, natural gas utilities offer some of the lowest yields in the sector. Using Hennessey Natural Gas Utility Fund (MUTF: GASFX ) and a few of the more popular gas utility stocks as proxies, the representative yield could be between 2.1% and 3.3%. With 50% of customer count from its gas utilities, TE’s yield is comfortably above these averages. Management has generated returns on invested capital in excess of sector average. With peer-average in the 4.5% to 5.0% range, TE’s 5-yr average ROIC is 6.0%, and 3-yr average ROIC is 5.5%. However, their cost of capital is high at 5.7%, according to ThatsWACC.com. TECO could be either an acquirer of smaller utilities, such as its purchase of New Mexico Gas, or as a candidate in the continuing march of utility consolidation. Until the stigma of coal is washed from investors’ memory, TE will trade based on its yield and not its growth prospects. If management delivers on its regulated growth platform, today’s share price and corresponding yield could be looked at as being both cheap and high yield. Author’s Note: Please review disclosure in Author’s profile. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in TE over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

TECO Energy is valued at a substantial discount to its peers based on its forward PEG ratio. TECO Energy offers a current yield of 5.02%. The stigma of its discontinued coal operations along with a dismal dividend growth profile is holding back share prices, but should change with its renewed focus on regulated assets. Are you a value buyer looking for peer undervaluation or are you looking to garner higher income from your invested capital, or a little bit of both? If so, TECO Energy (NYSE: TE ) should be of interest. TE is trading at a comparatively large discount to its anticipated growth rate for the utility sector and the current yield is 5.02%. One measure of fundamental value is the PEG ratio, or price to earnings to earnings growth. Utilities are always on the top of the PEG valuation scale due to slow growth and outsized yields. In most sectors, fair valuation is usually considered at 1.0 for large caps and 1.2 for smaller caps. Over 1.2 is considered overvalued and below 1.0 is undervalued. For utilities, however, it is not uncommon for the PEG ratio to be over 3.0. The PEG ratio for utilities is best used for peer comparisons. One tool that has been used since the early 1970s is the forward PEG ratio, or fundamental valuation based on anticipated 5-yr growth rates and forward earnings estimates. The forward PEG has been one of my personal uppermost due diligence considerations since researching stocks using Value Line in the local library way, way before the internet. The reference librarian got to know me pretty well. However, I digress. Yardeni.com offers an interesting chart of the forward PEG for the utility sector going back 20 years, as represented by the S&P 500 Utility Sector. Below is the chart of the current forward PEG ratio (green line), relative sector P/E to the S&P 500 forward P/E (blue line), and the current forward PEG ratio (red line): (click to enlarge) The current utility sector forward PEG is 3.2 and the average forward P/E is 15.8, reflecting a sector-anticipated growth rate of 4.9%. Enter TECO Energy. The company is going through a transition by selling its coal mining operations to focus solely as a regulated natural gas and electric utility. Its geographic coverage is Tampa Electric (700,000 customers) and Peoples Gas (350,000 customers) in Florida and recently acquired New Mexico Gas (513,000 customers). Earnings per share guidance by management in 2015 is in the $1.08 to $1.10 range, with 2016 consensus estimates of $1.18 to $1.22. Progression in estimates is based on an expansion of its regulated asset base of between 4% and 7%, recent Florida rate case approval with agreed rate increases until 2018, and an allowed ROE in the favorable 10.25% range. TE’s earnings growth rate is offered at between 9.0% and 11.5%, and substantially above the sector average of 4.9%. TECO is trying to sell its coal producing assets in Virginia, Kentucky, and Tennessee. Held as a discontinued asset since third quarter 2014, TECO Coal LLC had a buyer for $80 million in cash and potential future payments of $60 million based on performance targets. However, with the current financial stress of the coal industry, the buyer was unable to acquire the necessary financing and the sale did not close earlier this month. Last week, TE announced a new buyer had stepped in with a 30-day close schedule, but neither terms nor buyers were disclosed. For all intents and purposes, these assets have been written down and the immediate benefit to shareholders from the sale will be a one-time cash inflow of between $0.20 and $0.50 a share. Historically, the coal business has been a large segment of earnings, representing upwards of 30% of net income. As recently as 2011, coal generated over $50 million in income, and coal could be counted on to supply earnings per share of between $0.25 and $0.40 annually. Using the lowest 2016 earnings estimates of $1.13 and the lower project growth rate of 9%, TE’s forward PEG would be 1.7, substantially below the 3.2 of the sector. The current valuation of TE at $17.80 equates to a sector-average forward P/E of 15.7. The undervaluation is based on a much higher growth rate profile. TE’s current yield is 5.02% and represents a substantial income advantage to the sector average 3.5% yield. TE falls in the top tier of utility dividend payers for yield, but offers the disadvantages of a high payout ratio and very low historic dividend growth. While earnings growth is expected to be above average, until the payout ratio declines from around 87% last year to a more comfortable 65% to 70%, investors should not expect dividend growth above a mere nominal level. For example, 3-yr TE dividend growth is 1.3% and 5-yr dividend growth is 1.9%. The best investors should expect over the next three years is inflation-matching dividend growth. However, the current yield of 5.02% should pique the interest of income seekers. Historically, natural gas utilities offer some of the lowest yields in the sector. Using Hennessey Natural Gas Utility Fund (MUTF: GASFX ) and a few of the more popular gas utility stocks as proxies, the representative yield could be between 2.1% and 3.3%. With 50% of customer count from its gas utilities, TE’s yield is comfortably above these averages. Management has generated returns on invested capital in excess of sector average. With peer-average in the 4.5% to 5.0% range, TE’s 5-yr average ROIC is 6.0%, and 3-yr average ROIC is 5.5%. However, their cost of capital is high at 5.7%, according to ThatsWACC.com. TECO could be either an acquirer of smaller utilities, such as its purchase of New Mexico Gas, or as a candidate in the continuing march of utility consolidation. Until the stigma of coal is washed from investors’ memory, TE will trade based on its yield and not its growth prospects. If management delivers on its regulated growth platform, today’s share price and corresponding yield could be looked at as being both cheap and high yield. Author’s Note: Please review disclosure in Author’s profile. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in TE over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News