CF Industries CF is set to release its fourth-quarter 2016 results after the bell on Feb 15.

Last quarter, the fertilizer maker had delivered a positive earnings surprise of 160%. Its sales, however, fell by double digits year over year on reduced selling prices across all segments, and missed expectations.

CF Industries missed the Zacks Consensus Estimate in three of the trailing four quarters while beating once with an average negative surprise of 18.83%. Let’s see how things are shaping up for this announcement.

Factors to Consider

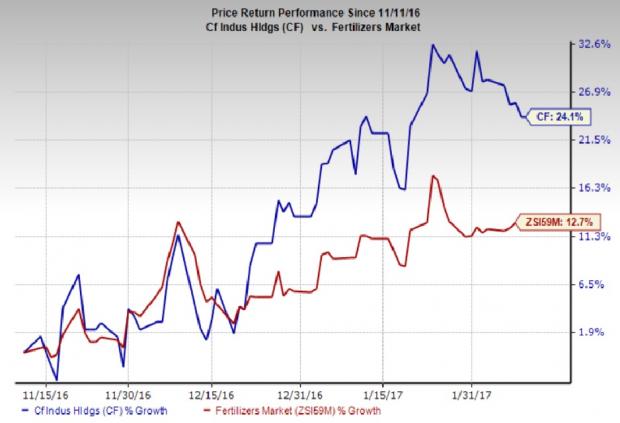

CF Industries has outperformed the Zacks categorized Fertilizers industry in the past three months, aided by its forecast-topping earnings performance in the last quarter and efforts to boost production capacity. The company’s shares have gained around 24.1% over this period, compared with roughly 12.7% gain recorded by the industry.

CF Industries is well placed to gain from its efforts to expand production capacity. The company has completed its capacity expansion projects which should drive its growth and increase its cash generation capability.

The company, in late 2016, announced the completion of its capacity expansion projects with the successful start of new ammonia and urea plants at its Port Neal, IA, Nitrogen Complex. The annual gross ammonia capacity at Port Neal now stands at 1.2 million tons, higher than the previous capacity of 380,000 tons.

CF Industries is also expected to benefit from higher nitrogen demand driven by healthy U.S. corn plantations. Notwithstanding the current oversupply in the industry, the company sees global nitrogen demand to grow roughly 2% annually. The company has built a strong UAN order book.

However, CF Industries continues to see pricing pressure as witnessed in the last reported quarter. Depressed global energy prices and excess capacity have contributed to a softer nitrogen pricing environment.

Nitrogen prices are expected to remain under pressure in the near term due to elevated supply. Abundant nitrogen supply driven by new production capacity is expected to hurt prices in the final quarter of 2016 as well as in 2017.

As such, a difficult pricing environment is expected to continue to weigh on the company’s sales in the December quarter.

CF Industries Holdings, Inc. Price and EPS Surprise

CF Industries Holdings, Inc. Price and EPS Surprise | CF Industries Holdings, Inc. Quote

Earnings Whispers

Our proven model does not conclusively show that CF Industries is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below:

Zacks ESP: Earnings ESP for CF Industries is currently pegged at -50.00%. This is because the Most Accurate Estimate stands at a loss of 9 cents per share while the Zacks Consensus Estimate is pegged at a loss of 6 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter .

Zacks Rank: CF Industries has a Zacks Rank #3 which increases the predictive power of ESP. However, the company’s negative ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks that Warrant a Look

Here are some other companies in the basic materials sector that you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Iamgold Corporation IAG has an Earnings ESP of +100% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here .

Vale S.A. VALE has an Earnings ESP of +34.29% and carries a Zacks Rank #2.

Intrepid Potash, Inc. IPI has an Earnings ESP of +20% and carries a Zacks Rank #2.

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2017?

Who wouldn’t? As of early December, the 2016 Top 10 produced 5 double-digit winners including oil and natural gas giant Pioneer Natural Resources which racked up a stellar +50% gain. The new list is painstakingly hand-picked from 4,400 companies covered by the Zacks Rank. Be among the very first to see it>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Intrepid Potash, Inc (IPI): Free Stock Analysis Report

Iamgold Corporation (IAG): Free Stock Analysis Report

VALE S.A. (VALE): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International