Scalper1 News

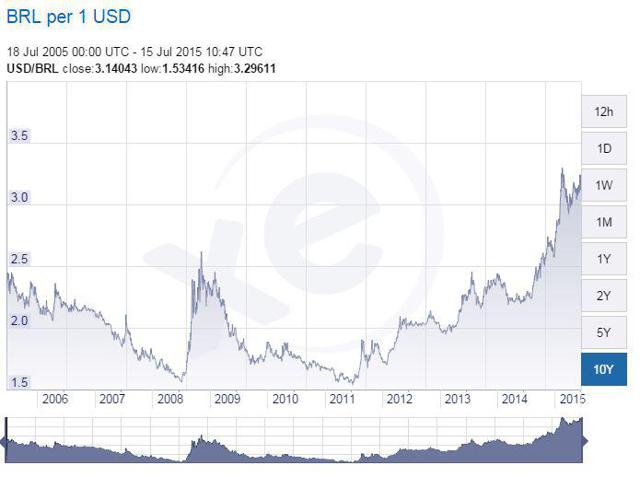

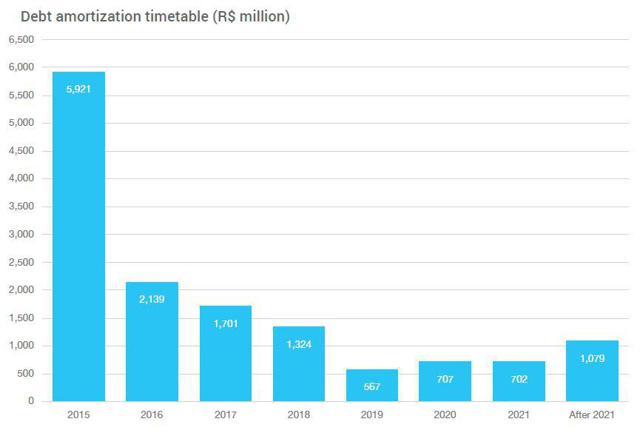

Summary The company lost the concessions for about 40% of its electricity production, and the effect of that should lower net income by 50%. It is a stable company not at risk of bankruptcy, getting close to the bottom with its current price decline. The positive long-term economic outlook for Brazil should also positively influence CIG. The downside risk of investing in CIG is about 35%, and the upside expectation is about 100% or more in the next few years. Stable but state-owned energy company Companhia Energética de Minas Gerais (NYSE: CIG ) operates in generation, transmission, marketing and distribution of electricity, energy solutions (Efficientia S.A.) and distribution of natural gas (Gasmig) in 23 Brazilian states and in Chile. The Cemig Group comprises of the holding company (Cemig), its two main wholly-owned subsidiaries – Cemig Geração e Transmissão S.A. (‘Cemig Generation and Transmission,’ or ‘Cemig GT’) and Cemig Distribuição S.A. (‘Cemig Distribution,’ or ‘Cemig D’) – and other subsidiaries and affiliates; a total of 206 companies, 18 consortia and two Equity Investment Funds (FIPs). With a direct interest of 26.06%, CIG also controls Light S.A., an electricity distributor serving 31 cities in the state of Rio de Janeiro, a region with over 11 million consumers. CIG also has an interest of 43.36%, exercising control, in the transmission company Taesa (Transmissora Aliança de Energia Elétrica S.A.). As part of a growth strategy increasingly aiming to expand in renewable energy sources, in 2014, CIG became part of the control block (27.4%) of Renova, a leading company in Brazil’s wind power market, which also owns investment portfolios in solar and other renewable sources. The controlling stockholder of CIG is the State of Minas Gerais in Brazil, which owns 51% of the common (voting) shares. Another major stockholder is AGC Energia S.A., holding 32.96% of the common shares. CIG is a strongly-positioned energy company that is state owned. Every investor should be aware of the ownership issue because according to Transparency International , Brazil should improve on transparency in local governments and integrity in public contracting. As you will see later, those are the issues that are hammering CIG at the moment. Macro look CIG has been hammered with really bad news lately (about this later), and when this is combined with the trouble the Brazilian economy is currently going through, a 70% decline in its share price in the last 3 years should not be a surprise. Figure 1. shows that the Brazilian currency has depreciated by 50% in relation to the US$ in the last 5 years, and the depreciation trend is still strong. An investment in CIG is not only an investment in a company, but also a currency bet. Figure 1. USD vs. BRL (click to enlarge) Source: xe.com On the other hand, Brazil is currently in an economic slowdown that does not affect CIG because it is a non-cyclical company, and according to the World Bank , Brazil’s economy is expected to fall by 1.3% in 2015 but grow in 2016 by 1.1% and 2.0% in 2017. The turnaround in the economy could be a positive sign for investing in Brazil and will presumably have a positive impact on the currency. Also a turnaround would be very helpful for CIG because of its short-term debt structure (Figure 2.) with an average debt cost of 7.05% in real terms (currently, the inflation in Brazil is just below 9%). Figure 2. CIG’s debt (click to enlarge) Source: Cemig IR Current bad news that hammered the stock To find out what is really happening, you have to search for Brazilian news agencies because news about CIG flies under the radar of the big international news agencies. A few days ago, CIG managed to finance only 60% of the one billion R$ offering with a 7.97% interest rate. The most plausible reasons for that are the high debt of Brazilian energy companies in general and the current out-of-favor status of the sector. Before the failed financing issue, Fitch also degraded CIG’s credit rating from “AA” to “AA-” because of its aggressive acquisition plans, high dividend payout ratio, and political risks. But the most important bad news is the loss of the concession contracts for the Jaguara, São Simão, and Miranda hydroelectric plants that accounted for about 40% (Fitch 36% and Diariodocomercio 45%) of the company’s electricity generation potential. The loss of the contracts should have a negative impact of R$1.5 billion on CIG’s annual EBITDA. Consequently, it should impact a little bit less than 50% of CIG’s net profits that were at R$3.1 billion for 2014. Valuation Because of the currency risk, I will base my valuation on the dividends in order to clearly see what an international investor can expect in the future. The current dividend is US$0.15 per share; it is 25% of the 2014 net earnings and not 50% as usual and statutory due to the low levels in the electricity-generating water reservoirs. As soon as the financial situation of the company stabilizes and the water levels rise, CIG will pay out the rest of the dividend up to the statutory 50% of the net earnings for 2014. I am going to continue using the 25% payout ratio to take a large margin of safety. In the worst case scenario, assuming that CIG will not be able to renegotiate the concession contracts for the Jaguara, São Simão and Miranda hydroelectric plants, its net income will probably fall by 50% and the dividend will fall accordingly. Thus, in the future, we can expect a dividend of US$0.07 per share and EPS of around US$0.28. If we add the 15% depreciation of the Brazilian Real (R$) in relation to the US dollar, we get a constantly lower dividend in real terms for international investors. So in the worst case scenario, with all the risks accounted for, and expecting a P/E ratio of around 8, the share price of CIG should be US$2.24, a downside risk of 35% at the moment. Conclusion I am not sure that all will be so bad as it is at the moment, and that the current situation with the concessions is final. If the company manages to renegotiate the contracts, and we see a turnaround in the Brazilian economy with lower interest rates, CIG’s strong growth strategy would be boosted, and it could become a very successful investment. By keeping the current EPS of US$0.65 and by adding a P/E ratio of 10, we find ourselves very quickly with a US$6.5 valuation per share. As soon as the economic situation in Brazil improves, and the management works out a deal with the government for the concessions, the stock has a very large positive potential. I would put the downside risk to US$2.24 and the upside expectation to US$6.65 in the next two years. So the upside expectation is about 100%. Due to the current financial problems and concession contract issues, I will not initiate a position at the moment but wait to get better buying opportunities with a larger safety margin. I believe CIG is a sound company that is currently in a bad internal and macro position but without any bankruptcy risks on the horizon, and getting very close to the bottom of its price decline (the time frame for the bottom should be about one or two years; that for me is very short term but for the majority of investors a very long term). Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The company lost the concessions for about 40% of its electricity production, and the effect of that should lower net income by 50%. It is a stable company not at risk of bankruptcy, getting close to the bottom with its current price decline. The positive long-term economic outlook for Brazil should also positively influence CIG. The downside risk of investing in CIG is about 35%, and the upside expectation is about 100% or more in the next few years. Stable but state-owned energy company Companhia Energética de Minas Gerais (NYSE: CIG ) operates in generation, transmission, marketing and distribution of electricity, energy solutions (Efficientia S.A.) and distribution of natural gas (Gasmig) in 23 Brazilian states and in Chile. The Cemig Group comprises of the holding company (Cemig), its two main wholly-owned subsidiaries – Cemig Geração e Transmissão S.A. (‘Cemig Generation and Transmission,’ or ‘Cemig GT’) and Cemig Distribuição S.A. (‘Cemig Distribution,’ or ‘Cemig D’) – and other subsidiaries and affiliates; a total of 206 companies, 18 consortia and two Equity Investment Funds (FIPs). With a direct interest of 26.06%, CIG also controls Light S.A., an electricity distributor serving 31 cities in the state of Rio de Janeiro, a region with over 11 million consumers. CIG also has an interest of 43.36%, exercising control, in the transmission company Taesa (Transmissora Aliança de Energia Elétrica S.A.). As part of a growth strategy increasingly aiming to expand in renewable energy sources, in 2014, CIG became part of the control block (27.4%) of Renova, a leading company in Brazil’s wind power market, which also owns investment portfolios in solar and other renewable sources. The controlling stockholder of CIG is the State of Minas Gerais in Brazil, which owns 51% of the common (voting) shares. Another major stockholder is AGC Energia S.A., holding 32.96% of the common shares. CIG is a strongly-positioned energy company that is state owned. Every investor should be aware of the ownership issue because according to Transparency International , Brazil should improve on transparency in local governments and integrity in public contracting. As you will see later, those are the issues that are hammering CIG at the moment. Macro look CIG has been hammered with really bad news lately (about this later), and when this is combined with the trouble the Brazilian economy is currently going through, a 70% decline in its share price in the last 3 years should not be a surprise. Figure 1. shows that the Brazilian currency has depreciated by 50% in relation to the US$ in the last 5 years, and the depreciation trend is still strong. An investment in CIG is not only an investment in a company, but also a currency bet. Figure 1. USD vs. BRL (click to enlarge) Source: xe.com On the other hand, Brazil is currently in an economic slowdown that does not affect CIG because it is a non-cyclical company, and according to the World Bank , Brazil’s economy is expected to fall by 1.3% in 2015 but grow in 2016 by 1.1% and 2.0% in 2017. The turnaround in the economy could be a positive sign for investing in Brazil and will presumably have a positive impact on the currency. Also a turnaround would be very helpful for CIG because of its short-term debt structure (Figure 2.) with an average debt cost of 7.05% in real terms (currently, the inflation in Brazil is just below 9%). Figure 2. CIG’s debt (click to enlarge) Source: Cemig IR Current bad news that hammered the stock To find out what is really happening, you have to search for Brazilian news agencies because news about CIG flies under the radar of the big international news agencies. A few days ago, CIG managed to finance only 60% of the one billion R$ offering with a 7.97% interest rate. The most plausible reasons for that are the high debt of Brazilian energy companies in general and the current out-of-favor status of the sector. Before the failed financing issue, Fitch also degraded CIG’s credit rating from “AA” to “AA-” because of its aggressive acquisition plans, high dividend payout ratio, and political risks. But the most important bad news is the loss of the concession contracts for the Jaguara, São Simão, and Miranda hydroelectric plants that accounted for about 40% (Fitch 36% and Diariodocomercio 45%) of the company’s electricity generation potential. The loss of the contracts should have a negative impact of R$1.5 billion on CIG’s annual EBITDA. Consequently, it should impact a little bit less than 50% of CIG’s net profits that were at R$3.1 billion for 2014. Valuation Because of the currency risk, I will base my valuation on the dividends in order to clearly see what an international investor can expect in the future. The current dividend is US$0.15 per share; it is 25% of the 2014 net earnings and not 50% as usual and statutory due to the low levels in the electricity-generating water reservoirs. As soon as the financial situation of the company stabilizes and the water levels rise, CIG will pay out the rest of the dividend up to the statutory 50% of the net earnings for 2014. I am going to continue using the 25% payout ratio to take a large margin of safety. In the worst case scenario, assuming that CIG will not be able to renegotiate the concession contracts for the Jaguara, São Simão and Miranda hydroelectric plants, its net income will probably fall by 50% and the dividend will fall accordingly. Thus, in the future, we can expect a dividend of US$0.07 per share and EPS of around US$0.28. If we add the 15% depreciation of the Brazilian Real (R$) in relation to the US dollar, we get a constantly lower dividend in real terms for international investors. So in the worst case scenario, with all the risks accounted for, and expecting a P/E ratio of around 8, the share price of CIG should be US$2.24, a downside risk of 35% at the moment. Conclusion I am not sure that all will be so bad as it is at the moment, and that the current situation with the concessions is final. If the company manages to renegotiate the contracts, and we see a turnaround in the Brazilian economy with lower interest rates, CIG’s strong growth strategy would be boosted, and it could become a very successful investment. By keeping the current EPS of US$0.65 and by adding a P/E ratio of 10, we find ourselves very quickly with a US$6.5 valuation per share. As soon as the economic situation in Brazil improves, and the management works out a deal with the government for the concessions, the stock has a very large positive potential. I would put the downside risk to US$2.24 and the upside expectation to US$6.65 in the next two years. So the upside expectation is about 100%. Due to the current financial problems and concession contract issues, I will not initiate a position at the moment but wait to get better buying opportunities with a larger safety margin. I believe CIG is a sound company that is currently in a bad internal and macro position but without any bankruptcy risks on the horizon, and getting very close to the bottom of its price decline (the time frame for the bottom should be about one or two years; that for me is very short term but for the majority of investors a very long term). Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News